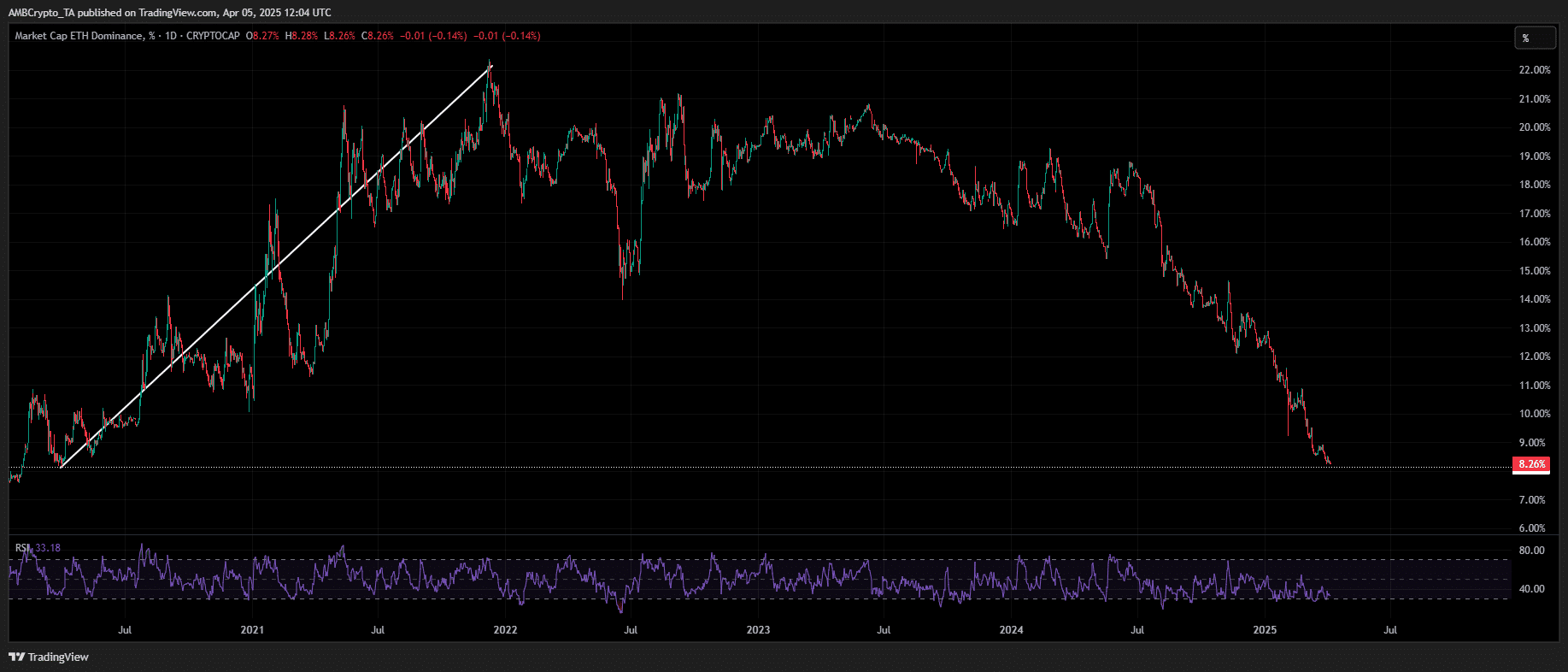

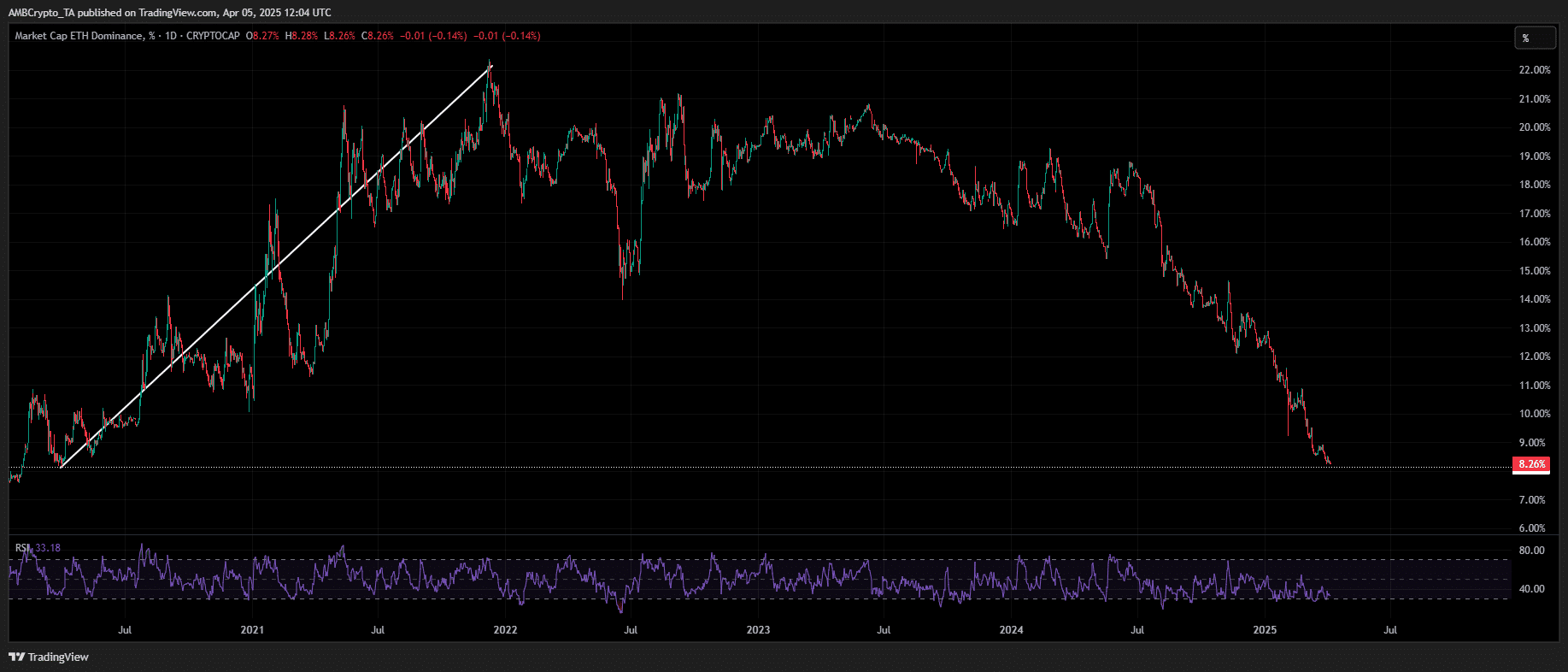

- Ethereum Dominance has collapsed into a low of five years of 8%.

- The data from Ambcrypto show that the dominance of Ethereum has fallen since mid -2024, despite a bullish cycle.

Ethereum [ETH] emerged as one of Q1’s largest high-cap underperformers.

Although his price decrease in Focus remains, a more worrying metric is its market dominance, which has fallen to a low -five -year low of 8%.

In fact, it is the statistics that the levels have witnessed who last witness during the market cycle induced by COVID.

At the time, Eth Dominance organized a sharp Q2 recovery, which caused a double digit foot to the ground.

This time, however, important technicalities are varying RSI remains anchored in over-sold territory and cannot be reset despite ETH trade at a lowest point in two years.

Source: TradingView (ETH.D)

It is clear that the risk-off sentiment from Ethereum remains increased, suppressing new entry into the retail trade and limiting the upward momentum. Given the current conditions, a dominance shell of 2020 style seems unlikely.

Moreover, a broader structural shift is clear, in addition to the statistics and technical chains.

Ambcryptos analysis of the graph above emphasizes Ethereum’s persistent dominance-Near trend since mid-2024, despite a historic bullish macrocycle.

Important catalysts-included post-ranging capital rotations, the Trump meeting and the three tariff reductions of the Federal Reserve-Hebben do not ignite meaningful recovery.

Despite this steel wind, ETH closed the year with a modest annual profit of 47%.

The dominance of the market, however, was eroded by 4%, withdrawing to 12% by Q4 2024, as a result of which persistent “relative” weakness against wider market trends underlines.

Ethereum -Dominance falls against macro trends

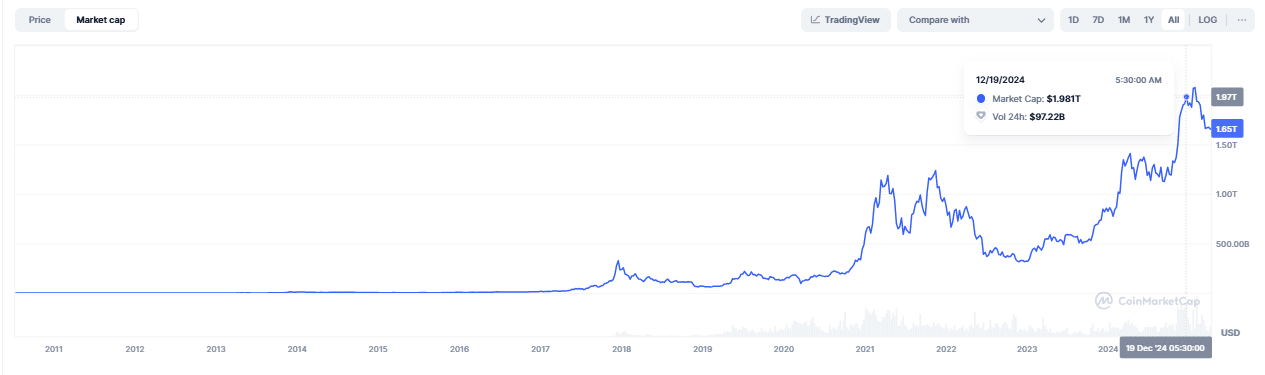

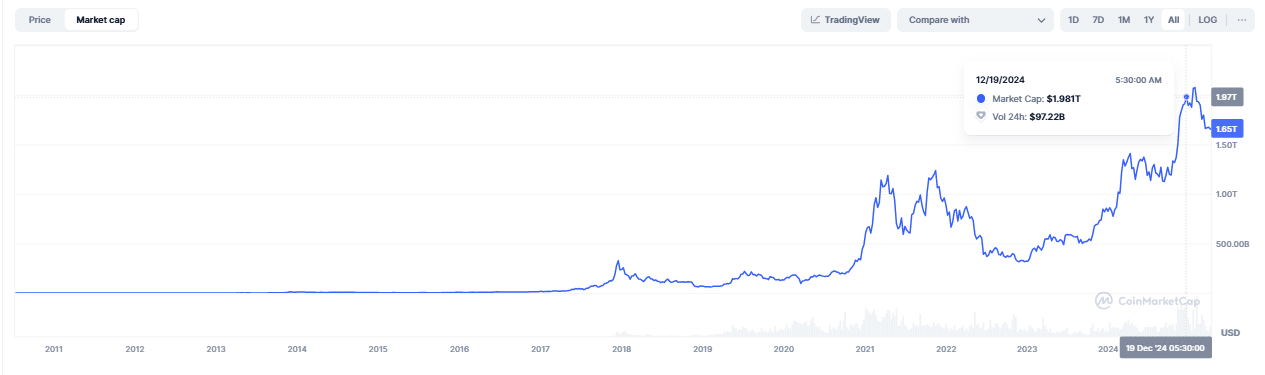

While the dominance of Ethereum was eroded in 2024, Bitcoin’s Market Dominance (BTC.D) rose from 54% to 61% against the center of the Q4, which means that the total market capitalization of BTC for the first time in history the total market capitalization of $ 2 billion in the history of $ 2 biloth.

Source: Coinmarketcap

This shift underlines the relative weakness of ETH, powered by aggressive capital strotations in Bitcoin, fueled by macro-driven risk position and speculative priority of a potential “Trump pump”.

A comparable imbalance of capital flow has now been unfolded. The institutional demand for Bitcoin has been dominated since March, while ETFs continue to escape, which indicates a weak conviction.

As macro insecurity gets deeper, institutional liquidity Will dictate market stability. Bitcoin increasingly confirms its role as a risk-off assets.

In the meantime, Ethereum continues to lose the market share five-year dominance low in strengthening the story of persistent capital rotation away from ETH.

Credit : ambcrypto.com

Leave a Reply