Bloomberg Commodity strategist Mike McGlone says that there is a chance of a huge correction in American markets that can pummel the price of Bitcoin (BTC), oil and shares.

In a message on the social media platform X, McGlone says that the US has a “self -correcting mechanism” that can go back to President Trump’s tariff war, which could create market chaos.

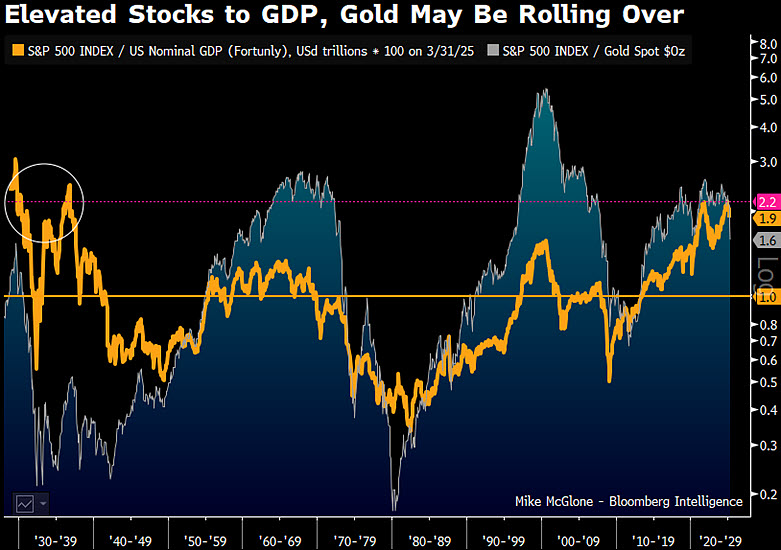

The analyst shares a graph that suggests that the S&P 500 versus BBP -Ratio and the S&P 500 versus Goud -Ratio are both at raised levels -an set -up that historically marked stock market crashes, such as in the 1930s, late nineties and 2008.

According to McGlone, such an event, or “reversal” can lead to a significant fall in the shares, bitcoin oil, buyer and bonds.

“The American self -correcting mechanism cannot be stopped. If unprecedented rates and cuts do not work, pushback will be in the next elections. If the major attempt of re -balanced, it could reset world order for the coming century.

The problem is that the discombobulation comes with the American stock market capitalization versus GDP and the rest of the world, the highest in about 100 years.

My normal reversing base case:

– 50% drawing on the US stock market

– $ 40 per barrel of crude oil

– $ 3 per pound copper

-3% US 10-year yield

– $ 10,000 bitcoin, 90% drawings in most millions of cryptocurrencies

– $ 4,000 gold, the out of a bit because of no simple reversal “

While McGlone’s predicted, Drawdowns seem serious, the analyst seems out That the size of the potential next to the next movements is “normal” based on historical terms.

At the time of writing, Bitcoin acts for $ 87,529.

Follow us on X” Facebook And Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Generated image: midjourney

Credit : dailyhodl.com

Leave a Reply