- BRETT has made significant gains and the upward trend is likely to continue.

- Despite this optimism, technical indicators send mixed signals about BRETT’s near-term trajectory.

In the past week, Brett [BRETT] is up 63.24%, reflecting strong buying momentum.

This pressure has extended to the daily time frame, delivering a 39.38% increase and positioning the asset for potential further growth.

The resistance level remains a challenge

According to AMBCrypto analysis, there was room for more upside for BRETT. Notably, it has the potential for a gain of 29.46%, targeting a price of $0.19550.

However, for this rally to materialize, BRETT must overcome two critical resistance levels. The first hurdle was at $0.15030, followed by $0.17160, where notable selling pressure could emerge.

If BRETT fails to break the initial resistance at $0.15030, it could retreat towards the demand zones between $0.13474 and $0.11912.

At this level, the asset may find temporary support before falling further, or experience enough buying pressure to fuel a sustained rise.

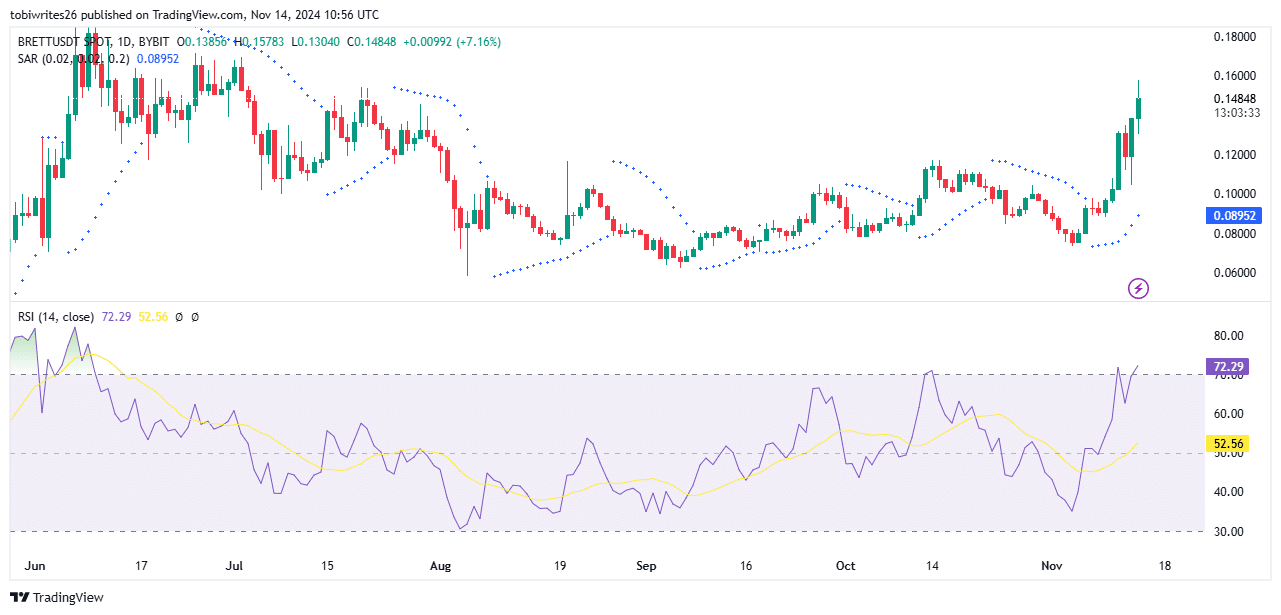

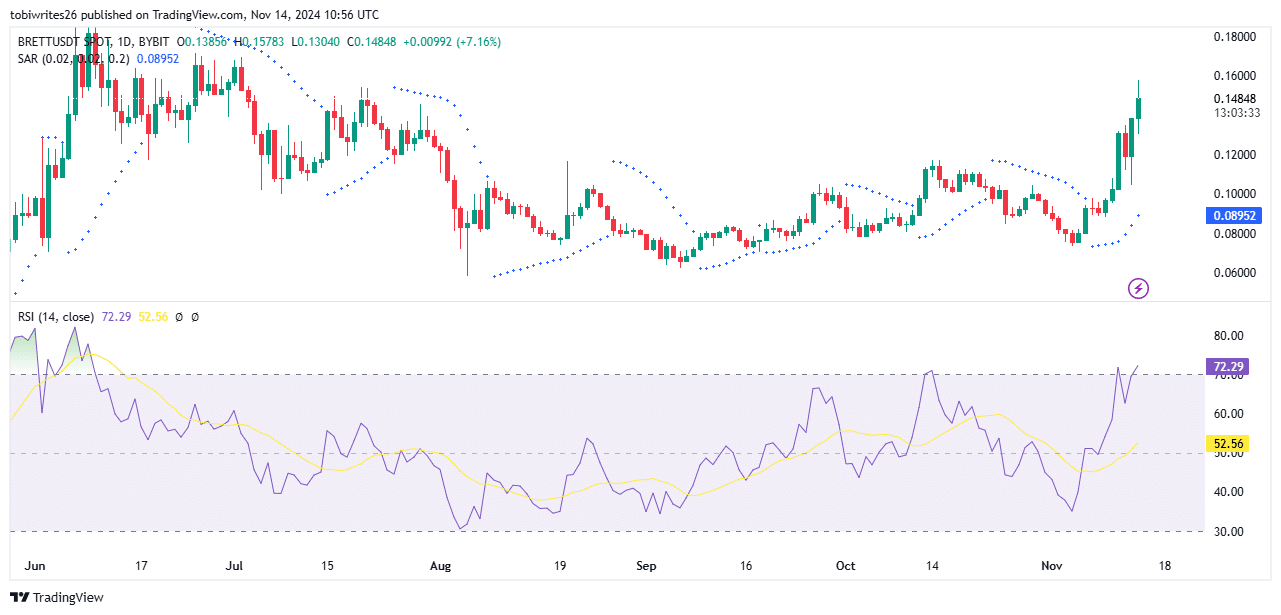

Source: TradingView

BRETT is targeting $0.195

On-chain activity and behavior of market participants indicated a bullish outlook for BRETT, with the asset possibly aiming for a target of $0.195.

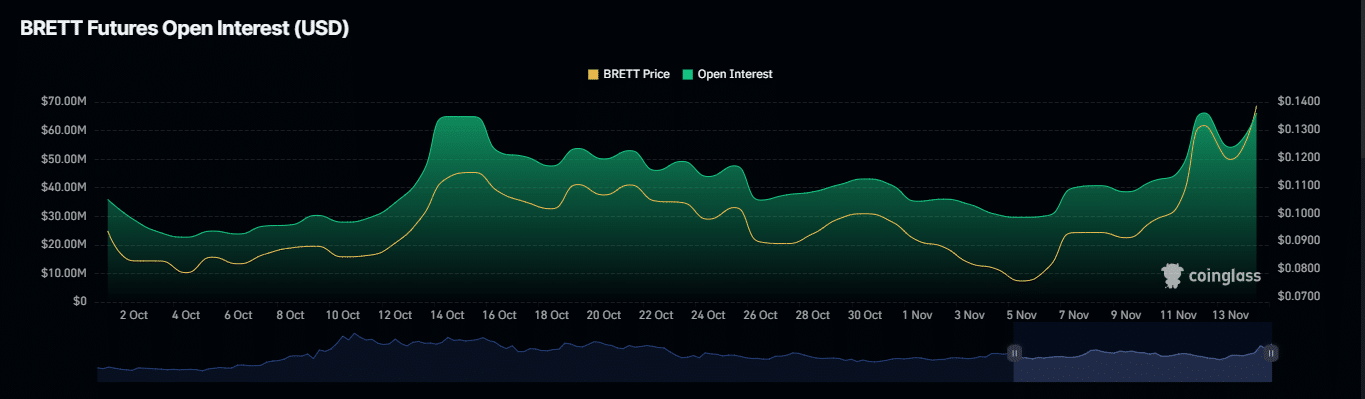

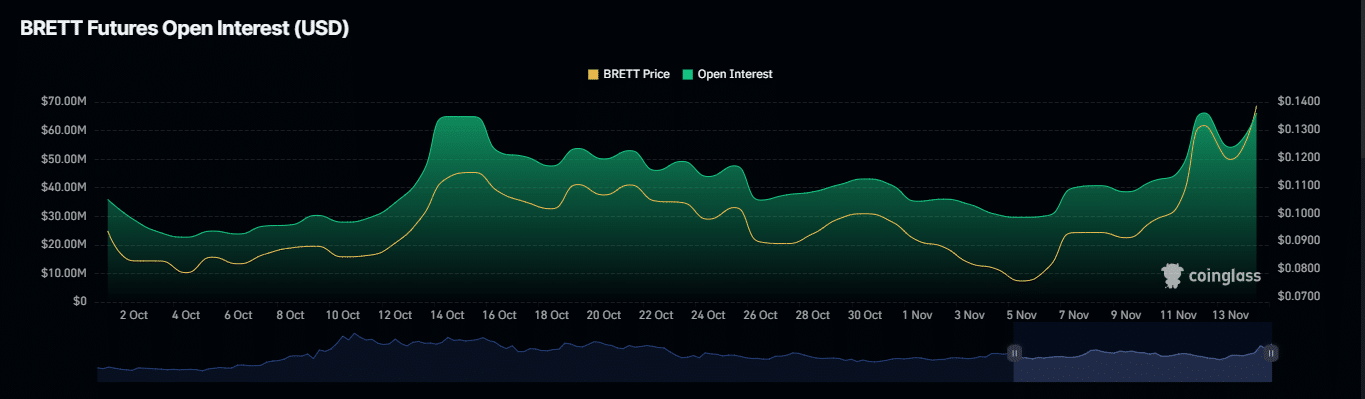

Since the last update, BRETT’s Open Interest (OI) has increased by 58.26% to $72.73 million, indicating a strong increase in market activity and indicating positive sentiment around the asset.

A high OI often indicates greater involvement and an influx of long positions, especially in futures contracts, as tracked by Mint glass.

Source: Coinglass

Moreover, BRETT’s long-short ratio remained slightly positive, at 1.0032. A ratio above 1 reflects more active long positions than short positions.

When this trend aligns with price growth – as evidenced by BRETT’s recent performance – it generally signals continued bullish momentum.

Overall, these numbers suggest that BRETT could be well positioned for further gains, potentially reaching the expected $0.195 target.

Mixed technical indicators cloud BRETT’s rally prospects

BRETT’s recent rally is showing signs of strength, but technical indicators offer a mixed outlook for its sustainability.

The Parabolic SAR (Stop and Reverse) indicator, which tracks the direction of the market through the placement of points relative to the price, is currently signaling bullish momentum with points placed below the price of BRETT, indicating potential for continued gains.

In contrast, the Relative Strength Index (RSI), a tool for measuring overbought (above 70) and oversold (below 30) conditions, reads 72.79 for BRETT, indicating it is overbought.

Read Brett’s [BRETT] Price forecast 2024–2025

This elevated RSI level warns that momentum may soon weaken, leaving BRETT vulnerable to a short-term pullback before any sustained upward movement occurs.

Source: trading view

These mixed signals meant that while BRETT was in bullish territory, the potential for a momentum shift warranted caution.

Credit : ambcrypto.com

Leave a Reply