- Cortex’s volume soared as its price fell more than 54% on the charts

- If the trend reversal solidifies, CTXC could see a breakout

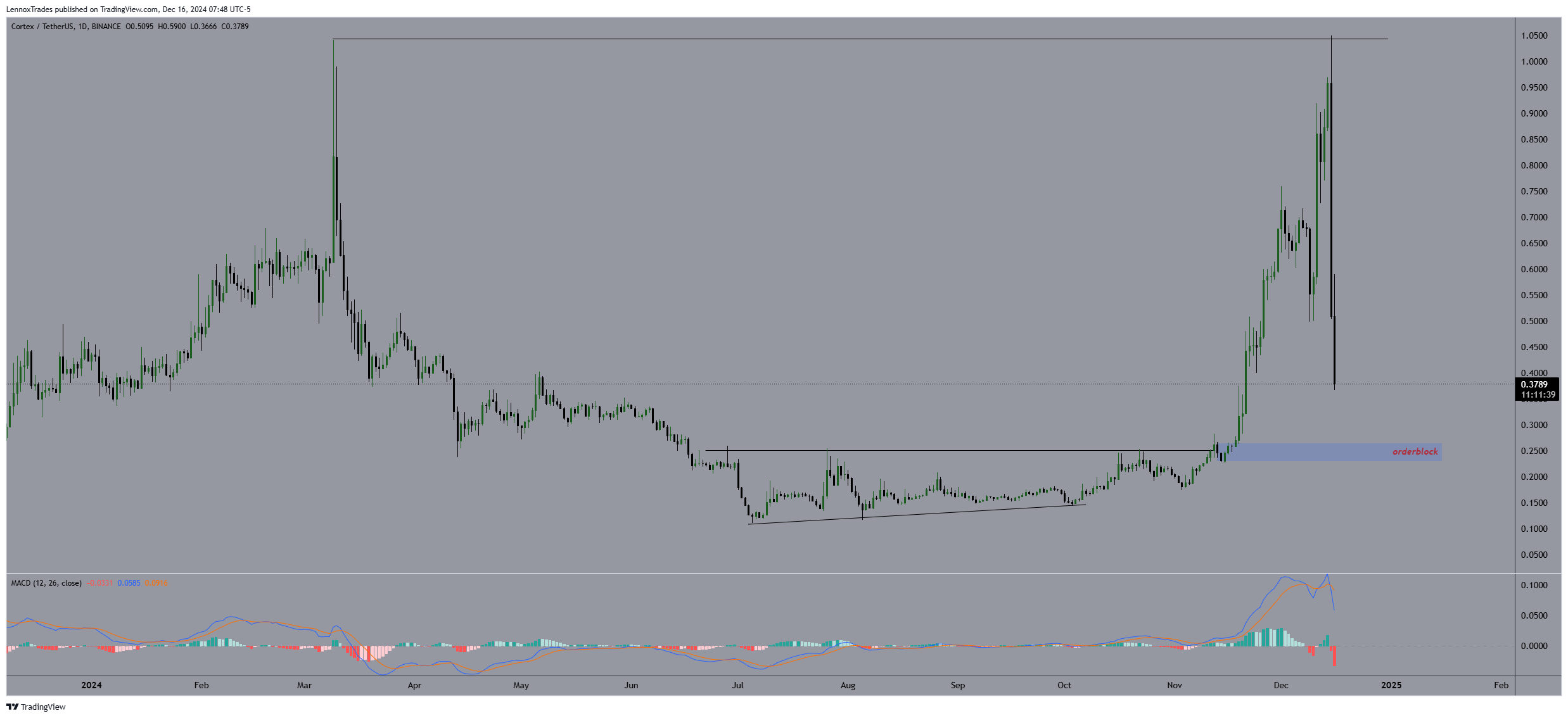

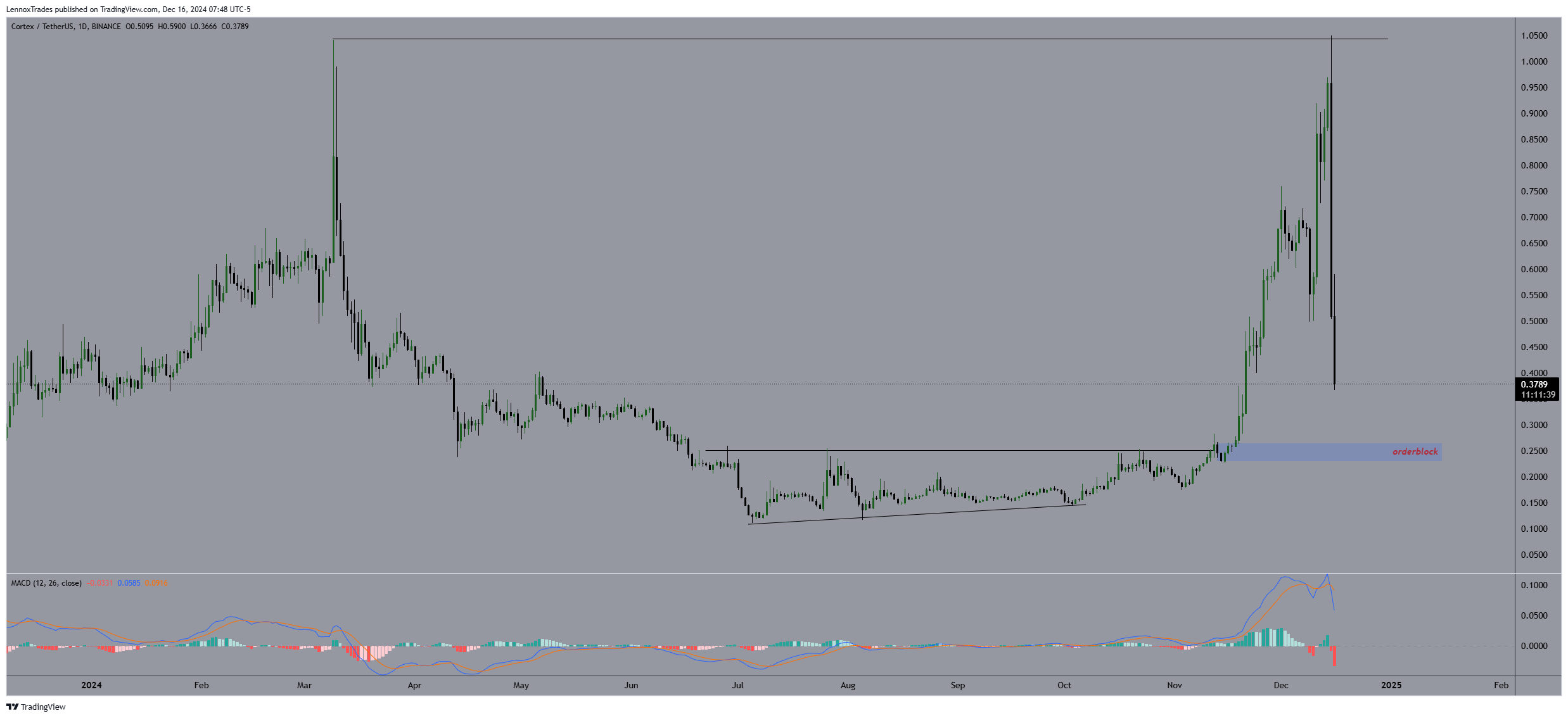

The trading volume of Cortex (CTXC) crypto rose sharply, while the price itself fell significantly on the charts. In fact, CTXC’s volume spike was four times larger than in previous weeks. This was accompanied by a sharp price drop from a high of around $1.05 to a low of almost $0.37, representing a drop of around 45%.

CTXC’s $0.25 ‘order block’ has historically acted as both support and resistance, and at the time of writing the price appeared to be approaching there. This zone produced a modest recovery, indicating some resistance to further declines on the charts.

Source: trading view

However, despite the bearish trend, the increase in volume that accompanied the price drop indicated accumulative activity by traders anticipating potential value.

The MACD indicator pointed to a close convergence and a potential bullish crossover, indicating possible upside momentum. If this trend reversal solidifies, CTXC could record a breakout.

This suggested what the critical area for this potential rally could be if CTXC can hold itself above the $0.40 resistance level. This will likely pave the way for a bigger recovery.

Profitability at a break-even price

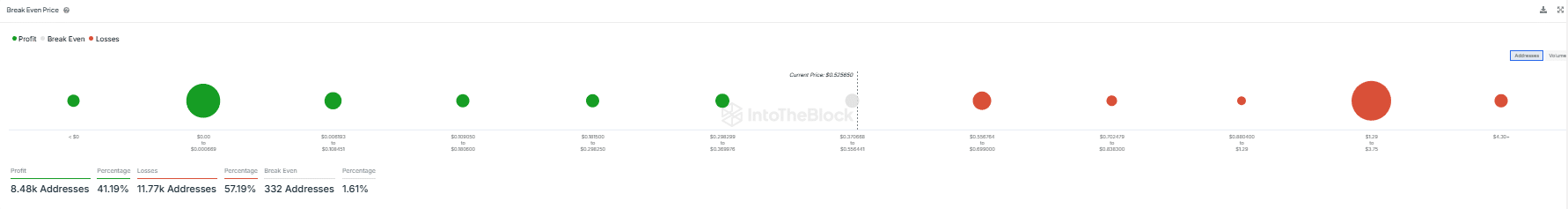

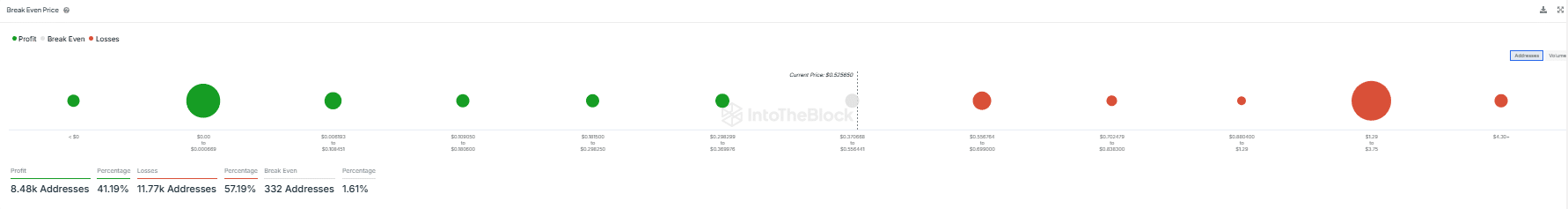

CTXC’s distribution of addresses based on their profitability, compared to breakeven prices, yielded a 41.19% gain. These addresses hit the market for $0.385250.

On the contrary, 57.19% of addresses experienced losses with prices ranging from $0.40 and above to $0.50, with the largest losses concentrated. Breakeven addresses were just 1.61%, indicating minimal trading activity.

Source: IntoTheBlock

CTXC’s future market behavior could revolve around these levels as addresses with losses could decide to sell as the price approaches their entry point, potentially limiting upward price movements.

Conversely, continued upward trends could convert more addresses into profitability, promoting more positive sentiment in the Cortex market.

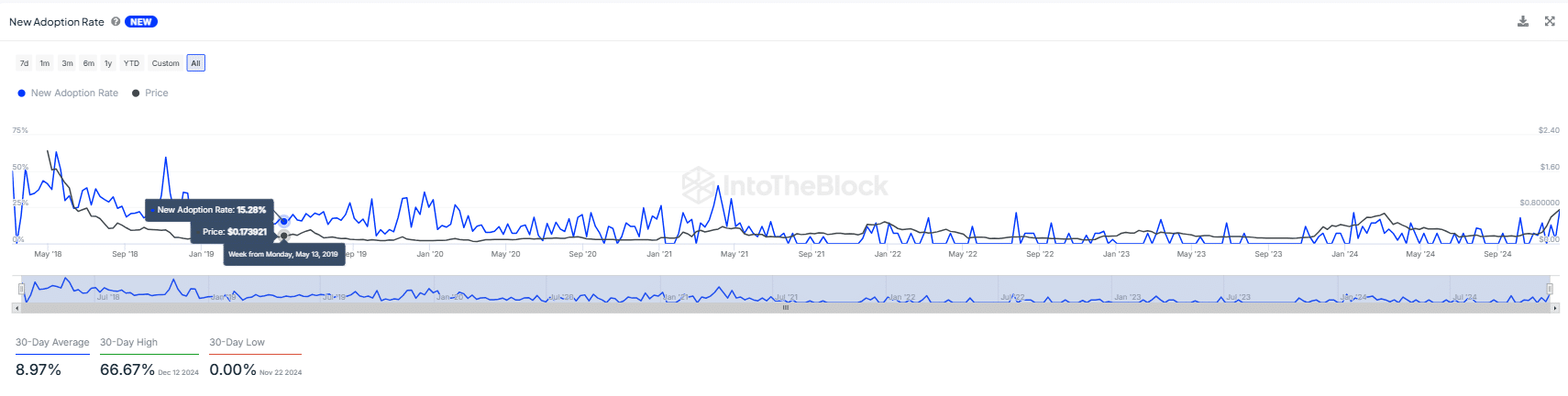

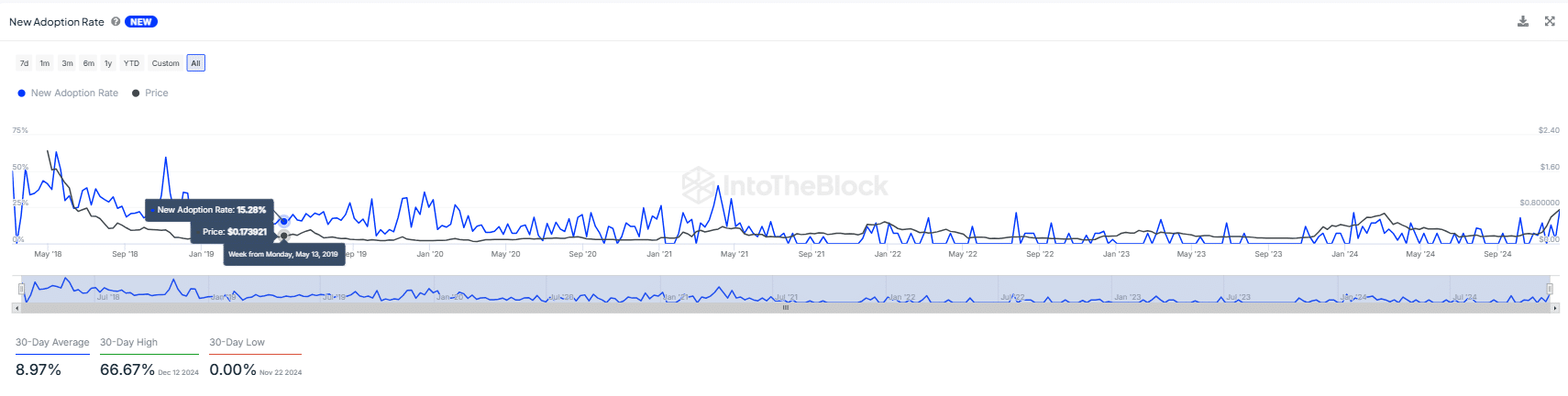

CTCX new acceptance rate

Cortex’s new adoption rate saw a notable spike in May 2018, reaching nearly 50%, coinciding with a price spike of around $0.30. This trend showed that high adoption rates previously caused price increases, although this relationship decreased over time.

Subsequent spikes in adoption in 2019 and 2020 showed a similar, albeit more insignificant, impact on price. This pointed to diminishing returns due to new adoption increases in the price of the asset.

Source: IntoTheBlock

In 2024, the adoption rate has remained stable at around 8.97%, significantly lower than previous highs. It also did not correspond to any significant price changes, as the price stabilized around $0.80.

This pattern indicated that while early increases in adoption significantly affected Cortex’s price, the effect has diminished. Likely due to market maturation or reduced responsiveness to changes in adoption.

If the adoption rate continues to rise, the past impact on price suggested that future price movements may no longer be strongly correlated with the new adoption rate. By extension, this indicated a decoupling of user growth and direct price incentives.

Credit : ambcrypto.com

Leave a Reply