- 69.9% of HBAR’s top traders on Binance have long positions.

- HBAR’s RSI remains below the overbought zone, indicating there is still significant room for further upside.

Hedera [HBAR]is making waves in the cryptocurrency landscape following impressive momentum and a breakout of bullish price action patterns.

This sudden shift in market sentiment appears to be in anticipation of the upcoming political event on January 20, 2025. This shift has caused HBAR to rise significantly over the past 24 hours.

According to CoinMarketCap data, HBAR is up as much as 16% over the past 24 hours and is currently trading around the $0.345 level.

During the same period, traders and investors have shown strong interest and confidence, resulting in a 101% increase in trading volume.

HBAR Price Action and Technical Analysis

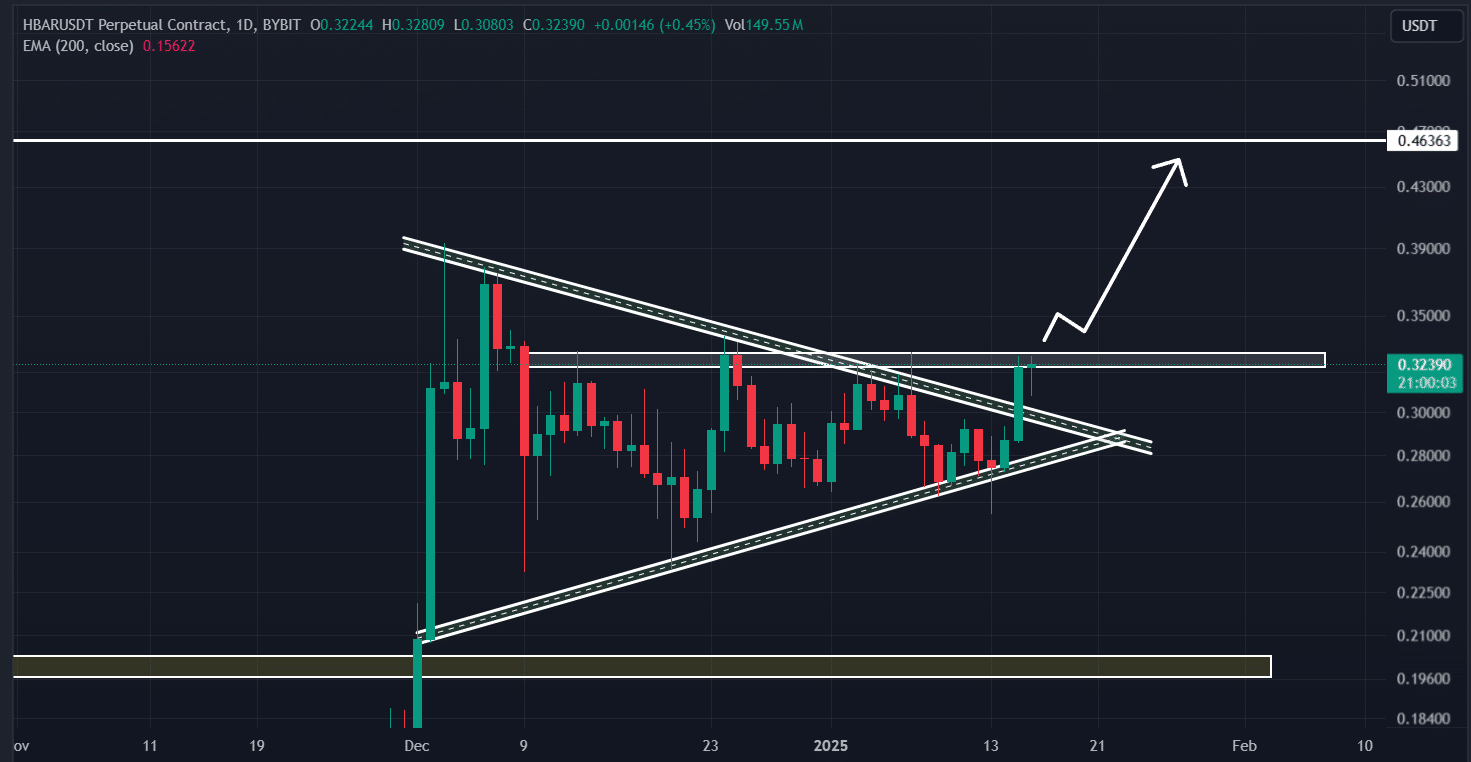

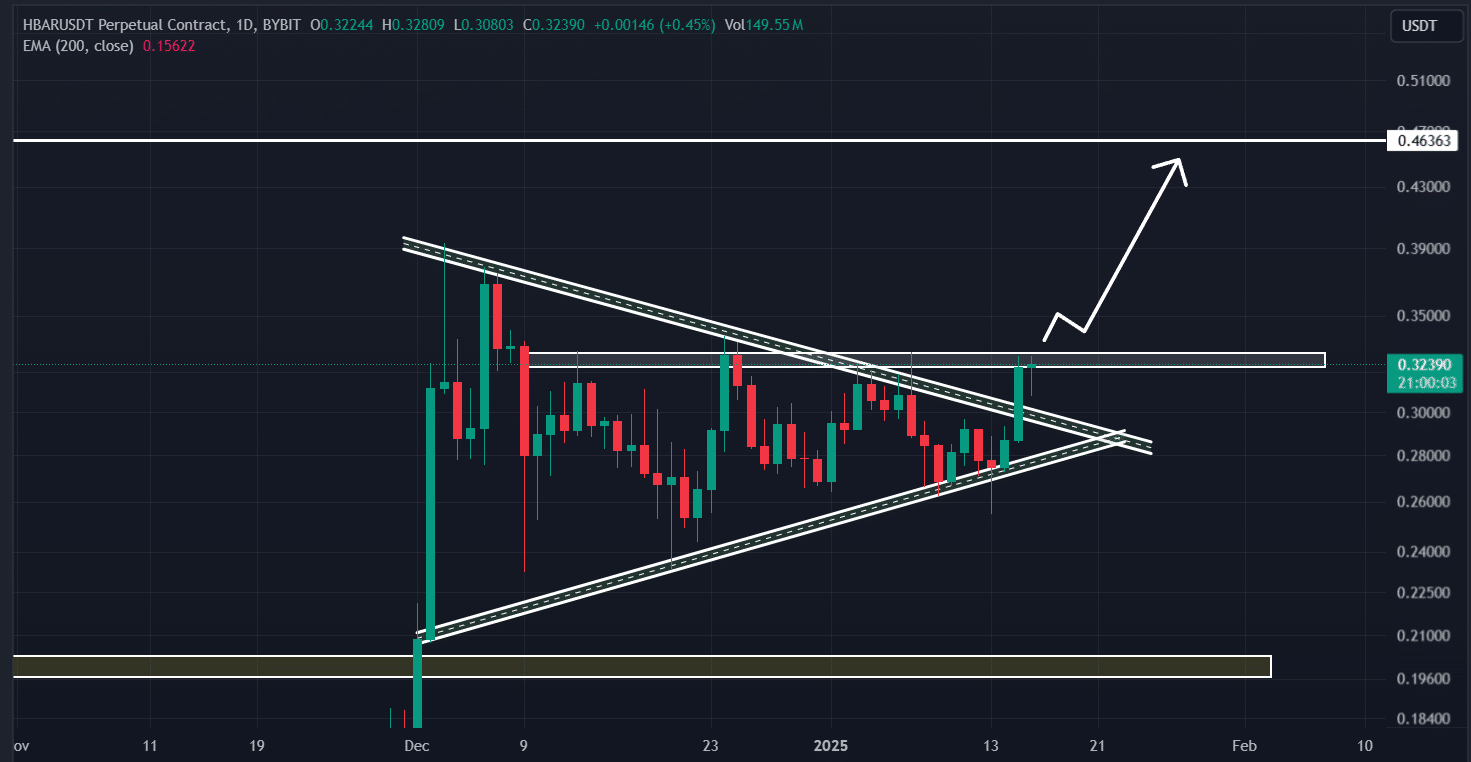

This price increase has attracted significant attention from investors and traders. It caused a breakout from the long-term consolidation and symmetrical triangle pattern that HBAR had formed on the daily time frame.

With this breakout, the altcoin appears bullish and poised for massive upside momentum.

Source: TradingView

According to AMBCrypto’s technical analysis, HBAR not only broke the symmetrical triangle pattern, but also broke the resistance level that had hampered the upward momentum.

Based on the recent price action, if HBAR remains above the $0.34 level, it could potentially rise by 35% to reach the $0.465 level.

On the plus side, HBAR’s Relative Strength Index (RSI) remained below the overbought zone despite notable upside momentum. This indicates that the asset still has plenty of room to rise significantly.

70% of top traders have long positions

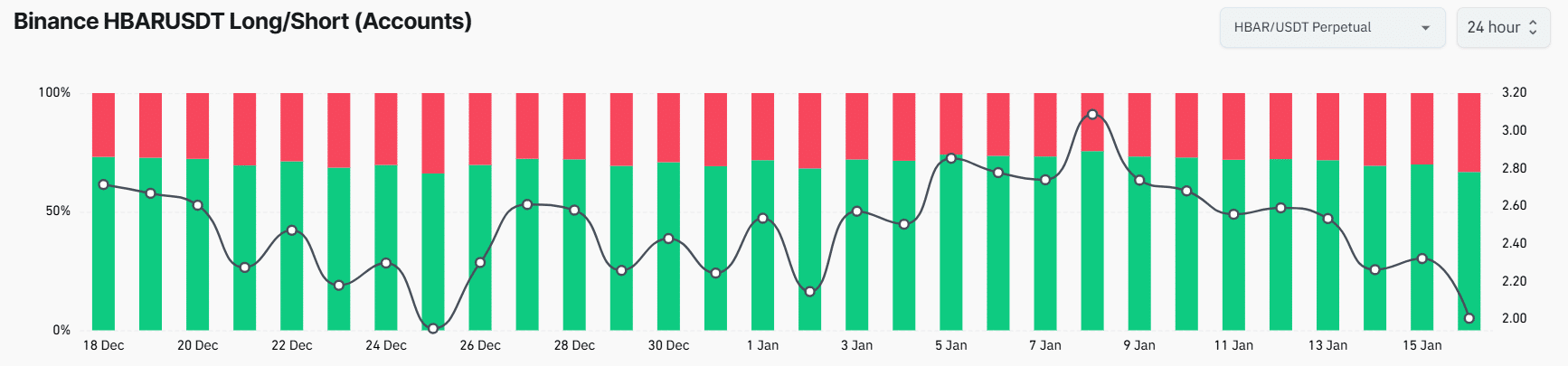

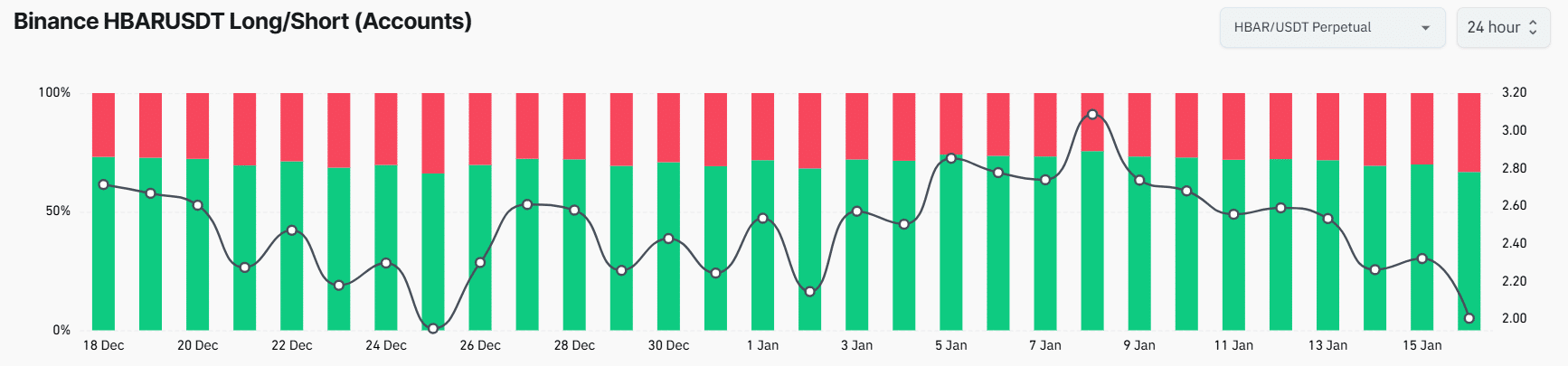

This bullish outlook appears to be attracting significant attention from intraday traders, as reported by on-chain analytics firm CoinGlass.

The The Binance HBAR/USDT Long/Short Ratio was 2.32, indicating that for every 2.32 long positions, there is one short position.

Source: Coinglass

Currently, 69.9% of top traders on Binance have long positions, while 30.1% have short positions.

Is your portfolio green? View the Hedera Profit Calculator

When this on-chain metric is combined with the technical analysis, it appears that bulls are currently dominating the asset, which could support the altcoin in reaching the predicted level in the future.

Credit : ambcrypto.com

Leave a Reply