Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

In a period characterized by extraordinary polarization, market participants are torn apart between two opposite camps: one prediction that the current dip is only an arrangement for an approaching altcoin rally, and the other determination that the wider Crypto Bull Run has already reached its conclusion. In one after On X, Kororh Khaneghah, founder of Zero Complexity Trading, stated: “At the moment there is the most distributed timeline I have ever seen. Bulls believe that this is the last dip for an altealth season. Bears think that Bull Run is over. “

According to Khaneghah, “it is becoming more challenging to ‘predict’ cycle phases as crypto matures.” He emphasizes developments that did not appear in earlier cycles, including a shift from a traditional altitude season to a Memecoin season, Ethereum (ETH) still does not break his all-time highlights, and Bitcoin (BTC) surpasses his AH

Two scenarios for crypto

1. This cycle is different from others

Khaneghah points to growing institutional involvement – an element noticeably absent in earlier bull markets. He quotes data that suggests that BlackRock currently has almost $ 52 billion in BTC (via Arkham). According to him, this considerably increases the long -term buying pressure for Bitcoin, which leads to potentially shallower withdrawal because “will continue to buy settings.”

Related lecture

Due to increased institutional importance, Khaneghah expects BTC to continue to rise. This dynamic can change how capital runs in Altcoins: “In this cycle, Altcoins have seen capital visility. This means that there are more assets on the market and the liquidity spreads over several sectors, so that each sector cannot pump. “

He contrasts the Memecoin market with Defi. In the previous cycle, the Memecoin market was about half of the Defi. In this cycle, Memecoin market capitalization has that of Defi.

If this scenario applies, Khaneghah believes that BTC will remain the center for large movements, while Altcoins experience more fragmented, micro -bull. “This means that earlier Playbooks from Bull Run do not apply and that you just have to exchange rotations,” he notes.

2. The Bull Run is not over yet

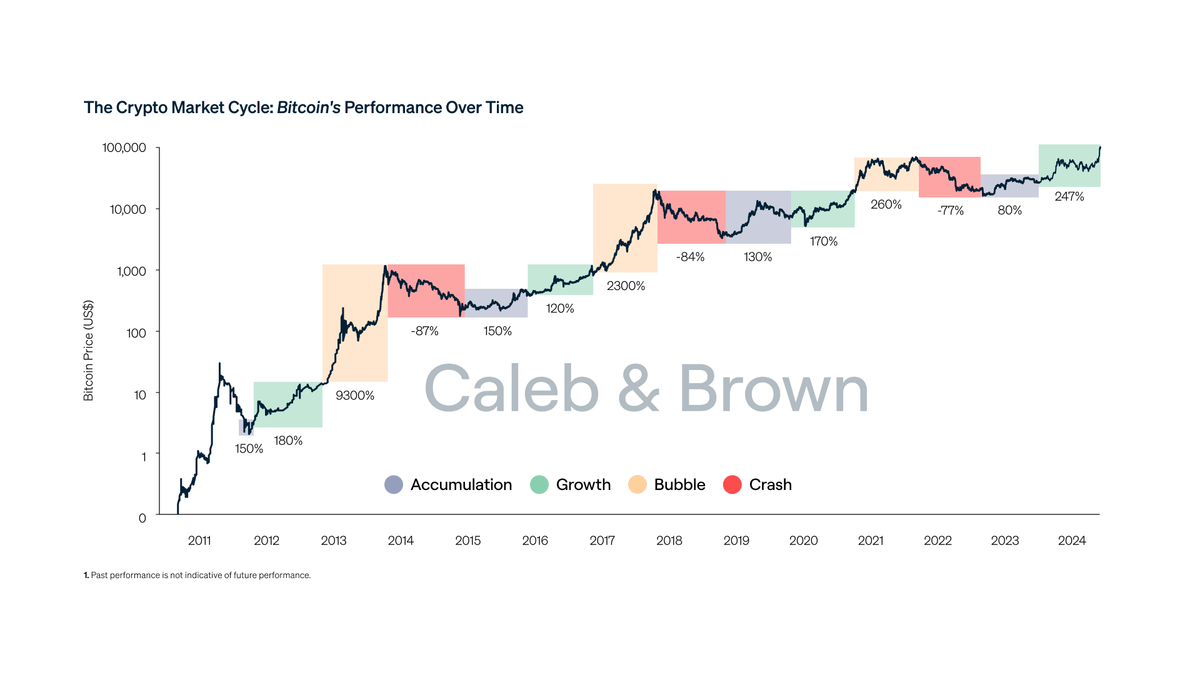

Khaneghah notes that BTC has only run 1.6x above the previous cycle heights before he withdraws and it mentions: “Not what a normal exit summit/bubble looks like.” From a historical point of view, BTC is often withdrawn from 40-50% from his ATH before he rises higher. In the current cycle, BTC has only withdrawn around 26% from its peak, suggesting that the possibility of repeating more patterns from the past.

A common Bull-Run Trigger, according to many analysts, is ETH surpassed his earlier cycle High-IS that still has to occur, given that ETH has not yet violated $ 4,000. Khaneghah states that this delay can indicate a delayed altitude season and a much longer overall cycle than expected.

Related lecture

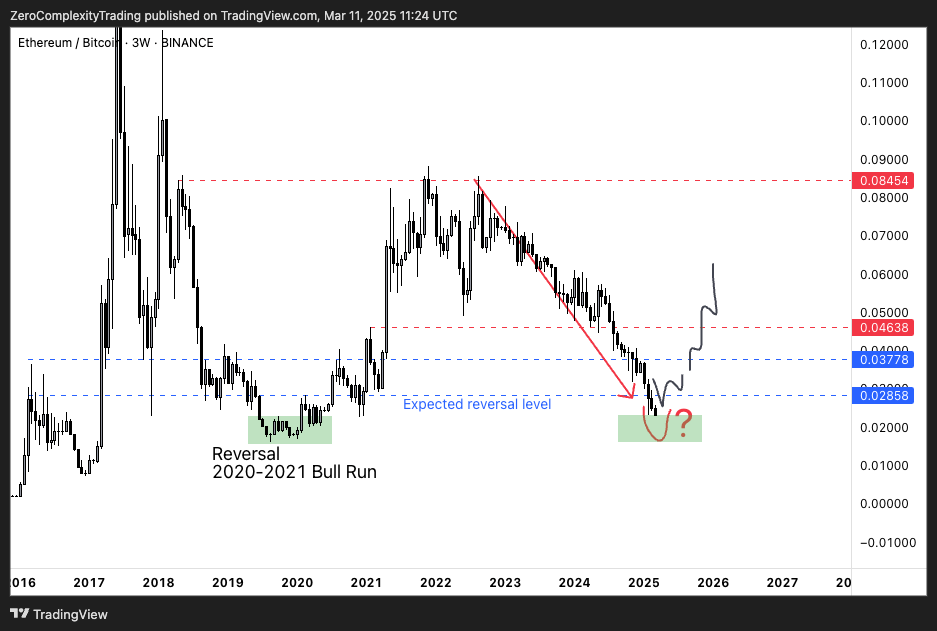

For Altcoins to regain momentum, Khaneghah sees the ETH/BTC pair as a critical indicator. A soil in ETH/BTC, combined with a rotation of capital of memecoins in other utility sectors such as Defi and RWA (real world assets), could recover Altcoin rallies.

Khaneghah concludes that traders do not have to be fixed on the bull or bear side: “If you are a trader, you do not have to marry a bias or commit to scenario 1 or 2. If BTC – Dominance continues, BTC acts by demanding the power and shortening the weakness. -S Alts starts to soil, switch capital there and buy the strongest coins. “

At the time of the press, BTC traded at $ 81,786.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply