- At the time of the press, the price of ONDO seemed to consolidate, with a decline of 6.26% that increased uncertainty in the short term

- Large transactions have decreased and liquidation risks can increase volatility

Ondo [ONDO] Finance has conquered the decentralized finance (Defi) space Stormantenhand and in just 30 days surpassed $ 1 billion in total value (TVL). This remarkable increase of 57% has firmly based on the forefront of the tokenized us Treasuries Market, which now exceeds a total market value of $ 4 billion.

As a result, the project is now quickly becoming an important player in this fast -growing sector.

What does the ONDO price action indicate?

Analyzing the recent price promotion of the Altcoin revealed some interesting patterns. After its sharp walk, Token has exchanged within a symmetrical triangular formation, with its price that approaches the lower limit of the pattern.

At the time of the press, ONDO traded at $ 0.96, a decrease of 6.26% in the last 24 hours. This hinted at a certain level of uncertainty in the short term. Although the overall trend has been positive, the prevailing downward trend trends raises some questions about the short -term stability of the token.

Source: TradingView

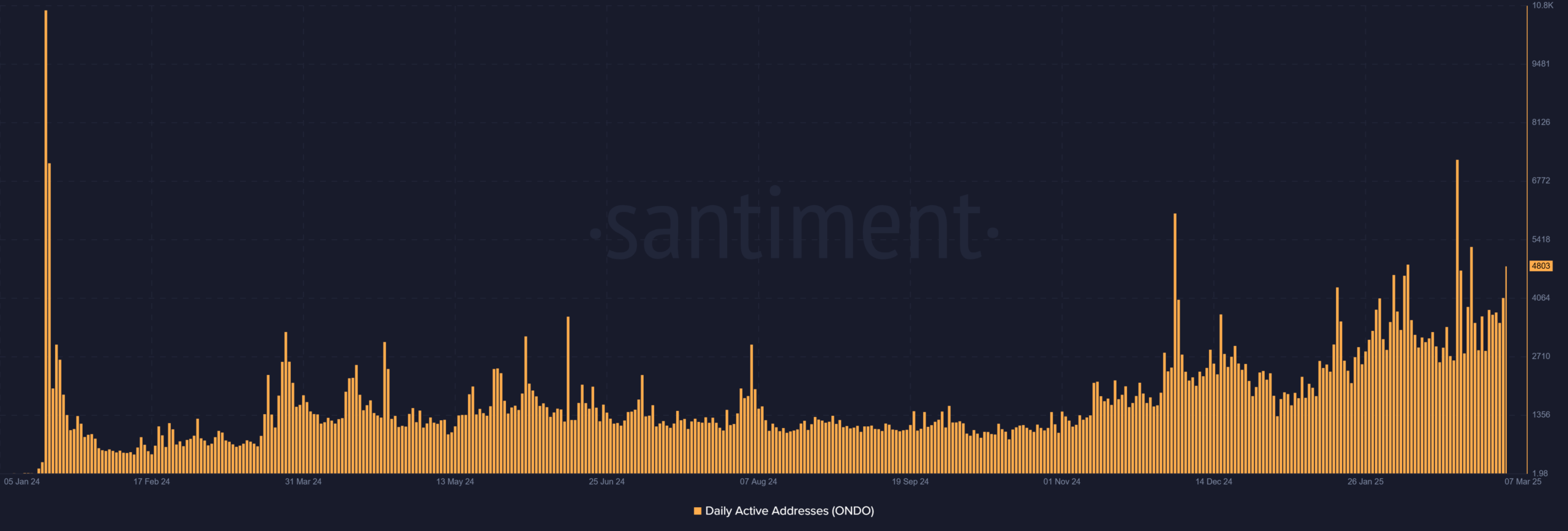

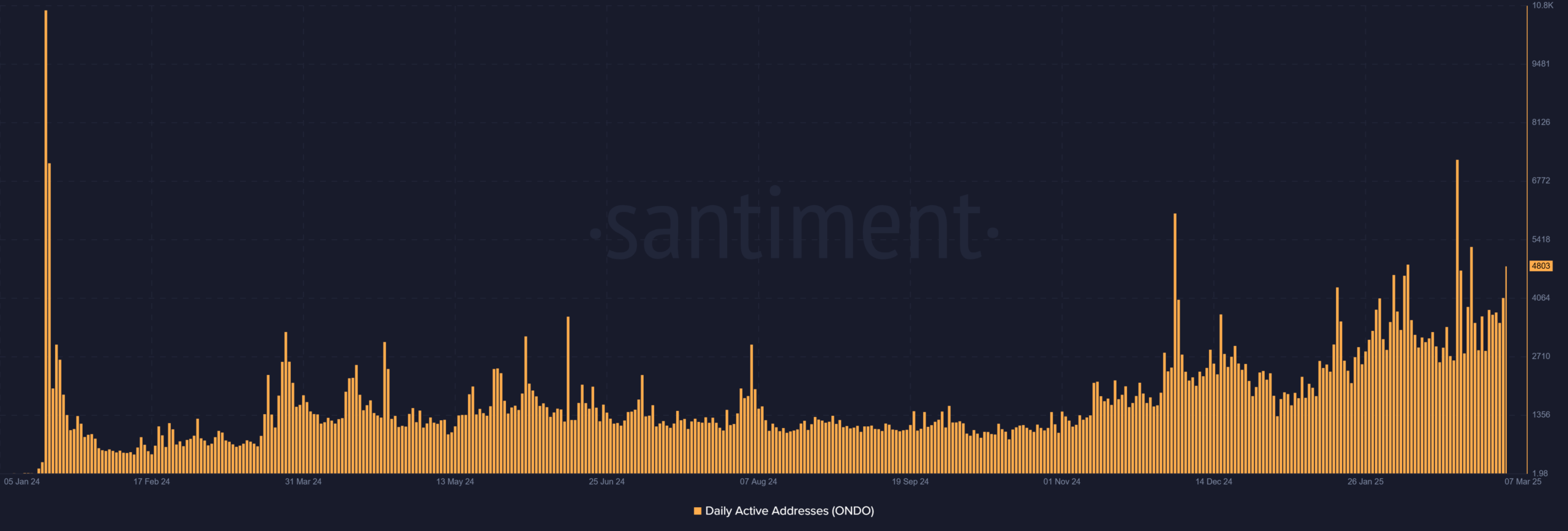

How have daily active addresses evolved?

ONDO registered 4,803 daily active addresses, with a moderate increase in user activity. This walk in daily involvement is a positive indicator, especially given the growing acceptance of Tokenized treasuries.

Moreover, this growth in daily active addresses means that more investors have dealt with the platform and have participated in the growing Defi Ecosystem. However, it is still to be seen whether this trend will continue, given the volatility on the market.

Source: Santiment

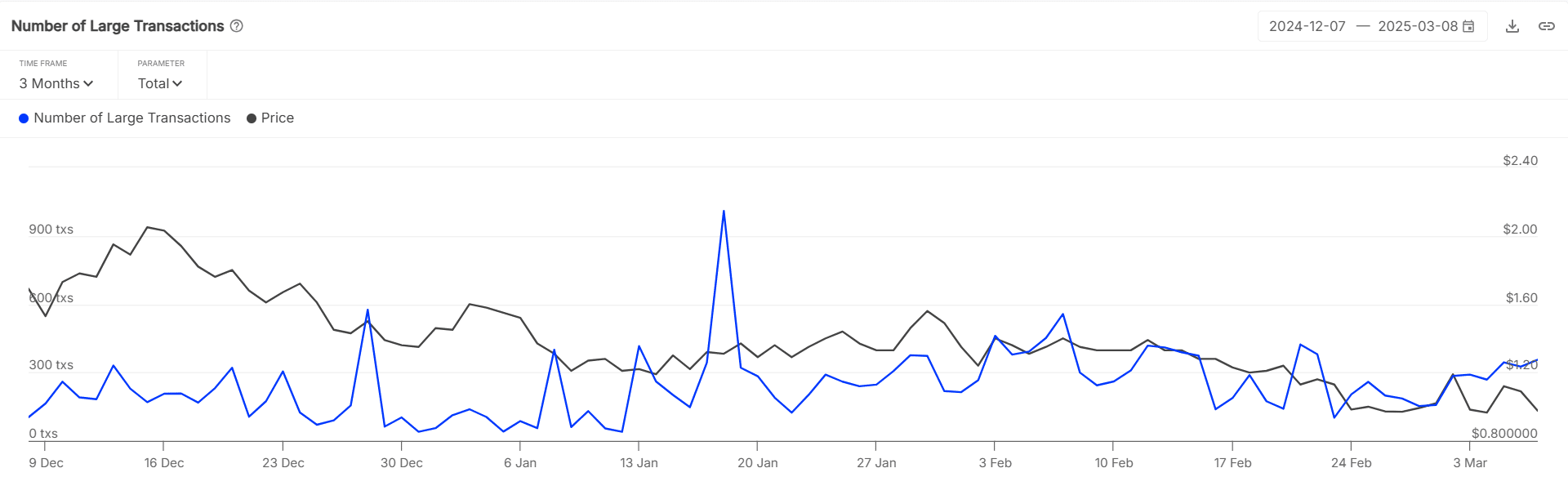

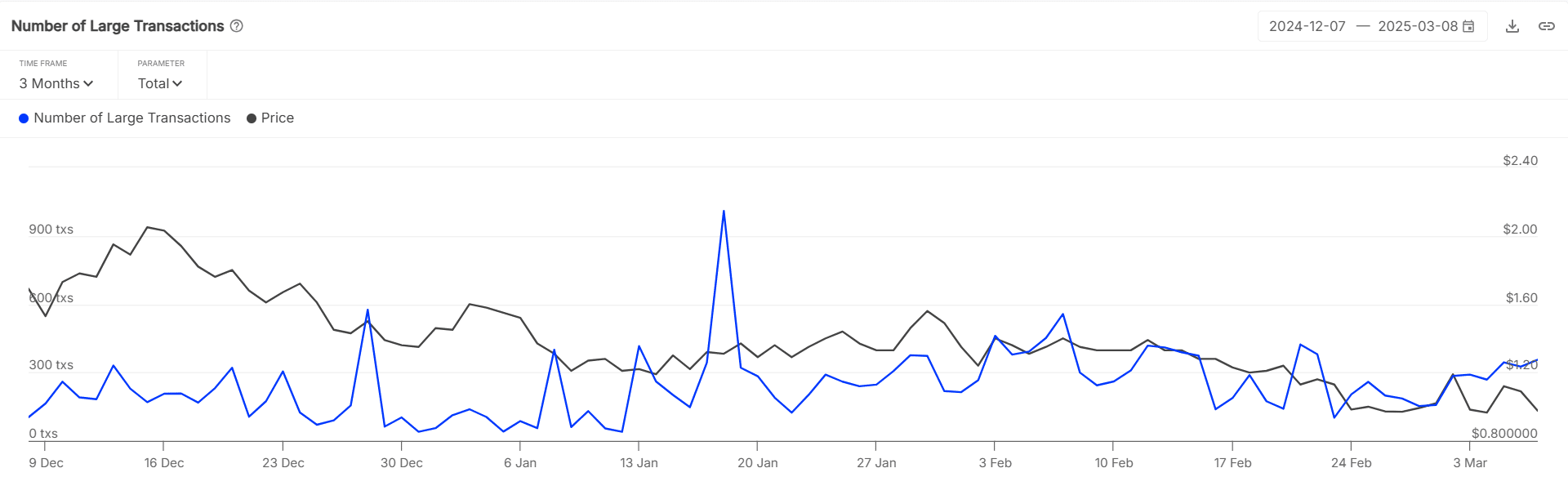

What do big transactions tell us?

Large transactions have decreased, with a fall of 1.09% in large transaction activity. This meant that some of the most important players might withdraw from ONDO, possibly because of the latest price correction.

Moreover, it can be a sign that institutional investors follow a more cautious approach, wait for clearer signals before they commit more capital.

The decrease in large transactions emphasized the need to check the sentiment on the wider market.

Source: Intotheblock

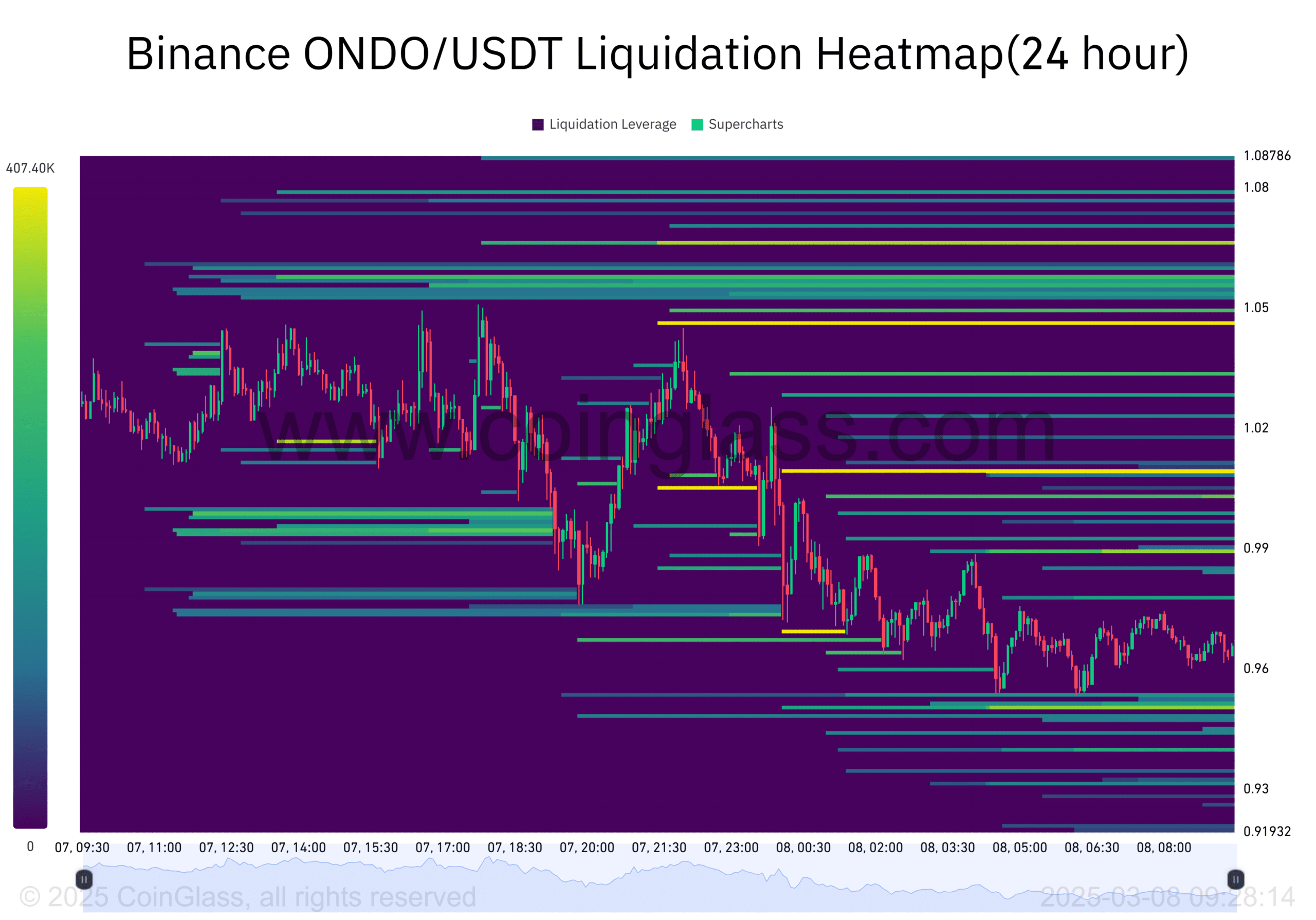

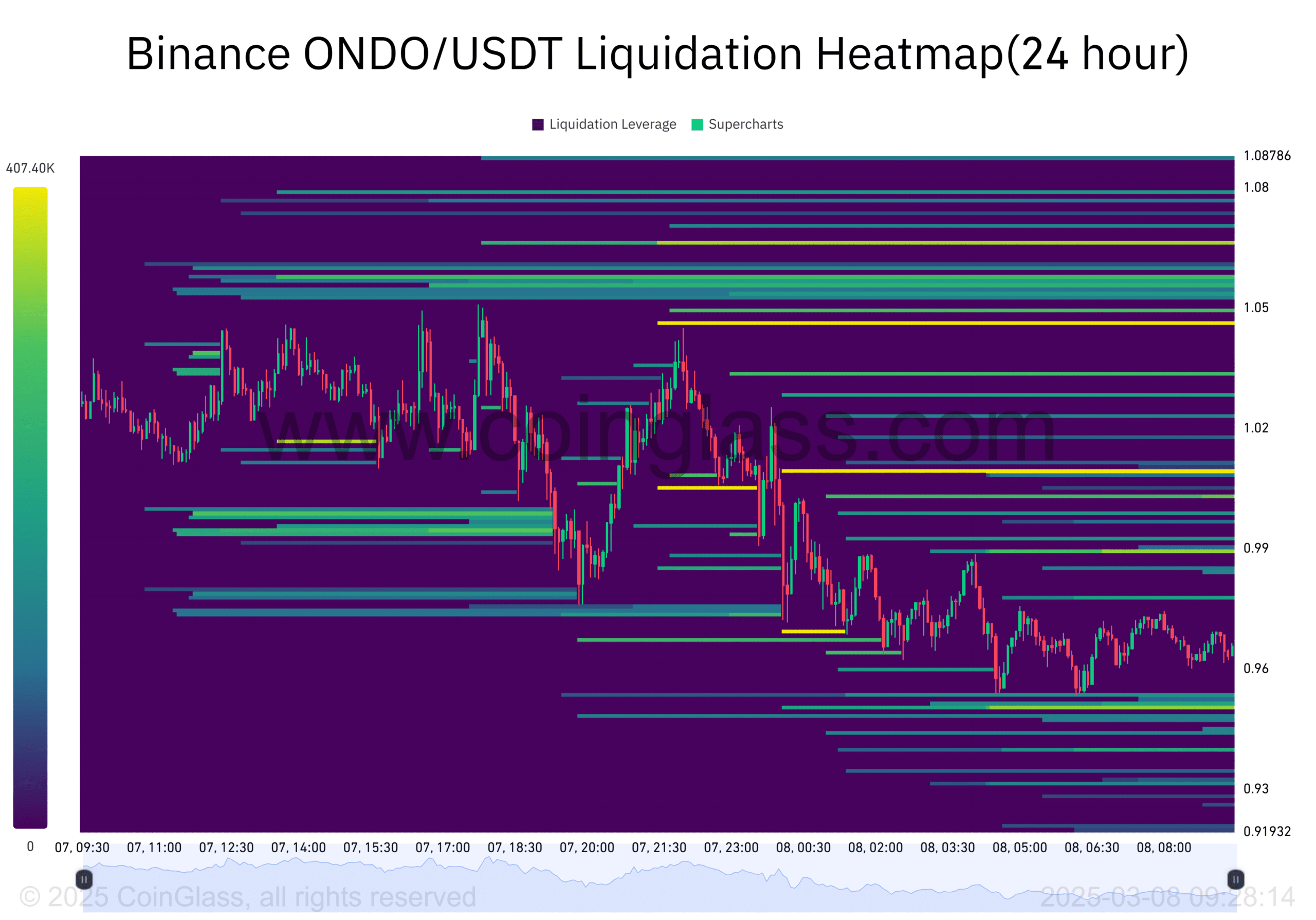

What reveals the liquidation warmth over market sentiment?

The liquidation heat for ONDO has also added to the cautious prospects. Significant liquidations seemed to happen in the price range of 0.96-1.00 – a sign that many traders are exposed to risk in the vicinity of these levels.

As the price continues to approach this range, we could see an increase in liquidation activity, which can contribute to further volatility. That is why looking at the liquidation levels will be essential. Especially since it may indicate potential for competitive price fluctuations if there is a wave of liquidations.

Source: Coinglass

Despite the remarkable growth of ONDO in TVL and Walking in user activity, various factors in the short term have indicated on potential volatility.

Although its position in the Tokenized Treasuries market remains strong, the recent price drop, the lowering of large transactions and liquidation risks indicate that it can be confronted with challenges.

Although ONDO has undoubtedly established himself as a dominant player in the Defi space, it continues to maintain this growth in the light of these risks uncertain.

Credit : ambcrypto.com

Leave a Reply