An analyst has explained how Bitcoin has been following gold for a while, which can give hints about what the next is for BTC.

Bitcoin has recorded the footsteps of Gold on a period of 2 days

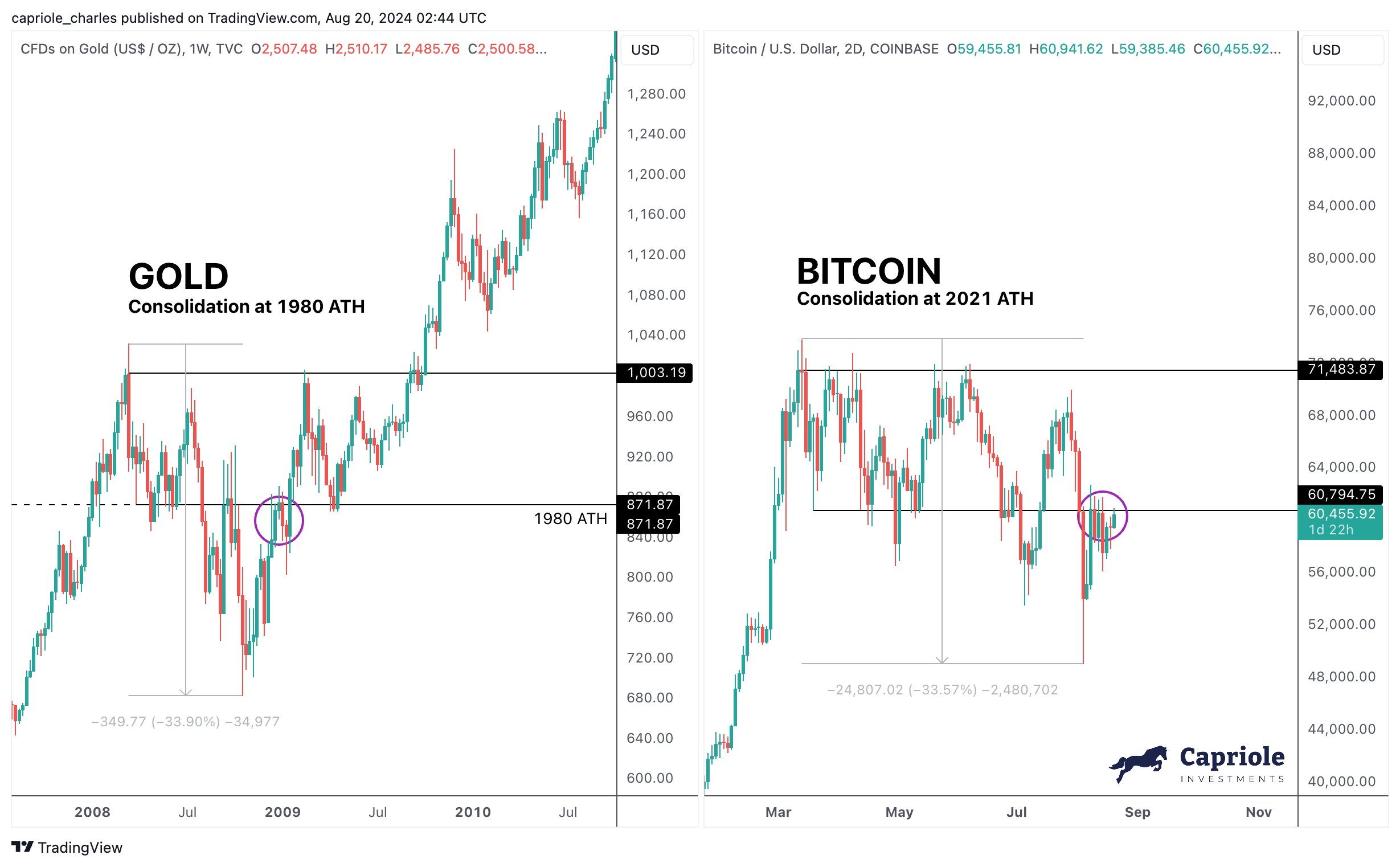

Last year Capriole Investments -founder Charles Edwards shared in an X after How Bitcoin followed the same structure as the gold of all time high (ATH). Below is the graph that the analyst posted then.

From the graph it is visible that BTC was consolidating at its ATH 2021 in a way comparable to Gold’s movement around the ATH 1980. The consolidation of the latter ended that the broke and could collect itself twice as higher.

In a new one afterEdwards has shared a late update about how it finally played for Bitcoin.

As the consolidation around the respective Aths hinted, there was indeed some similarity between the pimples for the prices of the two assets.

But this is all in the past, where does the newest Bitcoin price campaign compete against gold? A graph has been placed here by the analyst, and emphasizes the point that BTC is currently:

As Edwards has emphasized in the graph, the outbreak of BTC has continued to resemble Gold’s since the consolidation phase around the ATH, except for the fact that the volatility of BTC has been about twice as high, both in terms of upward and downward movements.

That said, the newest closure of the cryptocurrency has looked less promising than what the precious metal in a similar stage shown in its structure. It is possible that the two can vary from here, but in the event that they do not, the path of Gold can give a look at what awaits us for the coin.

As is apparent from the graph, the traditional Safe-Haven assets saw a significant increase from this point. Based on this, the analyst has noticed: “Close back above $ 110k and this will probably go bananas.” It is still to be seen how things would play for Bitcoin in the near future.

In a different news, the provider of institutional Defi solutions Sentora has shared data with regard to how the offer of the cryptocurrency is currently distributed over the various segments of the sector.

It seems that the individual investors check around 69.4% of the total potential bitcoin supply. The ETFs and other funds have around 6.1%, while companies around 4.4%. About 7.5% of all BTC that will ever be there has already been lost due to missing keys and/or forgotten.

BTC price

At the time of writing, Bitcoin trades around $ 104,200, a decrease of more than 4% in the past week.

Credit : www.newsbtc.com

Leave a Reply