Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

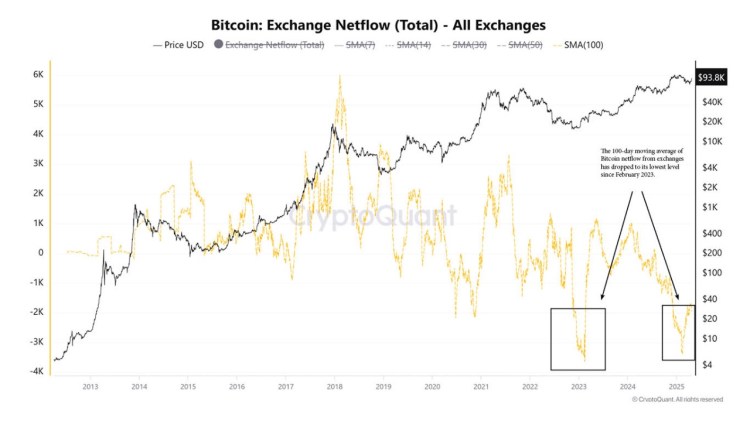

Bitcoin is on the rise again Positive sentiment return After Donald Trump has unveiled plans to lower the rates on China. This suggests that the tariff wars that started in January 2025 could end. Taking Bitcoin whales as a sign have started to reset movements. So far they have bought nearly 20,000 BTC, with BTC exchange outings that rise to levels that are not seen in more than two years.

Bitcoin Exchange outflows reach February 2023 levels

According to the on-chain data tracking platform Cryptoquant, more BTC from fairs has been streamed at levels that have not been seen in two years. This data was taken on the basis of 100 days of progressive average base and it appears that Netflows is falling considerably compared to not only 2025 and 2024, but dating as early as 2023.

Related lecture

Cryptuquant’s data to show That Bitcoin network from all stock markets crashed by more than 50% in the past year. At the moment it is so low that the last time it was so low in January 2023, when the cryptomarkt just came out of the impact of the FTX -Crypto exchange.

When the net streams are so low, this suggests that Bitcoin investors choose to gather instead of selling. It points to recordings of stock exchanges in private storage, where investors hold their hold BTC In anticipation of higher prices before they start selling.

“This is essentially indicating the highest Bitcoin outflow of stock exchanges since that date,” Cryptoquant explained in the post. “An overview of historical patterns suggests that this could mean that this is re -assigned by investors.”

BTC whales become bullish again

The recent Bitcoin price increase seems to be powered by bulls that had taken the reduced price to collect large quantities of BTC in a very short time. Santiment reported on this development and showed how the Bitcoin price increase of 11% could have been powered by buying Activities of these big investors.

Related lecture

Post to show That investors between 10 and 10,000 BTC had gone on a SPree last week. In total they added 19,255 more BTC to their balances in just seven days. This shows that whales had realized how undervalued the BTC price was and had seized the opportunity to get a profit quickly.

At the time of writing, the Bitcoin price was around $ 94,578 trending, which showed a strong endurance of the bulls.

Featured image of dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply