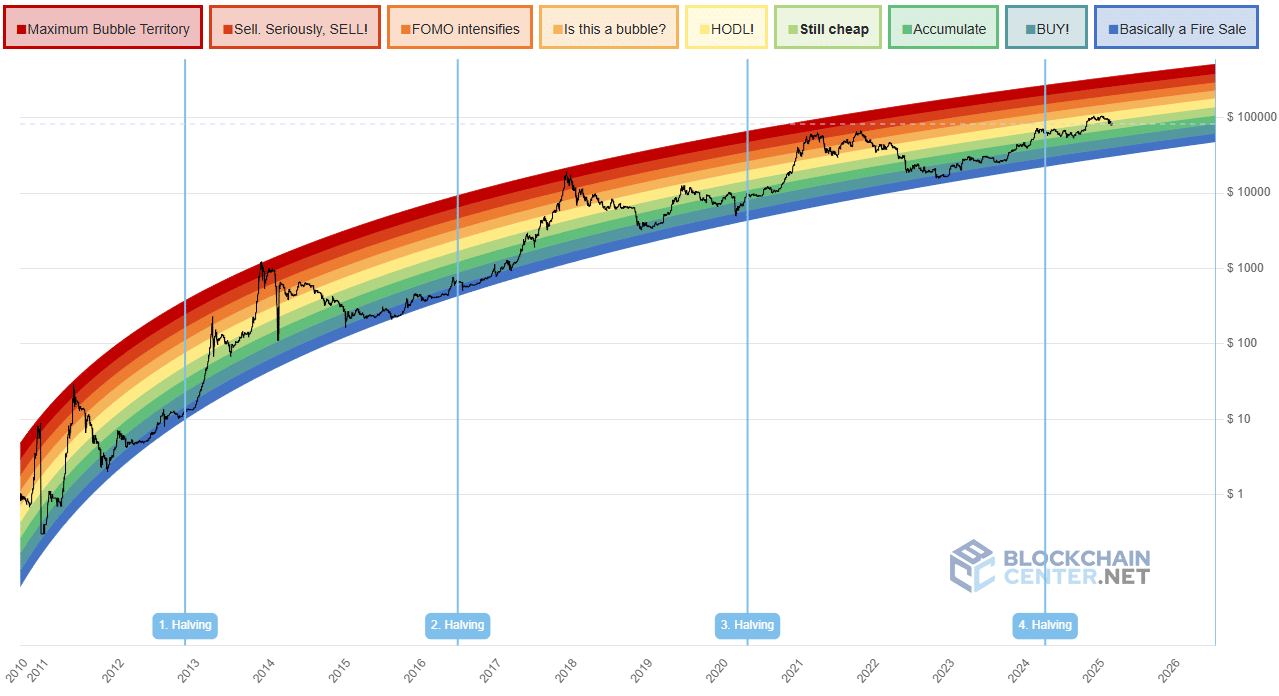

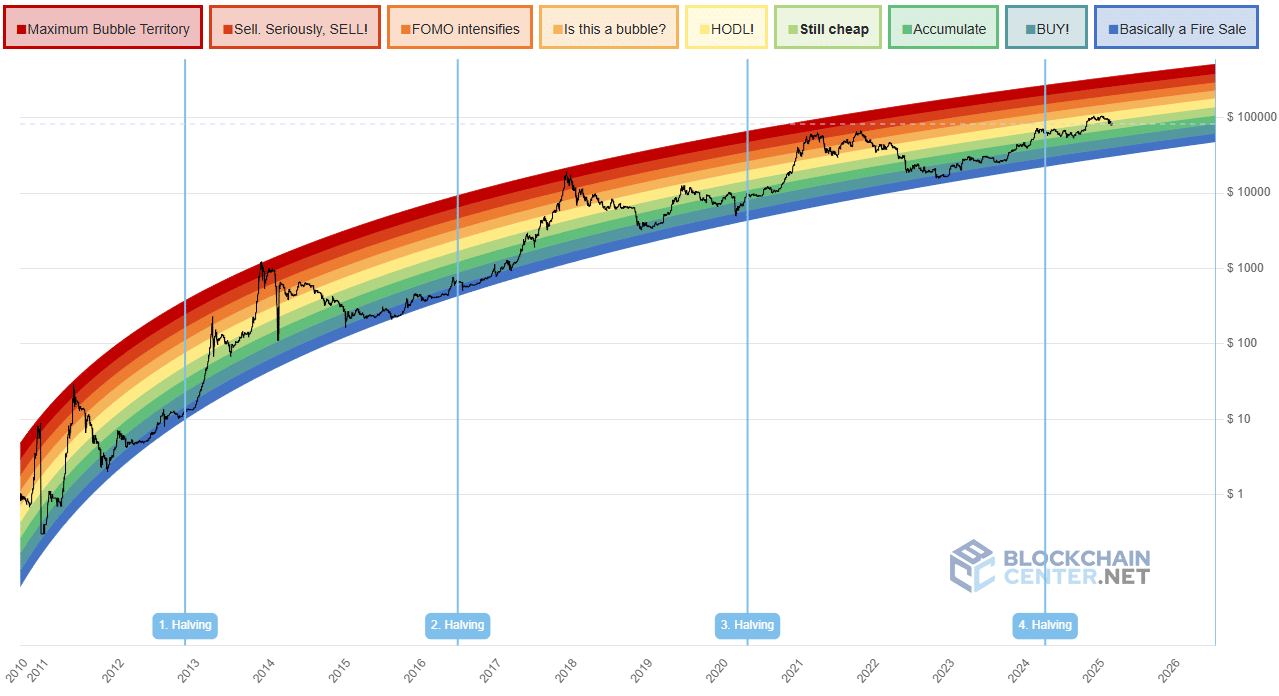

- The Bitcoin Rainbow Chart showed that the recent dip was a buying option, even as fear.

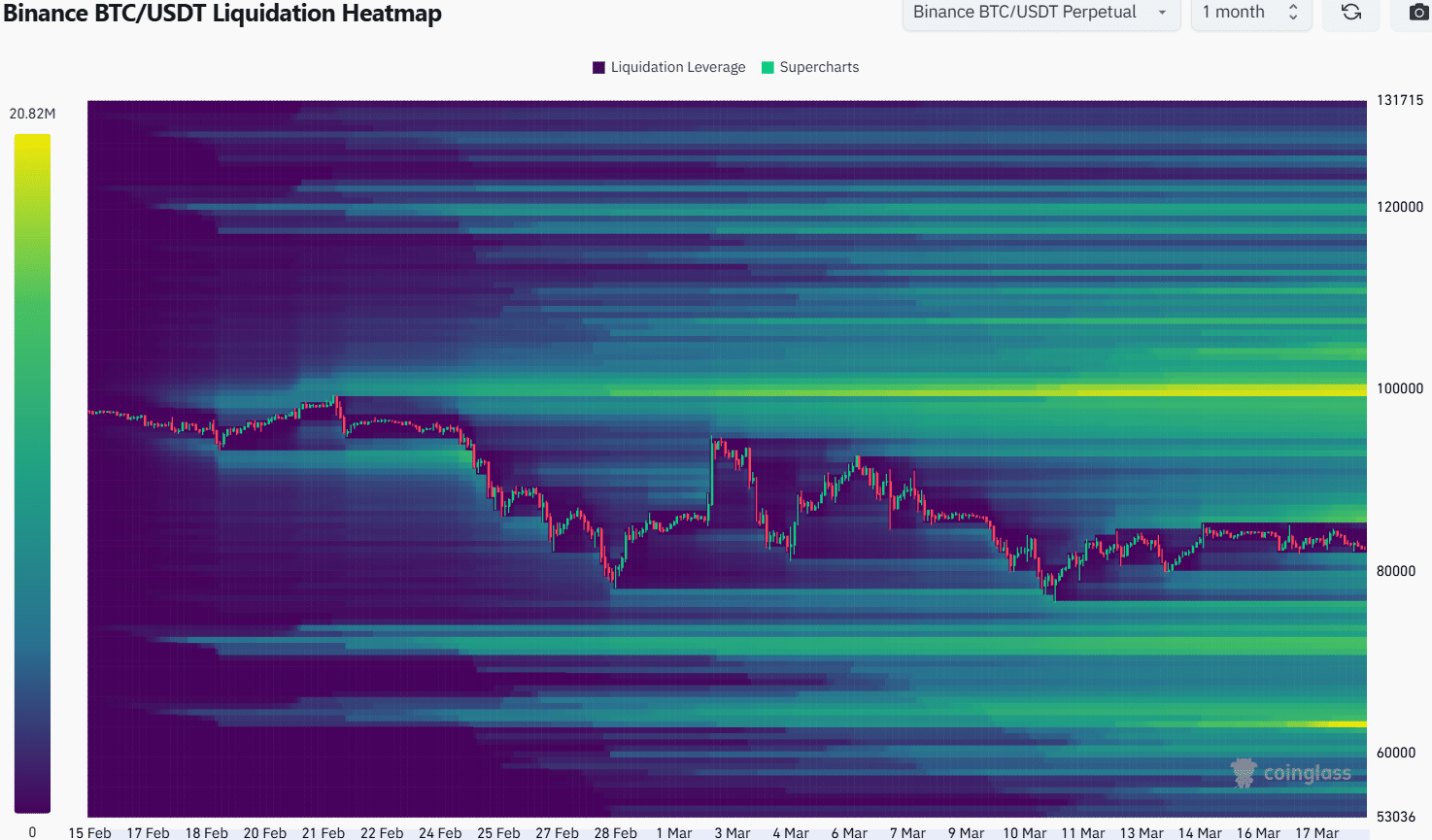

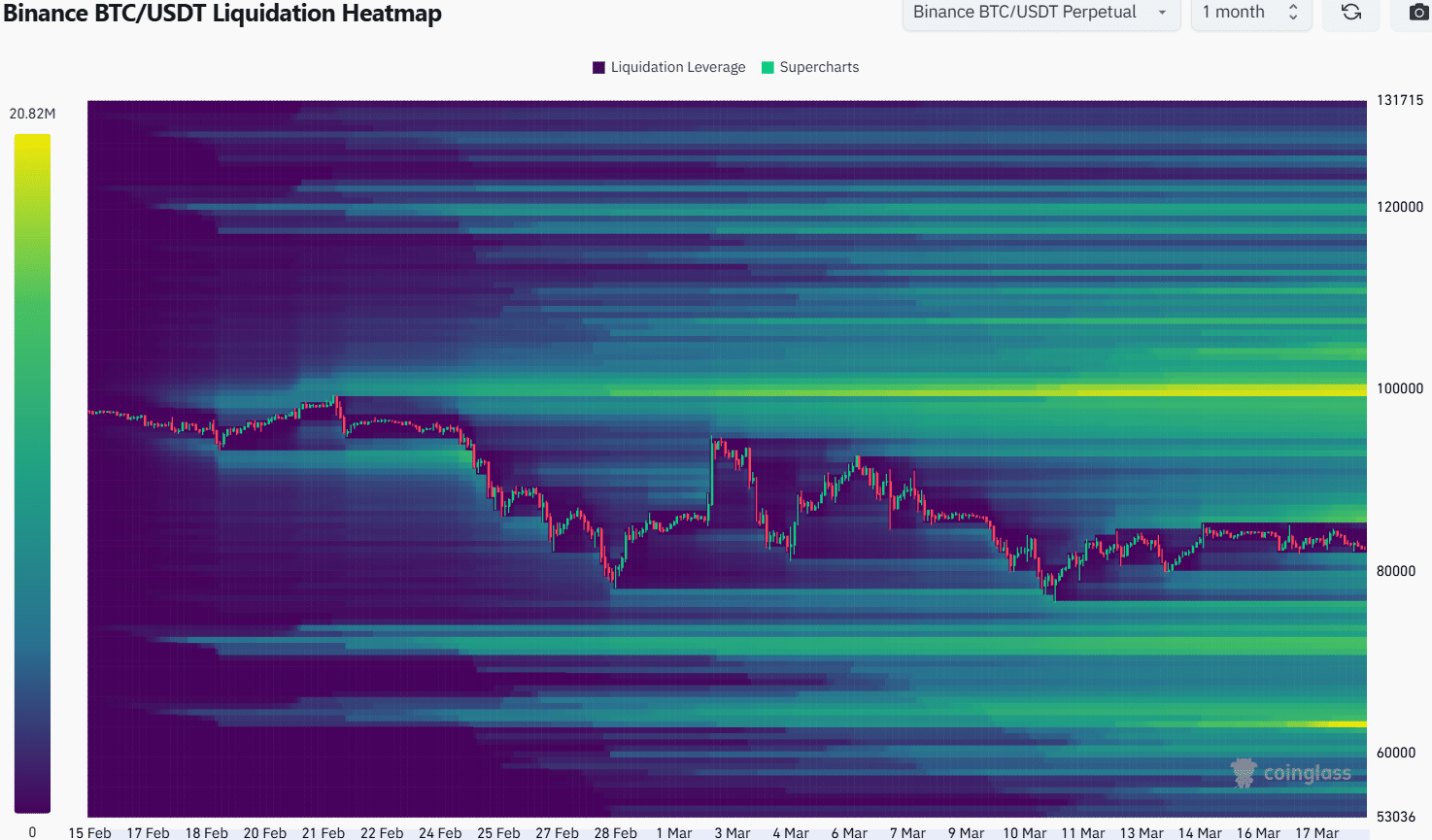

- The liquidation heats pointed to $ 86.3k in the coming days.

Bitcoin [BTC] Saw a price of 6.89% bouncing from the 1-day trade sessee price of 10 March, closing to $ 78.6k. It is already a remarkable resistance in the $ 84k region.

Analysis of the price diagram and the liquidation levels showed that consolidation was likely in the short term.

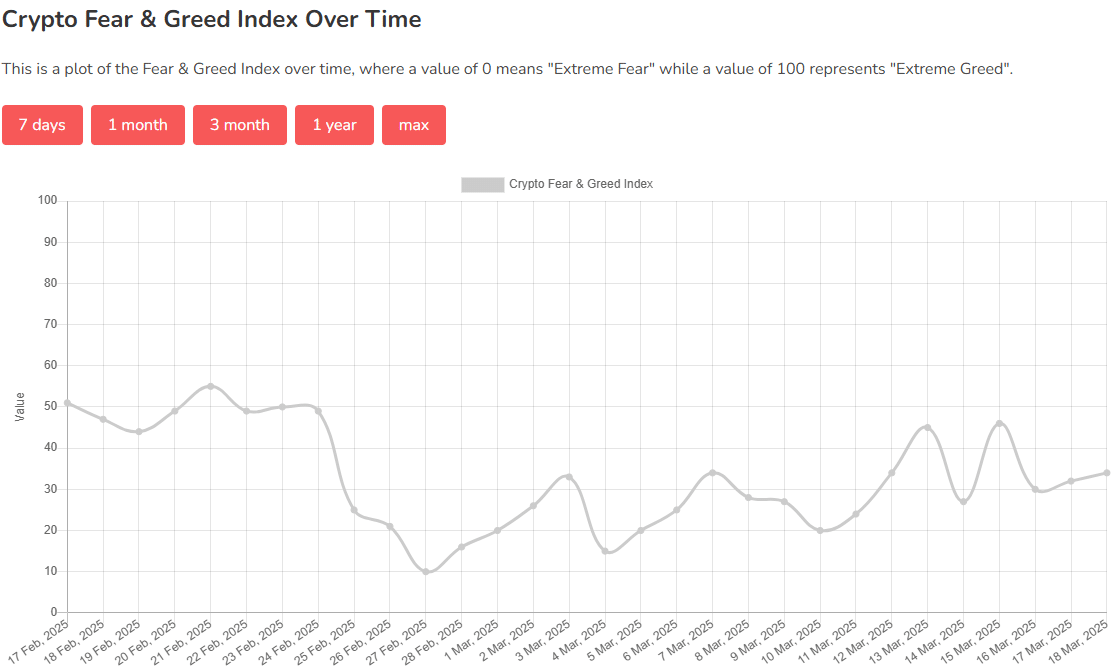

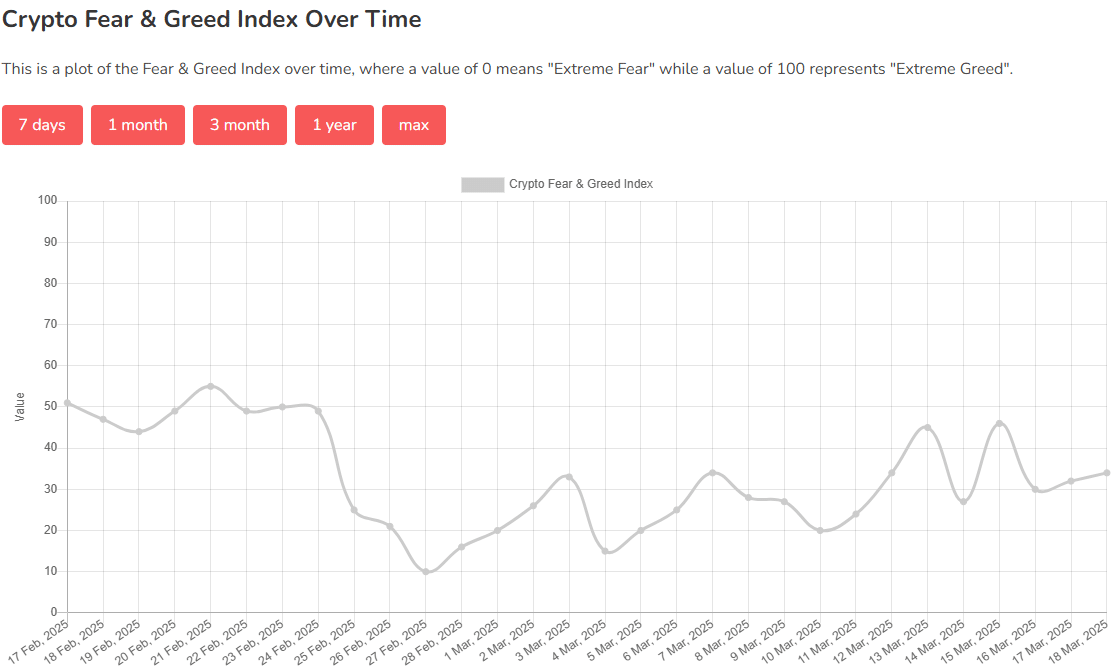

Source: alternative.me

The Bitcoin fear and greed index was at the age of 34 and showed fear. In the past week it floated around 30-40, immersing to extreme fear and a value of 24 to 11 March.

Bitcoin Spot ETFs saw the $ 900 million outlines in the past five weeks, which underlines the Bearish market sentiment.

Buy Bitcoin while fear grabs the wider market

Source: Blockchain Center

At least this was the message of the Bitcoin Rainbow Chart. The long -term valuation tool for Bitcoin with fun colors can be useful for investors. It is based on the idea that the price growth of Bitcoin follows a logarithmic pattern over time.

The graph has done a good job when identifying cycles and soils, but it must be noted that this was usually done afterwards. At the moment the Bitcoin Rainbow Chart shows that the biggest crypto was “still cheap”.

For $ 82K it was a fairly large claim, especially in the background of falling stock markets around the world. On the other hand, that can be the appeal to investors – the risk of rewarding was still tempting.

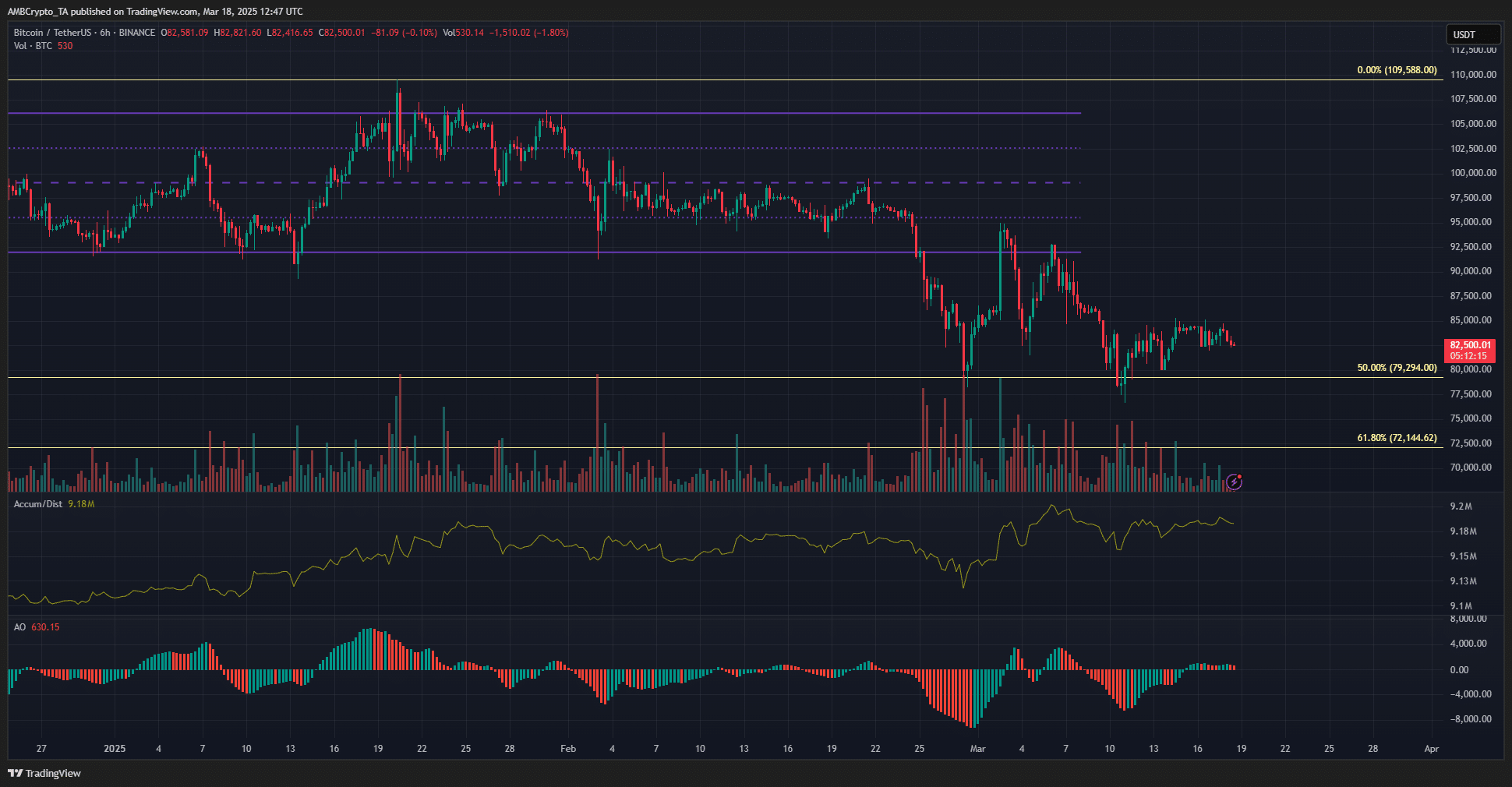

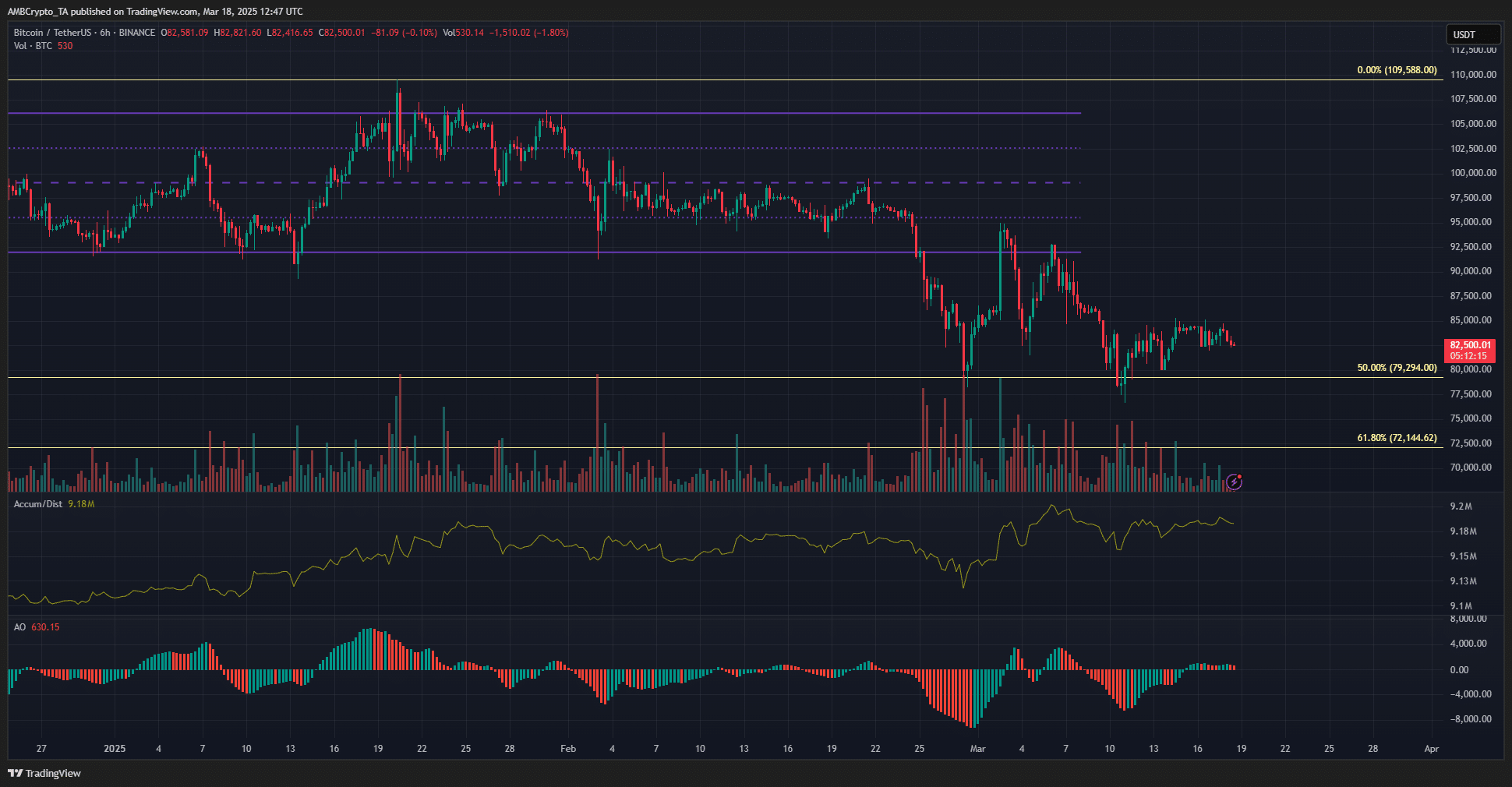

Source: BTC/USDT on TradingView

Research of the 6-hour graph showed that the short-term structure was BEARISH. The level of $ 85k has served as a resistance last week. The A/D indicator showed an upward trend in March, while the price is strung to $ 80k.

This was an encouraging finding. The increased raised accumulation and the purchase activity increases, according to the indicator.

The great oscillator showed that momentum was somewhat bullish, but not high enough to stimulate trends.

Source: Coinglass

The 1-month liquidation heat outlined the $ 100k and $ 71.7k $ 72.3k as considerable liquidity clusters. Closer to the price, the $ 86.3k and $ 76.3k were also levels that could attract the prices for them.

Given the bearish structure of BTC, a movement to the south probably seemed. However, the A/D indicator showed that a bounce was possible.

Moreover, such a bumper beyond the local resistance at $ 85k could become bullish market participants, before the Beararish reversal is initiated on the magnetic zone of $ 86.3k.

That is why traders must maintain a bearish prospect until the local resistance areas have been violated.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer

Credit : ambcrypto.com

Leave a Reply