- In the past 24 hours, ARB recorded the highest chain netflow among major blockchains.

- However, the size of transactions has decreased and overall market interest has waned.

After a price drop of 11.91% last week, Arbitrum [ARB] continued its downward trend at the time of writing. While the daily time frame showed a smaller decline of 1.10%, continued price pressure highlighted limited upside potential.

AMBCrypto’s analysis indicated that ARB may face further declines despite recent network gains, as market participants remained cautious and unconvinced.

Liquidity increase in ARB: a positive sign?

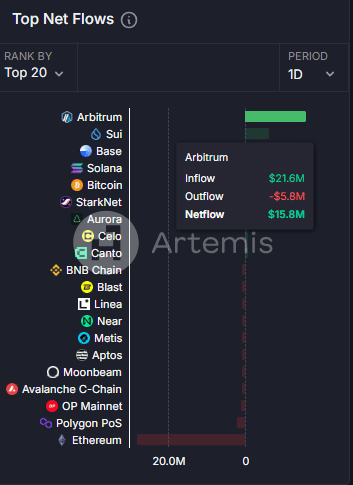

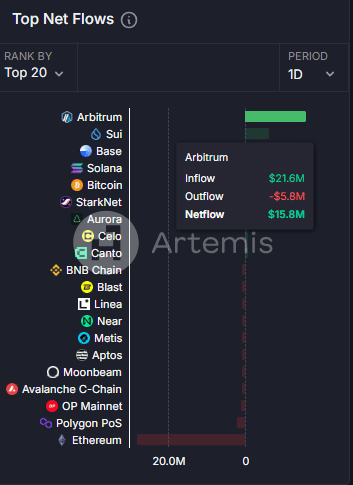

ARB has seen a significant increase in liquidity, with the chain’s net flow increasing to $15.78 million over the past 24 hours, according to Artemis.

This gives it an edge over Ethereum [ETH] and other major blockchains in terms of net asset movements.

Source: Artemis

The chain net flow, which measures the net movement of assets by subtracting outflows from inflows, serves as an indicator of blockchain activity and health.

The recent spike reflected a notable improvement in ARB’s network metrics, which could positively impact price direction.

However, reduced trading activity and low involvement of market participants mean that ARB’s near-term prospects are uncertain.

Market activity is declining for ARB

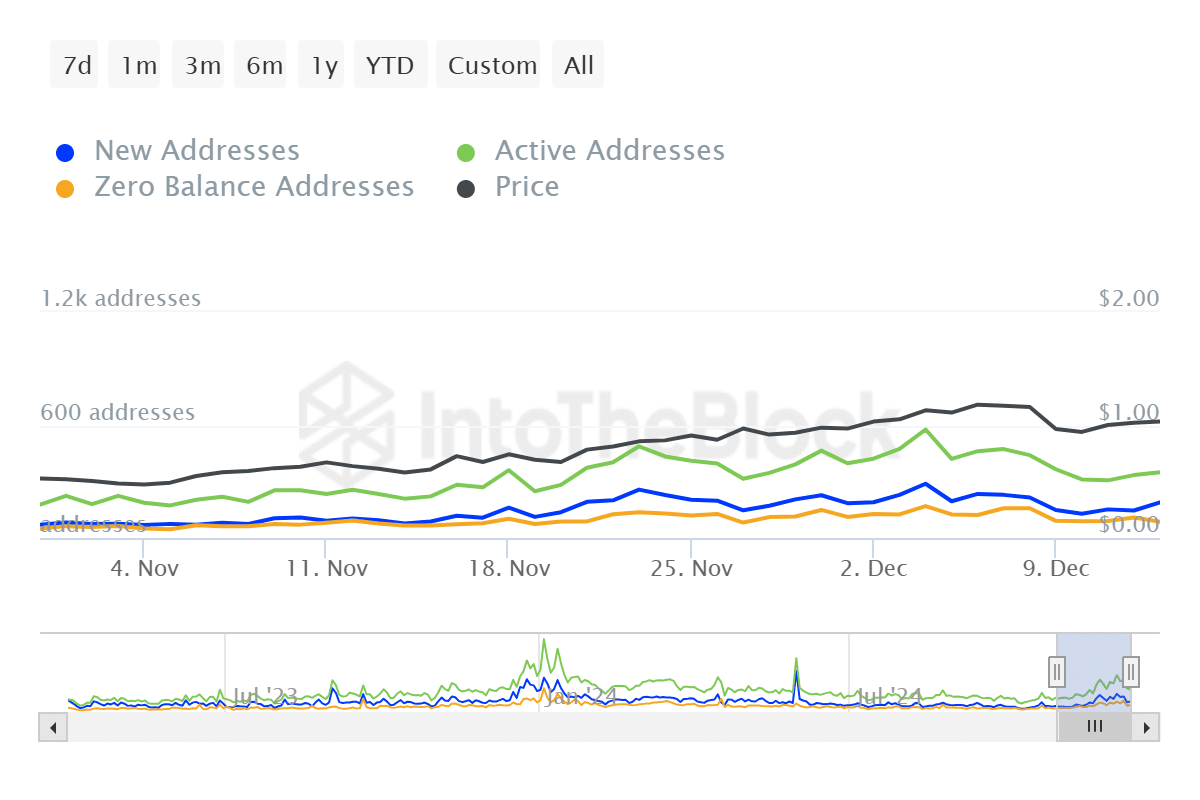

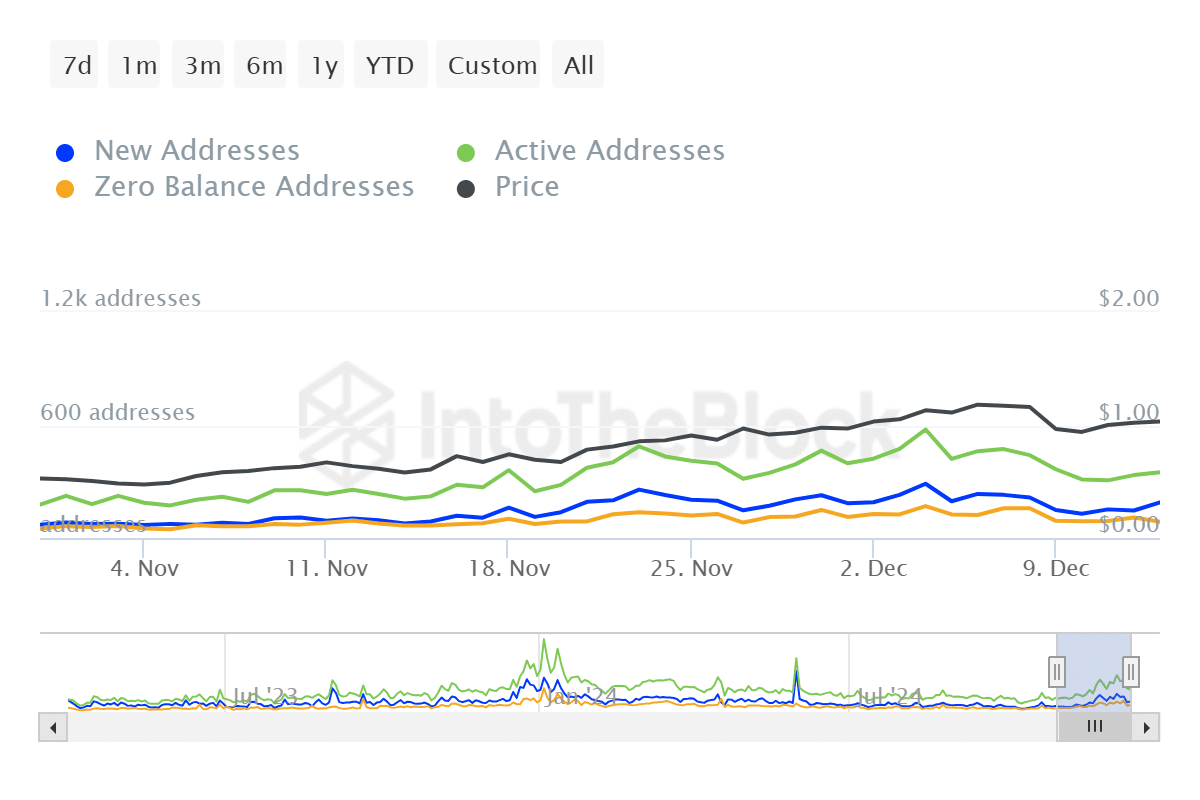

There has been a sharp decline in market activity ARB, and this is reflected in the significant decrease in the number of active addresses (AA).

According to data from IntoTheBlock, the number of Active Addresses (AA) has fallen by 24.30% over the past seven days, reflecting declining interest among market participants.

Source: IntoTheBlock

In addition, the average transaction size has decreased significantly. At the time of writing, the price has fallen from a weekly high of around $9,800 to $4,970 in the past 24 hours.

This metric, calculated by dividing the total transaction value by the number of transactions, indicates reduced network activity.

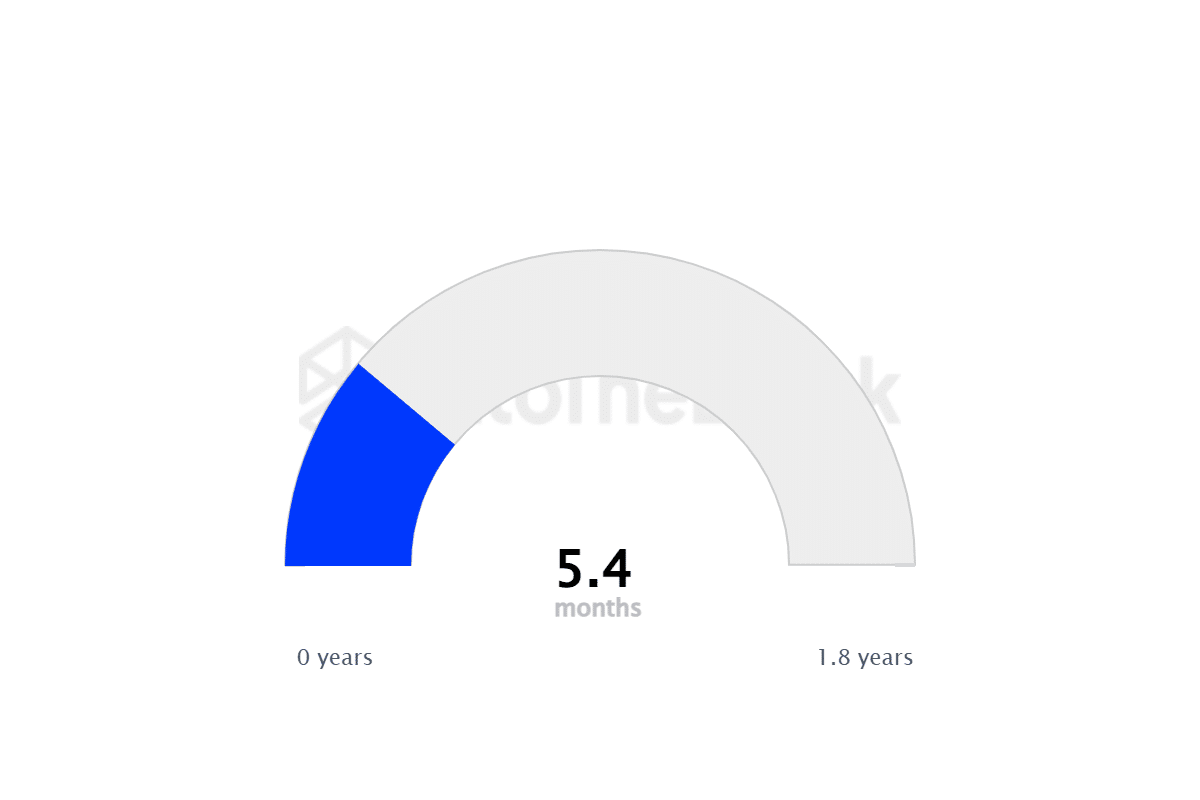

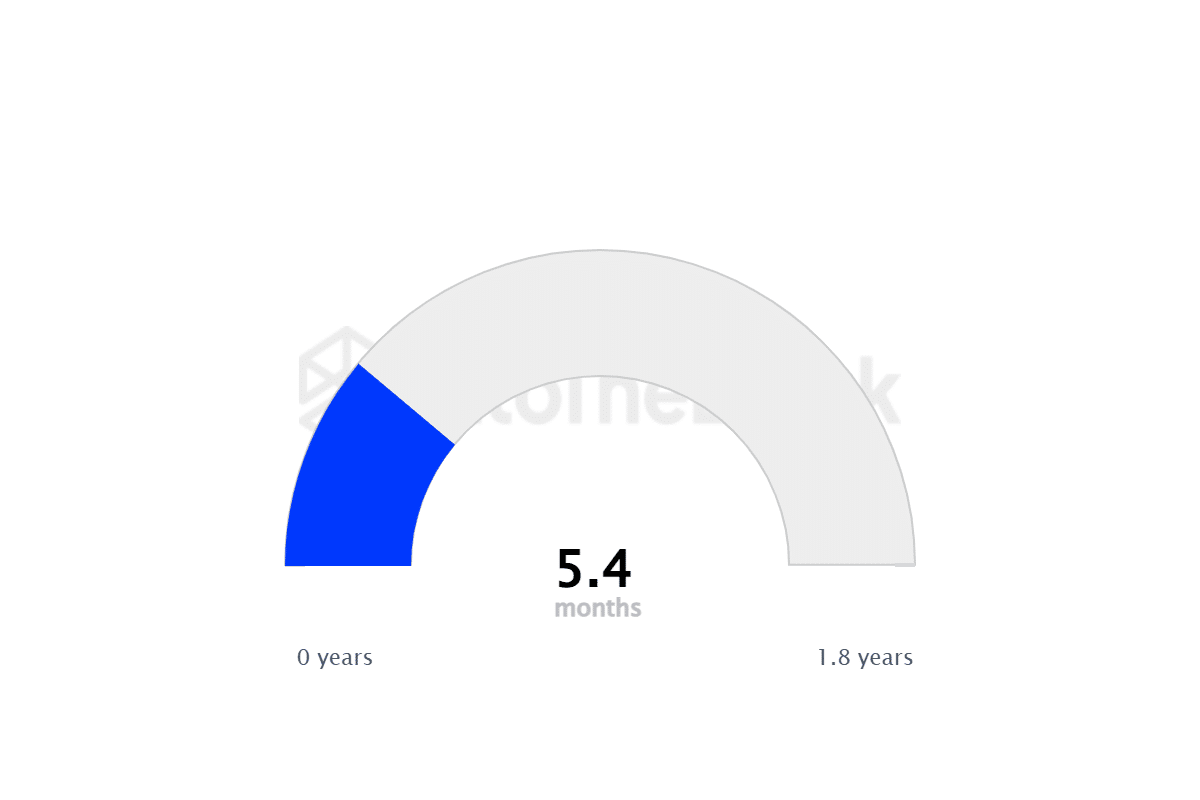

The decline has also affected the average investment period for ARB, which now stands at 5.4 months.

This suggests that most ARB holders are short-term traders who regularly exchange tokens, reducing demand for the asset in the long term.

Source: IntoTheBlock

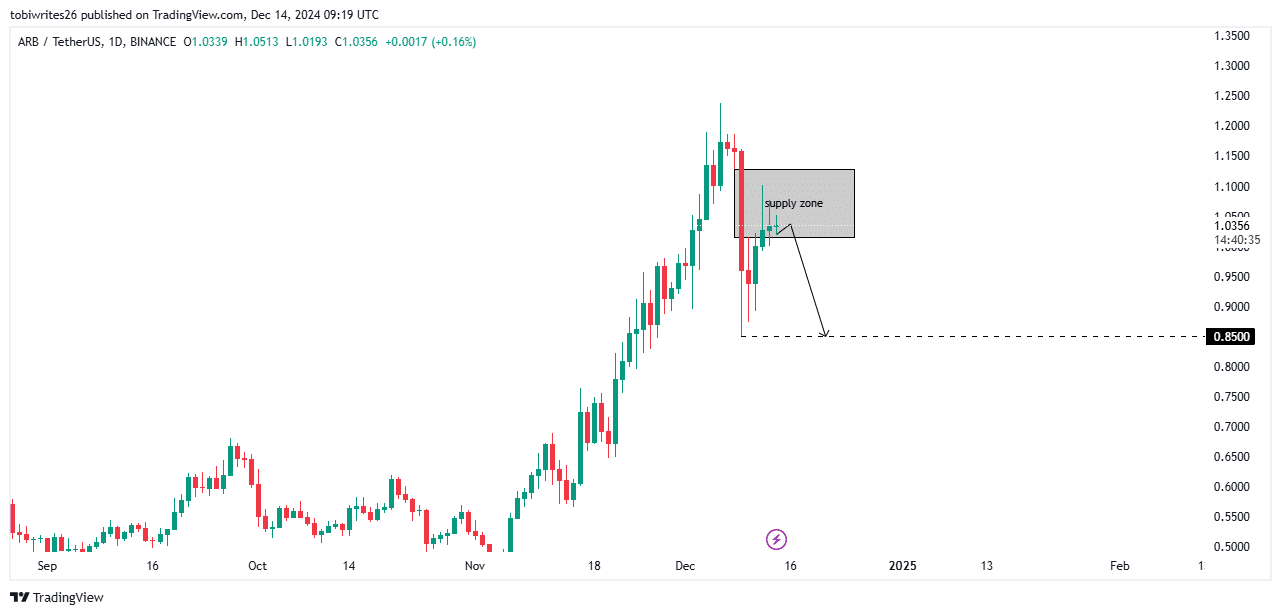

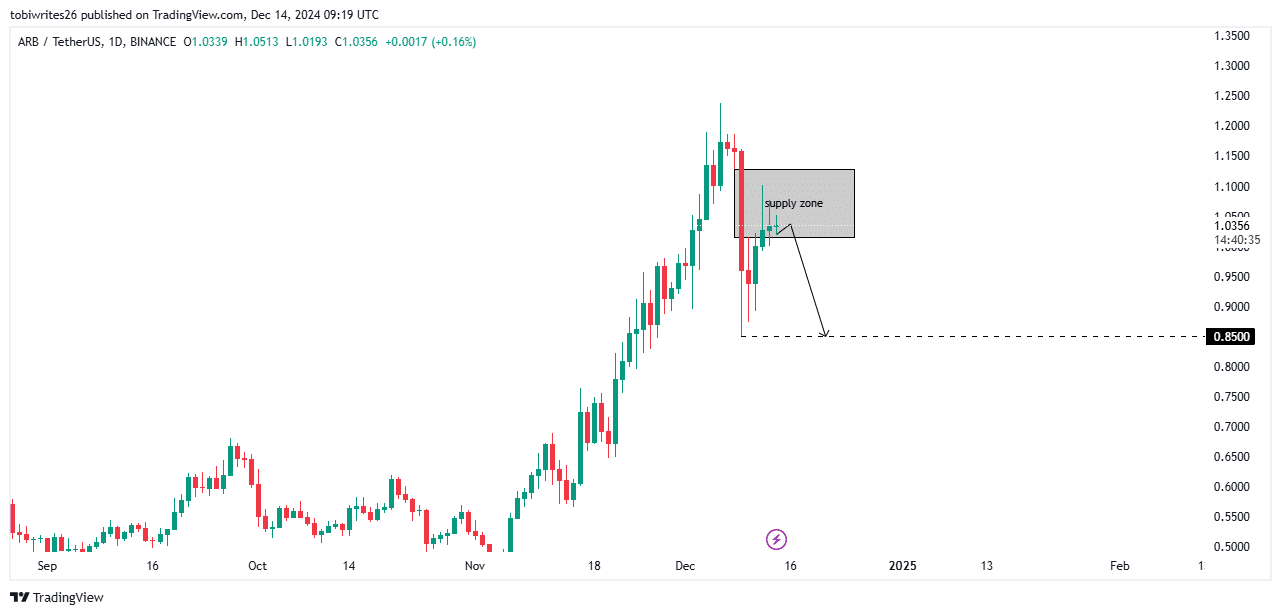

Trade in a supply zone

ARB has entered a supply zone on the daily chart, indicating a bearish outlook for the asset. A supply zone represents a price region with significant selling pressure, which often reduces the value of the asset.

Source: trading view

Read Arbitrums [ARB] Price forecast 2024–2025

Currently, the ARB is in a supply phase and is expected to decline further, possibly falling to $0.85, where a liquidity cluster is clearly visible on the chart.

For the token to reverse its trajectory and bounce higher, market sentiment around the asset would have to change positively.

Credit : ambcrypto.com

Leave a Reply