- The long -term returns of Bitcoin remain strong and signal the persistent beliefs of investors.

- Retail investors continue to build up conviction and strengthen the shelf life patterns.

Investors did not always consider Bitcoin [BTC] A store of value. At an early stage, the lake acted as a risky, high-reward active, largely driven by speculative importance.

But while Bitcoin ripens in an asset class of trillion dollar, which now competes with people like the ‘Magnificent Seven’, it remains a remarkably resilient cycle-per cycle annual returns.

Does this suggest that the underlying demand in Lockstep can be scaled with the Bitcoin’s market market maturity?

Bitcoin defies the size with persistent returns

A bitcoin ran around $ 17,000 on the 2022 cycle. At the time of the press, the same BTC ordered a price of $ 105,000, which represents an increase of 517%+ in just over two years.

Although the return profile is unmistakably strong, the capital needed to participate in this advantage is also dramatically scaled.

In other words, the acquisition of a single BTC now requires more than five times the investment it made in 2022, with a much higher access barrier, especially for participants in the retail trade.

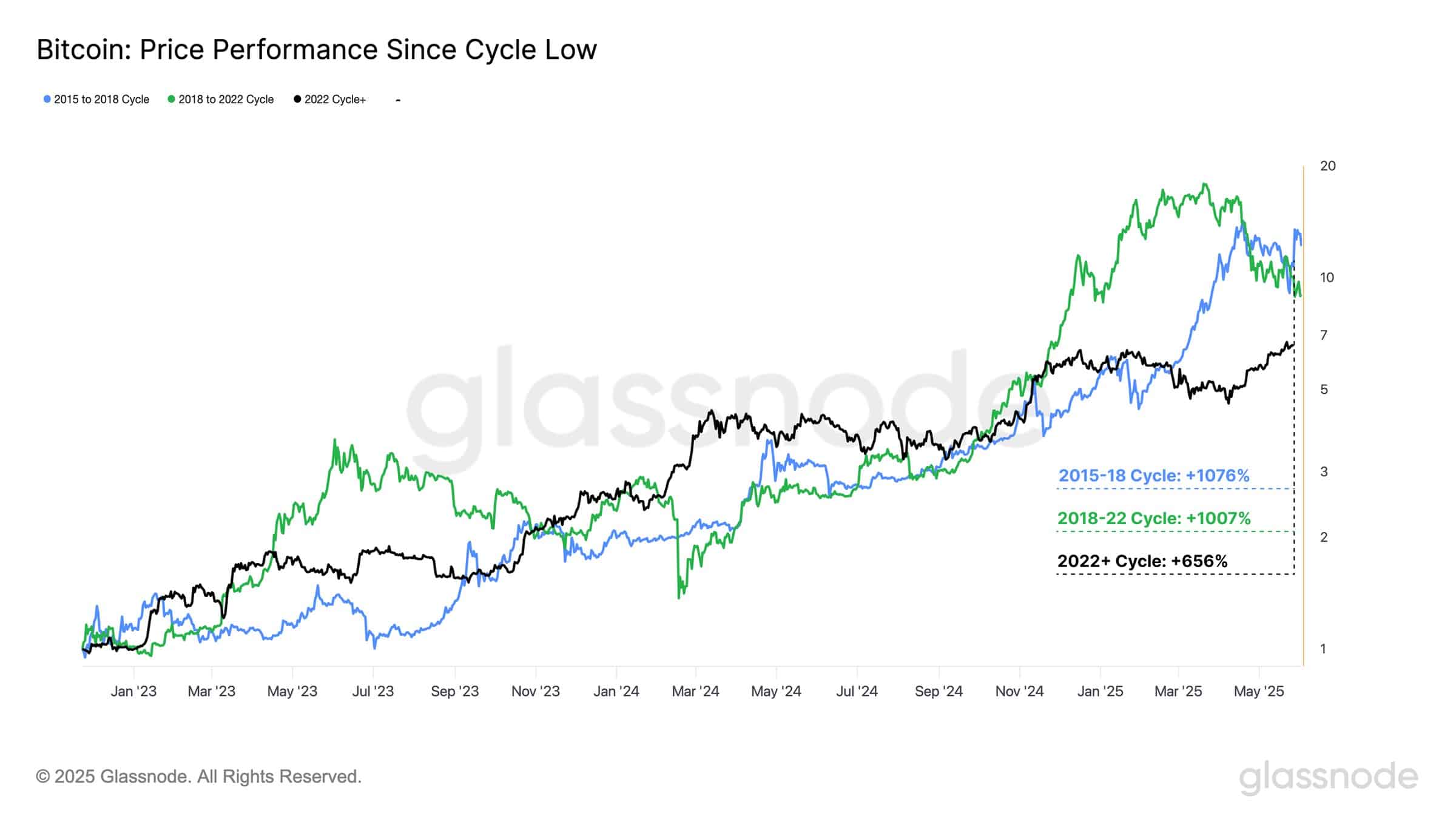

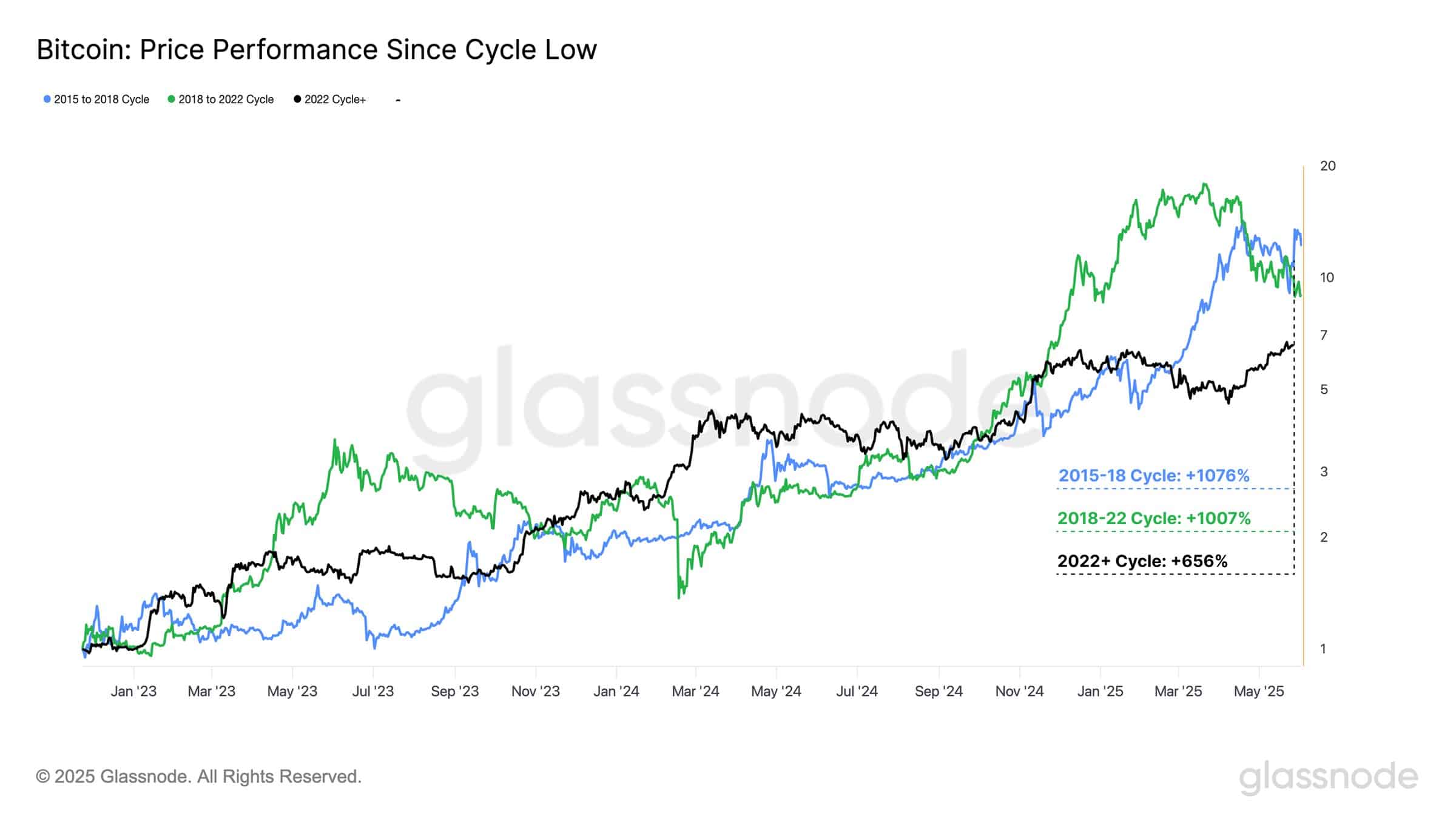

Still, Glassnode’s facts It reveals that since the 2022 cycle, Bitcoin has generated a return of 656%, indicating that long -term property continues to yield significant yields despite a higher capital threshold.

Source: Glassnode

AND we are only mid-2025. Zoom in on the graph, the current cyclus performance of Bitcoin is not far behind in the past, whether it is the 1076% profit of 2015-18 or the 1007% of 2018–22.

This consistent return pattern plays a crucial behavioral role. IT gives holders in the long term trust lingerWhile he also appeals to Fomo that attracts new investors. That mix keeps the market energetic and moving.

Retail investor behavior reflects the market strength

Certainly, institutional In Bitcoin, the quarterly over-quarter has been considerably expanded, as a result of the transition from a speculative asset to a ripe, long-term flot.

Consequently, you might think that retail investors would withdraw if institutions accumulate. However, data on chains reveal a remarkable increase of approximately 33% in addresses with more than 0.01 BTC in the past two years.

Source: Glassnode

Moreover, the number of addresses that recently manages more than 1 BTC is surpassed The 1 million marking, signaling of accumulation in both retail and institutional cohorts.

This persistent structure, despite the increased price of Bitcoin, indicates a strong conviction between market segments.

Smaller holders are active scale positions, gambling on large future returns that justify the considerable capital obligation, which strengthens the resilient Hodling framework of Bitcoin.

Credit : ambcrypto.com

Leave a Reply