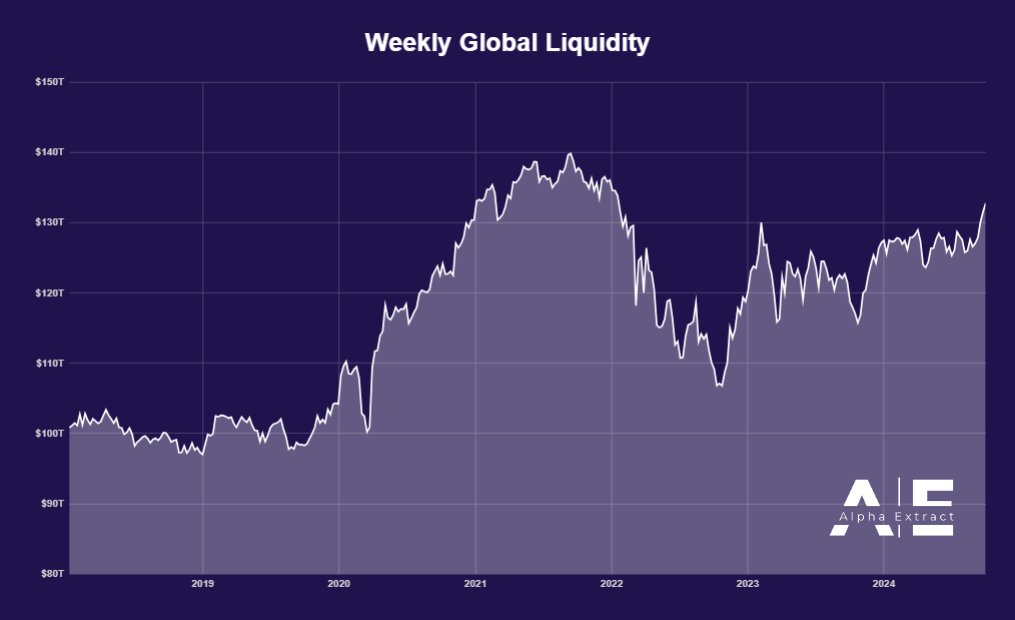

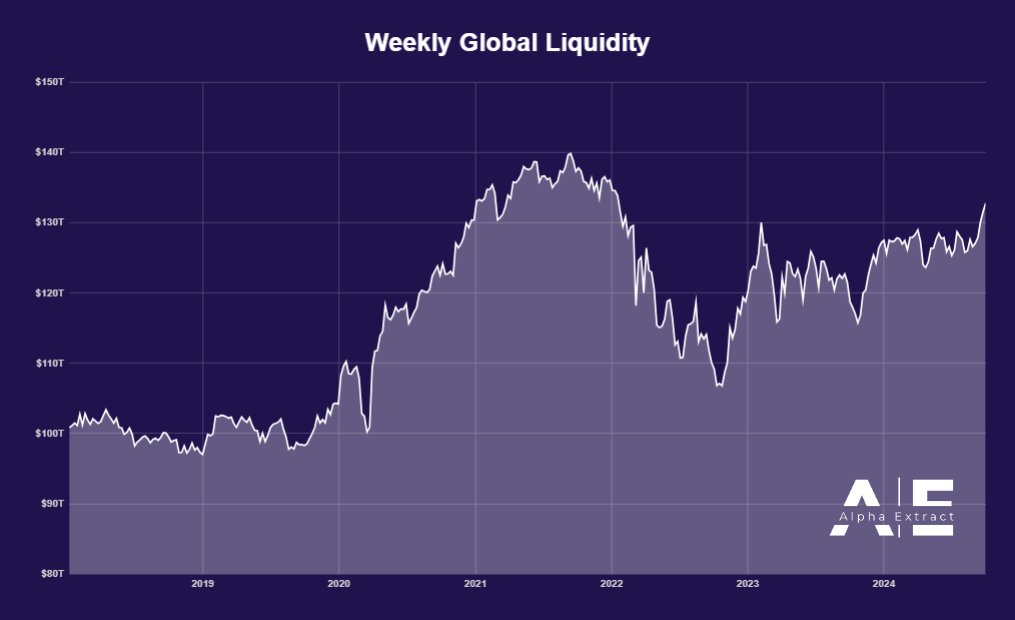

- The price of Bitcoin will rise as global liquidity increases.

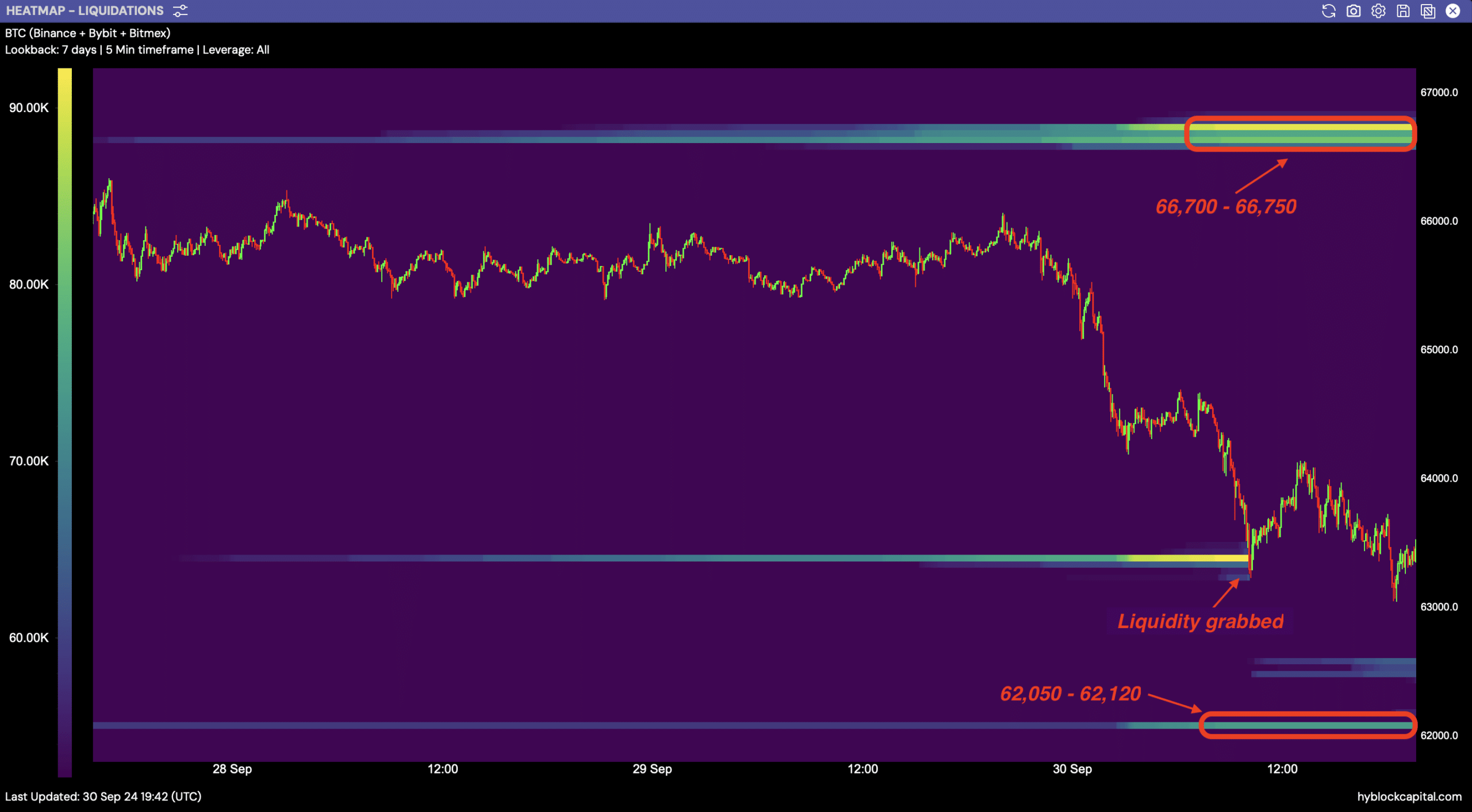

- Assessment of the following liquidity clusters for Bitcoin.

Bitcoin [BTC] continues to show strength, driven by rising global liquidity and favorable macroeconomic conditions.

With global liquidity increasing 0.92% to $132.8 trillion, the highest level since early 2022, Bitcoin is expected to benefit from this trend.

Improved collateral values and actions by the Chinese central bank have contributed to this increase. Although the Federal Reserve has not yet introduced stimulus measures, markets are optimistic about future interest rate cuts.

These factors suggest that Bitcoin could see higher prices, which would make the final quarter of the year particularly bullish for the broader crypto market.

Source: Alpha extract

Bitcoin’s Price Action and Key Levels

Bitcoin’s price recently bounced off the critical Fibonacci retracement level of 0.786 and is currently trading at $66,000. This level has consistently acted as a key indicator of both upward and downward movements this year.

The pattern of respecting this level shows that Bitcoin remains in line with global liquidity trends. As liquidity continues to rise, it is expected to rise further, with the next big target being new highs above $66,700.

The global liquidity boost will likely benefit Bitcoin as it remains a primary hedge against monetary inflation alongside gold.

Source: TradingView

Impact of September’s bullish close

This month ended with an increase of 7.35%, making it the best performing September in BTC history. This bullish sentiment is supported by Bitcoin’s ability to withstand recent corrections and maintain upward momentum.

Despite market expectations of a decline, Spot On Chain AI models are accurate predicted a bullish month, noting,

“There is a 69% chance of a new all-time high this month and a 54% chance that Bitcoin will reach $100,000 by the end of the year.”

The broader crypto market is also expected to benefit from favorable macroeconomic factors, especially potential interest rate cuts from the Federal Reserve and European Central Bank.

The Fed has shifted its focus from inflation to employment, with a 42% probability of a 50 basis point rate cut in November.

If upcoming US unemployment data turns out lower than expected, this probability could increase further. Rate cuts generally indicate a more favorable environment for risky assets like Bitcoin, causing its price to rise.

Liquidity clusters to keep an eye on

Major liquidity clusters for Bitcoin emerge as the price rises. Recent price moves towards $63,225 allowed Bitcoin to grab liquidity, paving the way for the next move.

The next high liquidity clusters are between $66,700 and $66,750, while lower clusters offer support around $62,050 to $62,120.

Read Bitcoin’s [BTC] Price forecast 2024–2025

These levels will be important to keep an eye on as Bitcoin continues its uptrend, potentially leading to a breakout to higher prices.

Source: Coinglass

Rising global liquidity, bullish technical patterns and positive macroeconomic signals position Bitcoin for higher prices soon.

Credit : ambcrypto.com

Leave a Reply