Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Bitcoin has risen dramatically against gold in the last 10 years, with an increase in an incredible 13,693%, according to the financial statistics shared by Crypto Entrepreneur Ted.

The figures show the alarming divergence between the two assets from April 2015 and April 2025. Especially this striking climb of Bitcoin Has attracted the attention of investors throughout the world.

Related lecture

Bitcoin vs. Gold: From the same foot to massive opening

Ten years ago, Gold and Bitcoin were at similar prices. In April 2015, Bitcoin moved between $ 200 and $ 250, while gold about $ 1,200 to $ 1,300 per ounce.

The fortunes of these investments have since become completely different. Bitcoin has risen to around $ 84,000 per coin, an increase of approximately 33,500% in the ten -year period. The cryptocurrency briefly peaked at almost $ 109,000 during the time frame.

If someone tries to tell you that gold is better than Bitcoin …

Just show them:

In 2015, 1 BTC = 1 ounce gold.

Today? The same Bitcoin increased 13,693% in 10 years.

Let the figures speak. pic.twitter.com/8jiph5isnr

– Ted (@tedpillows) April 17, 2025

Gold, on the other hand, has retained its image of reliability in relation to volatility, instead of offering spectacular profit. The precious metal rose by only 156% in the same period. Of the spectators of the market, the value of Gold is still anchored on its consistent, inflation-proof behavior that includes very long time scales.

Historical context shows a variety of growth patterns

Go even further shows an even bigger inequality in the growth rates. According to a market analyst on social media platform X, the gold price was only $ 20.67 per ounce in 1933. What for 2025 the price rose slightly to around $ 3,330 per ounce, which is indeed a steep increase, but a gradual increase compared to a period of almost a century.

Ted's analysis on X.

Bitcoin has had a completely different history. From a prize of $ 1 in 2011 it came to $ 84,000 by 2025. With such rapid rating rates, both excitement and skepticism were produced by financial analysts who debate about the dignity of such growths.

Pure inequality in size

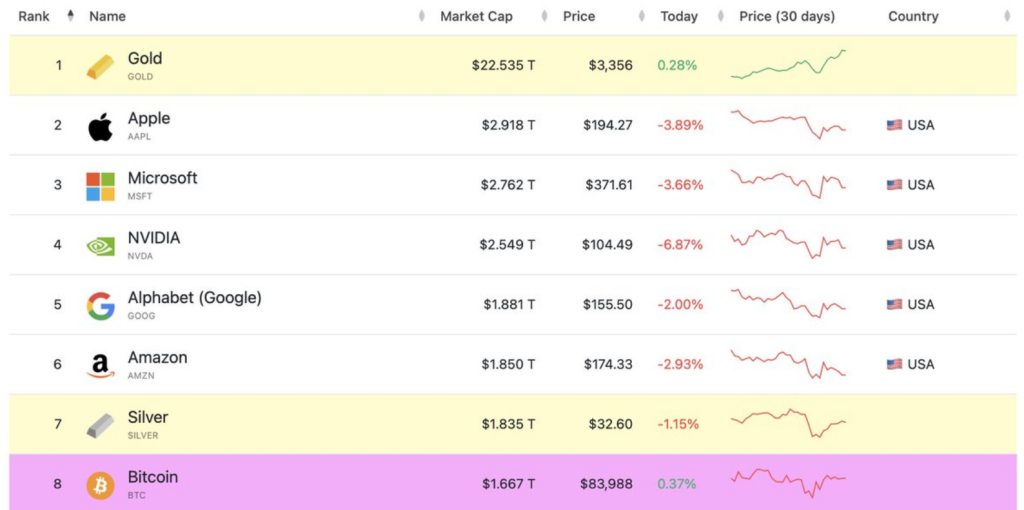

According to analyst Belle, a stark contrast in behavior is due to the enormous difference in the size of their market. Gold has about a market capitalization of just over $ 22 trillion. Because of this large size, gold offers an element of stability, making the market less sensitive to individual transactions or streams of short -term investments.

Gold added $ 1 trillion to its market capitalization in one day.

That is almost the full value of #Bitcoin now.This shows how huge traditional markets are and how early we are with Bitcoin.

Even a small shift in $ BTC Could let it fly. pic.twitter.com/ysjsgozkjx– Belle (@bitt_belle) April 17, 2025

Bitcoin’s market capitalization Is at around $ 1,667 trillion – large but still only a fraction of gold. This reduced size makes Bitcoin more sensitive to capital flows. Gold recently saw an impressive increase of $ 1 trillion in market capitalization for one day, but this was a much smaller percentage movement than the same dollar flow would activate in the value of Bitcoin.

Related lecture

The same dollar flow, different price effects

In the meantime, mathematics in terms of market capitalization generates intriguing scenarios for price movements. Based on reported calculations, if Bitcoin would get a boost of $ 1 trillion in market capitalization-comparable with the recent one-day rise in the gold can rise the price per unit from $ 84,000 to $ 135,000.

Featured image of the LEDN blog, graph of TradingView

Credit : www.newsbtc.com

Leave a Reply