- Bitcoin has fallen from his ATH by 11.28%, reducing the profitability of miners

- Miners can capitulate as a sustainability of profit/loss in an extremely underpaid zone enters

Since he reached a new highlight of $ 109k almost 3 weeks ago, Bitcoin [BTC] has fallen by approximately 11.28% in the charts.

This decline not only affected short -term holders in terms of profitability, but also miners. In fact, the last dip in the price diagrams of BTC miners who have had difficulty keeping up with the market.

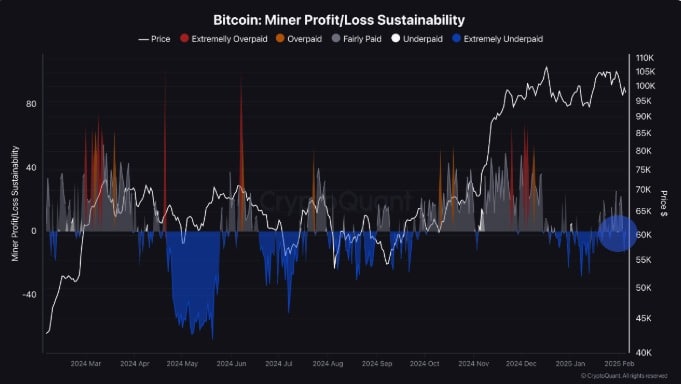

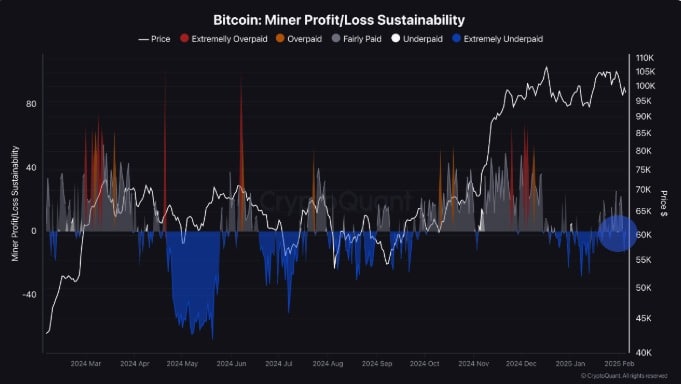

Cryptoquant analyst Frost, for example, noted that miners are now extremely underpaid and risk the capitulation of miners.

Bitcoin’s miner profit/loss goes to extreme underpaid zone

According to CryptoquantThe sustainability of Bitcoin Miners’ profit loss has been introduced the extremely underpaid zone.

Source: Cryptuquant

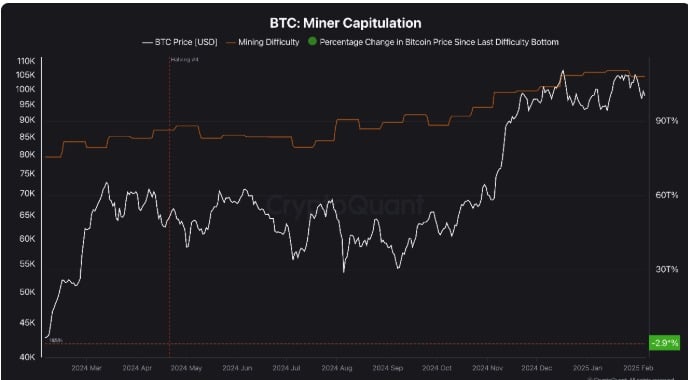

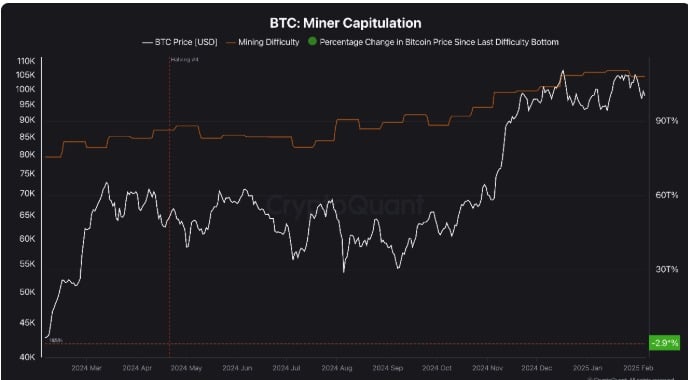

This, after the Halving of April 2024, which resulted in rising mining problems. Although it has become more difficult to minimize, the hash percentage of Bitcoin continued to grow – a sign of the increase in competition between miners.

Source: Cryptuquant

Because Bitcoin continues to deteriorate since he had touched his Ath, the return of miners have thrown. On the contrary, the realized mining costs have been relatively high compared to the last difficulty base.

This market condition suggests that miners will soon be able to capitulate. Historically, when the profitability of the miner becomes negative, it is often followed by a positive price response in the medium term. Simply put, miners responded by selling Bitcoin to cover the costs.

Source: Cryptuquant

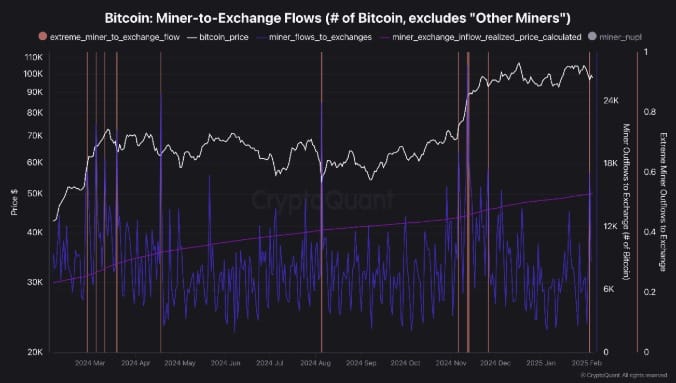

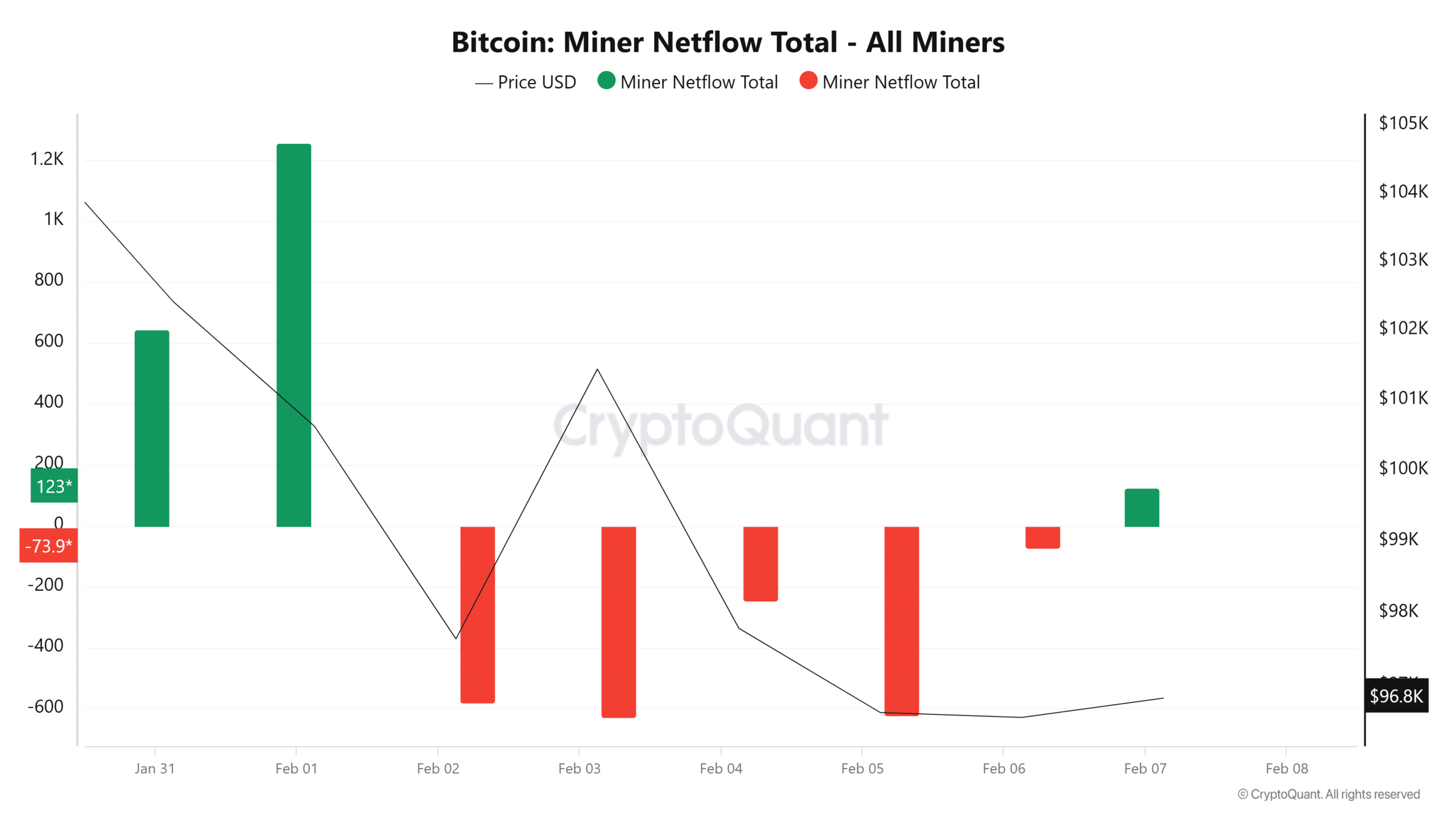

Now that miners are actively sold, the mine-to-exchange flows are also emerging record levels, indicating that miners are currently selling heavily.

We can also see this because the Netflow -Totaal of the miners became positive after it was negative for 5 consecutive days. This seemed to imply that more miners send their BTC tokens to exchange to sell.

Source: Cryptuquant

With miners who are confronted with operational problems, they responded by selling. Some can even be forced to temporarily capitulate.

In earlier cycles, this situation has created accumulation zones for other market participants to re -introduce the market.

Is minerer capitulation ahead for BTC?

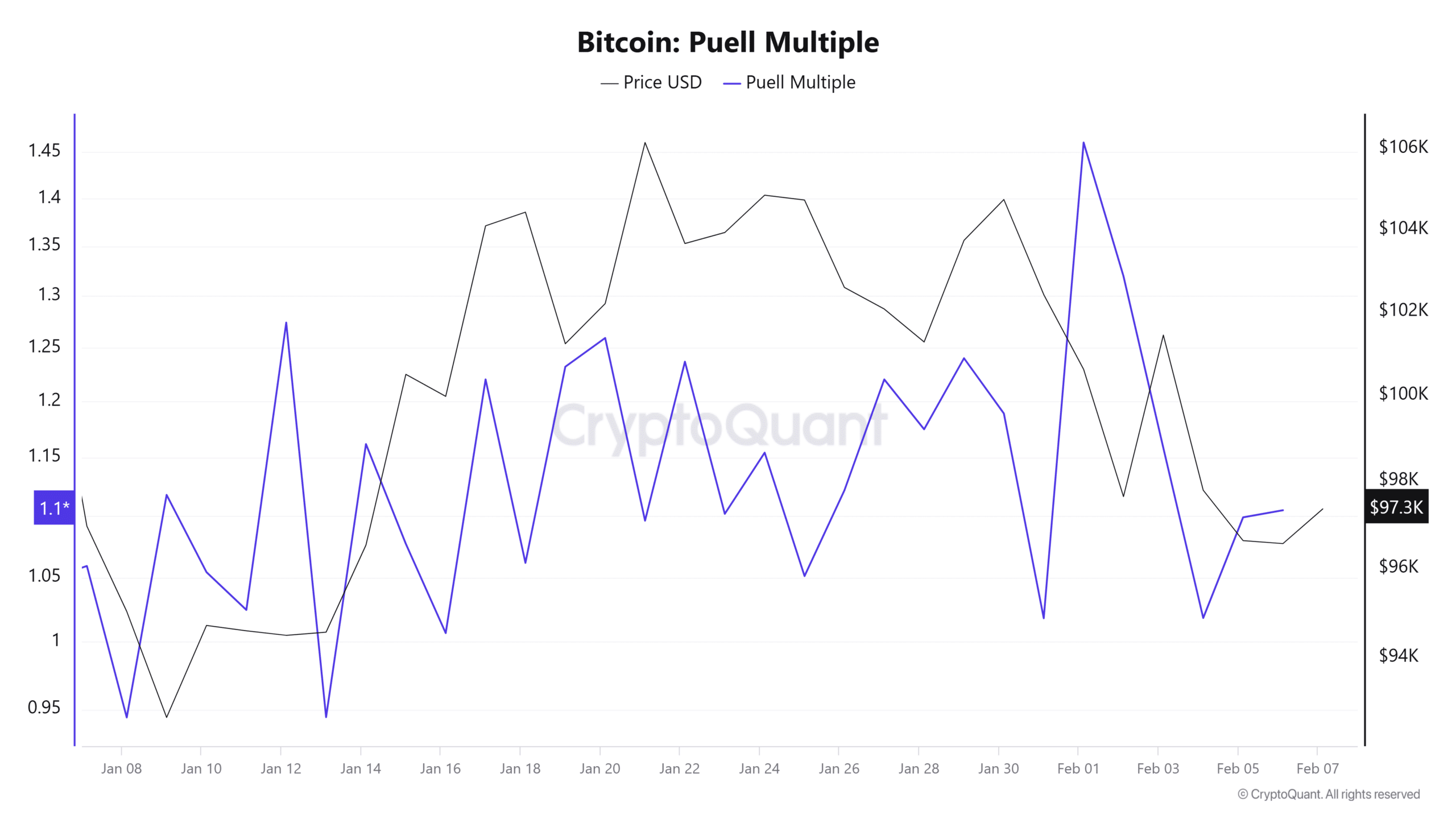

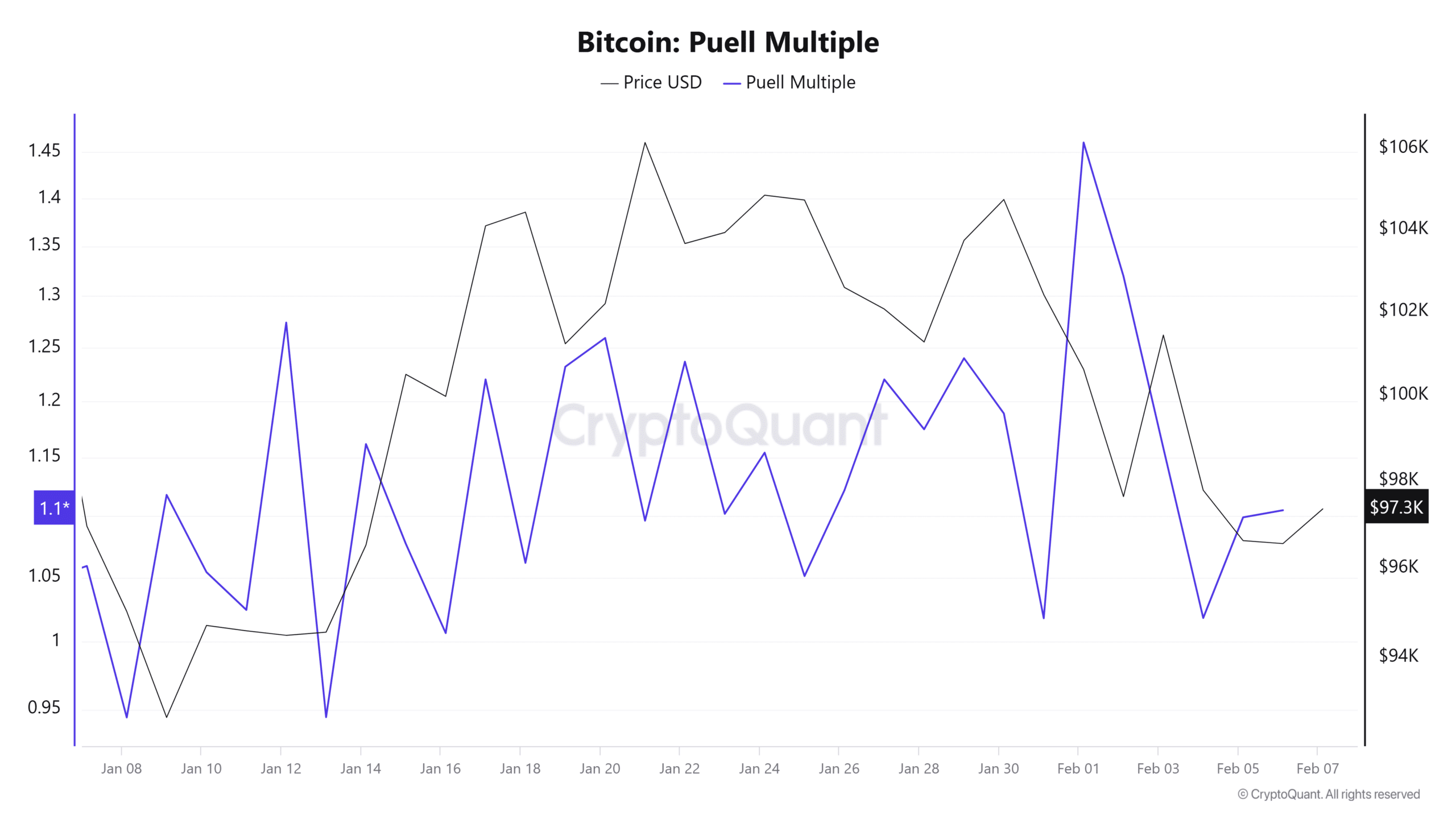

That is why, with the profitability of miners, it is essential to determine whether capitulation is in favor of miners or not.

Source: Cryptuquant

For example, look at the Puell – more well – this metric has stayed above 1 since January 13 and only falls under 1 in 2025 twice, during the first weeks of the year. What this means is that although the Puell -Multiple is fluctuating, the income of the miner remains moderately healthy.

Therefore, as long as this remains above 1, miners have less chance of capitulating. That is why the decrease can simply be a healthy correction instead of weakness. This can imply an accumulation of strong miners and investors.

What’s now?

According to the analysis of Ambcrypto, BTC’s price for preventing capitulation to prevent capitulation to increase my profit/loss.

If the price keeps falling, just like it in the past week, the capitulation of miners can be the following. That is why BTC has to reclaim and retain above $ 100k for the sustainability goals of miners.

Credit : ambcrypto.com

Leave a Reply