Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

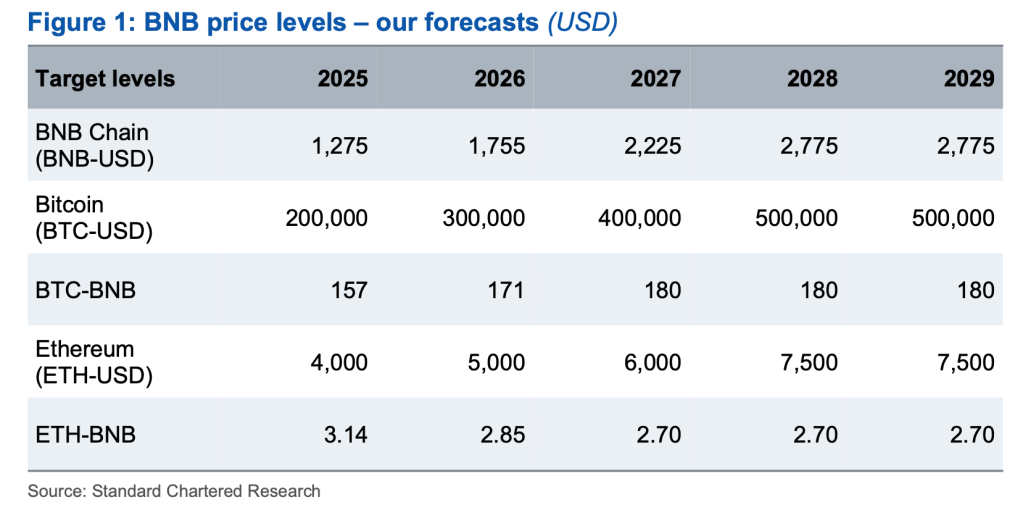

Standard Chartered has initiated the formal coverage of the exchange of Binance, BNB, and one of the most detailed long -term trajectories in industry set out for the actively. In a research memorandum shared With the block, Geoffrey Kendrick, the worldwide head of the Digital Asset examination head, argues that today could accelerate the token price from around $ 600 to $ 1,275 against 2025 and $ 2,775 against 2028, before 2029 “Plateauen” until 2029.

BNB could spijken with 360%

The path implies a profit of more than 360% compared to the current levels and, crucial, sites in what Kendrick calls ‘a benchmark-like role’ in the broader crypto capital structure. “Since May 2021, BNB has exchanged almost exactly in line with an unwanted basket with Bitcoin and Ethereum in terms of both returns and volatility,” wrote Kendrick. “We expect that this relationship will continue to hold, which means that the price from around $ 600 is currently stimulated to $ 2,775 against the end-2028.”

Related lecture

The broader outlook of Standard Chartered is unabashedly Bullish on the Majors: Bitcoin is expected to reach $ 200,000 in 2025 and $ 500,000 in 2028, while Ethereum is affected at $ 4,000 and $ 7,500 on the same horizon. When those predictions are translated into cross-asset ratios, they will reveal subtle shifts in market share.

The BTC-BNB ratio-how many BNB can buy a Bitcoin-it is expected that he will attack from 157 to 180 by 2027 in 2025, and then keep stable, which implies that Bitcoin’s dollar rating will probably dismiss BNBs. The ETH-BNB ratio, on the other hand, can be seen sliding from 3.14 in 2025 to 2.70 in 2027, indicating that Ethereum can surpass BNB, but will be softer than Bitcoin.

Kendrick acknowledges that BNB “Bitcoin and Ether can support both in real terms and as measured by market capitalization in circulation”, but he still argues that his deflotion tokenomics and deep link with the world’s largest centralized exchange “support its long -term value”.

The research memorandum investigates the architecture of the BNB chain. The “Proof-of-Stak-Stak-Autority” model rotates only 45 validators every 24 hours a sharp contrast with the Million-Plus-Validator set from Ethereum. Kendrick describes the BNB chain as ‘very centralized in relation to other chains’, and added that the activity of the developer has been ‘stagnated’ since the Defi -span of 2021 and now follows networks such as Avalanche and Ethereum.

Related lecture

Nevertheless, the coming technical milestones are expected to expand the resilience of the ecosystem. Kendrick quotes the recently completed Pascal Hard Fork and the imminent Maxwell -upgrade, in June, as examples of “incremental but meaningful” stimuli for developers.

On the demand side, the fortunes of the token remain tied to the trade engine of Binance. Holders receive layered cost discounts calculated on their token balance and 30-day volume-a mechanically enforced use case that has so far helped to retain the BNB chain of activity, even if competition from other ecosystems such as Solana grows, “Kendrick notes. Pancake wap, the dominant decentralized exchange on BNB chain, reinforces that liquidity loop.

In the meantime, the regular token, in combination with the supply stock, support a structural deflation that, according to Standard Chartered, justifies the Premium BNB commands on its market-CAP-CAP-GGDP-Valuation Screen-NU “Rijk” through the bank’s preferred meter.

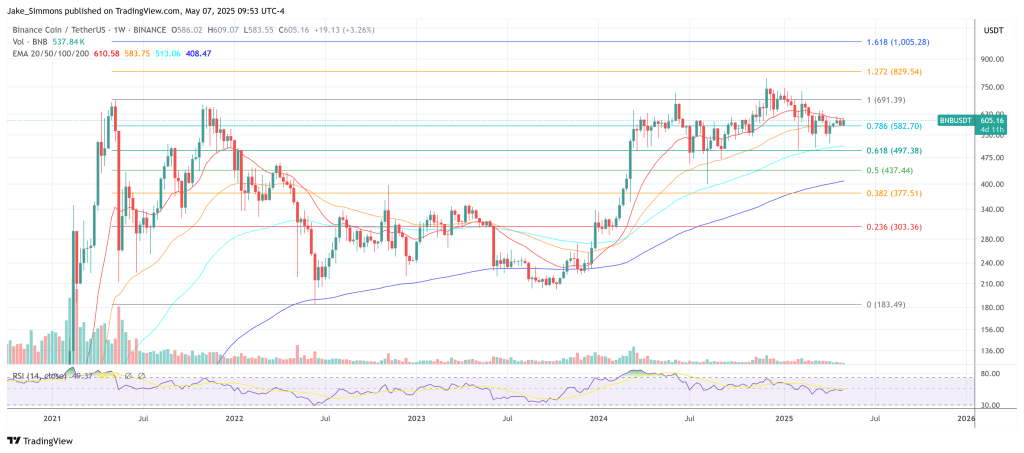

BNB traded at $ 605 at the time of the press.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply