Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Independent market technician Egrag Crypto placed a updated weekly XRP/USD hit list on X. De Visual, built on BitFinex data, frames the full NA-Juli 2024-OPMARS by XRP by XRP as the flagged pole of a classic bull-flag-leak-cover pattern patterns succeeded.

XRP ready for outbreak

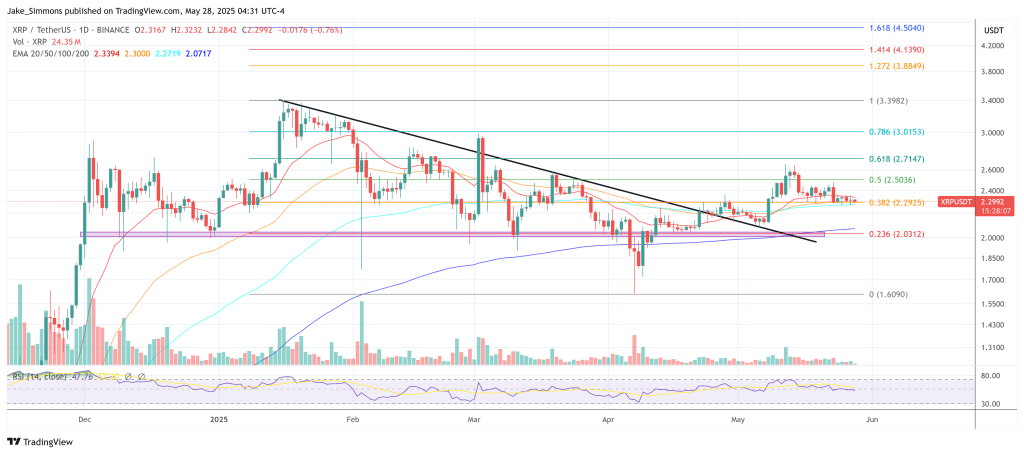

“The success rate of breaking is around 67-70 percent”, the analyst writesWith reference to bulk pattern recognition studies that underlie the statistical lead of the setup. XRP acts near $ 2.30, a value marked on the graph by a blue dotted horizontal line that crosses the body of the flag.

Related lecture

This records a white line of $ 1.50 the breakout shelf of the Late 2024 that now functions as the first support with a higher frame, while a deeper red horizontal at around $ 0.60 flags from the base from which the current cycle started. By switching on the entire structure, an increasing yellow-trying average-visual consistent with the EMA of 20 weeks (currently at $ 2.21)-including what Egrag calls the “still positive long-term trend pre-judgment”.

The technician derives three measured goals from the Move from that basis. “For long -term pimples, I prefer logarithmic maps, especially in crypto, because of the exponential growth for short periods,” he explained. Based on that, a projection projection extrapoles the entire height of the flagpall and lands at $ 18.00. A linear projection, which treats every Dollar from Advance equally, prints a clearly lower $ 5.50. Taking what he describes as a “liquidity-good average average mine preference method for crypto objectives”, sets Egrag at $ 11.75.

Related lecture

Because ordering books for digital asset remain relatively thin, the analyst overlaps a fifteen to twenty percent variability, which stretched the log target to around $ 20.70- $ 21.60, the average to $ 13.51- $ 14.10 and the linear to $ 6.33- $ 6.60. “I usually apply a variability of 15-20 percent because the crypto -liquidity is even smaller compared to legacy markets, so goals can go in both sides,” he warned.

A disclaimer that is pressed directly into the image repeats that the figures and goals are “only for simulation purposes and not financial advice”. Nevertheless, the route map is clear for Egrag: as long as XRP defends the midflagzone near $ 2.30 and, critically, the structural pivot stunt for $ 1.50, the technician argues that a final outbreak could be correct in the token in double digitter territorium latan $ object.

At the time of the press, XRP traded at $ 2.28, still floated just below the upper trend line of the bull flag. A close by above the resistance can quickly speed up the XRP price to 0.5 and 0.618 Fibonacci retracement levels at $ 2.50 and $ 2.71 respectively.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply