Este Artículo También Está Disponible and Español.

In a market loss shared On X points Independent Trader and Zero Complexity Trading -founder Kororh Khaneghah to a handful of critical crypto maps that, according to him, could dictate the next major market movement. Khaneghah, who has invested in more than 50 startups, emphasizes that the graphs for BTC/USD, BTC Dominance (BTC.D), Total2, ETC/BTC and SOL/BTC offer invaluable insights into the current state of the crypto market and Possible future shifts.

BTC/USD: Define the crypto market

Khaneghah identifies BTC/USD as the benchmark for measuring in which phase of the bull run could be the market. According to his opinion:

“This determines in which phase of the bull run we are.

– breaks above ATH CV de Bull Run

-Consolidation below ATH -> Altcoins Enter accumulation zones in

-Great structural breaks -> Time to become aisari “

He suggests that traders start to determine which of the three market environments Bitcoin is: a raging bullmarkt, a consolidation phase or a structural decline. Currently, Khaneghah BTC/USD “sees” under all the high tones ranging from a number of large uptrends “, which often presents a catch -up scenario for Altcoins or a long -term battery phase for Bitcoin’s next attempt to break all the time.

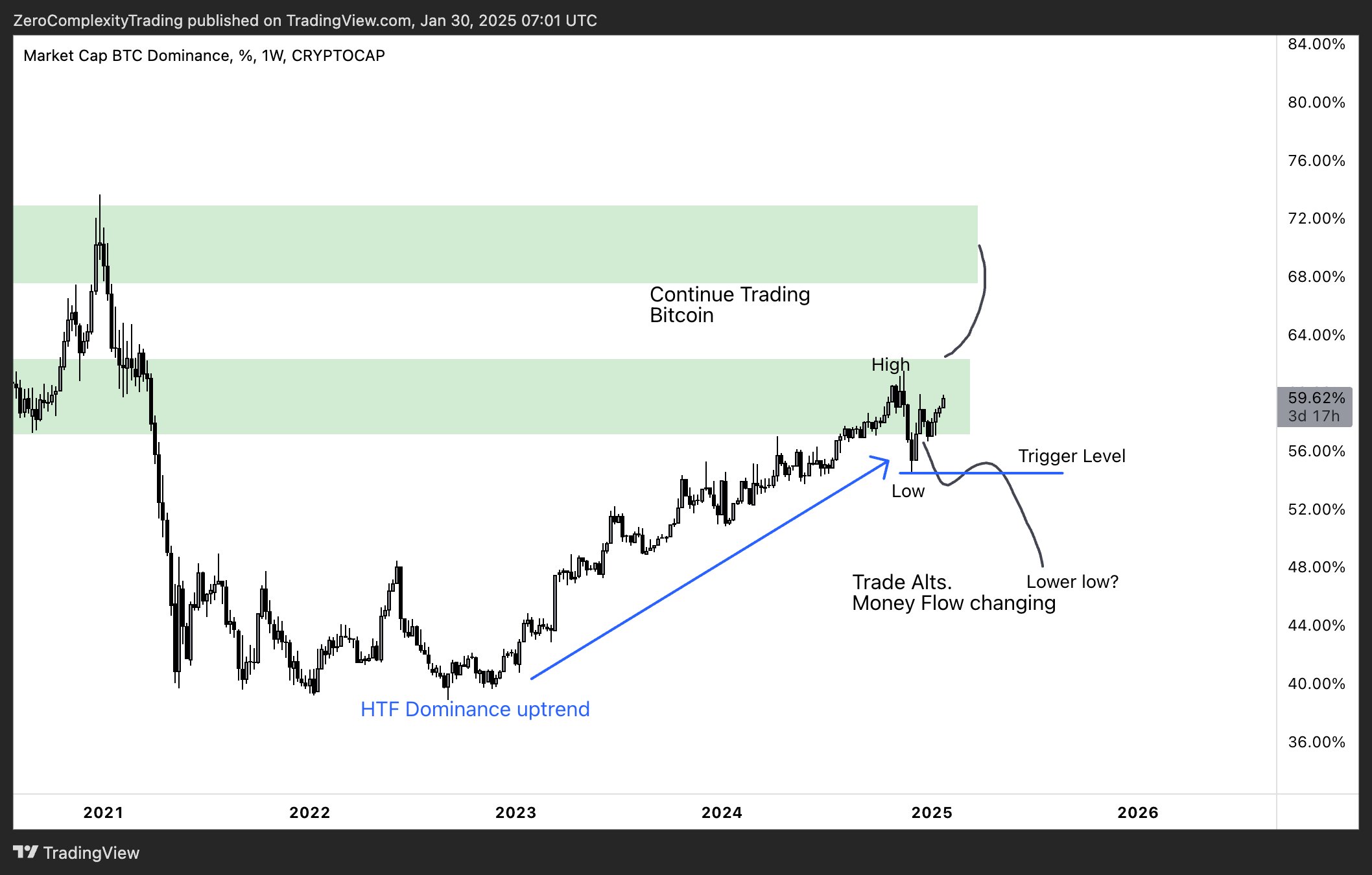

BTC Dominance (BTC.D)

To clarify whether Altcoins is ready for an important move, Khaneghah turns to BTC -Dominance. As he explains: “BTC.D (Bitcoin Dominance) follows Bitcoin’s share in the total crypto market capitalization. “Increasing dominance = BTC performs better and Altcoins delay (the same for above and disadvantage). Decreasing dominance = BTC cools down and money flows in Altcoins. “

Dominance usually increases that Bitcoin absorbs the majority of the market liquidity. In the meantime, a decrease in BTC.d often suggests that altcoins are about to see more capital inflow.

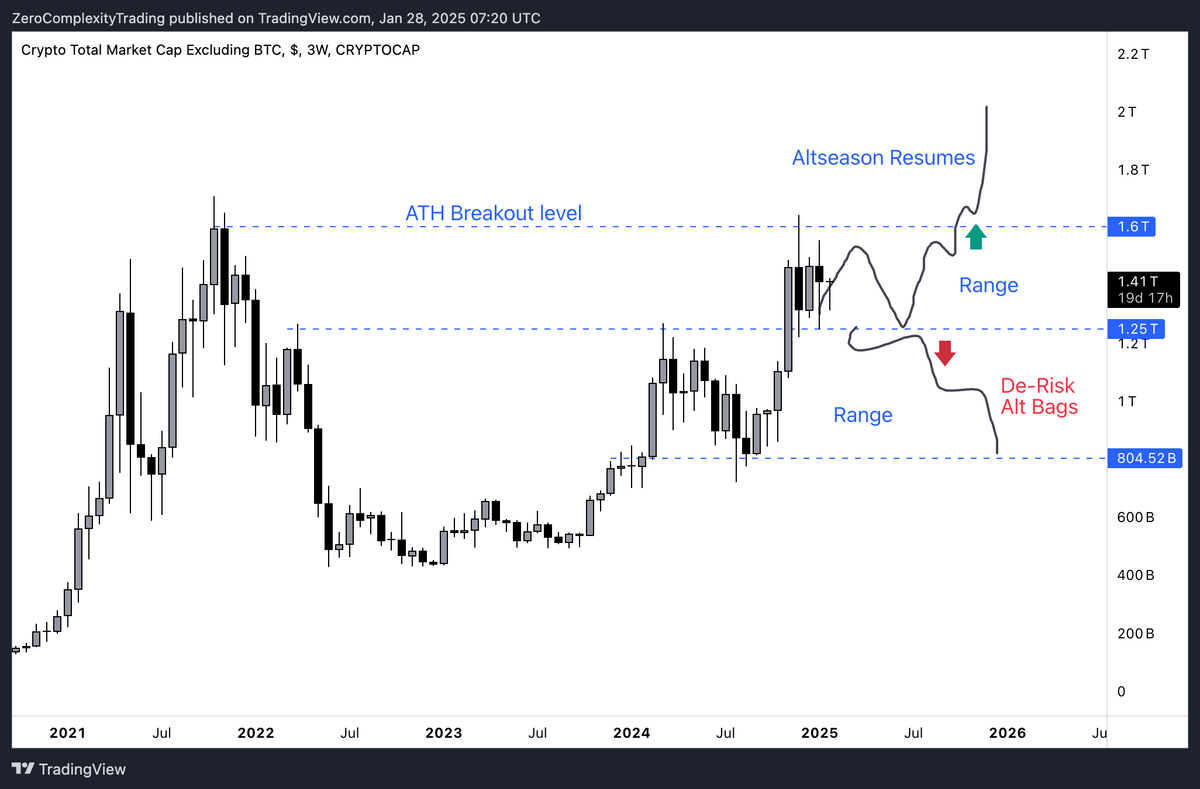

Crypto -Market capitalization excluding Bitcoin (Total2)

The Total2 graph, which excludes Bitcoin from the total crypto market capitalization, is the key to analyzing Altcoin behavior. Khaneghah advises: “When BTC.D falls, the total increases because capital runs in Altcoins. When Total2 broke out, search for longs on the strongest altcoins, rotate from Bitcoin and switch capital to Alts again. “

He emphasizes that the highest probability trade comes from identifying moments when the market is removed from Bitcoin. In these cases, traders can see a stronger return by entering Altcoin positions instead of staying mainly in BTC.

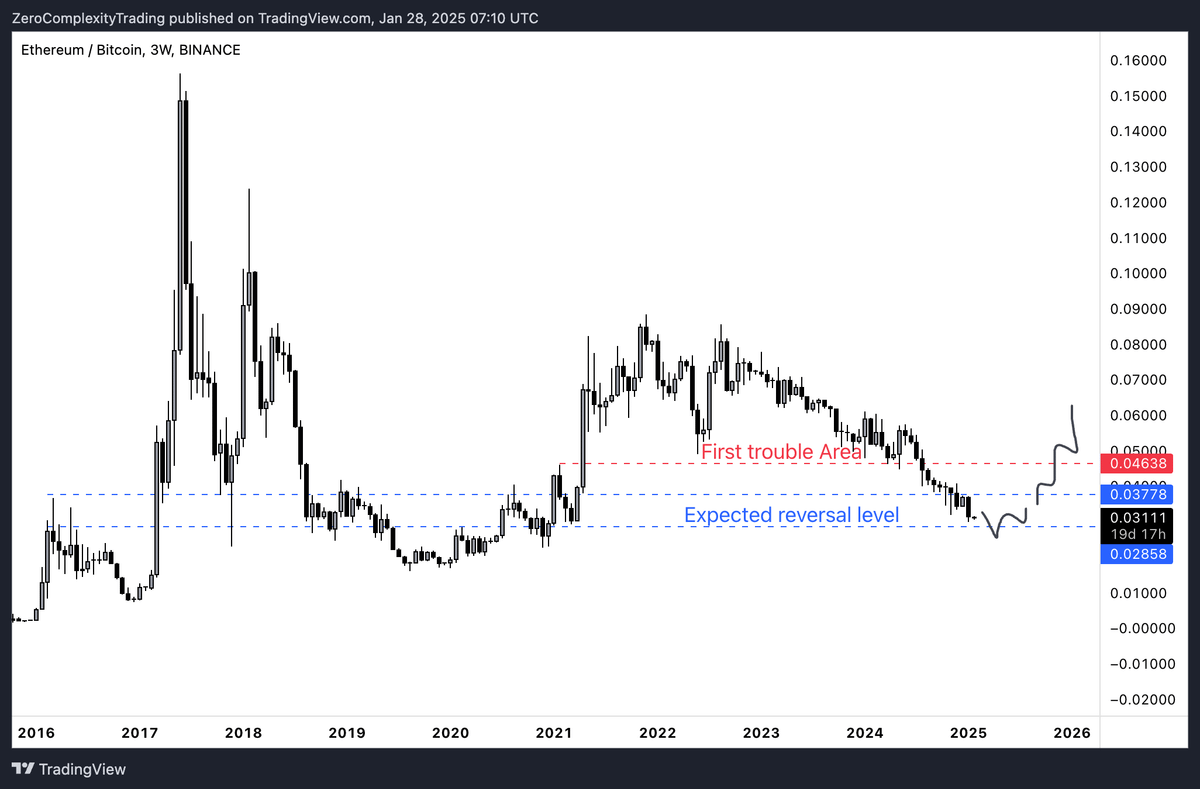

ETH/BTC

Khaneghah emphasizes that ETH/BTC is a useful barometer for a wider Altcoin -Sentiment: “The best altcoin playing happen when Eth/BTC stops trending down because market confidence in Alts is backed here.”

When Ethereum performs better than Bitcoin or stabilizes it, it generally arouses the confidence that Altcoins could experience rallies, often referred to as ‘alteshing season’.

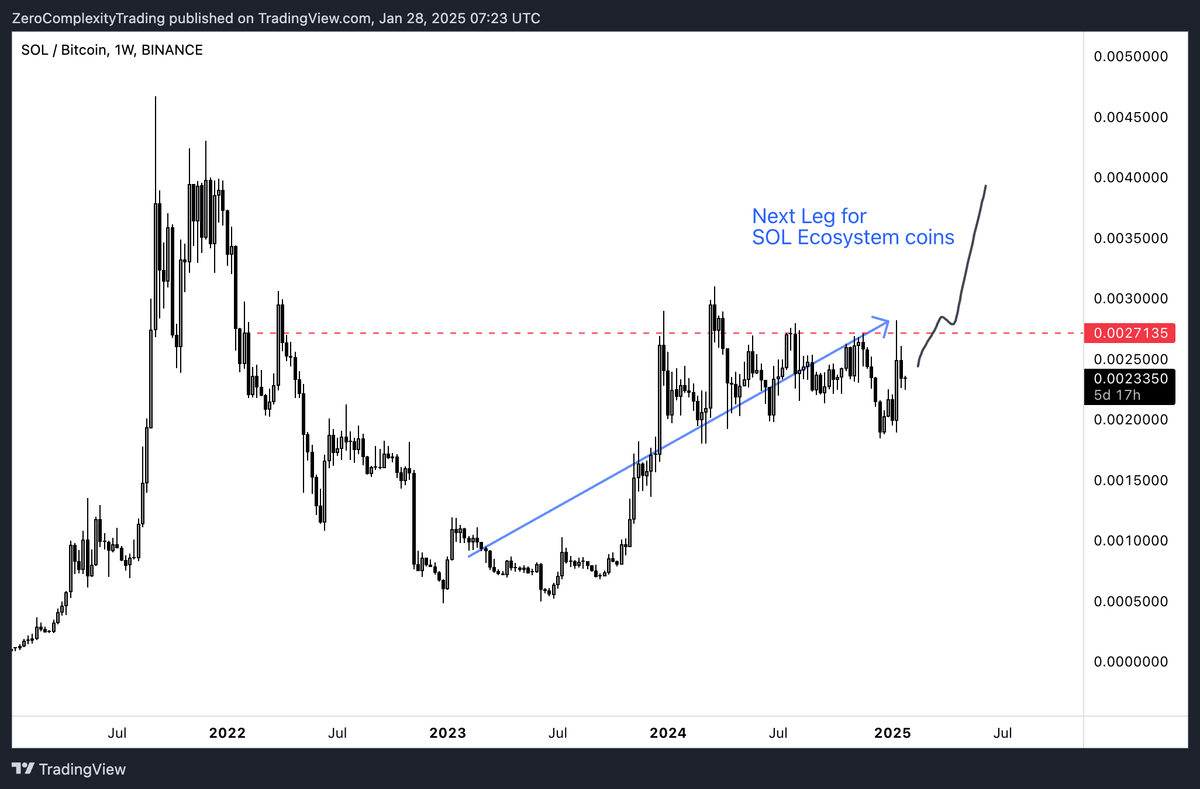

Sol/BTC

Khaneghah also seems to be a spotlight on SOL/BTC, which suggests that the performance of Solana compared to Bitcoin Altcoin Capital Rotation can reform: “I don’t normally watch this, but a comparison helps decide whether the money rotation has a better reward within the SOL -ecosystem or ETH. People will think that Sol has already been ‘pumped’, but I like to buy coins with power, instead of buying coins that can catch an offer. “

Although Solana has made considerable profit, Khaneghah believes that his strong performance can continue. He notes that if Solana continues to perform the Bitcoin, which can shift capital from ETH and possibly strengthen activity in the SOL ECO system.

At the time of the press, BTC traded at $ 105,026.

Featured image of Shutterstock, Graph of TradingView.com

Credit : www.newsbtc.com

Leave a Reply