- Binance volume rose while the medium term holders doubled, indicating the rising institutional accumulation.

- The interest and leverage of the public fell, in which market decisions and a weak moment of demand were emphasized.

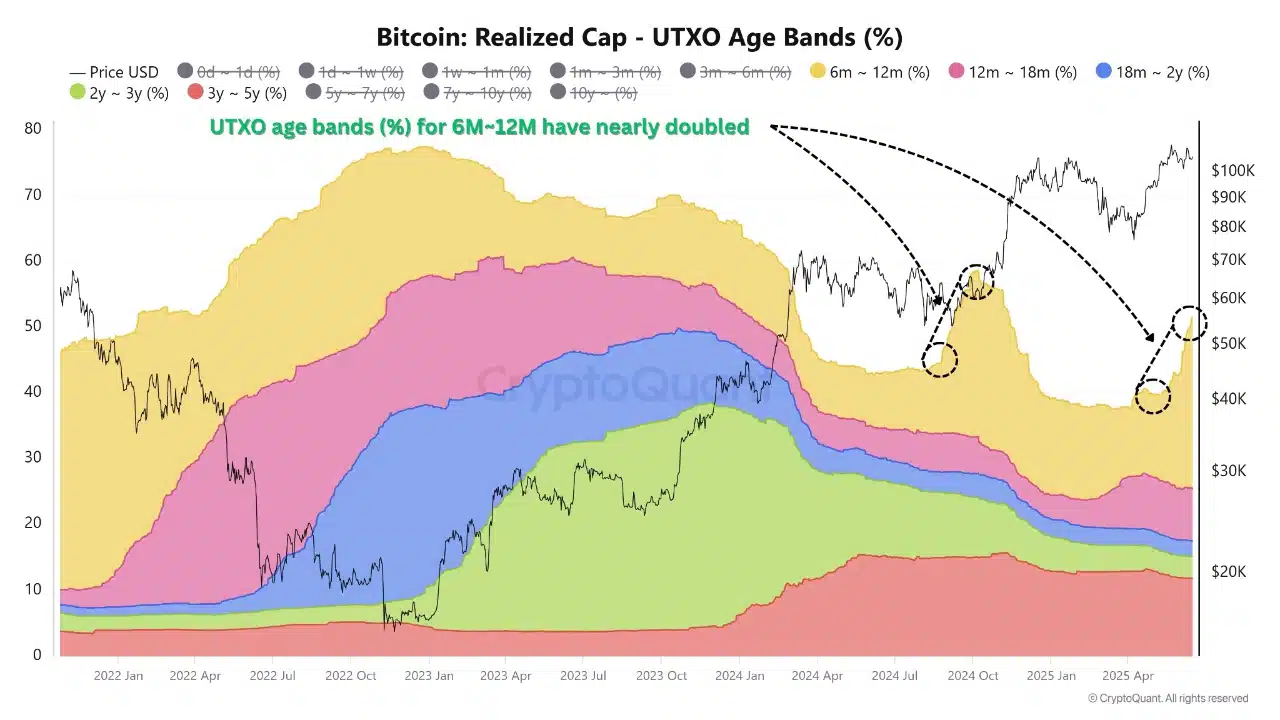

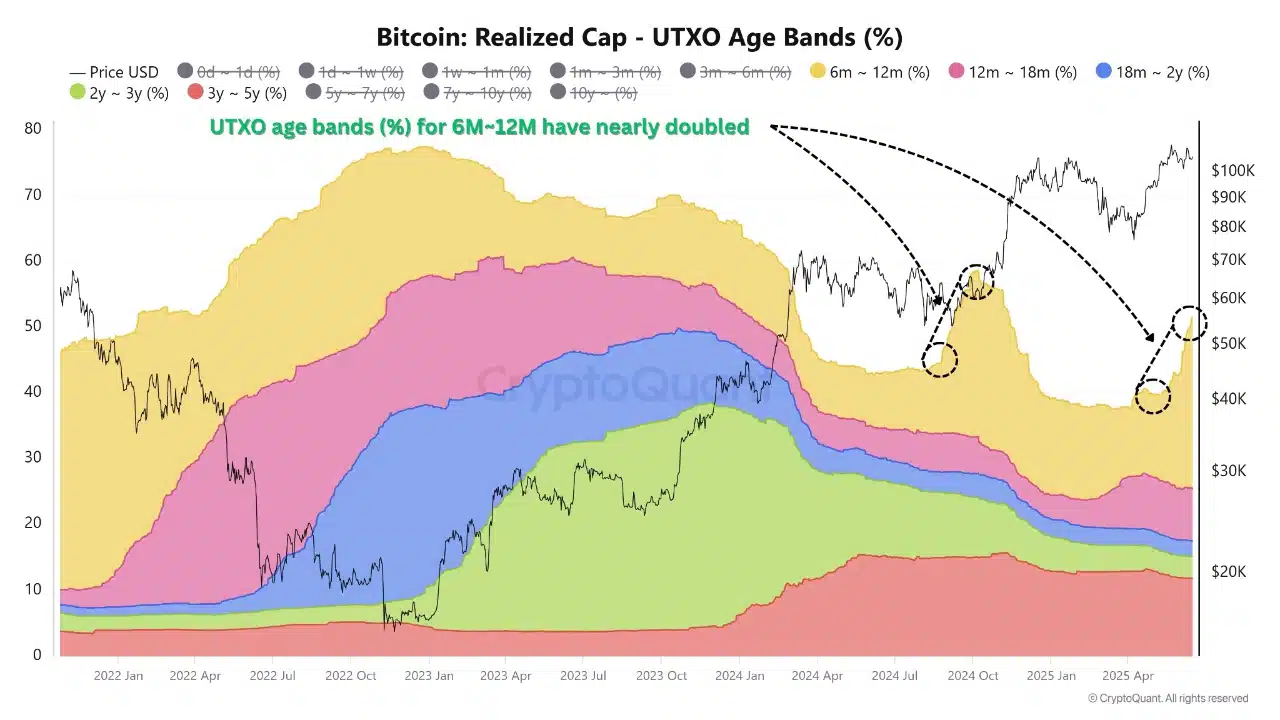

Bitcoin’s [BTC] Utxo Band doubled from 6 million to 12 million in June, indicating the conviction of rising holders, despite the fact that BTC fell 1.79% to $ 104,950 in the last 24 hours, a speed time.

This peak shows that more investors choose to retain volatility instead of taking a profit, reducing the available delivery.

From a historical point of view, such behavior of medium-term holders is very important as smart money for strong rallies. If this trend continues, Bitcoin could build a bullish setup based on accumulation.

The short -term demand remains fragile and traders must remain careful until the most important mounting signals return.

Source: Cryptuquant

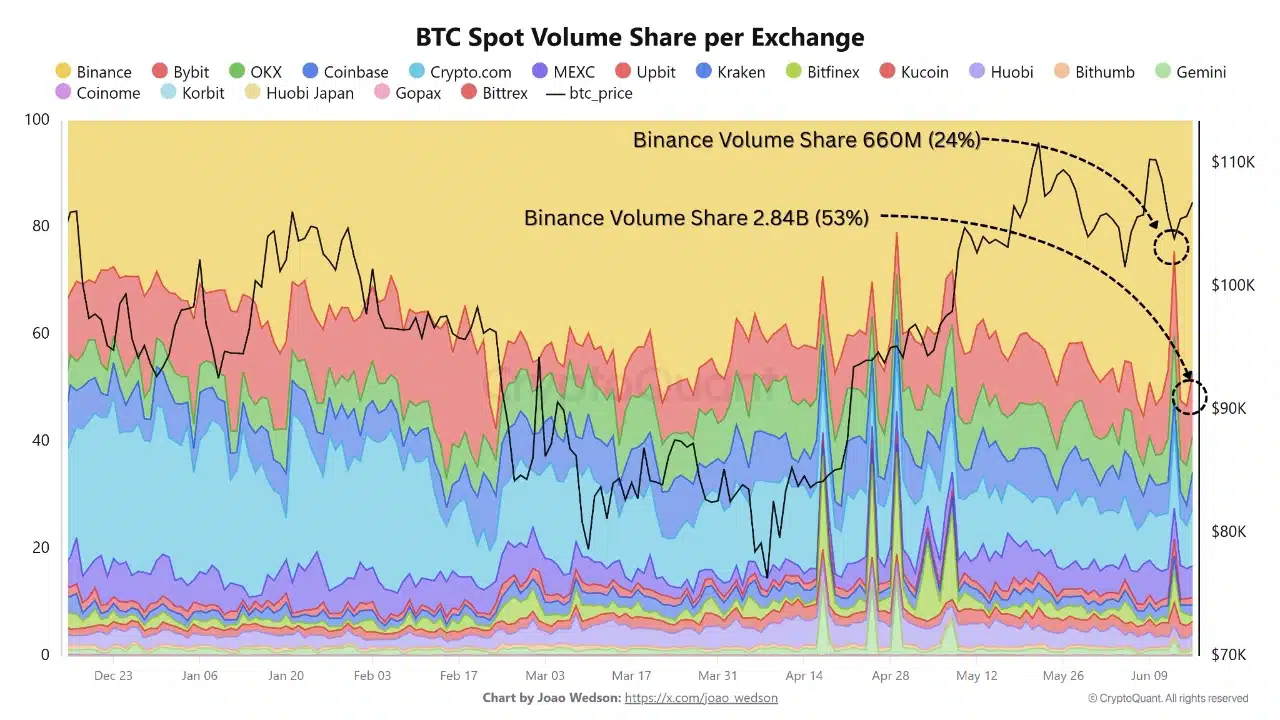

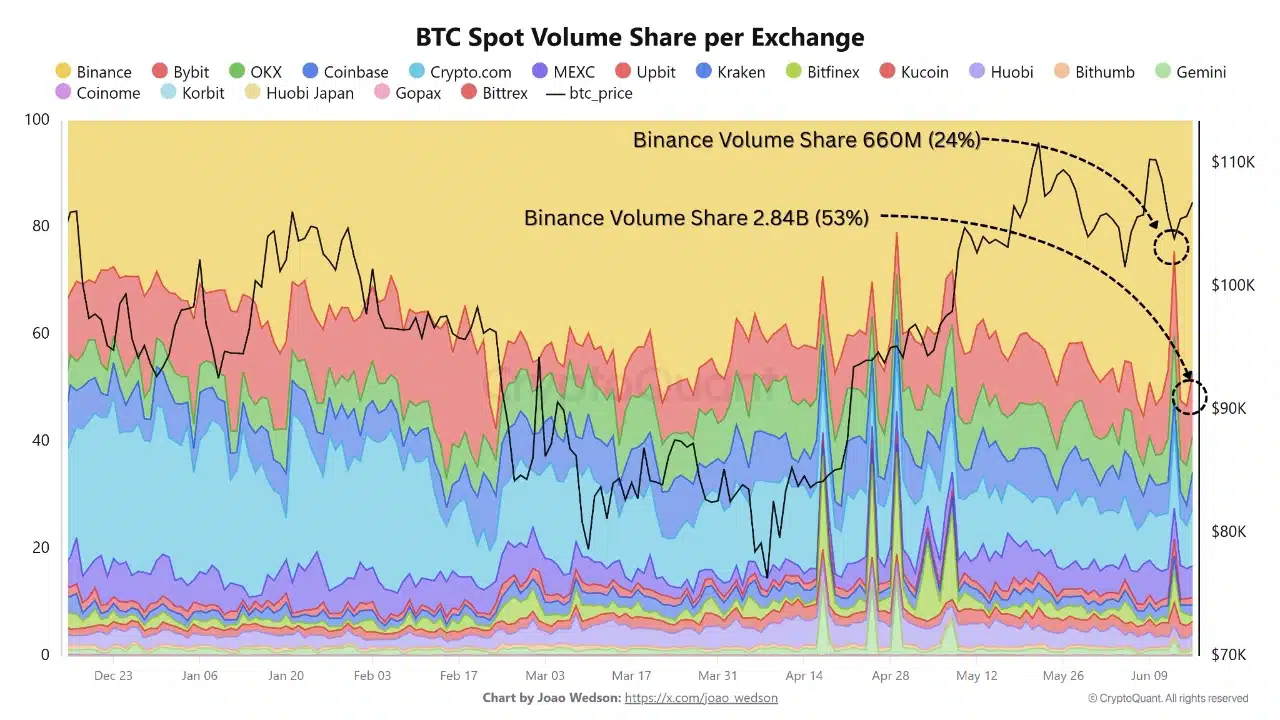

Why does Binance absorb the majority of the spot market activity?

The share of Binance in Bitcoin Spot Trading Volume has risen in just one day from 24% to 53% – a dramatic shift, pointing to a huge influx of capital.

This peak is probably powered by institutional players who again grant their activity, drawn by Binance’s deep liquidity and cost -effective trading structure.

Such a sudden rise in the exchange of dominance often indicates an approaching phase with high volatility, especially if it is fed by coordinated accumulation or strategic positioning prior to the most important price movements.

Moreover, this rapid consolidation of volume emphasizes the growing centralization in crypto -trading infrastructure.

If it is maintained, this can have permanent consequences for price discussion and market dynamics.

Source: Cryptuquant

Confirm a stock-flow ratio of 580 Extreme scarcity for BTC?

At the time of writing, Bitcoin’s stock-to-flow (S/F) rose to 580-one level well above historical averages.

This metric measures the relationship between the circulating range of Bitcoin and its annual issue, and such a sharp increase usually points to the tightening of delivery and long -term bullish potential.

However, the increased reading can be skewed by factors such as reduced miners’ sales or short -term fluctuations during activities at the chain.

Although a high S/F ratio supports the story of an imminent supply shock, it is not a standing signal for price valuation.

Persistent price growth still depends on increasing demand and broader market participation.

Without renewed investor’s interests and increased activities, increased S/F levels can only fail to cause immediate upward impulse.

Source: Santiment

BTC Social and Derivators Statistics show indecision as conviction stalls

BTCs Social dominance fell to 19.88%, while the binance financing percentage floated on a neutral 0.001%, as a result of fading crowd -engagement and trader indecision.

This combination suggests a low-judgment environment, in which neither bulls are neither assertively under control.

Historically, the falling of social interest in combination with flat financing preceded the great volatility, since the markets are waiting for catalysts. The lack of extreme sentiment or leverage reduces the short -term momentum.

That is why Bitcoin can remain accessible without a peak in involvement or directive financing. If these statistics shift sharply, they can indicate the start of the next large move of Bitcoin.

Source: Santiment

Negative DAA -Divergency continues to exist despite the recent price stability

The divergence of the price DAA remained negative, which suggests that the address activity did not keep track of recent price movements.

This persistent divergence calls for concern about the strength of the current market structure.

The growing address activity usually supports sustainable rallies, while divergence often indicates speculative or hollow price action.

The constant gap implies that fewer unique users transact the network, despite the price that hangs above $ 100k.

Source: Santiment

What power will prevail – processing or exhaustion?

The Bitcoin market is currently trapped between opposite forces: strong accumulation by holders in the long term and decreasing interest in the wider crowd.

Central term Utxo growth and the rising market share of Binance point to increasing institutional trust and long-term conviction.

On the other hand, negative divergence in daily active addresses (DAA), mutilated social sentiment and neutral financing percentages expose weak retail involvement.

For BTC to organize a sustainable outbreak, the coordination between institutional accumulation and enthusiasm of retail trade is essential.

Until that balance arises, Bitcoin stays at a crucial point – hanging between the potential for an outbreak and the risk of market fatigue.

Credit : ambcrypto.com

Leave a Reply