- Bitcoin fell below $ 106k, making his bias Bearish

- On-chain statistics emphasized a lack of enormous sale, which meant that investors had comfortable

Bitcoin [BTC] Under the real value gap fell to $ 106.5k-one sign that the bias was in the short term arary at the time of the press. In fact, it probably seemed to fall to $ 102.5k and as deep as $ 100k. However, a breakdown under $ 100k may be unlikely.

Geopolitical tensions and the possibility of war grow by the day while Nations exchange rockets in the middle -east. Inflation is delayed in the US, but it is not yet against the target interest rate of the Federal Reserve. Rates and economic uncertainty are also showing up. These factors have led investors to flee to gold as a value storage.

Despite the FUD in traditional markets, Bitcoin has remained strong above the $ 100k mark. This means that investors increasingly treat the crypto activum as a value of value.

Bitcoin investors are in a waiting mode

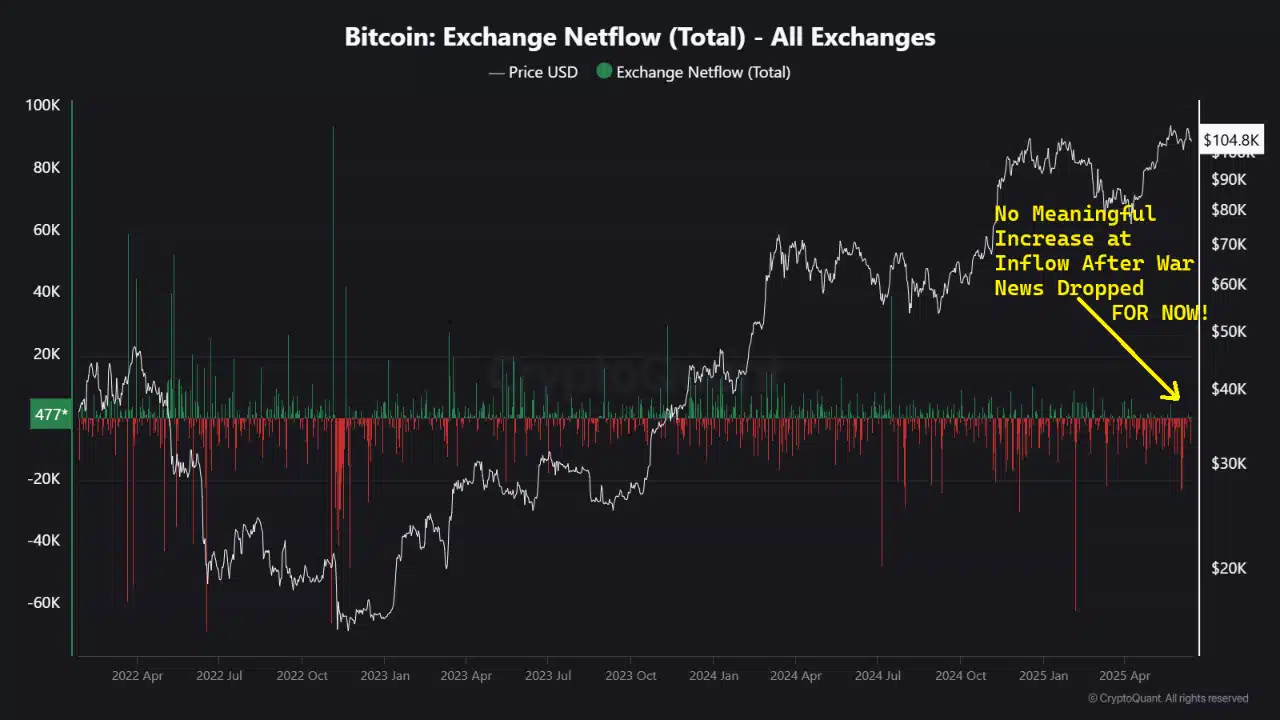

In a post Cryptoquant insightsuser Cryptome noted that the change in Netflows was not high. There has been no significant positive change in the Netflows, which did not mean high influx because holders realized profit and left the market.

This lack of sales, for now, can be a positive sign that investors may not panic.

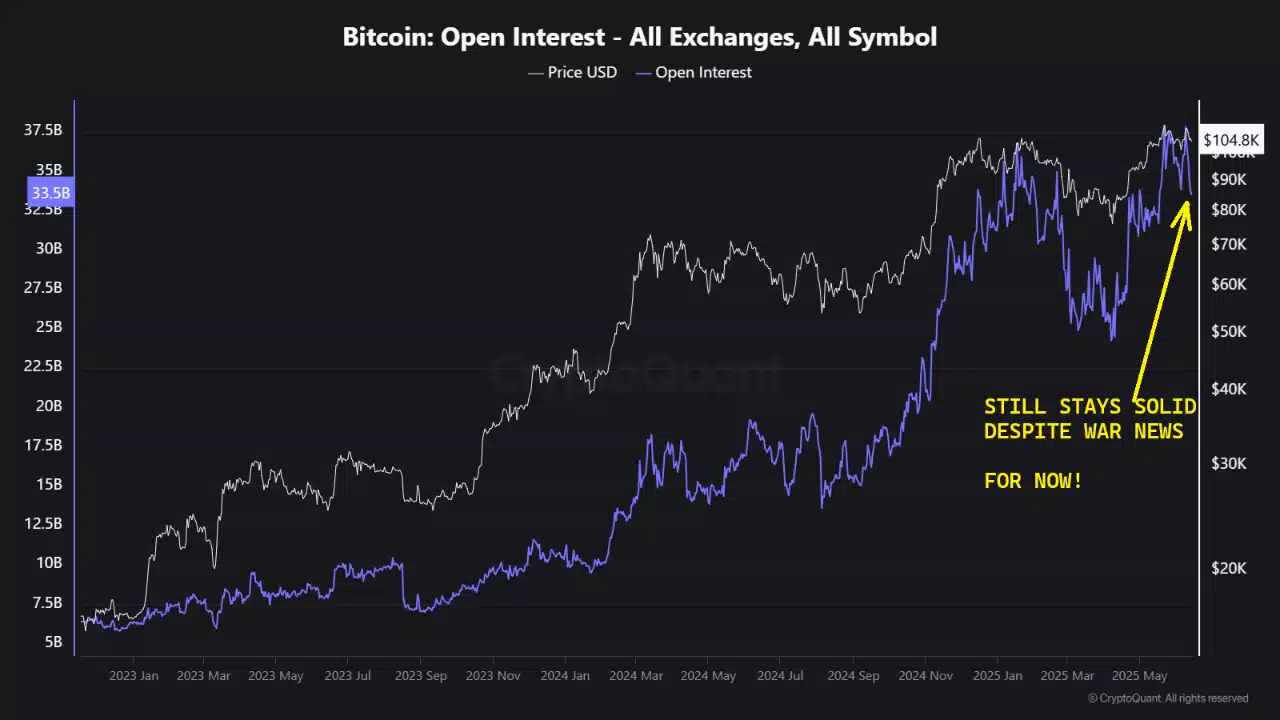

The open interest in centralized fairs did not show a big drop. The correction from $ 110k to $ 105k saw long liquidations, which meant that long positions were closed with violence, which declared a good part of the OI decrease.

However, it was not a large -scale sale. High OI levels meant that speculative interest was remarkably high, despite the fear and uncertainty in the market. It can be another sign that investors are now awaiting the waiting time.

In one Post on XCrypto analyst Axel Adler JR noted that reading was at 46%, just below the neutral threshold of 50%.

To resume the upward trend that it saw earlier in June, the index must climb more than 60%-65%. This would be necessary on persistent demand and capital inflow.

Source: BTC/USDT on TradingView

The 1-day graph revealed that a bearish bias was justified for Bitcoin in the coming days. Last Friday there was a long Southward Wick, whose low of $ 102.6k could be quickly revised. The CMF revealed that the sales pressure was dominant, with the great Oscillator suggested that a downward momentum has.

In general, market participants must expect volatility in the short term. In the light of Fud, however, the power of the holders is encouraging. It may be smart for retail investors to also adopt this wait -and -see attitude.

Credit : ambcrypto.com

Leave a Reply