On-chain data shows that around 95% of all Bitcoin holders are making profits after the last bullish action the asset’s price has seen.

Very few Bitcoin addresses are still underwater

In a new one after on X, market intelligence platform IntoTheBlock shared an update on what Bitcoin holder profitability currently looks like. The analytics company used on-chain data to determine this.

IntoTheBlock went through the transaction history of every address on the network to check the average price at which it acquired its coins. Wallets with a cost base below the current price are assumed to have some net unrealized gain.

Likewise, addresses of the opposite type are considered loss holders. The analytics firm calls the former investors “in the money,” while the latter are “out of the money.”

Naturally, the wallets with an average purchase price equal to the last spot price of the cryptocurrency would simply break even on their investment. They would be said to be “on the money”.

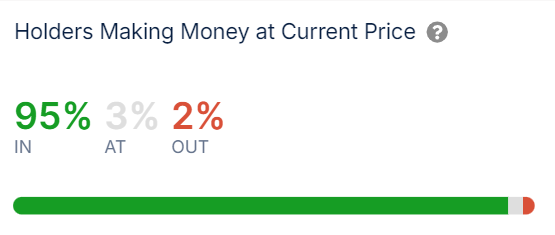

Here’s what the address distribution on the Bitcoin network currently looks like in these three categories:

As visible above, approximately 95% of existing Bitcoin holders currently have a net profit. About 3% of the remainder is at break-even level, while the remaining 2% is underwater.

The market distribution is therefore currently predominantly skewed towards profit owners. The reason behind this is the recent price increase that the asset has experienced.

“With 95% of Bitcoin addresses making a profit, market sentiment is booming,” IntoTheBlock notes. “Historically, such levels have signaled strong bullish momentum, but could also indicate potential overextension.”

In general, profit investors are more likely to sell their coins at any time, so if a large number of them are in the green, this can increase the likelihood of a massive sell-off with profit-taking motive. This is why a high profitability ratio can indicate potential overheating conditions.

There is a huge number of addresses in the money right now, so it is possible that another profitable event will occur. It remains to be seen if demand would be enough to absorb the selling or if a top would occur for Bitcoin.

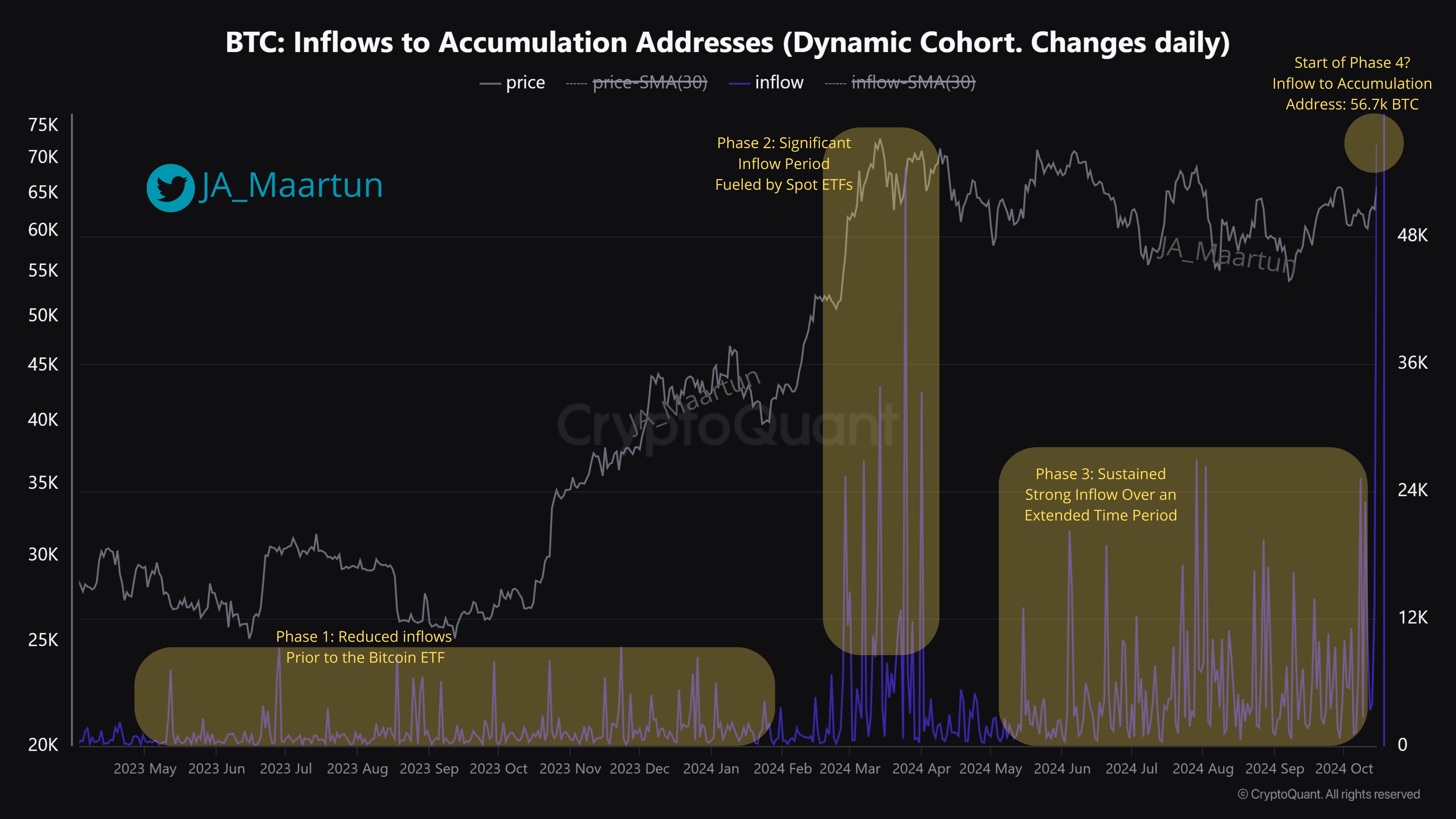

On a more bullish note, Bitcoin inflows into “accumulation addresses” have surged lately, as CryptoQuant community manager Maartunn has noted in an after.

The accumulation addresses refer to the wallets that have no history of selling on the network. These perpetual HODLers just added a whopping 56,700 BTC to their wallets, which suggests they may be starting a new phase of accumulation.

BTC price

At the time of writing, Bitcoin is trading around $67,400, up more than 11% in the past week.

Credit : www.newsbtc.com

Leave a Reply