The retail long/short ratio heatmap revealed clear trends in altcoin positioning. The leaders in long positions are assets like SUI and SOL, with persistent green areas indicating increased bullishness in retail.

On the other hand, coins like TRX and XRP showed higher levels of short interest, indicating that traders are expecting downward moves.

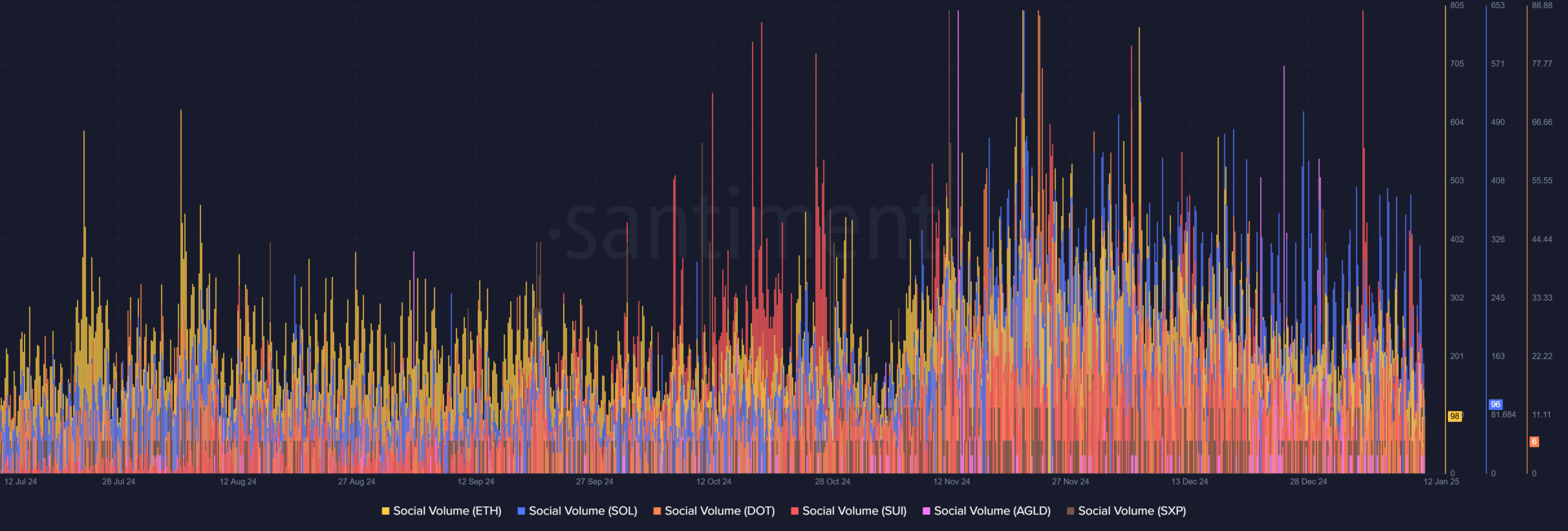

Source: Santiment

Social volume data reflected this sentiment. As shown in the chart, while Ethereum [ETH] Engagement remained high, but SUI and Solana quickly closed the gap, buoyed by network developments and community-driven hype. Altcoins like DOT and AGLD also saw spikes in social volume, indicating their rising popularity in trading discussions.

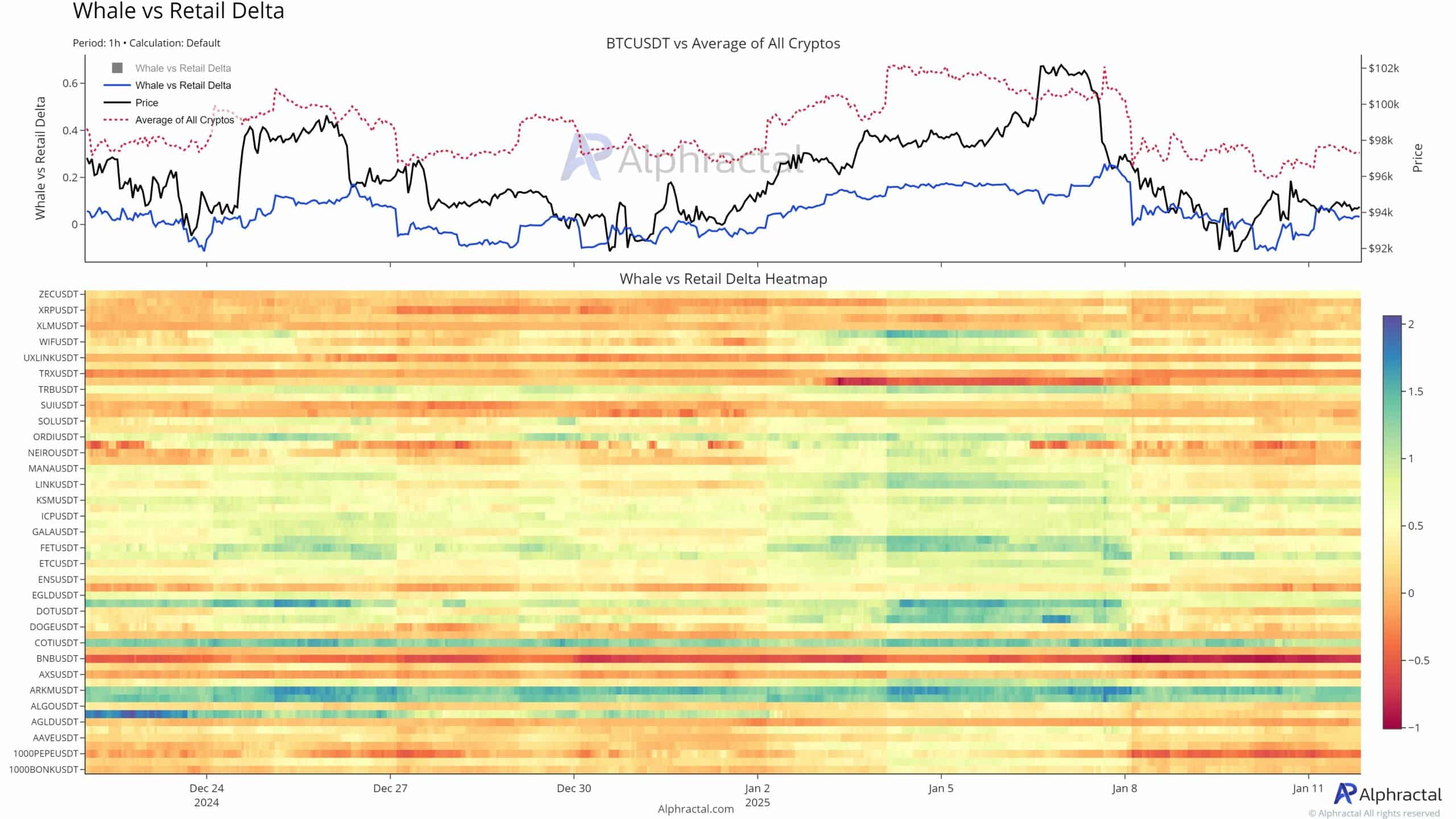

Despite the optimism surrounding altcoins, Bitcoin seemed to be in a neutral to slightly bearish zone. The average retail long/short ratio for BTC was close to parity, reflecting caution among traders amid slower price momentum.

This divergence is a testament to evolving market dynamics: traders are seeking higher risk-reward ratios in altcoins, while Bitcoin’s dominance is waning in speculative enthusiasm. For now, the altcoin rally appears to be driven by a mix of speculative retail interest and improving social sentiment.

Bitcoin’s long/short ratio suggests caution

Bitcoin’s neutral long/short ratio underscored its alignment with macroeconomic uncertainty and traders’ preference for stability.

With slower price momentum and a lack of decisive trend signals, participants appear reluctant to make large directional bets, preferring hedging strategies over speculative trading.

Source: Alpharactal

The Whale v. Retail Delta heatmap revealed moderate whale interest in BTC compared to other altcoins, indicating that large holders are not accumulating or offloading significantly. Instead, their behavior seemed to be in line with maintaining stability rather than increasing volatility.

This is in stark contrast to coins like TRX or GALA, where pronounced retail activity – often unbalanced by whale trading – causes sharper price swings.

Read Bitcoin’s [BTC] Price forecast 2025-26

Diverging Optimism – Altcoins and Market Stability

The uneven sentiment between altcoins suggested that the market is at a crossroads. Coins like SUI and SOL have seen concentrated bullish momentum, but this optimism is not universal. The shorting of assets such as TRX and XRP hinted at growing skepticism in other parts of the market.

This dichotomy seems to indicate a possible liquidity tug-of-war, where overly optimistic choices in some altcoins could amplify volatility spillovers. This fragmented sentiment entails risks for market stability.

If the speculative euphoria in certain altcoins comes to an abrupt halt, it could dampen broader confidence and lead to contagion effects. Conversely, continued optimism in select assets could pull capital aside, fueling a broader rally.

Credit : ambcrypto.com

Leave a Reply