Este Artículo También Está Disponible and Español.

Bitcoin has experienced a serious decline in recent days. After trading above $ 96,000 on Monday, the prize was under $ 80,000 for the first time since 11 November. This rapid decrease marks a decrease of almost 18% since the start of the week. From the all times of $ 109,588 on January 20, Bitcoin has now paid around 27% of its value.

Various factors are converged to exert downward pressure on the cryptocurrency. These include the newly imposed Trump rates, large-scale outsourcing of spot BTC ETFs and exceptionally high levels of liquidations in the Futures markets. Although sentiment has clearly taken a hit with the anxiety and greed index on 16 (“Extreme Fear”), some analysts note that these conditions can also determine the stage for the next important move – about the further or a potential rebound.

Related lecture

How low can Bitcoin go?

Renowned crypto analyst Scott Melker, also known as ‘The Wolf of All Streets’, highlights A developing bullish divergence on multiple timetables. In a message on X, Melker writes: “BTC 4-hour: Bullish divergence that still builds after the hidden Bearish divergence that I watch. This can of course fail, but RSI holds up well. If you have been following me for years, this is my favorite signal when confirmed. RSI with Bullish Divs building over several timetables. “

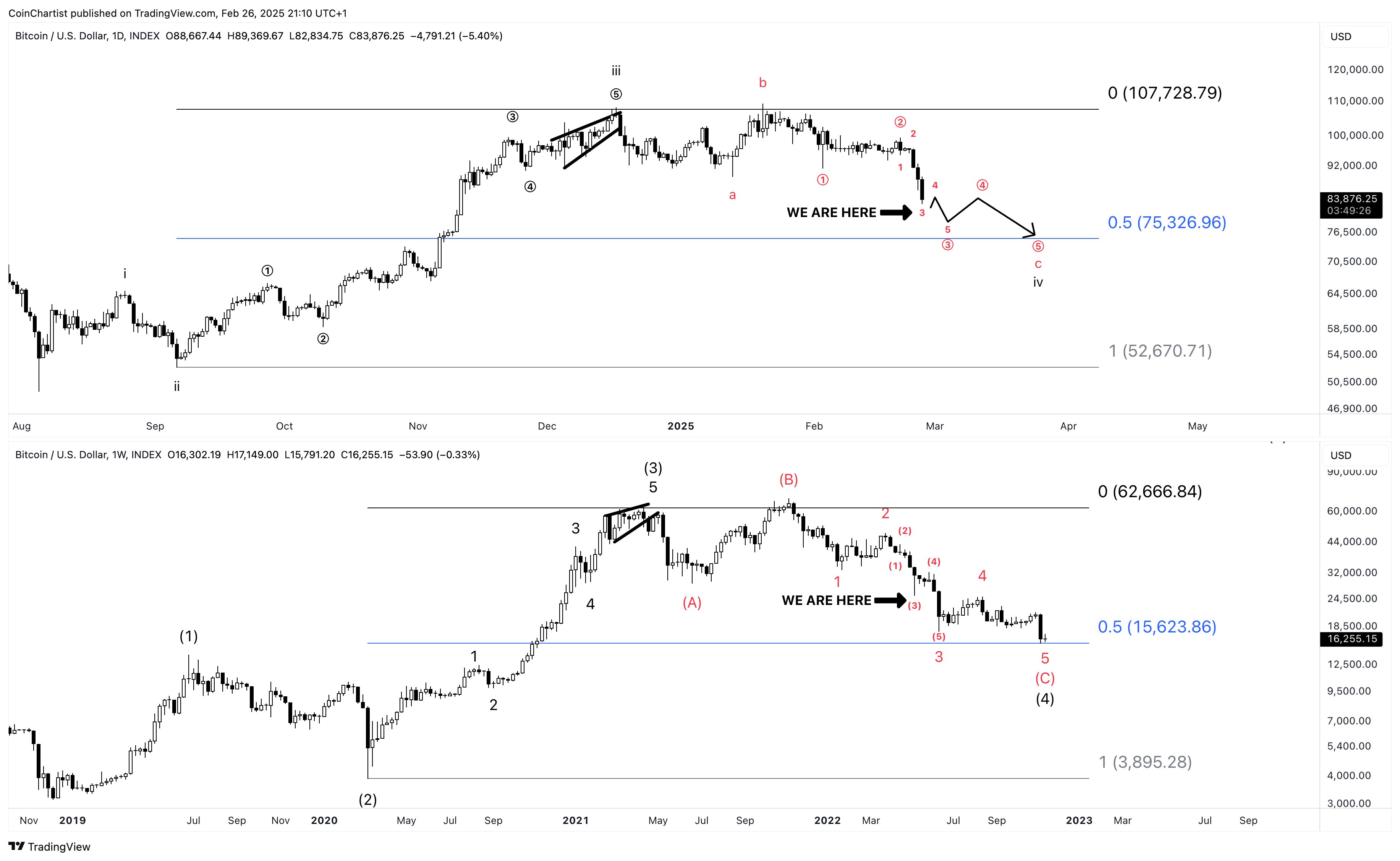

Technical Analyst Tony “The Bull” Severino, CMT (@Onythebullbtc) believe The market can detect a well -known corrective pattern that is comparable to what happened in 2021 and 2022. He suggests that this pattern “could get an extensive fifth of a fifth situation that will take us well into the end until the end of 2025.” He added that “this means that this could go much lower than many expect, up to around $ 75,000 if the same fractal with a higher degree is followed to the 0.5 FIB racement.”

Severino also warns that traders “do not want to see Bitcoin tagging the monthly parabolic sar, currently located at $ 75,742”, since a violation of that level can indicate a deeper correction. He expects the parabolic SAR to rise slightly against the monthly closure, making the critical support zone possibly pushed to the low range of $ 80,000.

Related lecture

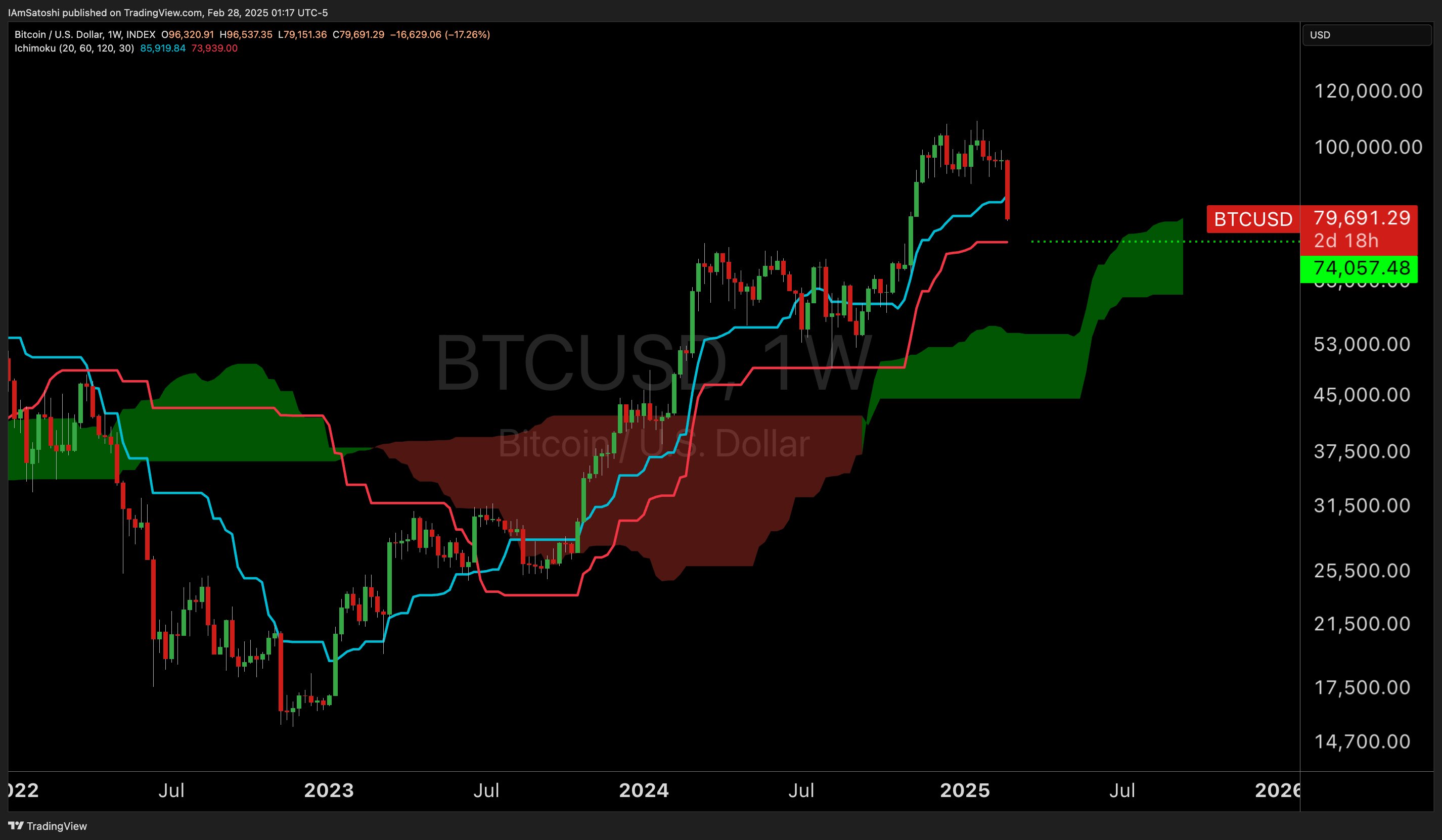

Prominent trader Josh Olszewicz (@Carpenoctom) follows the Ichimoku cloud for important insights. He point To a possible retest of Bitcoin’s weekly Kijun, referring to “Weekly Kijun support at 74k when we continue.” Olszewicz notes that Bitcoin last tapped the weekly Kijun during the Yen Carry Trade Unwr report in August 2024 – an event that saw increased volatility in the worldwide markets.

Analyst Daan Crypto Trades (@DaanCrypto) pulls Parallels with earlier market cycles when the daily RSI from Bitcoin to the 20 level dropped: “The last time BTC was this ‘over -sold’ [at 20] On the daily RSI was back in August 2023 when it traded at $ 25k. The time before was after the FTX implosion at the bottom of the Berenmarkt at the end of 2022. Short term this means little, but it should start with a peak of your interest. “

He also saw important buy orders about Binance Futures: “BTC ~ $ 1.8 billion in bids has appeared on the Binance Futures pair. These bids are between $ 70k $ 79k. What happens if such bids appear is varied. Sometimes the price never moves in, when it starts to touch them, it often fills a lot of them before they (soon) turn around. Keep in mind that these are bids that can be pulled away just as easily. This emphasizes because it is an insane amount and this is something that you rarely see. ‘

Ki Young Ju, CEO of Cryptoquant, emphasizes the role of liquidity in determining the Bitcoin process. He noted that the spot volume “was very active around $ 100k”, but explained that “prices fall when new liquidity dries up.” For Ju, the most important question is: where does fresh liquidity come from when the market is already in a distribution phase?

He provides a potential extensive consolidation between “$ 75k $ 100k”, which looks like the Bitcoin price action in the early 2024. This could take until good news for Bitcoin yields new liquidity, “predicts Ju.

At the time of the press, BTC traded at $ 78,856.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply