- QNT broke out of a falling wedge and retested the $139 resistance with strong technical indicators

- Market sentiment and on-chain metrics, including a 3.59% increase in large trades, also remained bullish

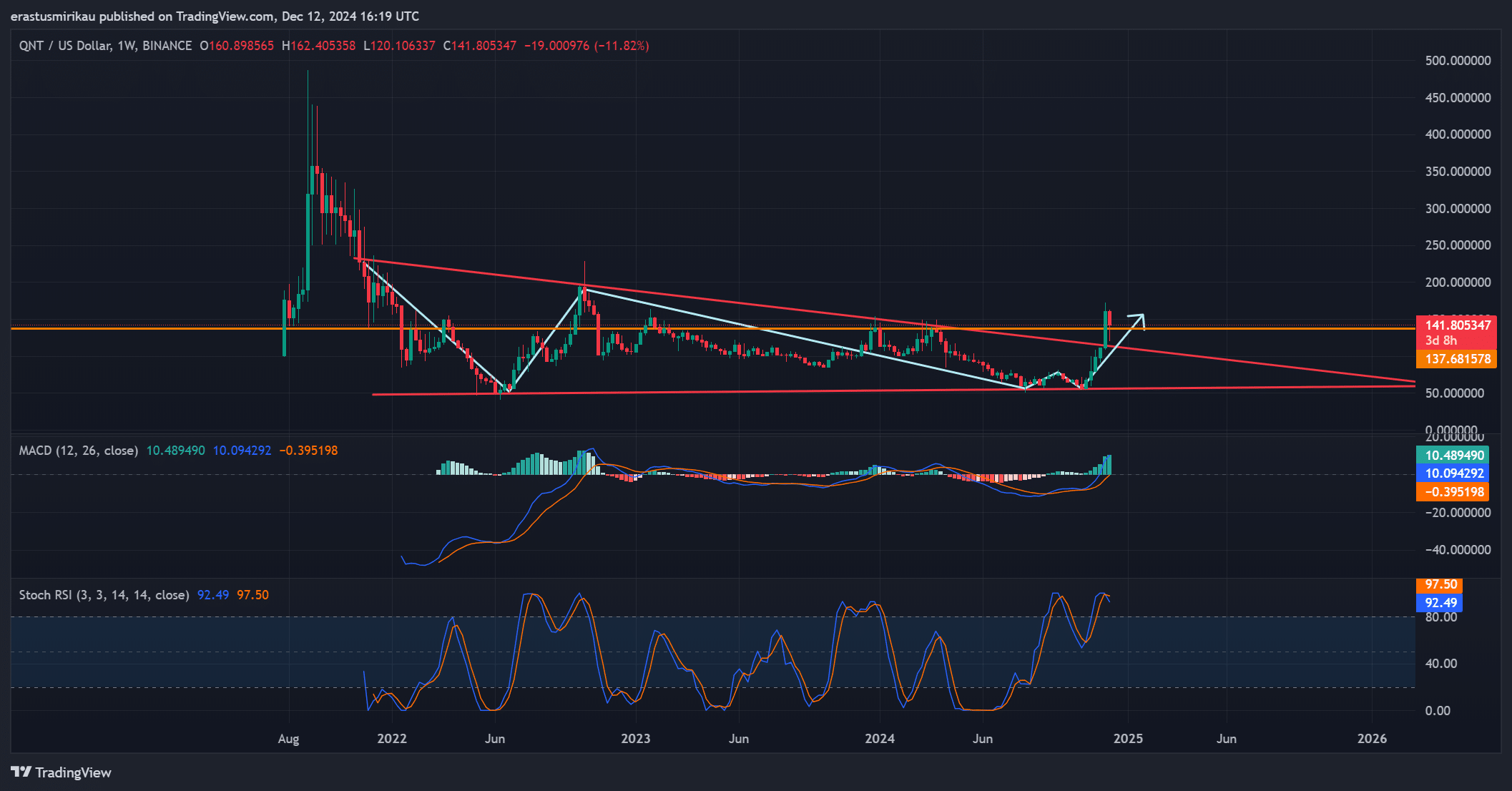

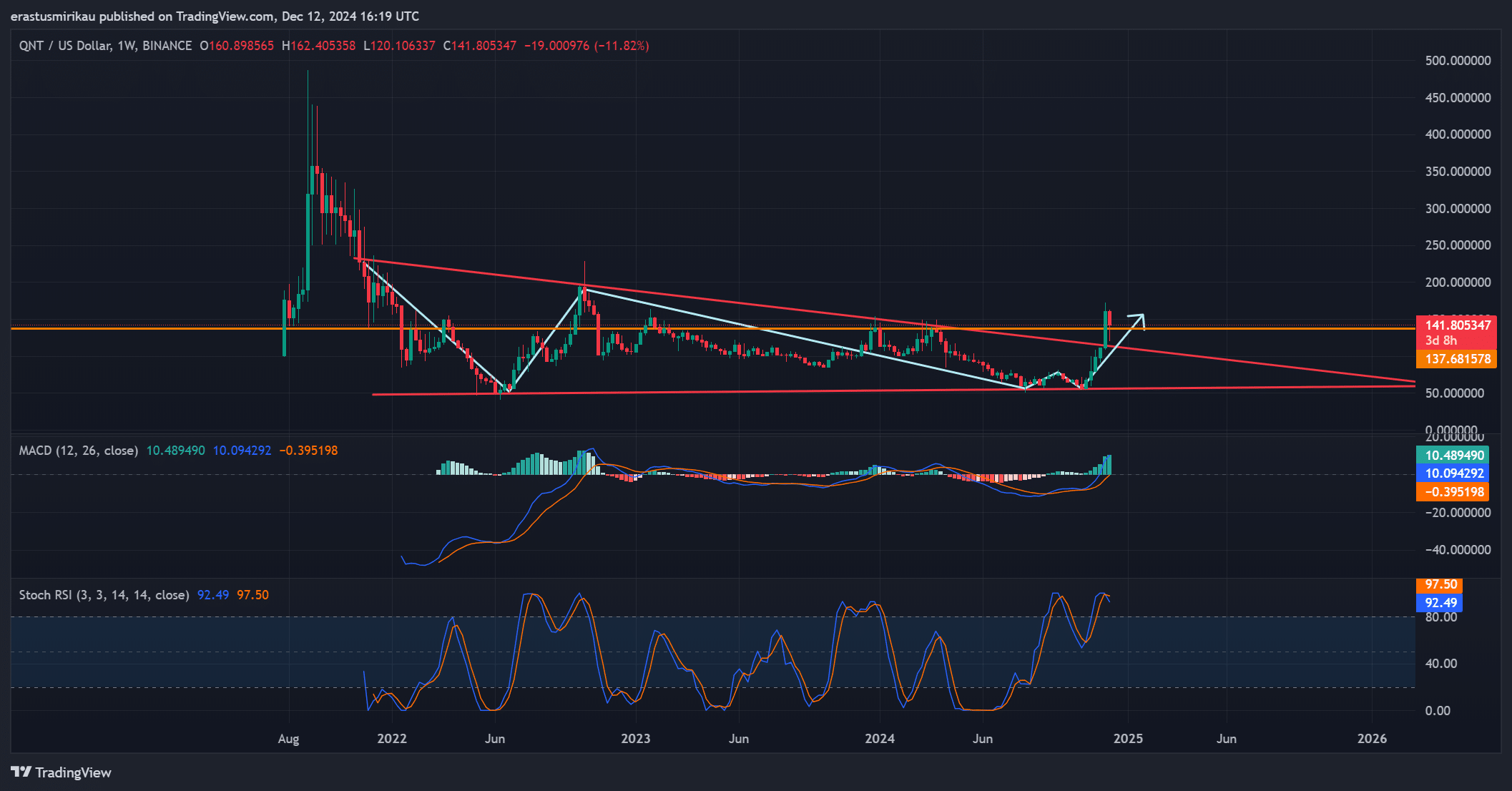

Quantitative [QNT] a prominent player in the crypto market, has attracted a lot of attention due to its bullish breakout and strong technical indicators. QNT was trading at $141.98, having fallen 6.08% at the time of writing, and appeared to be retesting the crucial resistance level around $139.

This pivotal moment could determine the token’s next trajectory as it fights to maintain its upward momentum.

QNT Chart Analysis – The Breakout and Key Resistance Retest

QNT recently broke out of a long-term bearish wedge, a classic technical pattern that often signals bullish reversals. However, the continued retest of the $139 resistance level is crucial. If this level continues, it could confirm the breakout and lead to higher price targets.

Moreover, technical indicators gave a mixed but overall positive outlook. The MACD recorded -0.39, indicating mild bearish pressure that is steadily subsiding. Furthermore, the Stochastic RSI stood at 97.50, reflecting the overbought level and indicating strong buying pressure.

While these numbers together indicate upside momentum, the $139 support must hold for the bullish scenario to hold.

Source: TradingView

Signals in the chain show growing strength

On-chain metrics reinforced QNT’s bullish case. Net network growth increased by 0.84%, indicating healthy network expansion and growing user adoption. In addition, large trades increased by 3.59% – a sign of increased interest from whales and institutional investors.

However, the number of ‘in the money’ addresses fell slightly by 0.22%, indicating a small decline in profitability for holders. Despite this, foreign exchange reserves fell by 0.07%, with only 1.542 million QNT held on exchanges, according to CryptoQuant’s analyses. This decline indicated lower selling pressure, often a precursor to upward price movements.

Source: IntoTheBlock

Market sentiment is turning optimistic

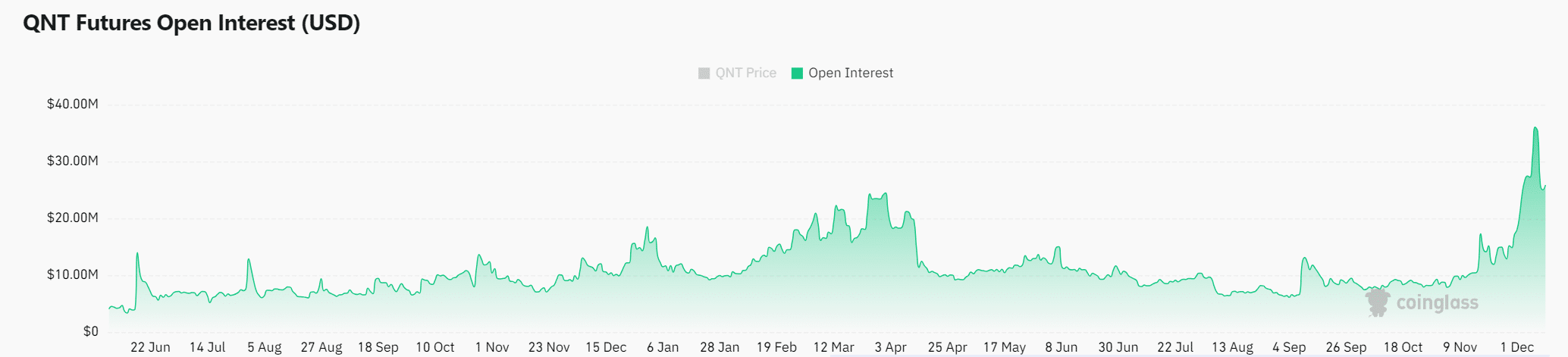

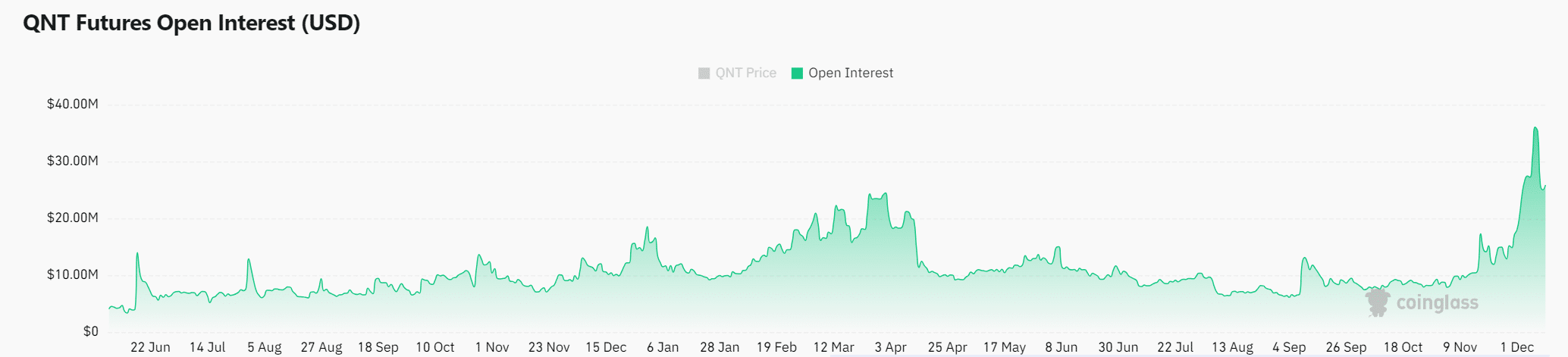

Market sentiment around QNT has remained bullish, supported by a 3.72% increase in open interest, while the same figures stood at $28.27 million. This increase highlighted growing trading activity and confidence among investors.

Moreover, public sentiment and smart money indicators also appeared to be aligned, further boosting optimism about QNT’s price trajectory.

Source: Coinglass

Read Quants [QNT] Price forecast 2024–2025

Can QNT recover in 2025?

QNT has a high chance to continue its bullish breakout and move higher. With a robust combination of technical strength, positive on-chain metrics, and growing market sentiment, the token could be poised for an upward move.

However, holding above $139 will be crucial to confirm this breakout and make significant gains in 2025.

Credit : ambcrypto.com

Leave a Reply