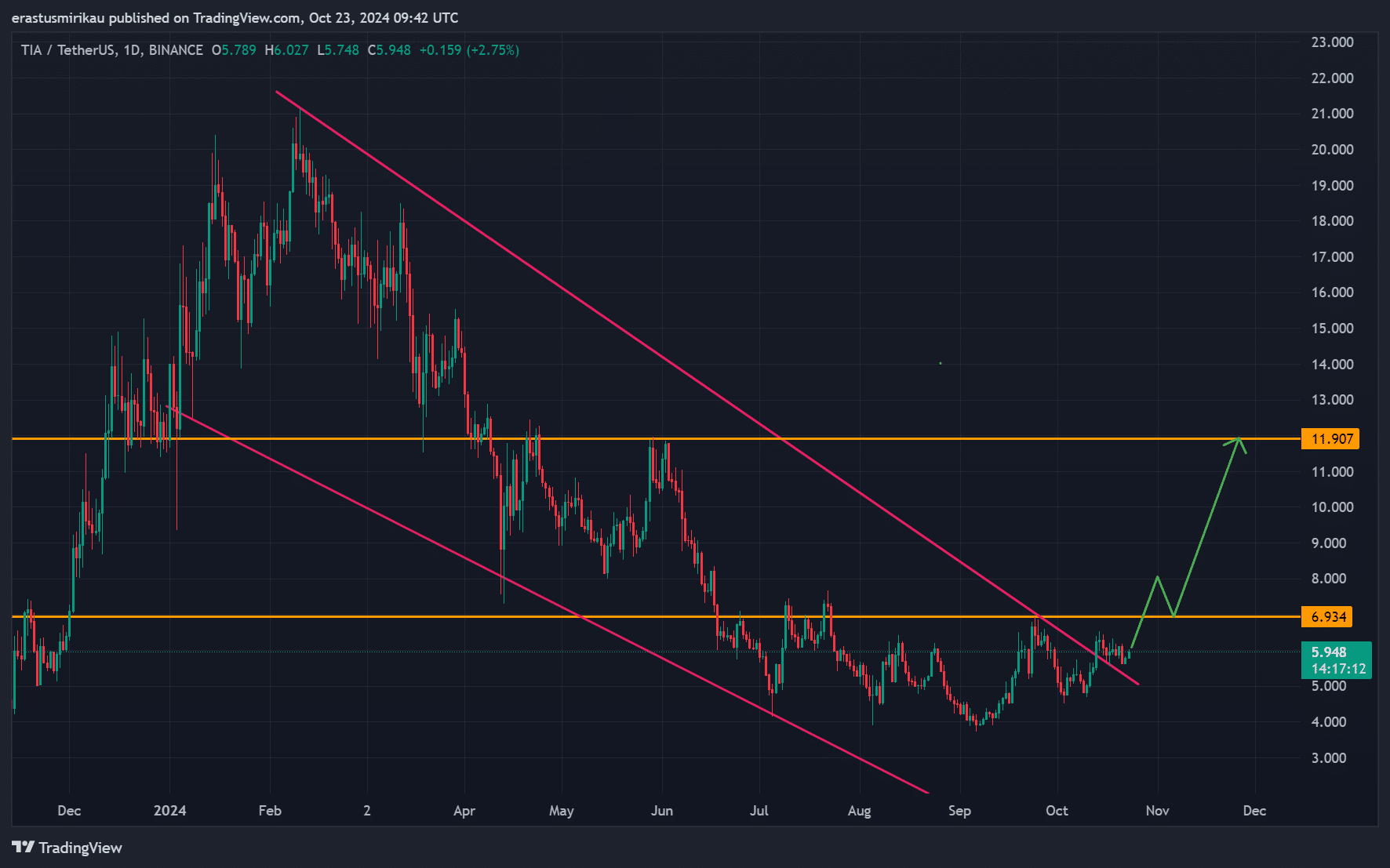

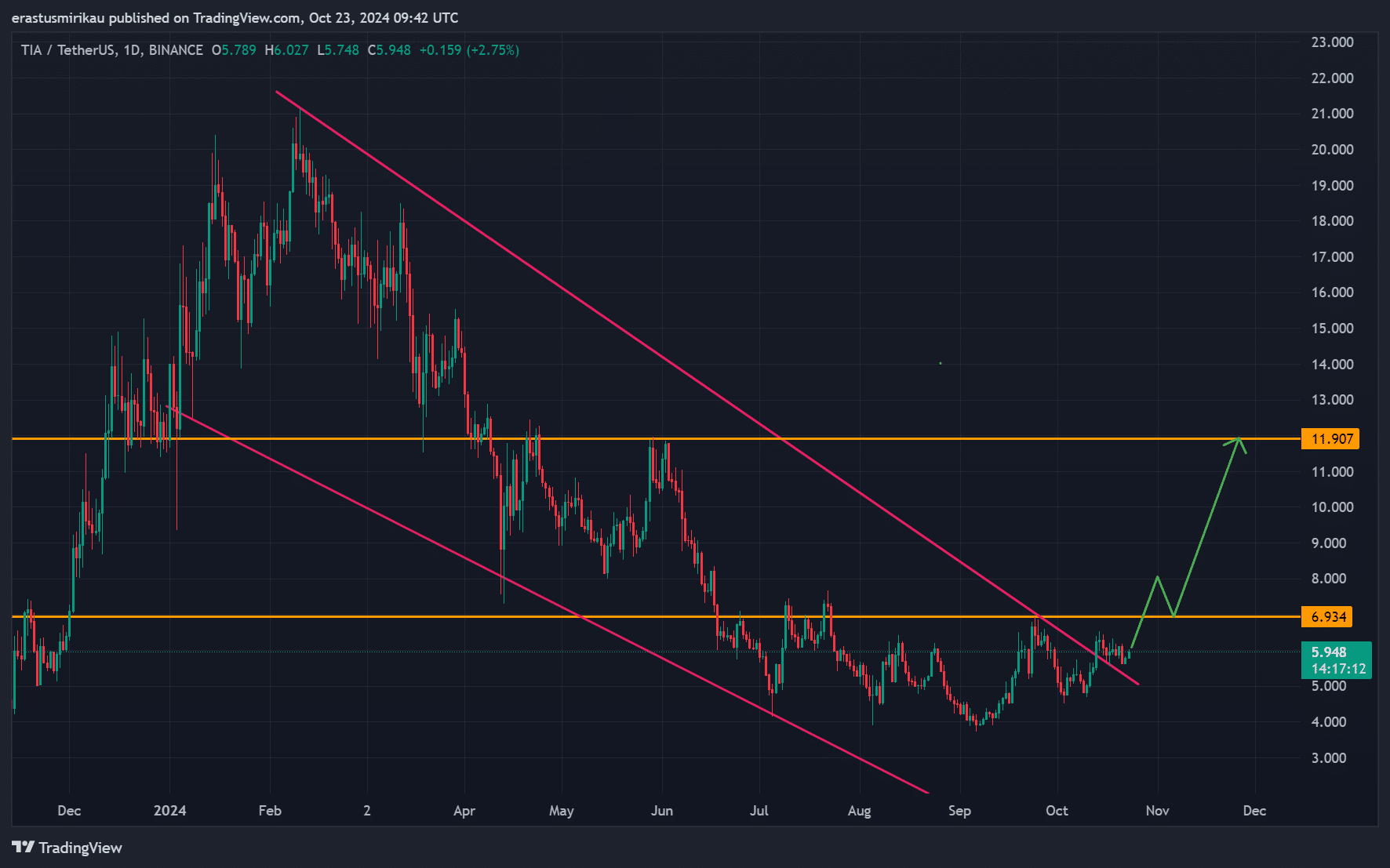

- Celestia has exited the descending channel and is targeting $6.9 as the next resistance.

- The increasing social dominance and increased open interest indicate growing market confidence in TIA.

Celestia [TIA] has gained notable traction after successfully breaking out of the descending channel and positioning itself for a potential bullish run.

Trading at $5.97 at the time of writing with a gain of 4.39%, analysts are watching to see if TIA can maintain this momentum.

However, the token now faces a crucial test: can it get past the next major resistance level at $6.9 and trigger a bigger rally?

TIA descending channel outbreak

The breakout from the descending channel, which has been forming for several months, has led to optimism in the market.

Celestia now faces key resistance at $6.9, which if resolved could lead to a prolonged rally. A further breakout could reach $11.9 as the next major price level.

However, if TIA fails to hold above $6.9, it could result in TIA falling back to its previous consolidation zone. Therefore, the coming days will be crucial as traders keep a close eye on these levels.

Source: TradingView

TIA technical analysis: RSI and MACD

As for the technical indicators, the relative strength index (RSI) stands at 55.19, reflecting a balanced but somewhat bullish market.

However, it still remains below the overbought threshold, indicating that Celestia has room to move higher without experiencing exhaustion.

Moreover, the MACD indicator is on the verge of a bullish crossover, which could push Celestia further higher. Both indicators suggest that the token has potential to expand its gains if current trends continue.

Source: TradingView

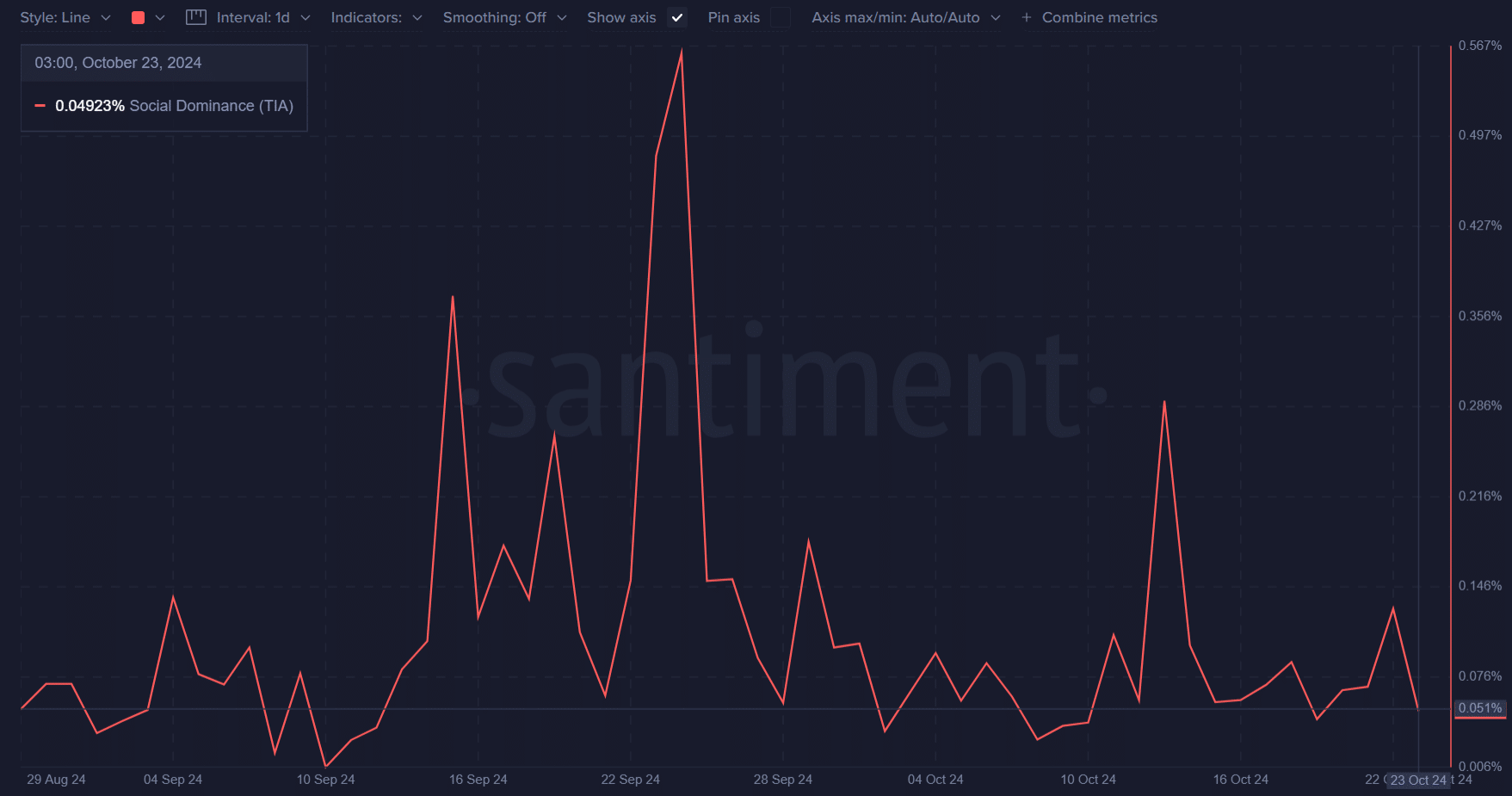

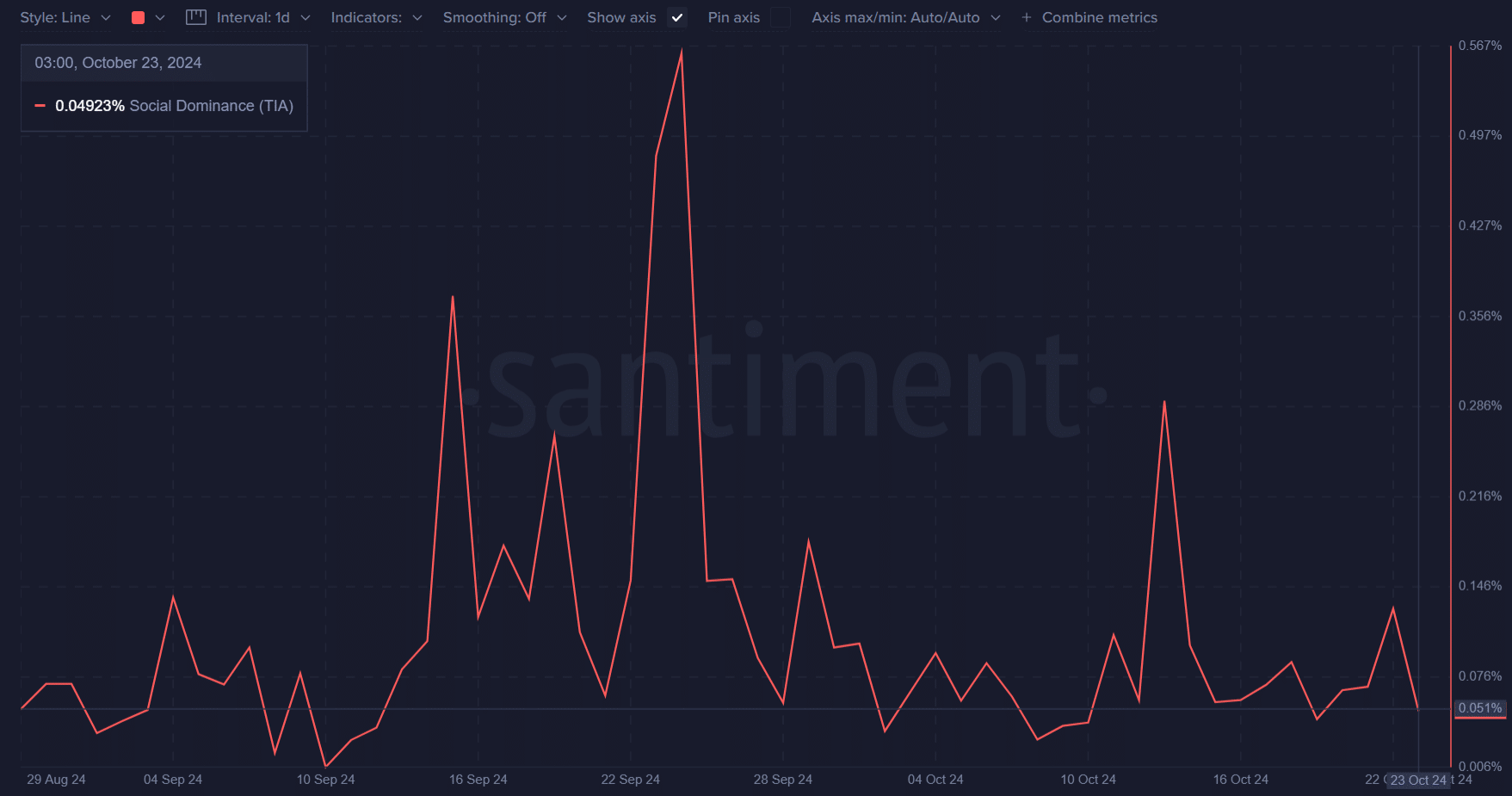

Social dominance and market sentiment

In the world of cryptocurrency, social sentiment can significantly influence price movement. Recently, TIA’s social dominance reached 0.049%, showing that it is slowly gaining popularity among retail investors.

Although this number is relatively modest, an increase in social activity often coincides with a surge in retail interest, which could therefore support further price growth.

Therefore, TIA’s growing visibility could strengthen the bullish momentum as more traders start discussing and investing in the token.

Source: Santiment

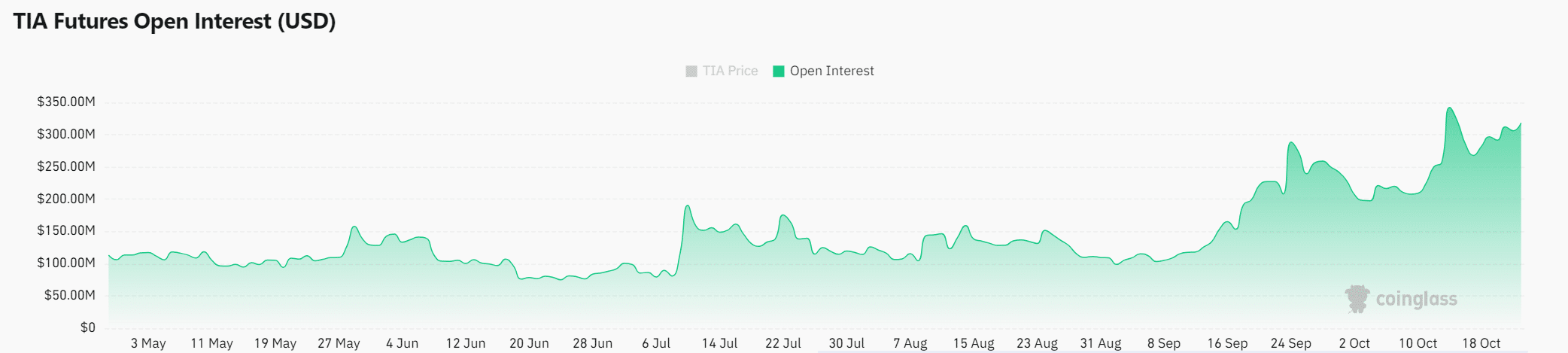

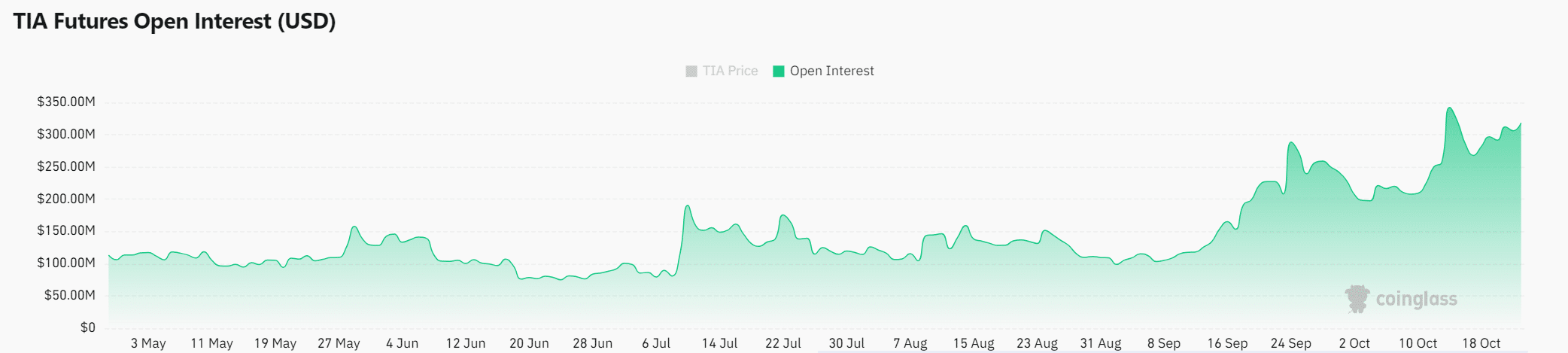

Open interest and market confidence

Open interest for TIA futures currently stands at $317.32 million, marking an increase of 0.66%. This increase suggests that traders are gaining confidence in the short-term performance of the token.

Higher Open Interest generally reflects greater trader participation and can strengthen market momentum. This uptick in interest in futures adds another layer of optimism surrounding the TIA outbreak.

Source: Coinglass

Is your portfolio green? View the TIA profit calculator

In short, Celestia’s technical setup and increasing market interest indicate that the company is well positioned for further gains.

However, breaking the USD 6.9 resistance is essential for the token to maintain its bullish momentum. Should TIA successfully overcome this hurdle, it could target higher levels such as $11.9.

Credit : ambcrypto.com

Leave a Reply