- Retail traders accumulated in Bitcoin Longs, but whales withdrew and indicating the potential for a correction.

- Rising retail optimism and survivors can lead to a sharp Bitcoin correction, because whales reduce exposure.

Bitcoin [BTC] Is at a crossroads, with market sentiment sharply divided between retail traders and whales. Retail investors are increasingly pending in long positions and feed optimism on a price recovery.

Meanwhile wHales currently show caution by closing long positions or even initiating short positions. Historically, aggressive long accumulation by retail traders often precedes a market correction and a potential liquidation wave.

With the growing tension between retail optimism and whales caution, the critical question of whether retail traders will stimulate the market higher or whether whales will send it to a recession.

Retail traders double while whales withdraw

Source: Alfractaal

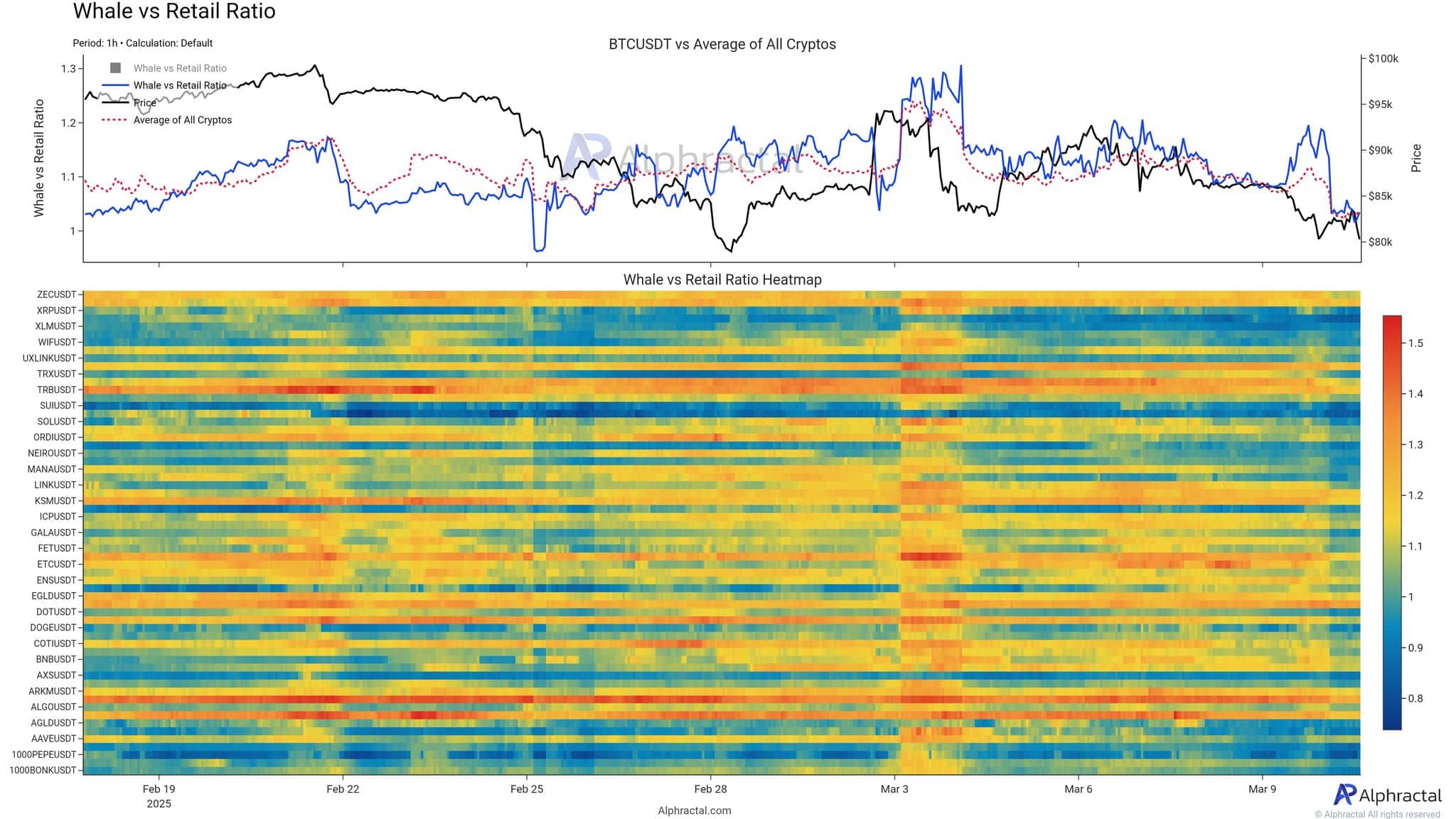

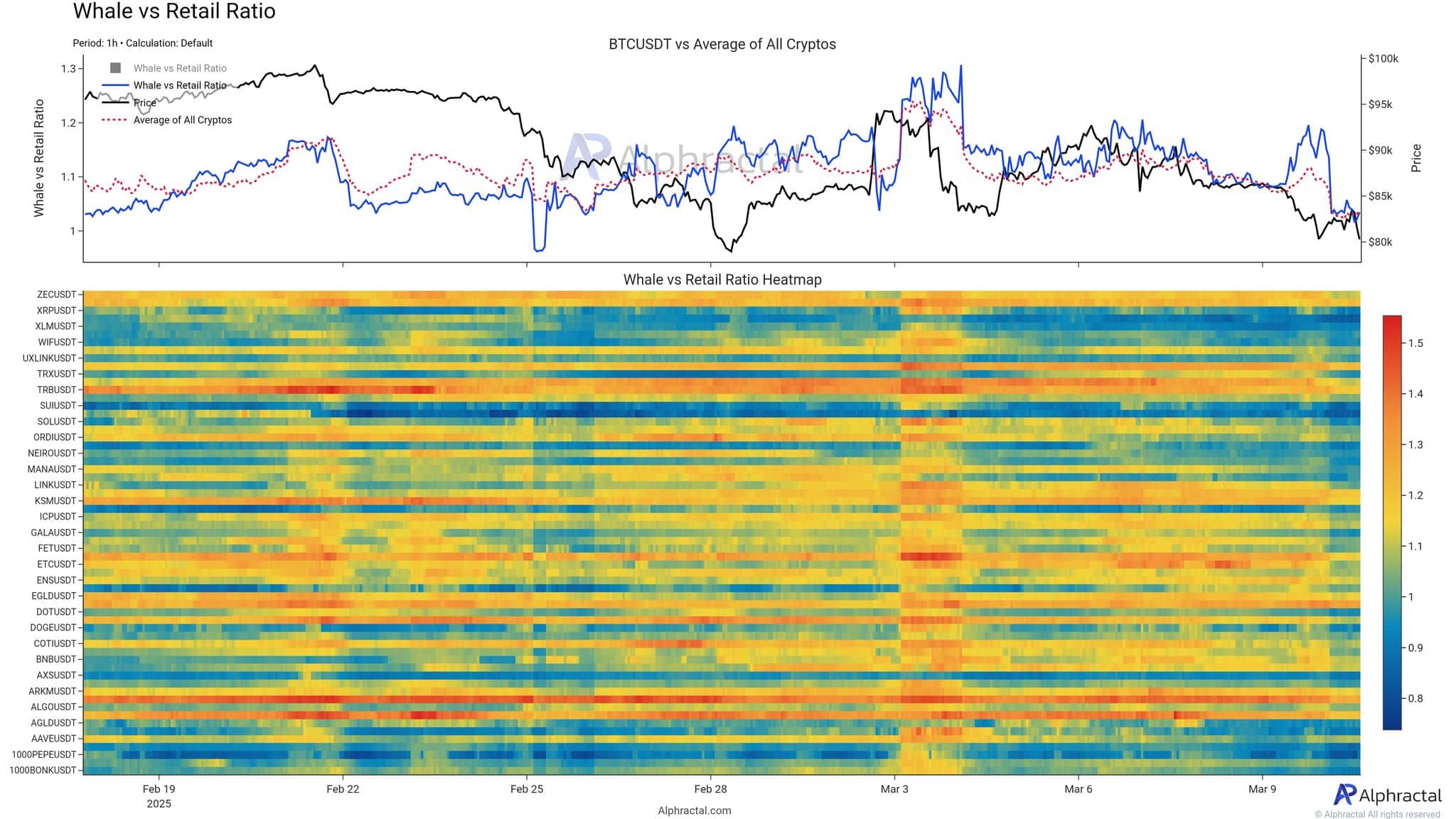

From the 3rd to 9 March, retail activity has risen, as reflected by the wider blue-yellow spectrum, especially while the price of Bitcoin remained under pressure.

Whales, on the other hand, seem to adopt a more careful position, as indicated by fewer red tires. Historically, a significant increase in the dominance of the retail trade without confirmation of whales are often followed by market corrections.

This divergence is similar to earlier bullfalls, where shops clash with whale-driven reversations. Current inequality suggests that whales may prepare for a decline, even if retail traders remain optimistic about further profit.

Bitcoin: Retail traders are all in, but at what costs?

The heat of the stores with a long/short ratio will show a strong increase in long positioning at retail traders in various altcoins from 3 March from 3 March.

Nevertheless, the price action of Bitcoin, displayed in the upper panel, deviates from this optimism – with the emphasis on a growing decoupling between sentiment and market direction.

Historically, such spikes in long bias preceded sharp corrections, because victory shop positions are vulnerable to rapid decline.

Source: Alfractaal

The intensity of the heatmap reveals increased beliefs of the retail bullish on the surface, but may possibly lay the groundwork for a liquidation-driven drop. If history is a guide, this imbalance can approach a reset, so that the current phase is marked as a precarious moment of recklessness.

The divergence between Bitcoin’s retail and whale event

The data emphasizes a clear gap: retail traders add aggressively long positions, while whales quietly reduce their exposure. Historically, such gaps have often led to rapid corrections, in which surviving retail traders are confronted with liquidation such as whales anticipating and benefit the decline.

Current trends suggest that although retail traders chase Momentum, whales prepare for possible volatility. Without the support of whales, a rally driven by the retail trade may have difficulty maintaining itself, thereby exposing Bitcoin to a sharp reversal.

Historical context and threatening risks

The historical cycles of Bitcoin often show a recurring pattern: retail traders enter long positions during periods of peak optimism, just like whales start to reduce their exposure. These phases often result in abrupt reversations and liquidation cascades.

This dynamic has repeatedly took place, characterized by Surges in Retail Trust, followed by competitive price drops. The current set -up shows a striking similarity, whereby the retail feeling is becoming more and more unilateral and structure is being used. This increases the risk of a sudden disadvantage.

Credit : ambcrypto.com

Leave a Reply