Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

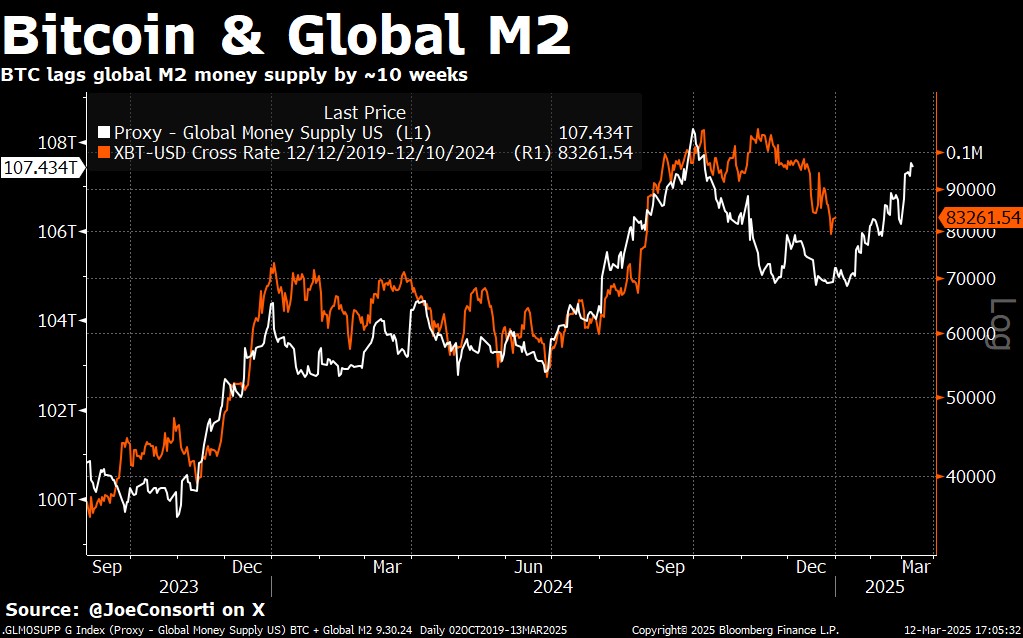

The tight correlation of Bitcoin with the global M2 has returned to the spotlight, which suggests that broader monetary conditions remain an important force behind the market trajectory of the cryptocurrency. Recent price promotion shows Bitcoin that convergates a delay of 70 days with the downward drift of M2-Ongever. This cyclical movement emphasizes Bitcoin’s continuous response to fluctuations in liquidity, even as other fundamental factors, such as the newly announced US Strategic Bitcoin Reserve (SBR), continue to capture the headlines.

Global M2 Correlation and Bitcoin-Marketinfficiency

In his last investigation remarkAnalyst Joe Consorti emphasizes that “Bitcoin’s directional correlation with the global M2 has been refined again”, indicating that the price is heavily influenced by trends for money supply. After a few months of divergence – partly affected by a strong US dollar – Bitcoin dropped to $ 78,000 and came within $ 8,000 of the projected path of M2.

The global M2 index is softened, the partial reflection of the robust performance of the dollar. Despite that resistance, Bitcoin seems to follow the general liquidity blue pressure that it followed during this cycle, which suggests that the price of Bitcoin still depends on large macro forces such as extensions of the central bank and contractions. “Although this relationship is not a direct cause and effect mechanism, it continues to offer a useful macro framework,” consorti writes.

He added: “The collection meals? Bitcoin remains the ultimate monetary active in a world where money supply, balance capacity and credit are constantly expanding. As the worldwide applies, Bitcoin follows it, at least directional. But this cycle is seeing extra variables that make M2 a less reliable independent indicator, such as the US dollar that is historically strong, creating a resistance on global M2 mentioned in USD, and more accurate measures of money supply and liquidity that appear on stage. “

Related lecture

Although macro conditions exert known pressure, the response of the market to the SBR announcement is confusing. After US President Donald Trump had formal plans to collect Bitcoin via a “budget-neutral” mechanism, the price decreased in just under a week 8.5%. Consorti described the sale as “an irrational response that emphasizes important inefficiencies in the prices of the geopolitical importance of Bitcoin.”

Executive Order 14233 mandates Treasury and Commerce officials to grow the BTC holdings of America – disturbing on 198,109 BTC – without a new taxpayer or conference overview. This is a stark contrast with earlier adoptions at government level, such as the legal payment movement of El Salvador, which coincided with an increase in the price of Bitcoin. Consorti attributes inequality to taking profit in the short term and a “sales-de-news” mentality, and adds that “the size of the sale indicates a complete failure to praise in the long-term implications.”

Despite the SBR-related dip, the technical signals from Bitcoin suggest a possible local soil formation. The cryptocurrency fell to $ 77,000 before he bounced back and filled a lay with a low volume in the range of $ 76,000- $ 86,000. Buyers seized the retracement and created two hammer candlesticks on the weekly graph.

Related lecture

Hammer Candlesticks usually point to a reversal, especially when they appear at cycle-defining support levels. According to Consorti, “historical precedent suggests that Bitcoin is these patterns at Cycle -turn points … The last time we saw this exact price structure, was consolidation during the end of Bitcoin’s summer, two months before the rise from $ 57,000 to $ 108,000.”

A remarkable trend in the midst of these price fluctuations is the rising dominance of Bitcoin, even during periods of market contraction. ETH/BTC recently dropped to 0.0227 – it is the lowest since May 2020 – which indicates intensifying skepticism compared to Altcoins. In the meantime, the institutional demand for Ethereum has also started, as is apparent from a decrease of 56.8% in the Asset Under Management (AUM) ratio for Ethereum vs. Bitcoin.

“This cycle is from Bitcoin and all future cycles will only further cement this reality,” Consorti claims. He suggests that Altcoins are fighting a tough fight, because Bitcoin-oriented stories get traction worldwide.

At the time of the press, BTC traded at $ 82,875.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply