- LINK has formed a double bottom pattern within a demand zone, as identified by the IOMAP data.

- Furthermore, analysis of merchant activity shows an increase in the number of large transactions and a decrease in NetFlow.

Despite a largely bearish trend, with a decline of 9.13% in the past 24 hours, continued market caution and increased activity could position Chainlink [LINK] for a future increase in value.

AMBCrypto has analyzed LINK’s potential path to the upside in the upcoming trading session, highlighting the key levels to watch.

Chainlink enters bullish territory after the formation of key support levels

LINK’s recent price decline has led to the formation of a double-bottom pattern, a bullish chart formation where the price hits the same low at different times before moving up.

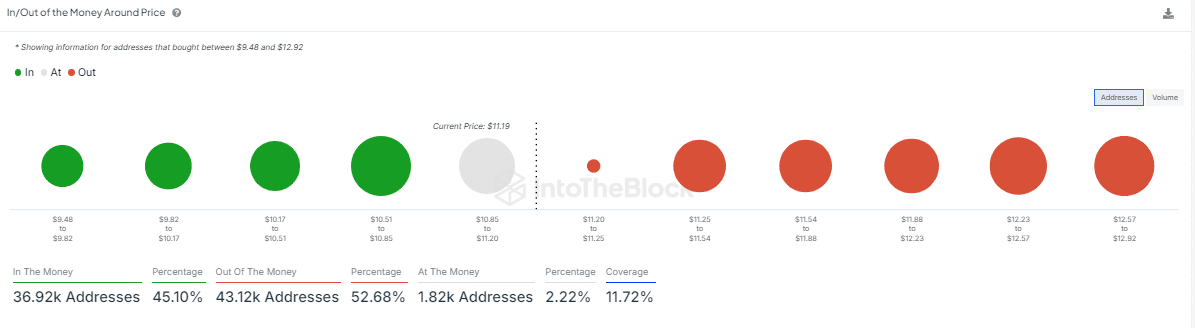

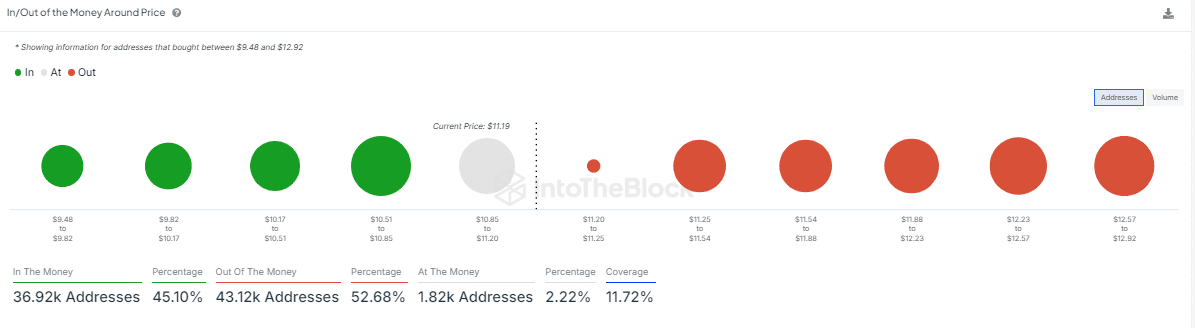

For LINK, this pattern emerged at $10.84, and then the price started to rise. This level corresponds to a significant demand zone as identified by the In and Out of Money Around Price (IOMAP) of InTheBlok.

Source: IntoTheBlock

The IOMAP data shows that the support level is between $10.85 and $10.51, with over 10.24 thousand buyers placing orders for 15.95 million LINK.

This concentration of buying activity indicates that LINK is currently in an accumulation phase, paving the way for potential price increases in the future.

Traders maintain a bullish stance on LINK

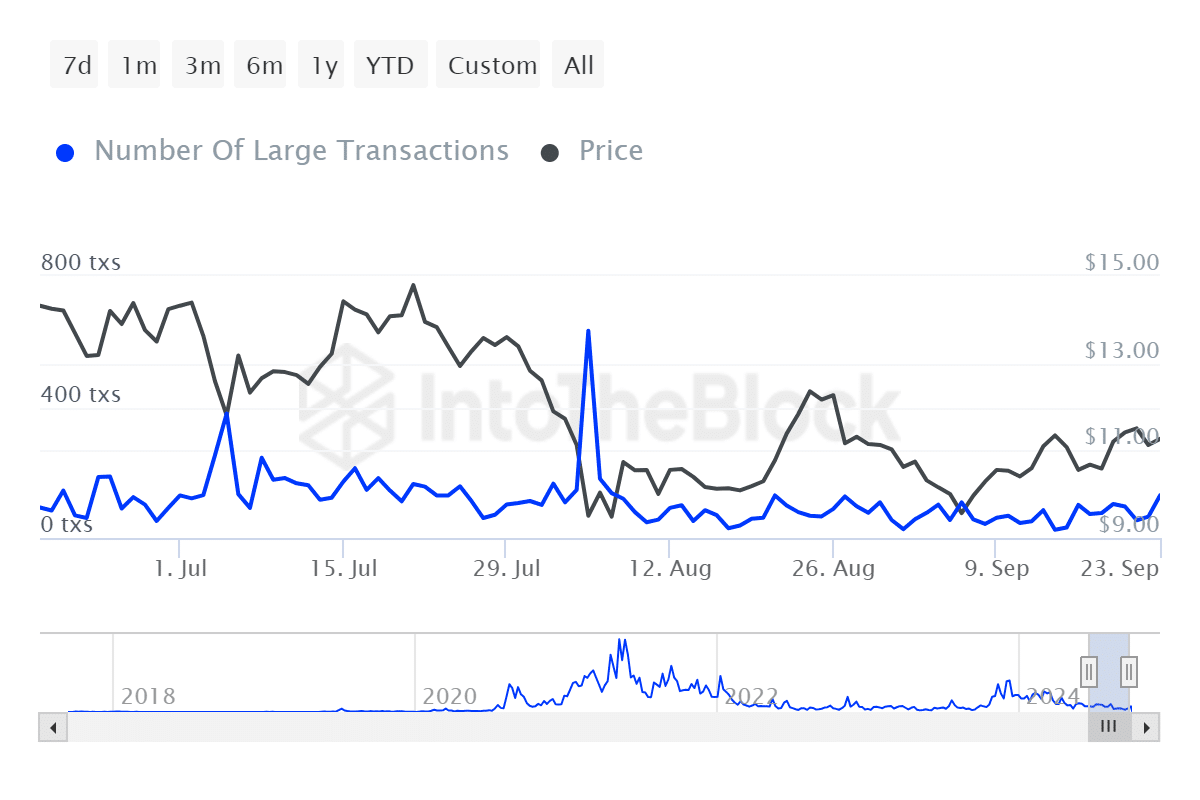

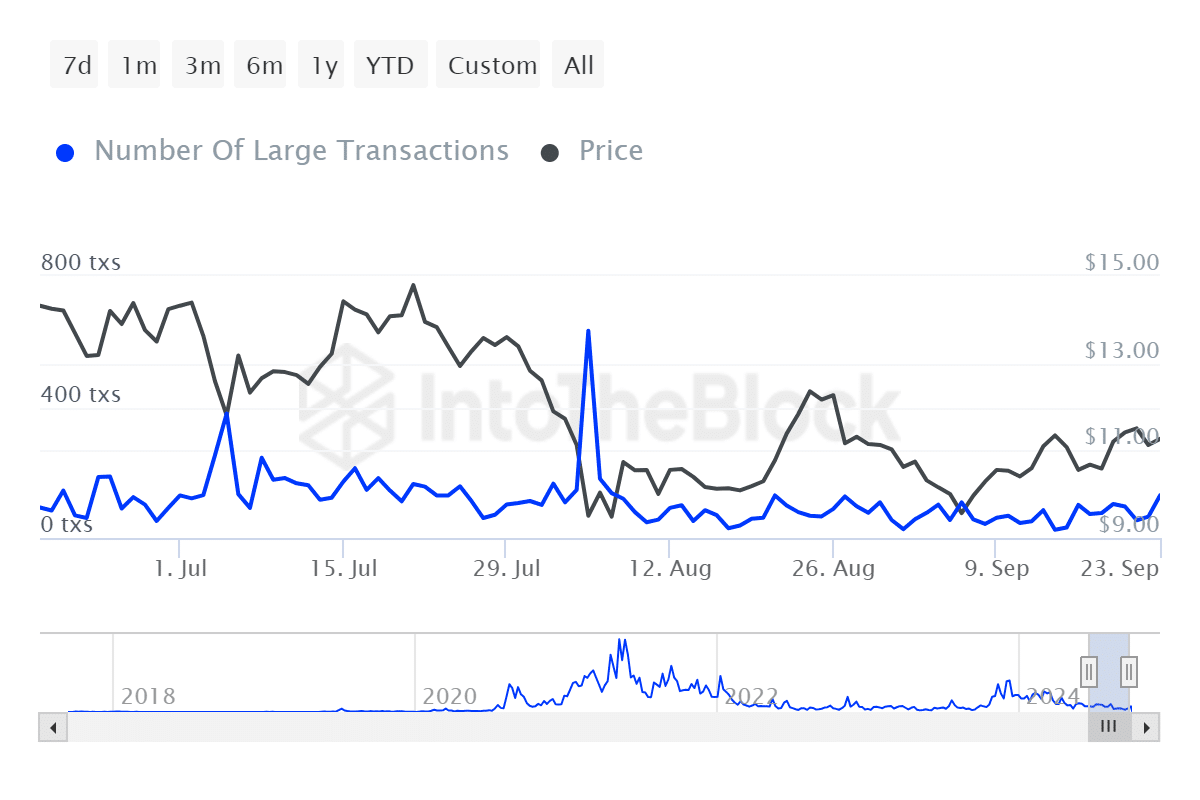

Recent data from IntoTheBlock shows that traders continue to exhibit bullish behavior against LINK, driven by trends observed in Exchange Netflow and large trades.

Over the past week, there has been a notable outflow of LINK from cryptocurrency exchanges, amounting to a negative 386.67 thousand LINK. This trend indicates growing confidence among market participants that LINK’s price will rise.

Source: IntoTheBlock

At the same time, the number of large transactions above $100,000 has increased, reaching a seven-day peak of 196 transactions.

This activity suggests that large LINK holders, often called whales, are actively accumulating more LINK, reinforcing bullish market sentiment.

Predicting LINK’s next move: a trend up or down?

As LINK navigates current market conditions, the next target level is projected at $12.98, assuming the demand level on the chart holds and sentiment remains bullish.

Read the one from Chainlink [LINK] Price forecast 2024–2025

Conversely, if the demand zone fails, buying pressure decreases and LINK breaches this critical support level, risks falling to a lower price point of $9.28.

Source: trading view

A significant shift to a bearish stance could be caused if the overall market turns negative, especially if Bitcoin leads a downtrend.

Credit : ambcrypto.com

Leave a Reply