- BTC acted in a rising wedge, with $ 86,400 as a crucial resistance level.

- An outbreak above $ 86,400 could push BTC to $ 90,000, while a rejection can lead to a drop below $ 80,000.

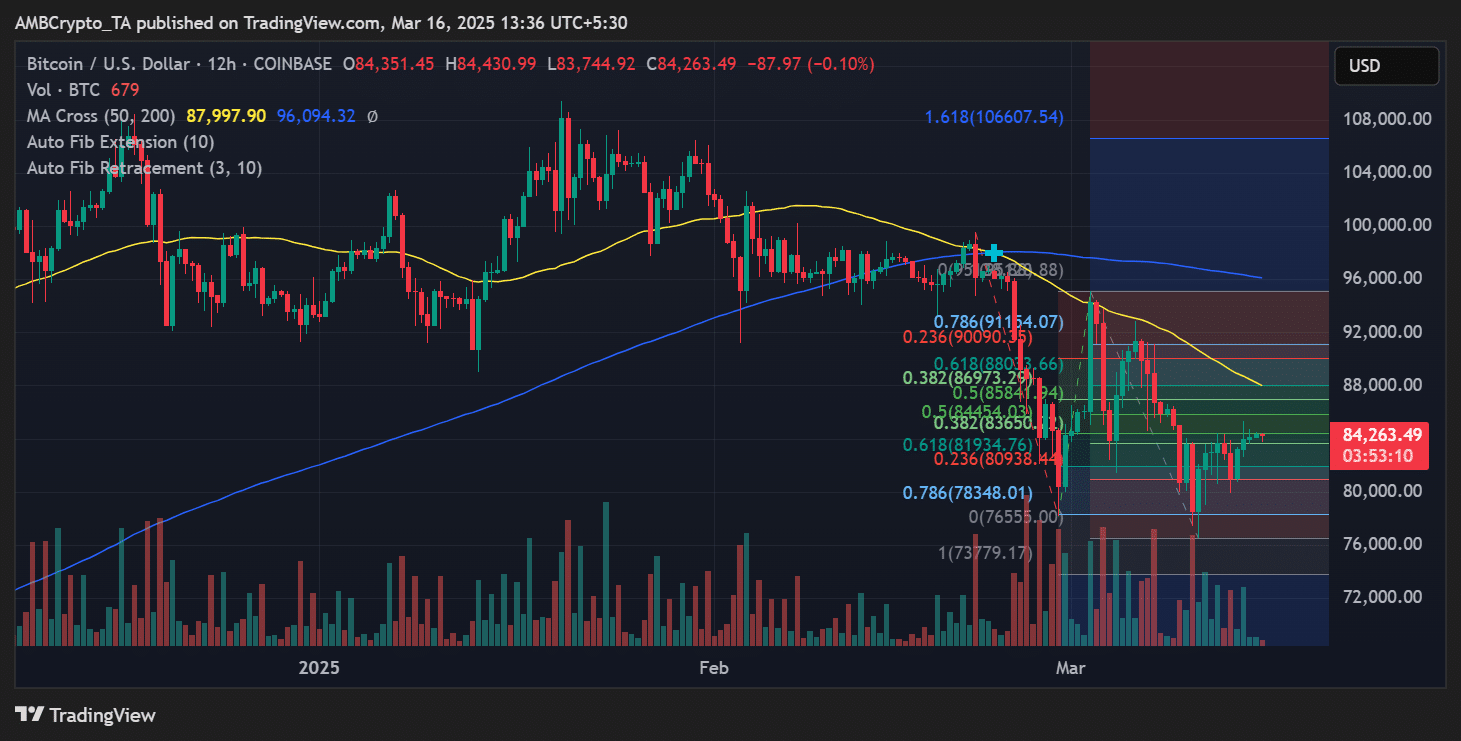

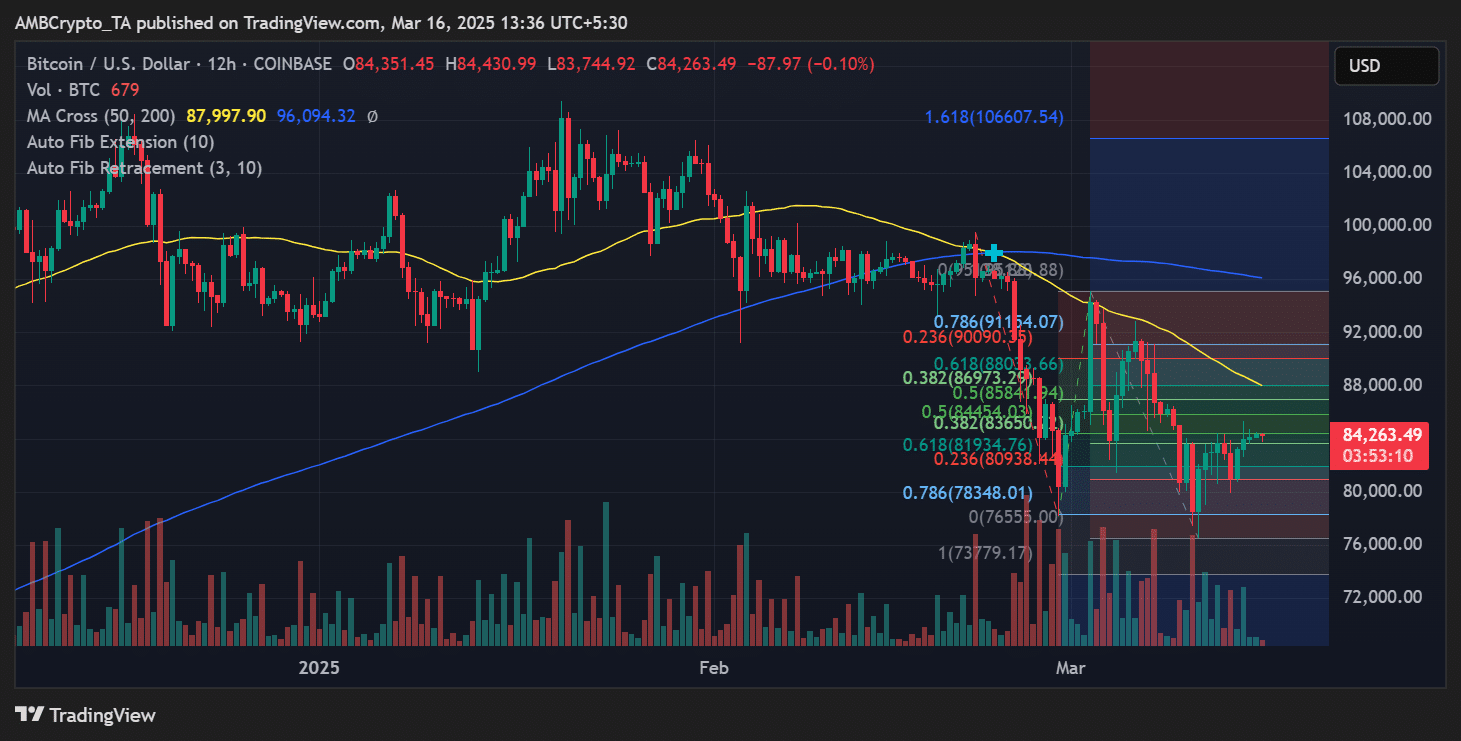

Bitcoin [BTC] Is consolidating within an increasing wedge pattern, with a critical resistance zone that looms up at $ 86,400. The price recently surpassed the resistance level of $ 83,800 and successfully tested it as support.

This level now serves as an important pivot point for the next major movement of BTC.

Traders look closely in the $ 86,400 region, which could dictate the short -term Bitcoin, or confirm an outbreak to higher price levels or cause a reversal of $ 80,000.

Bitcoin’s position in the emerging wedge

The rising wig pattern, visible on the lower timetables, shows Bitcoin trade within an increasing structure. Although this set -up may indicate bullish continuation, it often precedes Bearish Breakouts.

The press price of BTC was $ 84,263, still within the WIG but approached the upper limit. Volume analysis showed a falling activity, which suggests that buyers may lose momentum if Bitcoin approached the resistance.

The RSI [Relative Strength Index] floated around neutral territory, which means that there was no strong overbough or sold -to -sold signal.

However, a rejection can be more likely if BTC pushes to $ 86,400 and the RSI goes to Overbought levels.

Main resistance and support zones

Immediate resistance was at $ 86,400, which remains the most important obstacle. A successful break above this level could see that Bitcoin extends to $ 90,000 and possibly $ 95,000 as the momentum persists.

Large support was at $ 83,800, which was recently tested as support and was crucial for holding the bullish structure of Bitcoin. If this level fails, BTC can visit $ 81,700 again and possibly below $ 80,000 dives.

Source: TradingView

Fibonacci levels indicate that the 0.618 retracement level is in line with almost $ 86.900, which further strengthens the resistance zone.

On the other hand, the level of 0.786 at $ 78,300 can serve as strong support if BTC does not hold above the WIG.

What happens when BTC breaks the WIG?

A clean outbreak above $ 86,400 would make Beerarish invalid, which leads to a bullish run to $ 90,000 or higher.

However, if BTC does not retain the wedge structure, this can lead to a sharp fall, with initial adhesive goals near $ 81,700 and $ 78,300.

Market participants must keep a close eye on the volume of volume and RSI behavior to assess the breakout strength.

Bitcoin is currently at a crucial point, with traders pending a confirmation of whether the resistance will hold or break. In the coming days, it will be crucial in determining the next Grand Price Movement of BTC.

Credit : ambcrypto.com

Leave a Reply