The crypto industry experienced a transformative year in 2024, marked by rapid user acquisition and changing ecosystem dynamics.

A new report from Flipside highlights significant growth in user engagement, especially on Base and Ethereum, as decentralized exchanges (DEXs) and new blockchain projects reshaped the competitive market.

Growth within the chain and dynamics of emerging markets

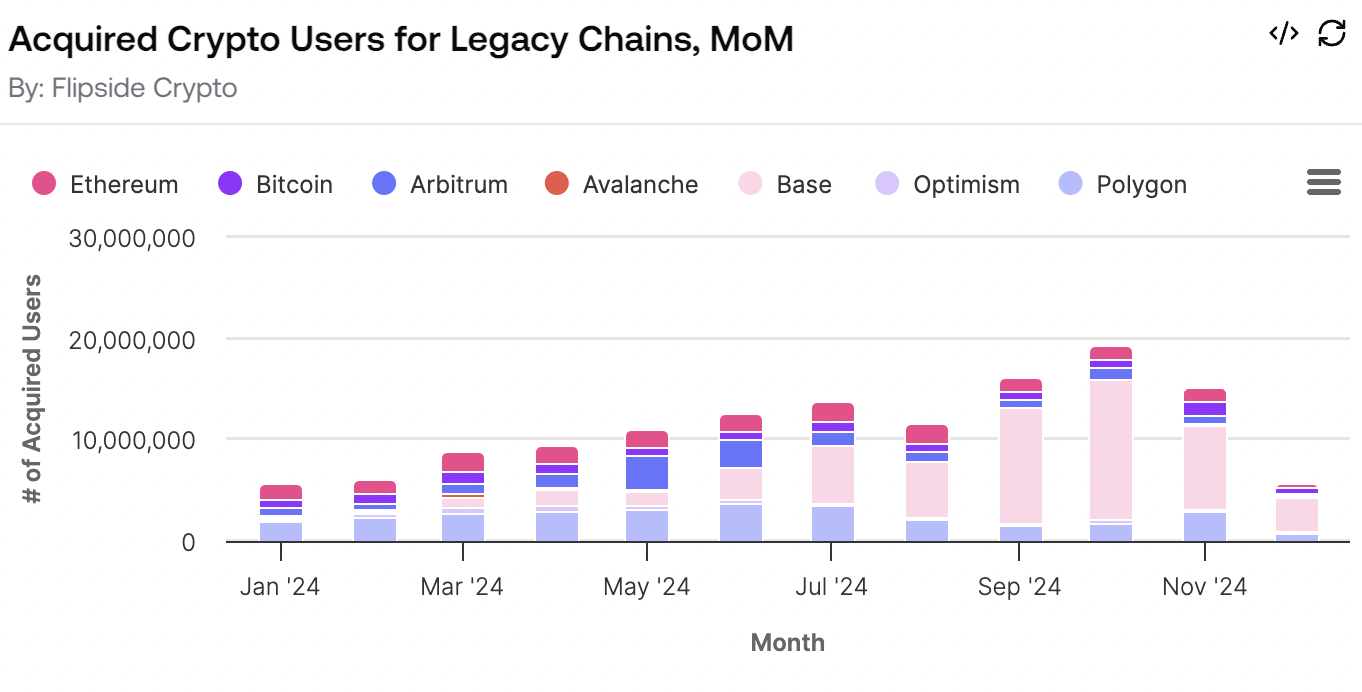

Base, a blockchain platform developed by Coinbase, led the market in 2024 with 13.7 million new users in October alone. This increase positioned Base as the fastest-growing chain, surpassing Ethereum’s stable average of 1.56 million new users per month. In comparison, Bitcoin’s growth lagged despite its price reaching $100,000, indicating speculative interest rather than the entry of new users.

Ethereum’s consistency as a user acquisition leader supports its established position, but Base’s rapid growth shows the potential for newer chains to disrupt the ecosystem. Polygon also saw engagement and leveraged non-DeFi activities to broaden its user base.

Acquired Crypto Users for Legacy Chains, MoM. Source: Flipside.

Base attracted 15.1 million super users – those with more than 100 transactions – even surpassing Ethereum and Polygon. This milestone reflects Base’s ability to sustain active engagement and position it as a standout platform. Polygon, on the other hand, has excelled by diversifying its business and maintaining high transaction volumes across gaming and non-financial use cases.

Flipside report reveals how DEXs evolve

Uniswap strengthened its dominance in the decentralized exchange sector, capturing 91.3% of acquired user activity on Base. Uniswap’s share on Ethereum also grew, strengthening its position as market leader. Trader Joe maintained its lead over Avalanche, supported by features such as Auto-Pools and multi-chain capabilities.

These shifts illustrate the increasing consolidation of DEX operations around major players, highlighting a maturing market. However, newer chains face the challenge of balancing innovation with user retention.

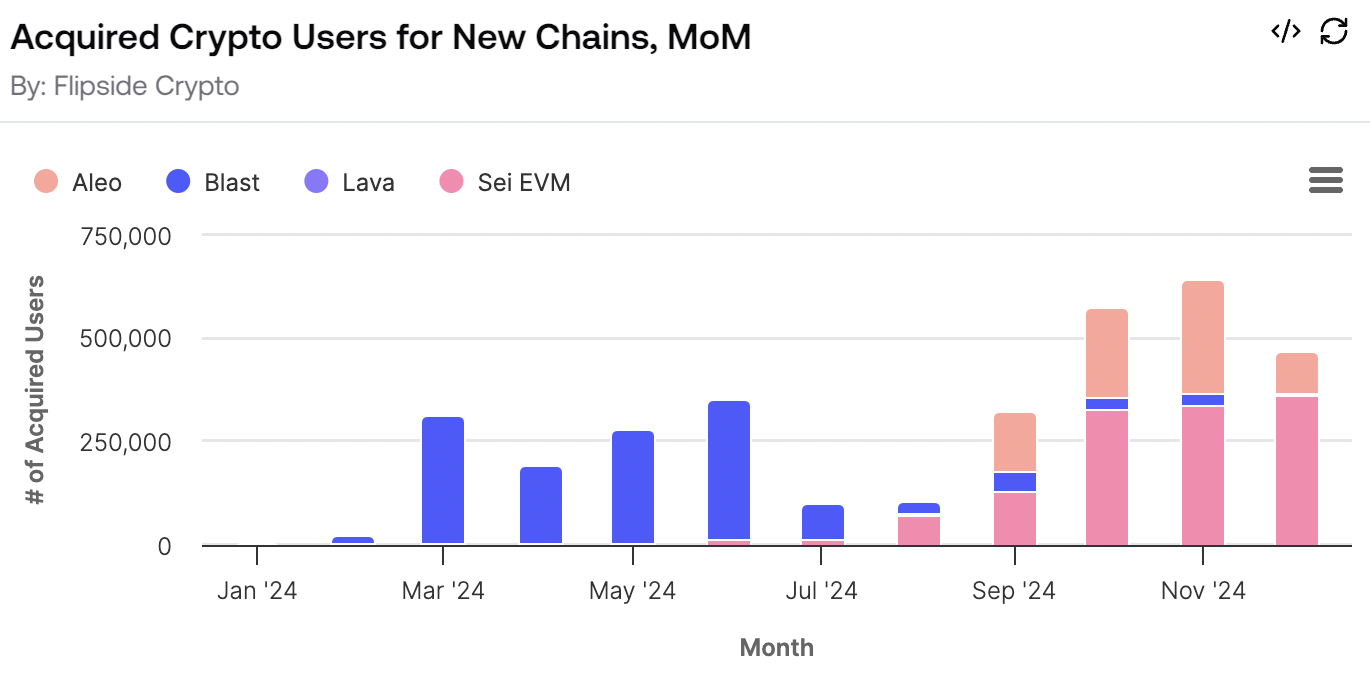

Acquired Crypto Users for New Chains, MoM. Source: Flipside.

New blockchain networks like Aleo have shown promising growth but face hurdles in maintaining user engagement. By comparison, Base emerged as a model for scaling engagement through features and partnerships. These new ecosystems must expand beyond trading to compete effectively in the broader crypto space.

Macro trends boost institutional confidence

According to the Flipside report, regulatory clarity played a crucial role in shaping the crypto space of 2024. The EU Crypto Asset Markets Regulation (MiCA) strengthened institutional trust, spurred ETF launches and a greater adoption. These developments supported consistent user growth across leading chains.

Ethereum remains a crucial foundation for innovation, especially for Layer 2 solutions. While Ethereum continues to expand its user base, fostering deeper engagement and new use cases remains a challenge.

As the crypto market matures, new trends such as GameFi and artificial intelligence integration are expected to drive adoption. These innovations can address scalability and data management challenges, unlocking opportunities for broader user engagement.

“Behind the headlines of record user growth lies a deeper challenge: building ecosystems that create meaningful, lasting engagement, not just fleeting speculation. In short, most blockchains are still in their infancy when it comes to converting casual users into valuable contributors,” the report said.

Flipside’s report highlights a pivotal year for crypto, as established platforms competed with emerging ecosystems. The future will depend on how chains balance innovation, user retention and regulatory alignment to maintain momentum into 2025.

With platforms like Base leading the way and Ethereum strengthening its dominance, the competition for user activity and engagement is far from over.

Credit : cryptonews.net

Leave a Reply