- Injective’s volume spike reflected the increase in the protocol’s increased social activity

- INJ retreated past key resistance following a sharp rise in spot outflows

Is Injective’s Native Token INJ About to Cause a Major Breakout? Well, recent on-chain data revealed some interesting findings that could indicate that the token is about to make a big move.

Injective could be in the crosshairs of liquidity flows as the crypto liquidity rotation continues to intensify amid waning BTC dominance. In fact, investors have been looking for cryptocurrencies and tokens with a lot of upside potential, especially those that have underperformed recently.

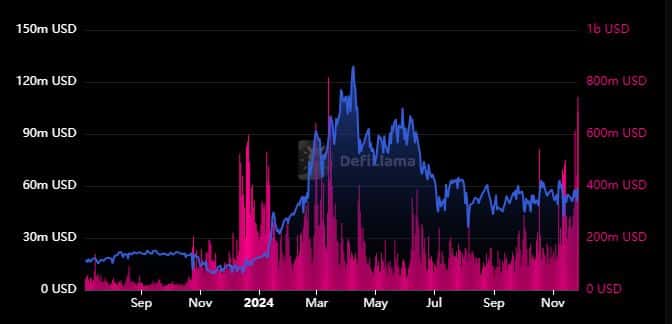

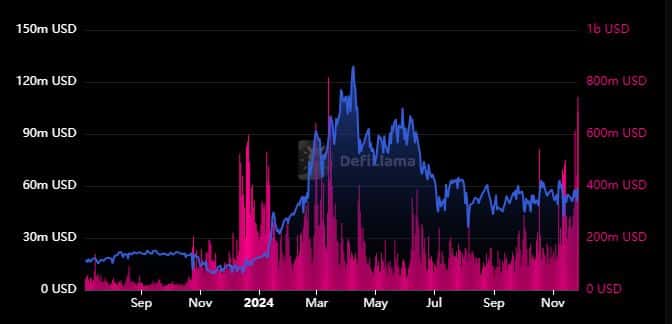

INJ, the native token on the Injective protocol, recently noticed an increase in token volume. The volume figure increased to $741.29 million in the last 24 hours at the time of observation. This was the highest increase in the past eight months and the second highest in 2024.

Here it is worth noting that Injective’s TVL has struggled to post significant gains in recent months.

Source: DeFiLlama

The increase in volume suggested that there has been a lot of trading with the INJ token so far this week. However, this was not surprising considering that the Injective network ranked highly among crypto projects with the highest social activity.

A spike in Injective’s social activity suggests that the network and its native token have gained popularity and visibility this week. However, does this necessarily lead to bullish momentum?

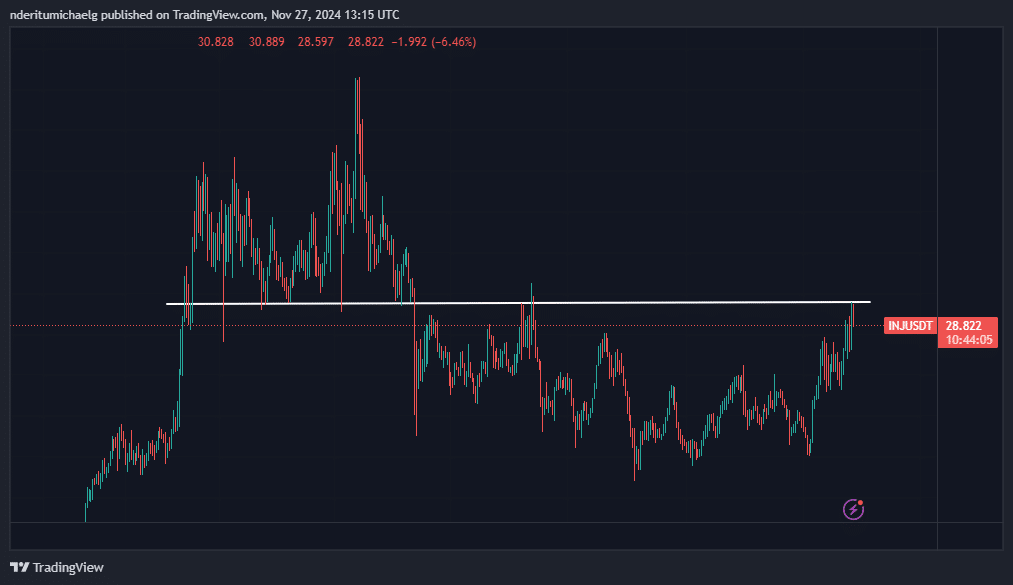

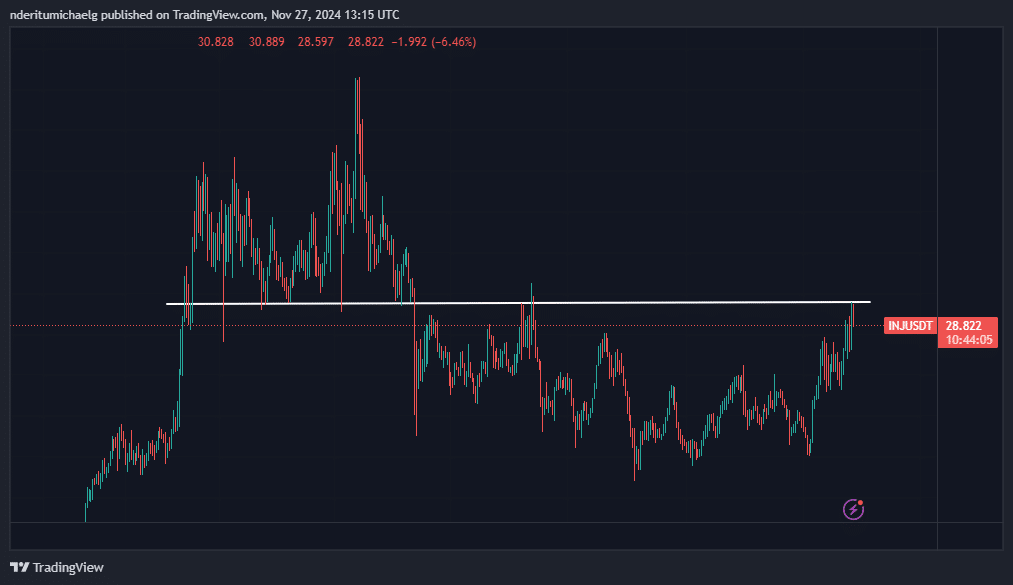

INJ is once again testing a notable resistance level

The aforementioned volume increase may have been related to the recent bullish momentum.

During Tuesday’s trading session, the INJ rose as much as 14.35%. This price increase penetrated the previous support and resistance zone around the $31 price range.

Source: TradingView

Will INJ’s Price Cause a Breakout of Resistance? It had already retreated 6.07% to its press time price tag of $28.89.

Well, the bearish outcome seemed to be consistent with the negative INJ spot flows seen in recent days, indicating that investors have been taking profits.

Source: Coinglass

The sharp increase in short-term outflows confirmed short-term profit-taking, diluting hopes for a major breakout. Injective can still be considered undervalued even at recent highs. Here it is worth noting that Open Interest in the derivatives segment was still low, which could explain why it still struggled to break the recent resistance.

Injective’s Open Interest peaked at $176.32 million in the last 24 hours. This was significantly lower than the peak Open Interest of $308.25 million on March 13.

The lack of a strong TVL comeback could be a sign that investors have not been as optimistic despite the volume increase.

Credit : ambcrypto.com

Leave a Reply