Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

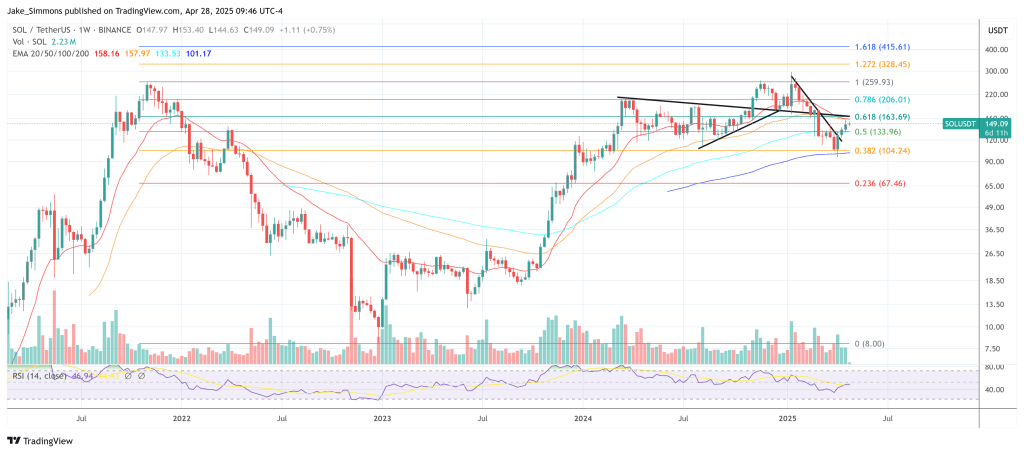

Daily price promotion in the SOL/BTC pair is starting to paint a sharp different image than the first quarter, according to a graph that was shared on Sunday by Veter supporter Josh Olszewicz.

The one -day graph explain A basic pattern (IHS) a textbook and shoulders (IHS) that has been forming since the beginning of March and now the neckline is approaching around 0.00162 BTC. At the time of the screenshot, SOL was quoted at 0.001588 BTC. With Bitcoin who change ownership in the vicinity of $ 94,765, that Solana places around $ 150 per coin.

The anatomy of the pattern is difficult to miss: a layer of March 19 at 0.00127 BTC ($ 120) forms the head, flanked by higher Swing Lows on March 11 left shoulder). The left shoulders is currently forming. The horizontal neckline fits in with the floor of the late December that broke in February and converts strong support into equally sturdy resistance. Measured from the head to the neckline, the amplitude is approximately 0.00033 BTC; A clean outbreak would imply a technical goal in the vicinity of 0.00195 BTC – convenically the lower limit of the distant edge of the Kumo cloud.

Solana Bulls have a target

The graph is covered with a long-saturated Ichimoku configuration (20/60/120/30). At the last closure, the Tenkan-sen was 0.00150 BTC, the Kijun-sen exactly on the neckline at 0.00162 BTC, and Senkou includes a printed 0.001742 BTC while Span B was kept higher at 0.002159 BTC. The cloud itself remains bearish – thick, red and overhead – and the tensioning difference starts to compress, which decreases downwards. A decisive push in the Kumo would cause classic Ichimoku edge-to-edge trade, aimed at Span B at around 0.0016 BTC (approximately $ 205).

Related lecture

The bullish setup takes place only two months after the market has completed the mirror image of the same pattern. From mid-December to Early Februari, SOL/BTC, a prominent head and shoulders carved, the neckline lost at the beginning of February and directly to the IHS of March. That down-and-up symmetry gives extra weight to the current formation by showing how faithful the couple respected the classic geometry in the past six months.

“1D SOL/BTC-IHS + E2E at a certain moment but not fast, probably at the end of May,” Olszewicz wrote on X. The caution of the analyst reflects the fact that the price is still under both the neckline and the Kijun-sen and the Kumo does not do until the last week of May. A premature attempt attempt risks rejection in a final judge-shouldest near 0.00151 BTC ($ 143), where the Tenkan-Sen currently also lives.

In particular, the Chikou -Span (lagging line) remains below the price and cloud, and emphasizes that the trend confirmation is awaiting; Both Ichimoku purists and pattern traders can therefore agree that 0.00162 BTC is De Lijn Solana Bulls, have to turn decisively.

Related lecture

If the edge-to-edge objective is reached, Sol would add about 26 % to Bitcoin from the current levels and reclaim the land that was last seen at the beginning of February. If the neckline rejects, the protection of the downward descent is thin until the twin shoulders at 0.00145-0.00148 BTC; A break of that plank would invalidate the bullish thesis and reopen the Mars trog.

For now, the market is content to rinse under resistance, while the clock taps in the direction of the bending of the cloud. Whether the timetable of Olszewicz Late Mei proves that visional route will depend on Bitcoin’s own process and the wider risk environment, but the price structure on the Solana/Bitcoin graph is clear: after a winter the bulls finally have a pattern that is worth defending.

Sol traded at $ 149 at the time of the press.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply