- Memecoin supercycle stories are warmed up while speculative capital flows to assets with a high beta.

- Shib has shown historically parabolic rallies, driven by speculative importance and liquidity stabs.

The Memecoin market continues to perform better, because large altcoins are struggling among Bitcoin’s [BTC] Dominance, with memecoins that register an increase of 6% in market capitalization in the midst of BTC consolidation.

Shiba Inu [SHIB]A High-Beta-Activum in the sector has shown historically parabolic extensions during the accessible phases of Bitcoin, which flourishes on speculative capital influx.

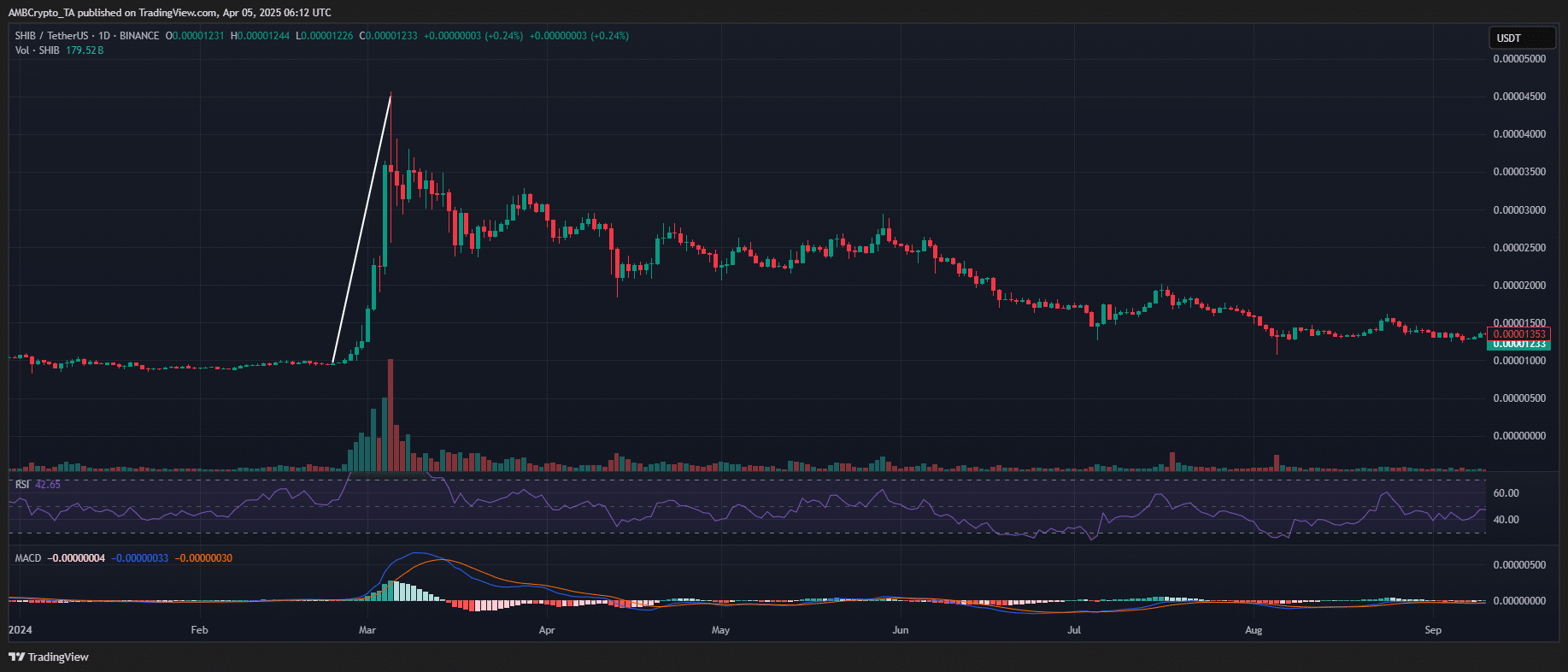

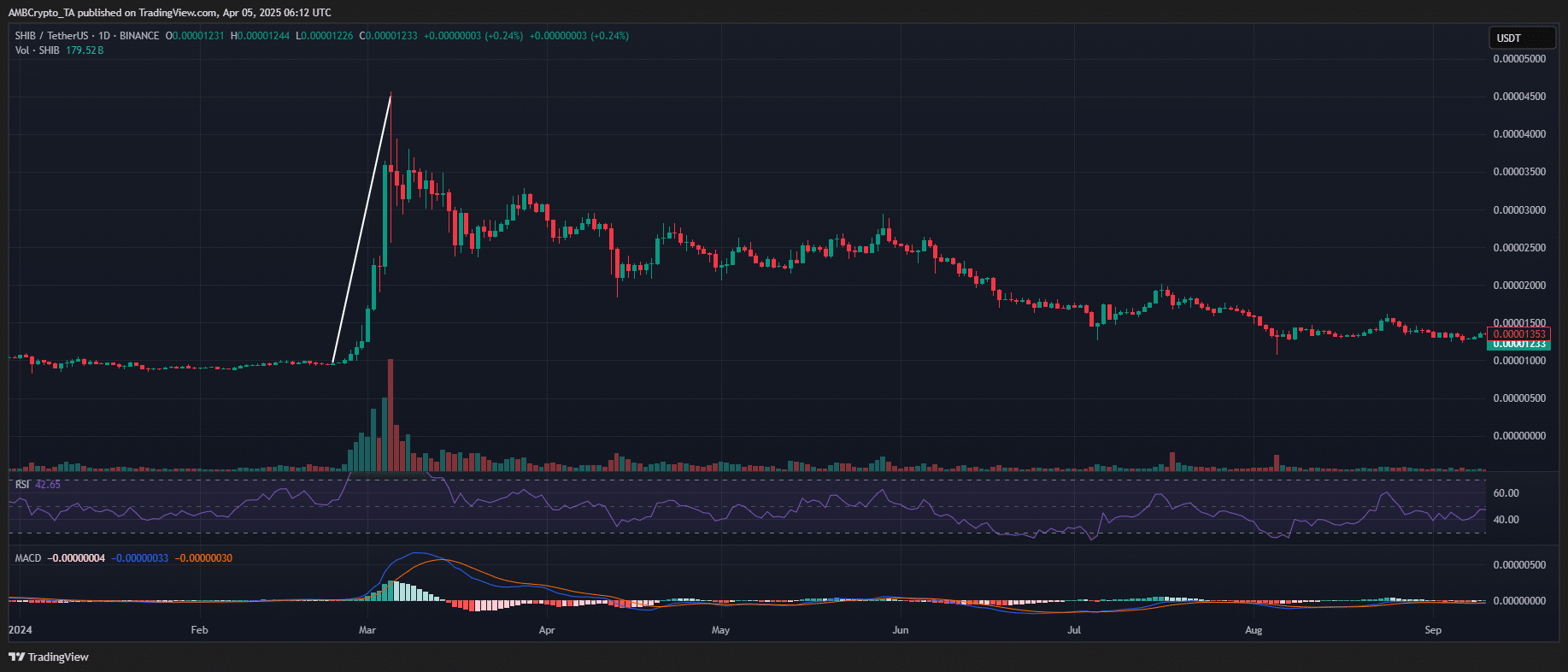

Especially at the beginning of March 2024, ShIB printed three consecutive higher highlights, each with a 30%+ intraday increase, after an outbreak of a long -term accumulation phase.

Source: TradingView (Shib/USDT)

Meanwhile, kept-up bid-liquidity and persistent bullish sentiment around Bitcoin during that cycle its structural reach, which prevented a broader market correction and capital can rotate in assets with higher volatility.

This divergence emphasized the tendency of memecoins to disconnect from broader market flows. That is why she positions them as speculative assets during risk-on market cycles.

There is now a similar setup. The recent 6% increase in Memecoin Market Capitalization Controlls corresponds to Bitcoin dominance that is approaching an overheated threshold, while Altcoins with high cap remain under pressure.

Is this the early phase of a memecoin -supercycle? If so, will Shib again show explosive upward volatility?

Catalyst for a Memecoin SuperCycle?

Interesting that shibs Changes On both spot and derivatives, the markets have fallen to a low of four years, indicating a tightening of delivery dynamics.

At the same time, an Ambcrypto report reveals that 80% of the total supply of SHIB is now under control of the long term, which indicates strong accumulation and reduced liquidity on the sales side.

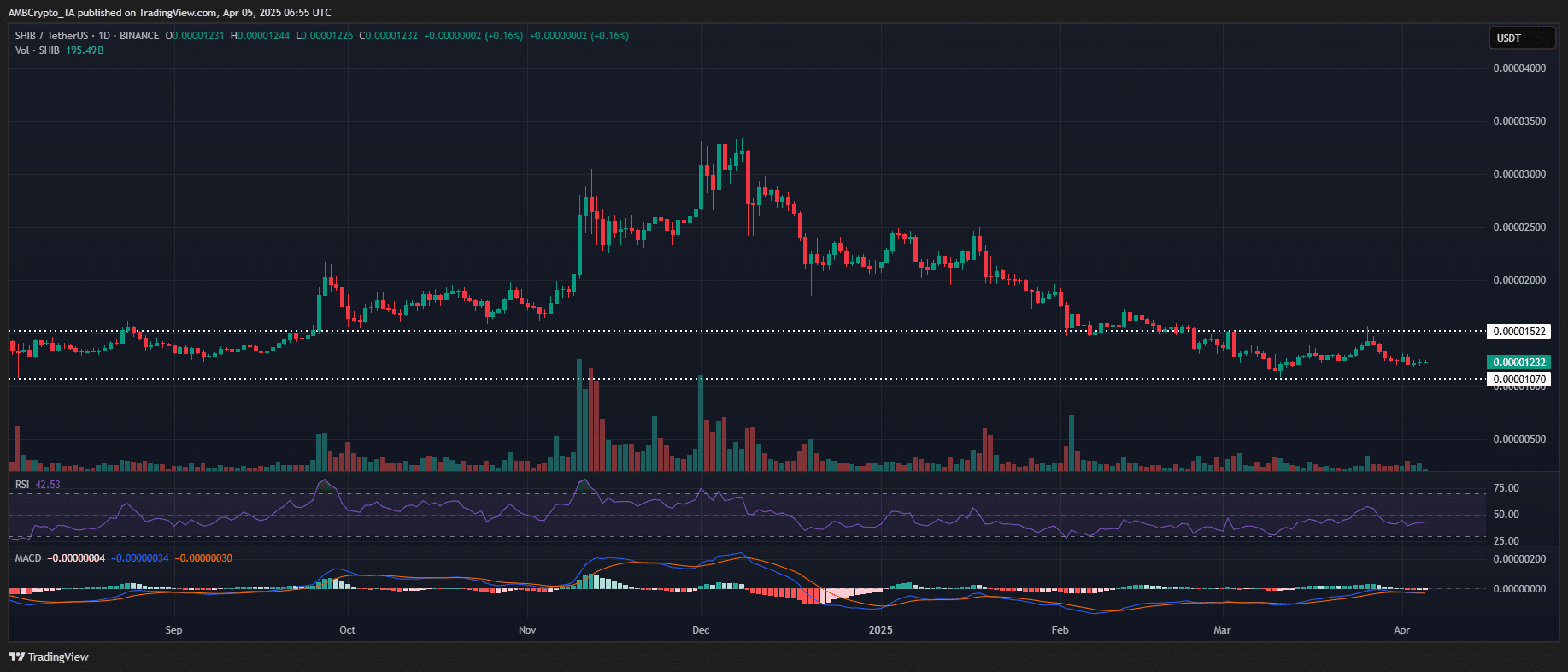

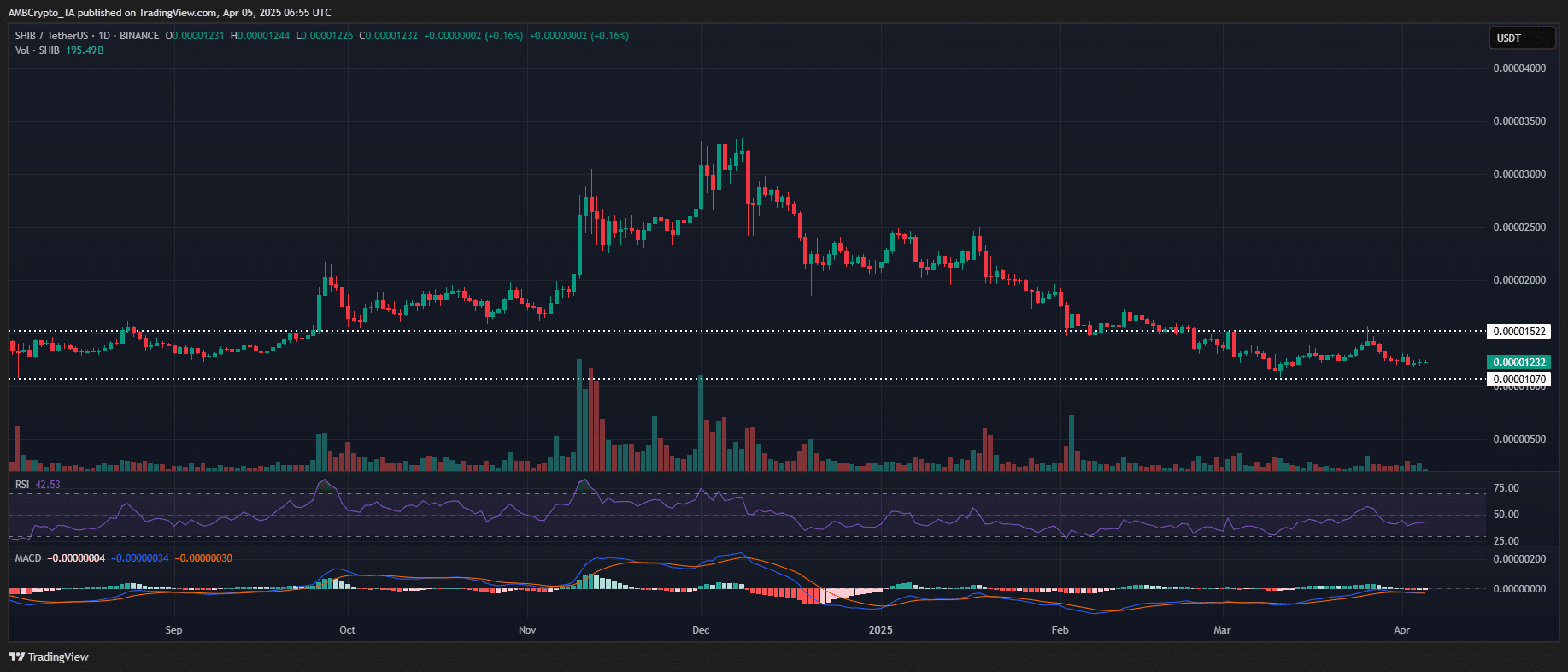

In fact, on the daily time frame, Shib had a consolidation of one month around $ 0.00001230, with a reach -bound accumulation zone.

Source: TradingView (Shib/USDT)

It is striking that Memecoins with high CAP also show comparable accessible structures, which suggests a ‘sector -wide’ liquidity raccumulation phase.

Support for this narrative data from Coinglass shows that Shib’s liquidity profile And the market structure resembles the early 2024 conditions and signal the upward potential of Q2.

However, in order to distinguish a sustainable momentum from the “hype” in the short term, consistent monitoring of liquidity flows, open interest and exchange reserves will be crucial.

For the time being, both analyzes on chains and the dynamics of the market structure that Memecoins are prepared for a supercycle, which perform better than traditional altcoins.

With tightening, increasing LTH dominance and rising speculative inflow, the memecoin sector remains the high volatility game to view in Q2 2025.

Credit : ambcrypto.com

Leave a Reply