After a nearly 20% price drop, sentiment around Cardano (ADA) is starting to shift from a downtrend to an uptrend due to the bullish price action pattern. Since July 2024, when ADA price falls to current levels, it tends to experience buying pressure, resulting in an upward rally.

The perfect purchasing level of ADA

Based on ADA’s daily chart, this is the fourth time in the last four months that the price has reached this support level, which we can consider a buy level.

Currently trading around $0.333, ADA has registered a price drop of 2.25% in the last 24 hours. During the same period, trading volume increased by 26%, indicating strong participation from traders and investors, likely due to the current level acting as a buying level.

ADA technical analysis and upcoming levels

According to the expert technical analysis, ADA seems bullish and is currently at a strong support level at $0.31. This level has provided significant support for ADA since July 2024. However, it has also been observed that when the asset reaches this level, it often witnesses a price increase of more than 20%.

Based on the recent price action, there is a high probability that ADA will see a notable price increase of over 20% to reach the $0.40 level in the coming days.

Despite this bullish outlook, the ADA daily chart has also formed a descending triangle pattern. If the ADA rises 20% this time, this pattern will be broken and we could witness a notable upward rally towards the $0.45 level.

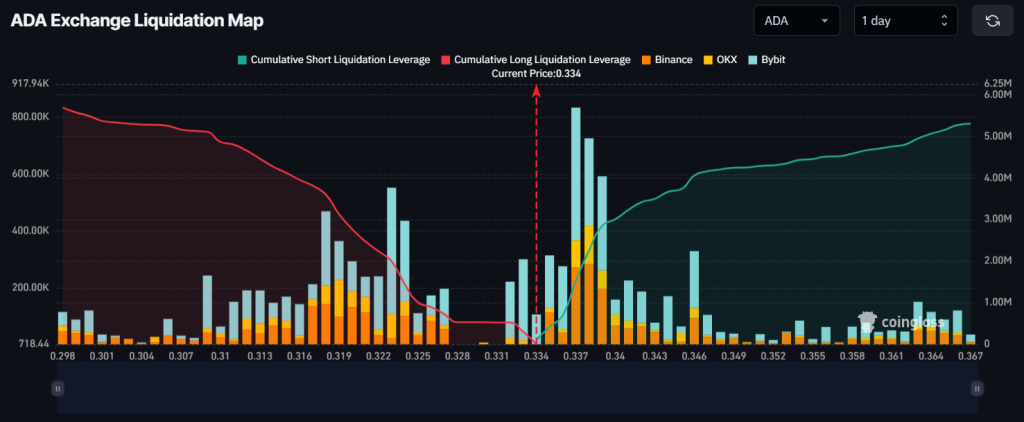

Major liquidation levels

As of now, the key liquidation levels are at $0.323 on the downside and $0.337 on the upside, with traders at these levels being over-leveraged, according to the on-chain analytics firm. Mint glass.

If sentiment remains bullish and the price rises to $0.337, nearly $1.53 million in short positions will be liquidated. Conversely, if sentiment changes and the price falls to the $0.323 level, long positions worth approximately $1.99 million will be liquidated.

Combining the liquidation data with the technical analysis, it appears that bulls are currently dominating the asset, further indicating a potential upside rally and a buying opportunity.

Credit : coinpedia.org

Leave a Reply