- BTC S&P correlation touches zero and signals the full disconnection of Bitcoin of traditional markets.

- Speculation about whether the independence of Bitcoin of shares could cause a major price increase are widespread.

Bitcoin [BTC] has long been seen as a risk -active, related to shares in times of market uncertainty. But a new shift is on the rise.

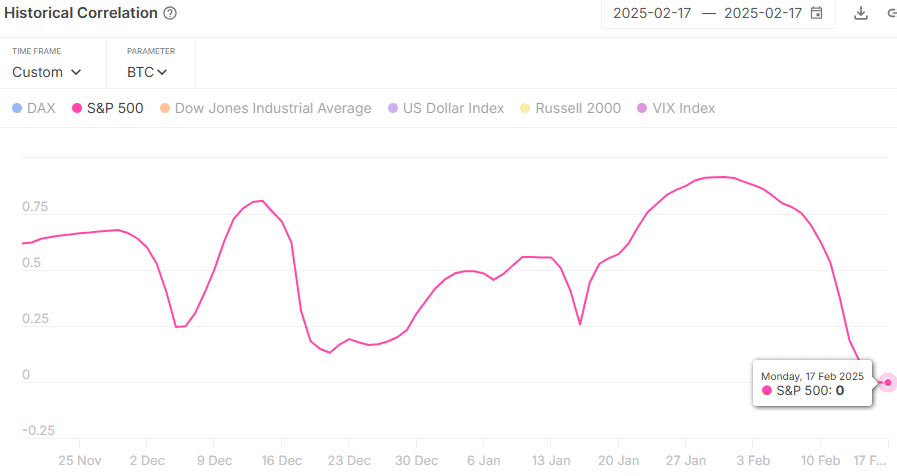

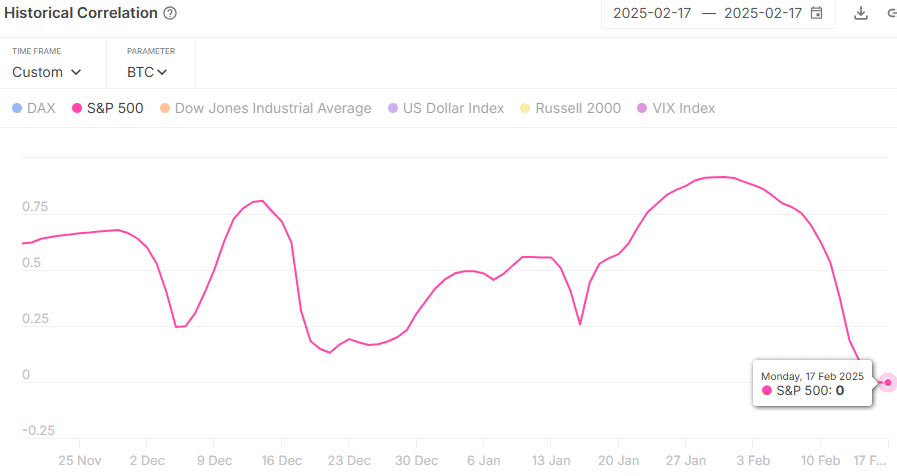

The correlation between Bitcoin and the S&P 500 has fallen at zeroSignaling a complete disconnection of traditional markets.

This break comes after months of positive correlation and reflects falls in cases where Bitcoin rose after similar differences.

While market guards assess what this means for the cryptomarket, people are wondering: is Bitcoin about to another big rally?

Insight into the correlation in the financial markets

Correlation measures how the price movements of two assets relate to each other. A correlation near 1 indicates that they are going synchronously, while -1 suggests an inverted relationship.

A zero correlation, as seen now, means that there is no connection between Bitcoin and the S&P 500, which indicates a shift in the market behavior of Bitcoin.

Historically, the correlation of Bitcoin with traditional assets is fluctuating. Periods of high correlation correspond to broader economic uncertainty.

However, a correlation decrease up to zero has often indicated a shift in Bitcoin’s price process.

The shift in correlation

In January, Bitcoin and the S&P 500 showed an almost perfect correlation, which for the first time moving in recent memory in combination.

This was remarkable because Bitcoin is usually considered a separate activa class, not closely linked to traditional financial markets.

The coordination of Bitcoin with the S&P 500 suggested that a wider sentiment for stock market influenced the price.

Source: Intotheblock

This correlation has fallen sharply since the beginning of February, so zero is reached. This dramatic shift indicates that Bitcoin’s price movements are no longer closely linked to trends on the stock market.

The decoupling of Bitcoin of the S&P 500 can mean a new phase for the cryptocurrency, more driven by its unique factors than external market influences.

Graphic analysis of the correlation trend further confirms this sharp decrease.

Historically, such decoupling has often preceded significant price movements for Bitcoin, indicating that it may soon be preparing for remarkable volatility.

BTC S&P: Historical context

Credit : ambcrypto.com

Leave a Reply