This article is available in Spanish.

Bitcoin has seen significant price movements in recent days, largely influenced by macroeconomic developments and market fundamentals.

Following the Federal Open Market Committee (FOMC) meeting and a speech by Federal Reserve Chairman Jerome Powell, the price of Bitcoin fell sharply below $99,000.

However, the leading crypto quickly recovered and climbed back to $104,000 earlier today before settling at $100,573 at the time of writing. This represents a decline of 3.4% over the past day and a decline of approximately $67 billion in market capitalization.

Related reading

Foreign exchange transactions reached record lows

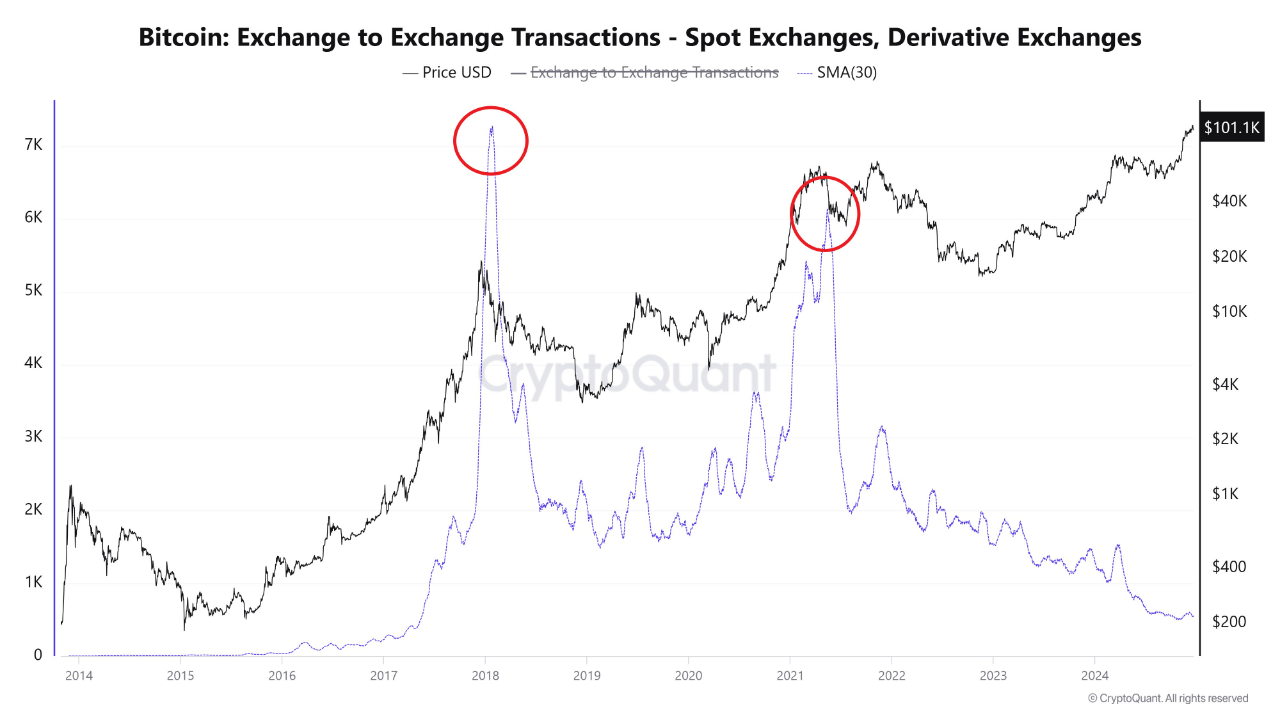

Amid this price performance, CryptoQuant analyst known as Woominkyu took care of insights in Bitcoin market activity, highlighting declining volumes of exchange transactions.

According to Woominkyu, historical data suggests a link between spikes in transaction volume and significant price movements. For example, spikes in currency transactions coincided with Bitcoin’s dramatic price increases in 2017 and 2021.

However, recent data shows a marked decline in transaction volumes on both spot and derivatives exchanges, due to reduced trading activity compared to previous years.

This decline, according to the CryptoQuant analyst, could indicate “decreasing market participation,” indicating a “period of consolidation or reduced volatility” in the near term.

Bitcoin Key Support Levels and Technical Insights

Market information platform IntoTheBlock has shed light at a key support zone just below the $100,000 mark. The data shared by the platform shows that more than 1.45 million BTC have been collected at an average price of $97,500.

This accumulation has created a significant demand zone, which could potentially serve as a ‘buffer’ against further price declines. The importance of this level lies in its ability to provide a foundation for price stability, especially as Bitcoin moves through its current phase of market correction.

It is suggested that a break below this zone could cause further downside pressure, while holding above it could boost recovery efforts.

Meanwhile, from a technical perspective, market analyst Satoshi Wolf’s insights highlight the critical nature of Bitcoin’s current price level. The cryptocurrency recently tested the $100,000 support level, in line with the 100-day Exponential Moving Average (EMA).

Related reading

This level is crucial because it combines technical indicators with psychological meaning. The Moving Average Convergence Divergence (MACD) indicator is showing bearish momentum, while the Relative Strength Index (RSI) is approaching oversold territory, indicating the potential for a price reversal.

Wolf suggests traders keep an eye out for a confirmed breakout above $104,000 or a breakout below $100,000, with volume confirmation key to validating both.

📊 $BTC Analysis: The chart shows a recent pullback after a strong uptrend, indicating possible profit-taking. Price is testing the 100,000 support, in line with the 100 EMA, a crucial level to keep an eye on.

If this holds, a return to 104,000 resistance is possible. MACD… pic.twitter.com/smLaqsr2Tz

— Satoshi Wolf (@SatoshiWolf) December 18, 2024

Featured image created with DALL-E, Chart from TradingView

Credit : www.newsbtc.com

Leave a Reply