Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

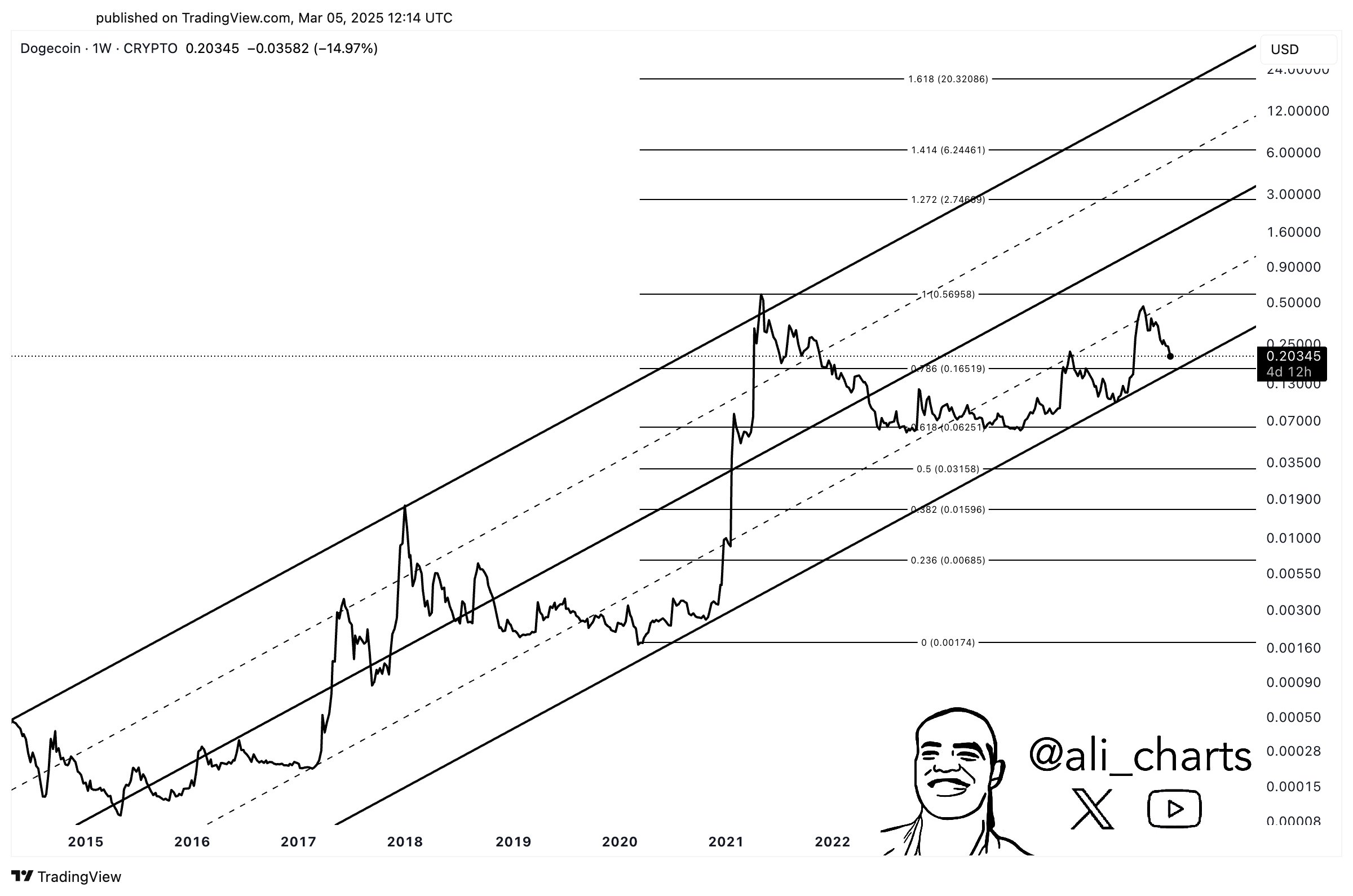

Dogecoin (DOGE) is confronted with a critical point on his long-term price graph according to a prominent crypto analyst Ali Martinez. The widely distributed graph – originally shared via X and then decomposed In a YouTube short-leave doge act in an increasing parallel channel that has led its price action since 2014. Now the Cryptocurrency inspired by Meme is precarious above an important support zone that could, if violated, drop a serious drop.

Dogecoin crashes income?

In the long -term pattern that was marked Martinez, every time the lower limit of this rising channel has been bounced, it has risen to the upper resistance level. Conversely, Doge has traditionally withdrawn to the lower limit when it does not break above the ceiling of the canal. This cycle has repeated itself by large swinghighs in the periods 2017-2018 and 2021, among other things, which underlines how important the lower trend line of the canal is for maintaining the wider upward trend of Doge.

The graph of Martinez also has several Fibonacci racement and expansion levels, which provides insight into historically significant prize points. These important horizontal thresholds are 0.236 FIB (approximately $ 0.0068), 0.382 FIB (approximately $ 0.0159), 0.5 FIB (approximately $ 0.0316), 0.618 FIB (approximately $ 0.0625), 0.786 FIB (approximately $ (approximately $ (approximately $) (approximately $ 0.1), FIB (approximately $) (approximately $ 0.1),) and 1,414 FIB (approximately $ 6.24). In particular, the area of approximately $ 0.16 – $ 0.19 converges with the lower limit of the rising channel and the higher end of the Fibonacci range near $ 0.1650.

Related lecture

In his most recent YouTube Short, Martinez warned that a decisive break below the support level of $ 0.19 could open the door for a crash to $ 0.015, which matches the 0.382 FIB racement.

“Dogecoin could crash if it loses this level of support that Dogecoin has been exchanging in an ascending channel since 2014. But now Dogecoin is at a critical point if it breaks the level of support of $ 0.19, it can cause a correction to $ 0.015, “he said.

Related lecture

A few days earlier, he noted On X that as long as the lower limit of the channel applies to $ 0.16, Doge retains a chance to return to the Middenkanaal or even the upper trend line. “Doge stays in an increasing parallel channel. As long as the lower limit applies to $ 0.16, a rebound to the middle channel for $ 2.74 or even the upper limit for $ 6.24 remains a probability! “Martinez noticed.

However, the bullish prospects depend on Doge that this vital support zone retains. Any confirmed decrease below $ 0.16 – $ 0.19 would probably confirm a significant bearish shift, so that the road is cleared for the steep corrective phase that Martinez describes. Such a scenario would again visit the price area near $ 0.015, winnings that Dogecoin has collected about different cycles.

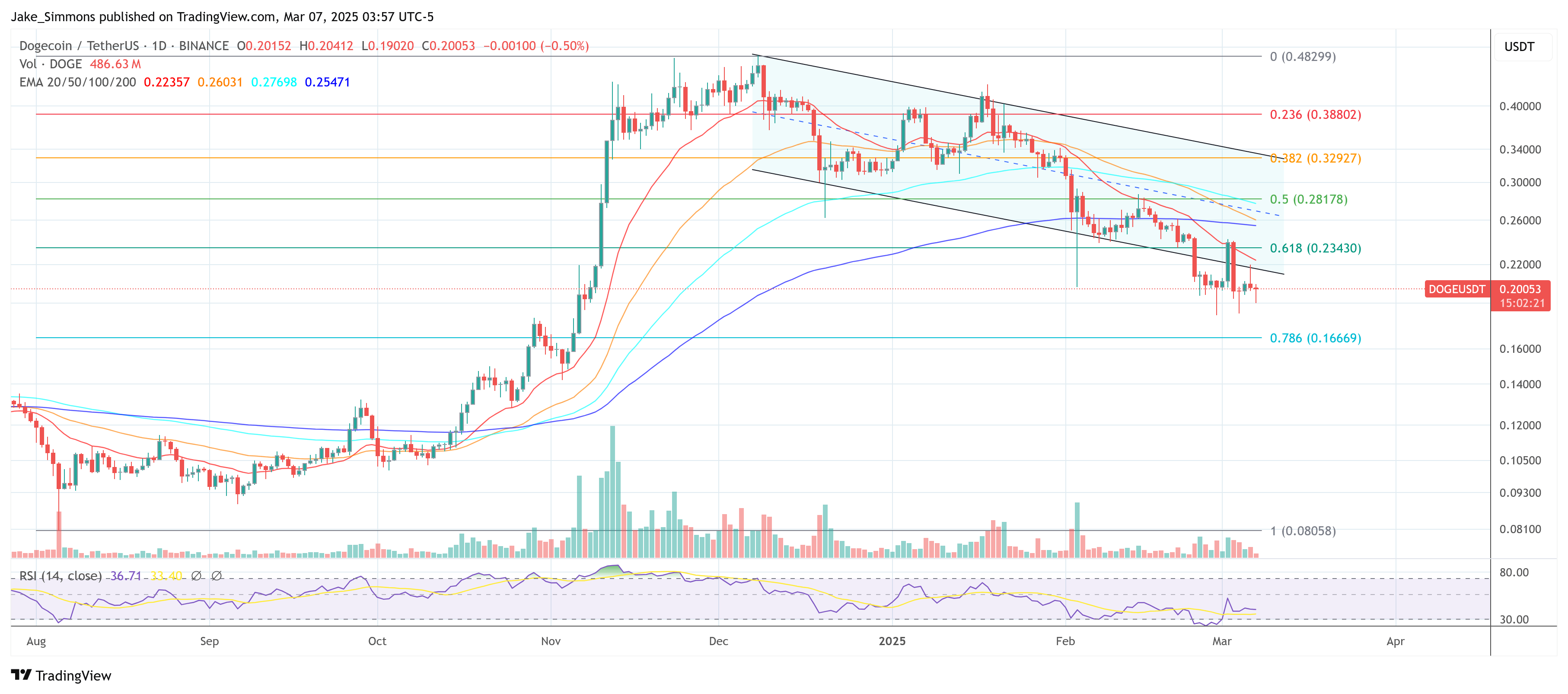

At the time of the press, Doge traded at $ 0.20.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply