- Dogecoin is the most popular memecoin and the price promotion could dictate the trends of the sector.

- On-chain statistics showed a purchase signal for long-term doge investors.

Since December 9, the Memecoin market has paid 39.4% in market capitalization. In the past month, the price diagrams of most memecoins are only directed down.

Bitcoin’s [BTC] The volatility around $ 100k Mark has influenced the Altcoin market, and in turn also the memes.

Source: Mint market cap

The launch of the official Trump [TRUMP] has done little to relieve this stress. Holders were tempted to sell their other meme companies and to buy Trump as the price grew.

After reaching a record high of $ 73.43 on January 19, Trump was also in a serious decrease and 71% dropped in two weeks.

Source: Trump/USDT on TradingView

The token is under the short -term range that it has formed, and there are probably new lows for it. The A/D indicator did not inspire much confidence either.

The price promotion of Trump could prevent the public from buying Memecoins in the near future.

Can Dogecoin save the meme market?

Like the leading memecoin of Market Cap, Dogecoin [DOGE] Will be a good indicator for the health of the sector in general.

At the time of the press it had one +0.89 Correlation With Shiba Inu [SHIB]Which meant that the performance of the large memecoins were closely correlated with those of the leader.

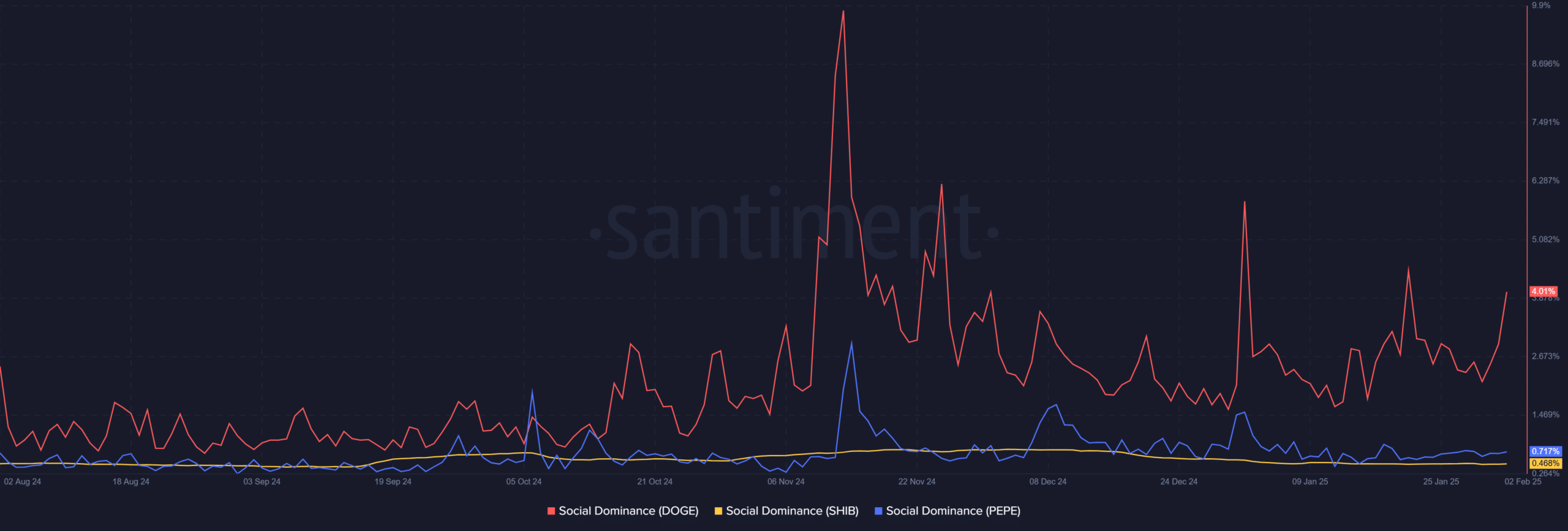

As the santiment data emphasizes above, Doge has consistently had a higher social dominance than Shib or Pepe [PEPE].

Social dominance is the percentage share in the entries of a coin in social media.

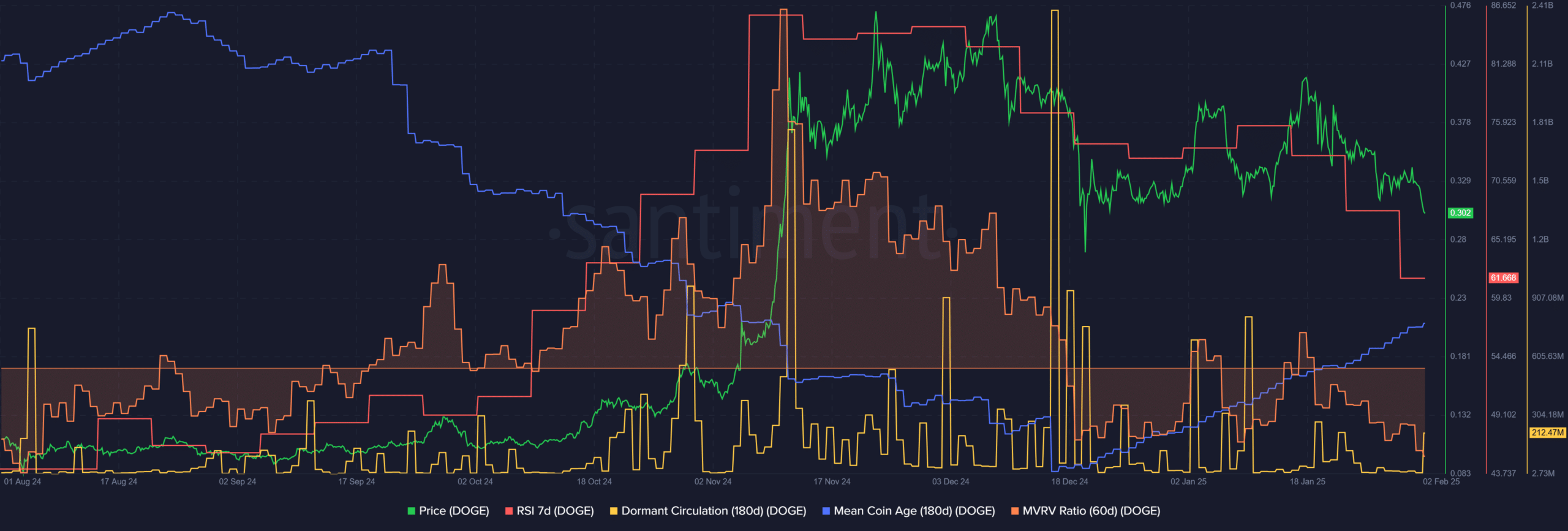

The statistics on the chain reflected bullishness. The sleeping circulation did not show a flurry of token movement that generally precedes a sales wave.

The average currency age has also risen in the last six weeks, although the price was unable to trend higher.

The 60-day MVRV was negative, which shows that holders were losses of short to medium term. Together the statistics presented a purchase signal.

Read Dogecoin’s [DOGE] Price forecast 2025-26

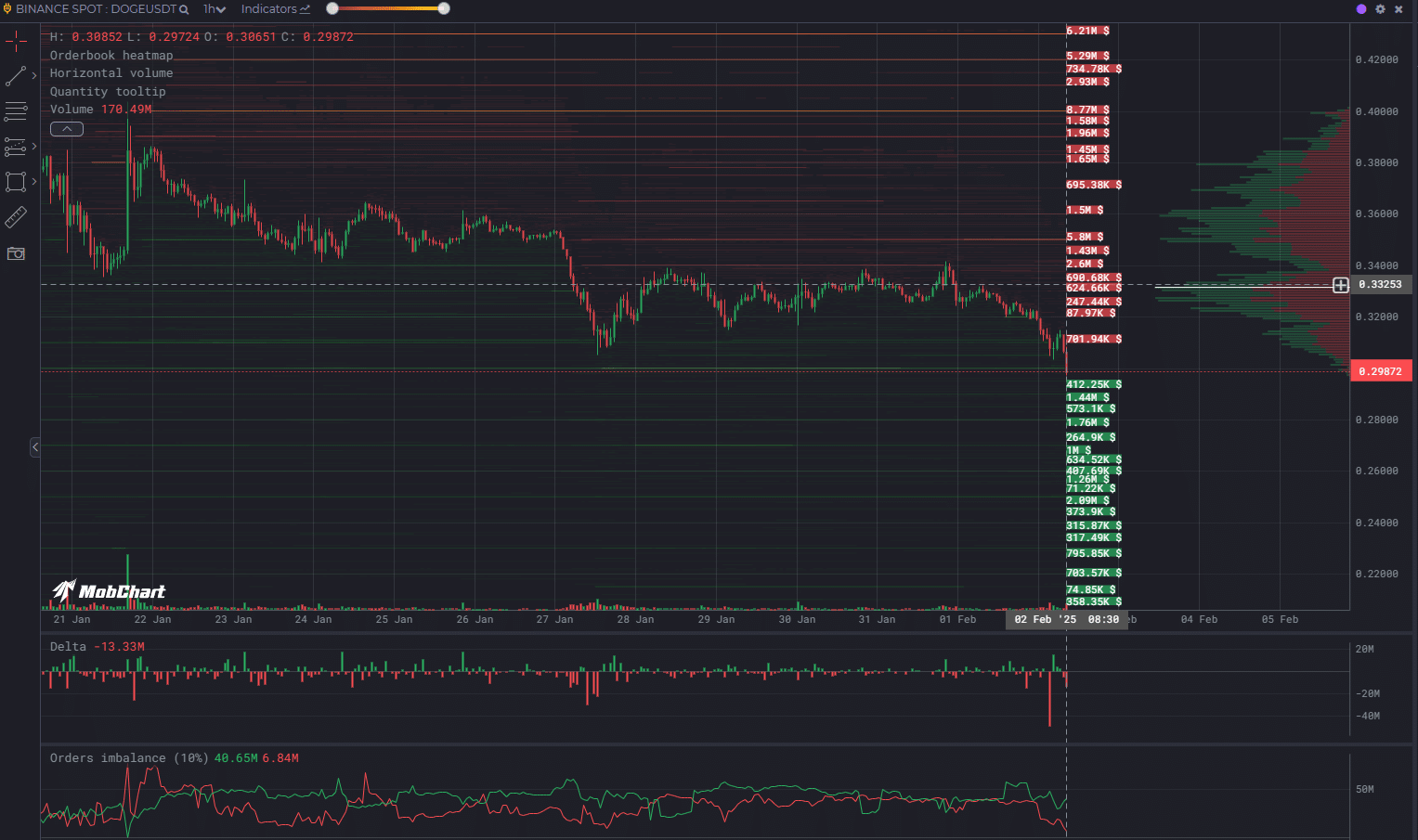

The orderbook data outlined the most important support resistance for the coming days. The concentration of limit buys orders on the $ 0.28, $ 0.27 and $ 0.26 round figures showed that the price could be attracted to these levels before a reversal.

The imbalance of the orders was skewed to the buyers in the 10% space around the current price, so that the idea of a bullish short -term reputation was embellished.

Credit : ambcrypto.com

Leave a Reply