- BONK has fallen about 21% over the past seven days, amid a bearish trend in the memecoin market.

- The lack of speculative activity amid the selling activity could lead to further declines.

Memecoins are under bearish pressure as their total market capitalization has fallen 15% to $97 billion over the past seven days. Bonk [BONK]currently the fourth largest memecoin, has succumbed to these bearish trends after dropping 21% in one week.

The memecoin’s downward momentum could continue due to the lack of interest from buyers in the spot market and fewer derivatives traders betting on its future performance.

BONK’s price analysis

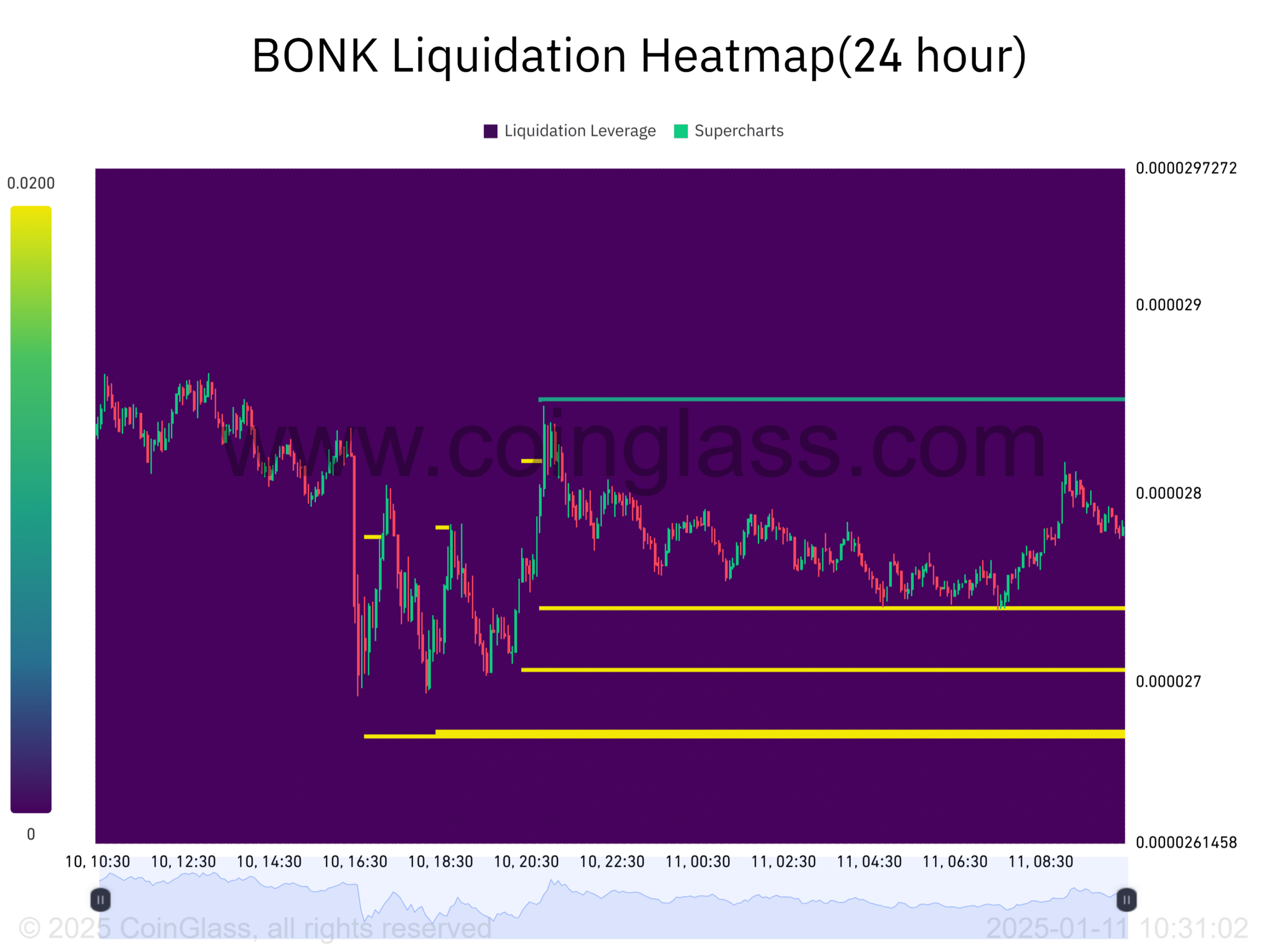

BONK’s daily chart shows memecoin trading within a descending parallel channel. This indicates a long-term downward trend due to higher selling activity than buying activity.

At the time of writing, the memecoin was testing support at the centerline of the channel. If the price falls below this, it could create bearish momentum. BONK must break past the upper trendline with high buying volumes for a bullish reversal.

Source: TradingView

The Chaikin Money Flow (CMF) indicator is in the negative region, indicating selling pressure, and BONK is likely in a distribution phase. The Money Flow Index (MFI) shows a similar outlook, amid a decline to 47, suggesting the bears have the upper hand.

Reduced speculative betting could fuel the downtrend

A sharp increase in trading activity in the derivatives market often shows high confidence among traders about future price movements. However, in the case of BONK, traders appear to be closing their positions.

According to Coinglass, the memecoin’s Open Interest fell 28% in one week to $14.12 million. At the same time, 24-hour trading volumes in derivatives reached $36 million, the lowest since the beginning of the year.

This decline could lead to stable prices due to reduced volatility, but reduced interest rates could cause negative sentiment and weak price movements.

Important levels to watch

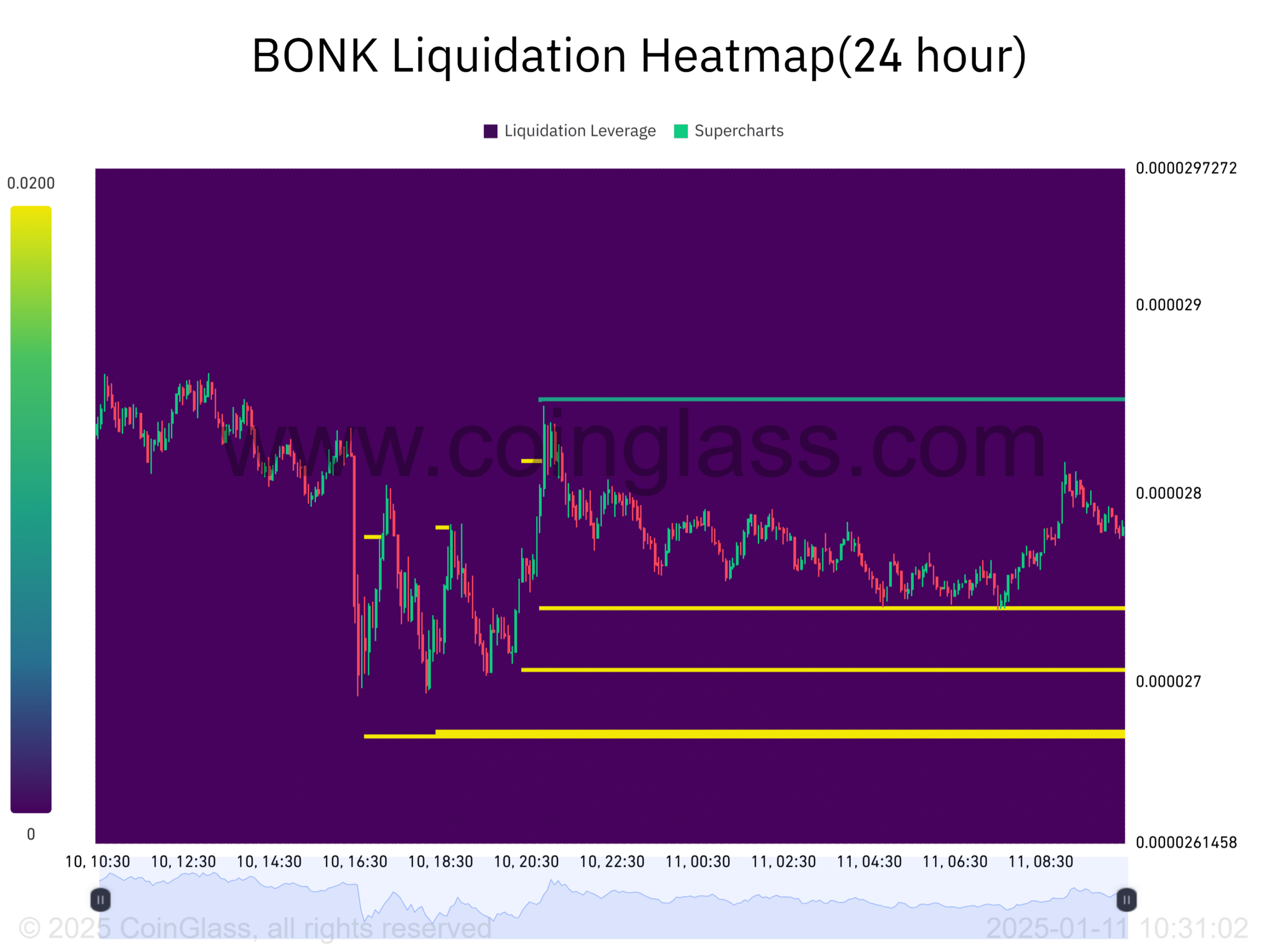

More than $1 million worth of long positions in BONK have been wiped out in the past four days, increasing pressure on the sell side. Despite these liquidations, several clusters could push prices lower below current prices.

Read Bonk’s [BONK] Price forecast 2024-25

The nearest liquidation cluster is at $0.0000273, followed by others at $0.0000270 and $0.0000267. If BONK drops into these zones, the resulting liquidations will fuel the downtrend.

Source: Coinglass

Conversely, the lack of liquidation clusters above the current price could hinder the uptrend and lead to consolidation in the current zones.

Credit : ambcrypto.com

Leave a Reply