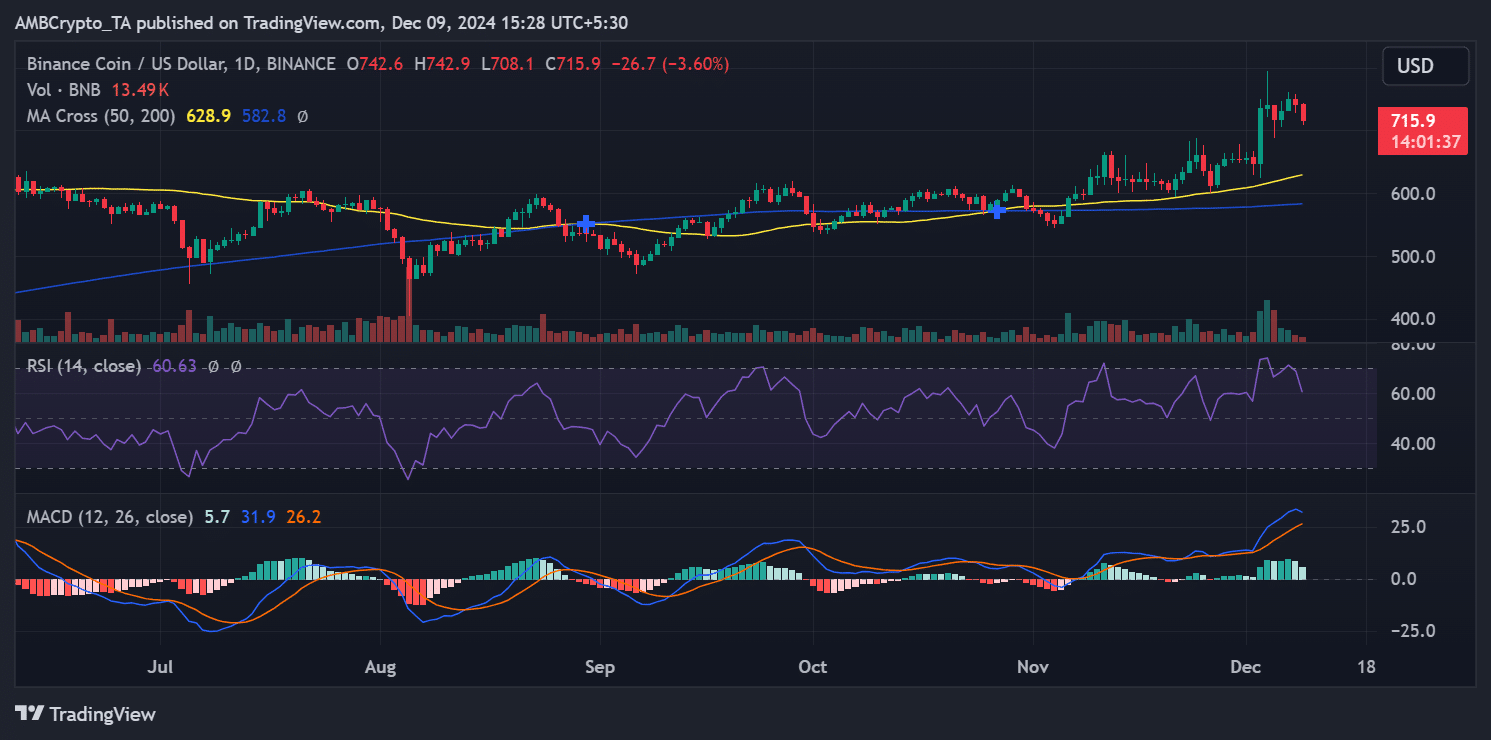

- BNB was trading around $715.9 at the time of writing.

- Rising on-chain activity and social sentiment reinforced BNB’s bullish outlook.

Binance coin [BNB] continues its impressive growth, recently reaching an all-time high of $794.

The increase, driven by increased trading volume and activity in the chain, reflects growing confidence in the ecosystem.

With strong technical indicators and bullish social sentiment, BNB shows potential for further upside momentum despite minor consolidation risks.

BNB: Price and trading activity are increasing

BNBBinance’s native token, has experienced remarkable growth in 2024, culminating in a series of upward trends towards the end of the year.

After breaking all-time highs just four days ago, the price was hovering around $715.9 at the time of writing. The rally was accompanied by increased trading volume, which researchers say is a sign of increased investor interest CryptoQuant.

BNB’s 30-day moving average trading volume has risen steadily since mid-2023, with recent values approaching historic highs.

This increase reflects the continued enthusiasm and growing confidence in Binance and its ecosystem.

Technical indicators such as the RSI at 60.63 suggest that the token is slightly overbought, but there is room for further growth. The MACD remains bullish, reinforcing optimism among traders.

Source: TradingView

Volume in the chain and social sentiment

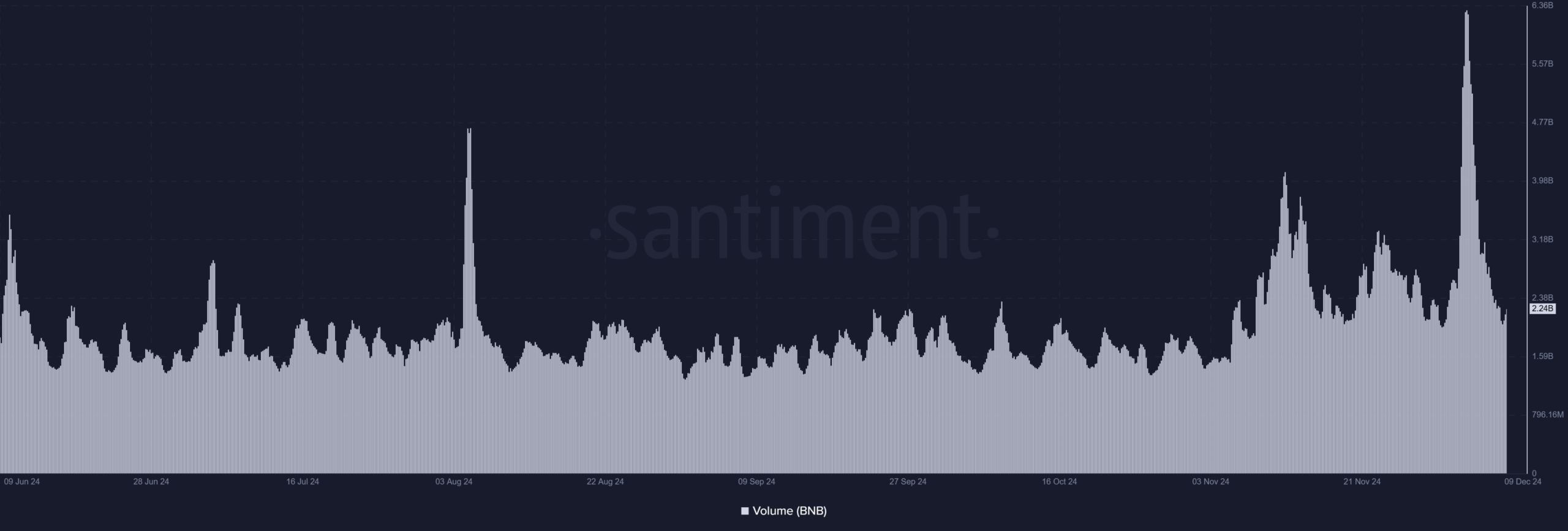

Data from the chain shows a sharp increase BNBs transactional activity. Analysis showed that volume increased to over $6 billion as the price rose to the ATH.

The increase in volume marked a significant increase in activity within the Binance blockchain and coincided with the broader market recovery and recent price breakout. At the time of writing, volume was approximately $2.24 billion.

Source: Santiment

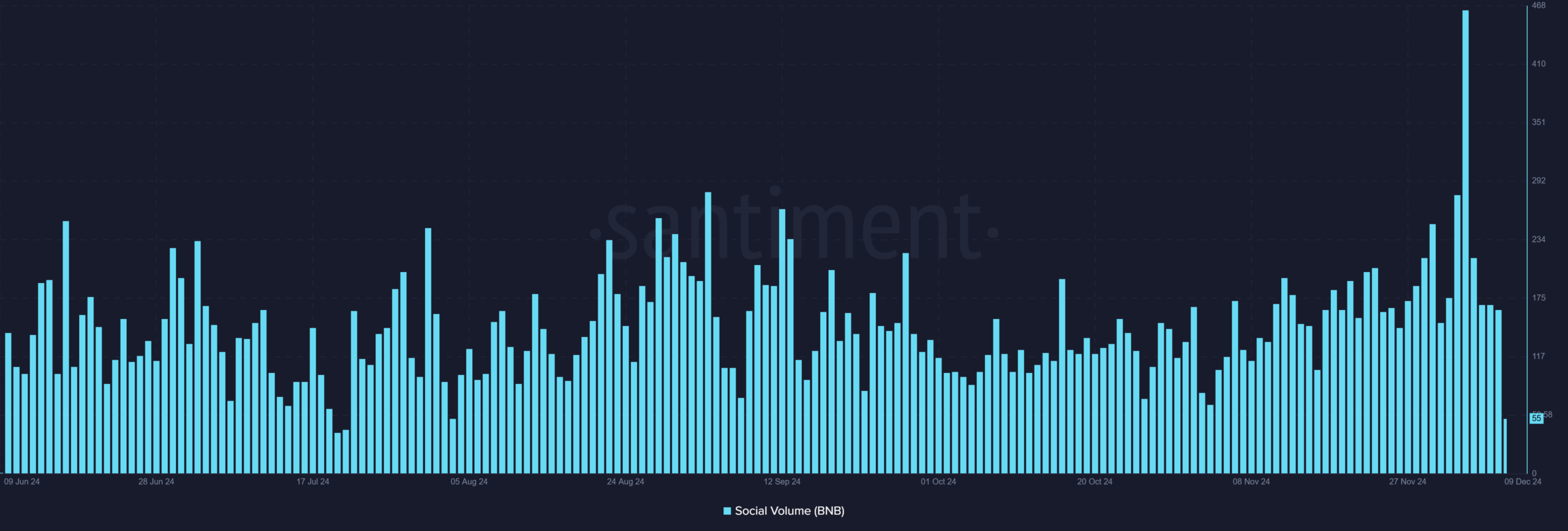

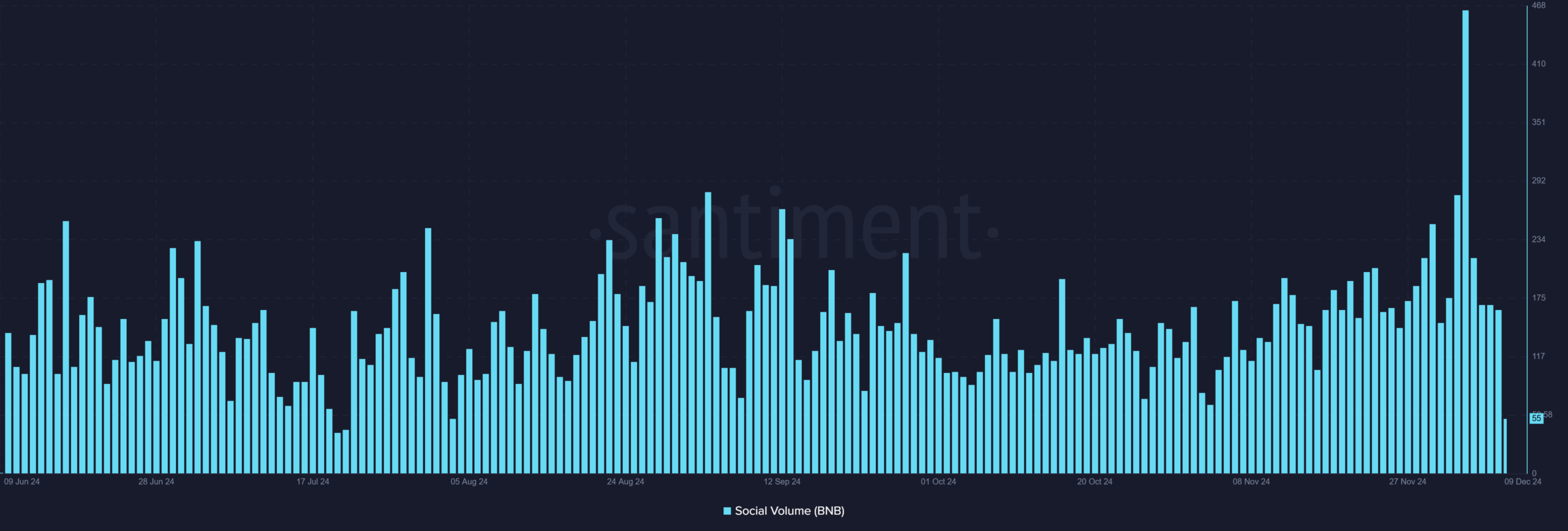

Furthermore, AMBCrypto’s analysis of social sentiment, as measured by Santiment, reflected growing interest in BNB. Social volume reached its highest level of the year, peaking at 465.

Historically, such spikes in social engagement have preceded or coincided with major price moves, reinforcing BNB’s current bullish narrative.

Source: Santiment

What can you expect from Binance?

The Binance Analysis of price and volume trends shows that BNB’s current momentum indicates a possible continuation of its bullish trajectory.

The steadily rising 30-day moving volume average and recent uptick in on-chain activity indicate continued interest from traders and investors alike.

Historically, such trends have foreshadowed extended rallies, especially when accompanied by strong social engagement.

However, BNB’s RSI, which is hovering near the overbought zone at 60.63, signals the possibility of short-term corrections or consolidation phases.

This could allow new investors to enter the market before a new potential wave.

The MACD’s bullish crossover supports the likelihood of further price appreciation, provided trading volumes remain consistent.

Read Binance Coin’s [BNB] Price forecast 2024–2025

If current trading activity and sentiment continue, BNB could aim for new highs soon. Key levels to watch include resistance at $750, with support around $680.

A break above resistance could strengthen BNB’s upside momentum, while staying above support would be a sign of strong market confidence.

Credit : ambcrypto.com

Leave a Reply