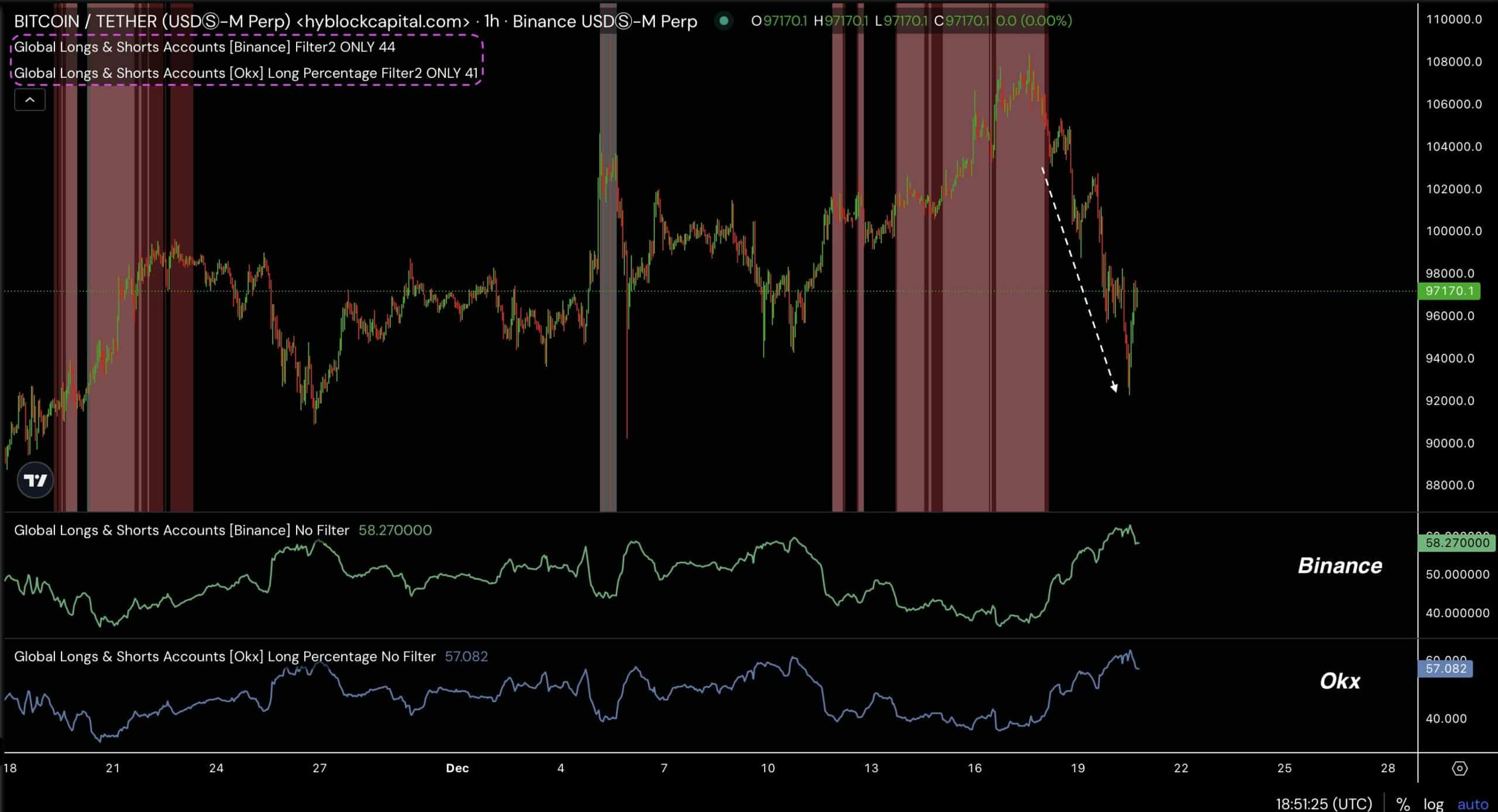

- Bitcoin’s long percentage began to rise as the price fell, leaving longs trapped

- Demand for Bitcoin soared as funding rates remained positive despite the dip

Bitcoin (BTC) saw a surge in long positions even as its price fell sharply, suggesting its traders were in a long trap. In fact, the percentage of longs on Binance and OKX escalated significantly as the price of BTC fell to a low of almost $92,000.

This trend signaled an impending reversal, one where the excessive bullish sentiment could reverse itself, leading to a possible price recovery as shorts come in and longs go out.

Source: Hyblock Capital

These cycles often precede significant market reversals. The downturn would position BTC for some recovery as long rates peak and begin to decline.

This would indicate a shift in sentiment, potentially trapping short positions. Here it is worth noting that apart from the long percentage increase, BTC also showed other signs of recovery on the charts.

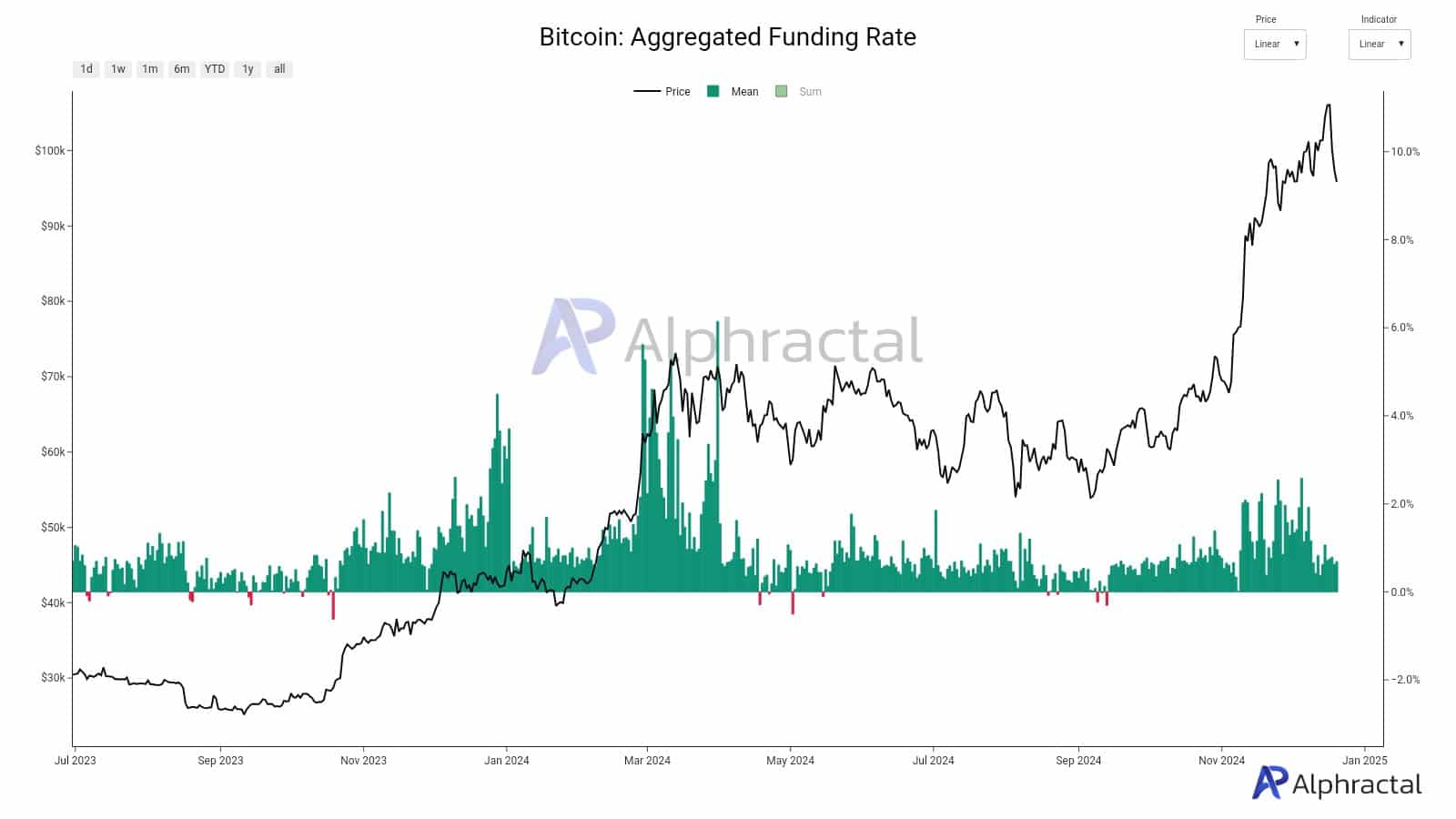

Bitcoin’s funding rate

The overall funding rate saw a sharp increase as the price escalated – a sign of strong bullish sentiment. Subsequently, the funding rate remained high while the price of Bitcoin began to decline – indicating an overloaded market.

Traders likely entered long positions during the rate hike, and the market’s inability to sustain higher buying pressure resulted in a correction.

Source: Alpharactal

The pullback could have spurred profit-taking or pushed shorts to take advantage of the high funding ratio, creating selling pressure.

Nevertheless, the continued positive funding rate indicated underlying market confidence, although caution may be warranted. If the financing rate maintains or reverses itself, it can signal potential market movements. Stabilization or a reversal in the funding rate could determine Bitcoin’s trajectory in the near term.

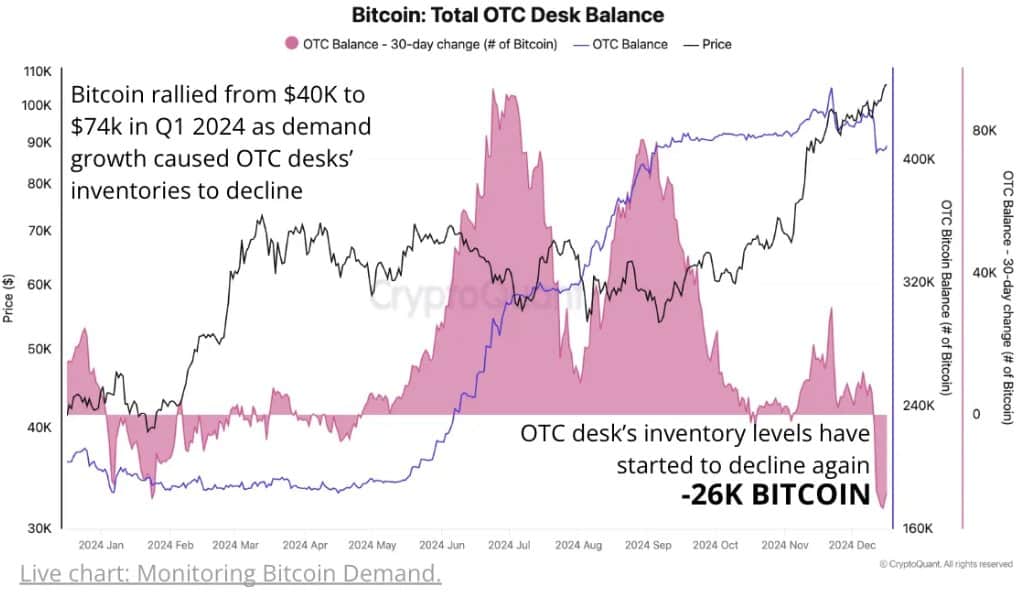

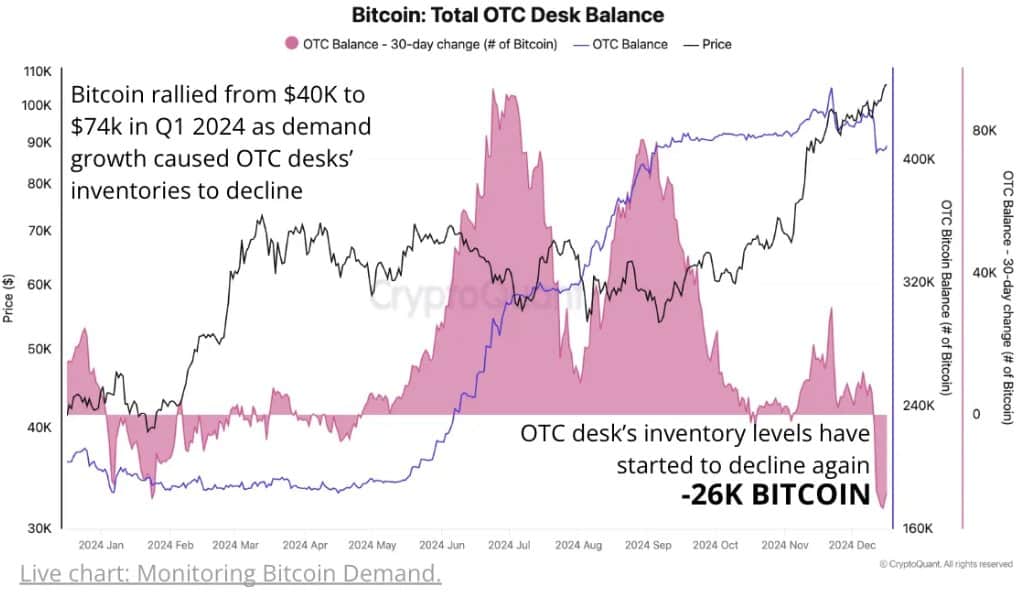

Demand meets brick wall

Bitcoin rallied significantly, rising from $40,000 to $74,000 by the end of the first quarter of 2024.

This increase was driven by increasing demand, as evidenced by significant inventory declines at over-the-counter (OTC) trading desks. During this period, OTC desks reported their biggest monthly inventory decline of the year, with a drop of 26,000 BTC – a sign of tighter supply.

Source: CryptoQuant

The total balance at OTC counters also decreased by 40,000 BTC as of November 2020, further indicating declining supply amid growing demand.

The drop in OTC balances alongside the price increase can be seen as a strong sign of strong momentum. The relationship also indicated that if OTC inventory levels continue to decline, Bitcoin’s price could escalate further. Especially if demand continues.

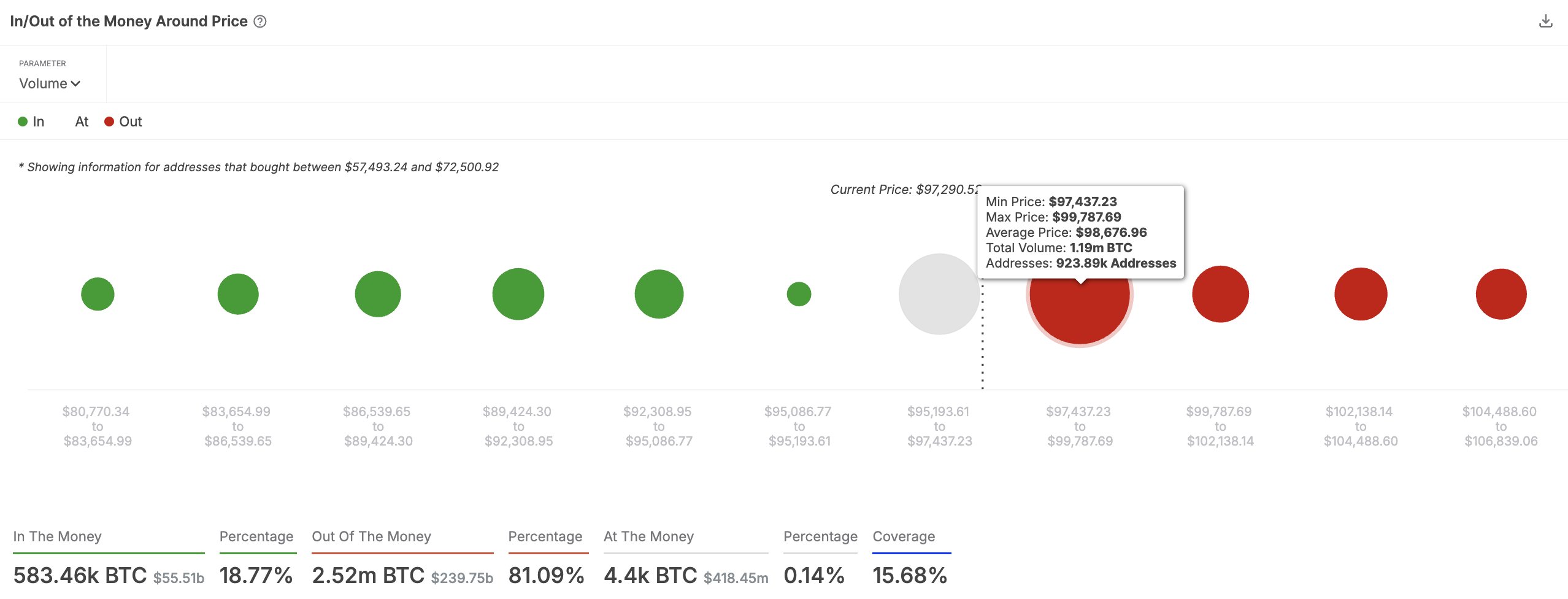

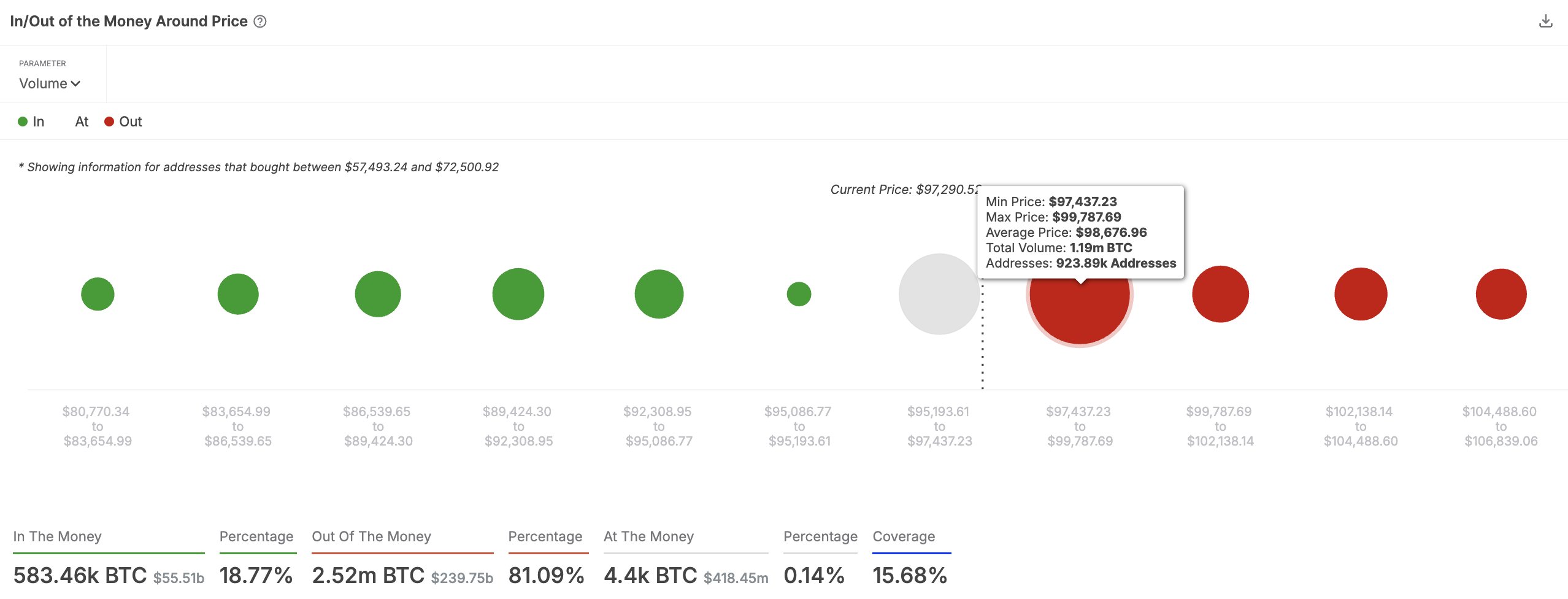

However, demand would face key resistance between $97,500 and $99,800, with 924,000 wallets holding over 1.19 million BTC.

Source: IntoTheBlock

If Bitcoin breaks above this resistance, there may be potential for reaching new ATHs. Crossing the barrier would mean strong buying momentum, potentially shifting the balance from bearish to bullish sentiment.

Credit : ambcrypto.com

Leave a Reply