This article is available in Spanish.

Cardano is trading at a crucial supply level that could trigger a significant rally to new highs. Following last week’s rate cut, optimism among analysts and investors has increased, with many anticipating strong upward momentum for the altcoin.

Related reading

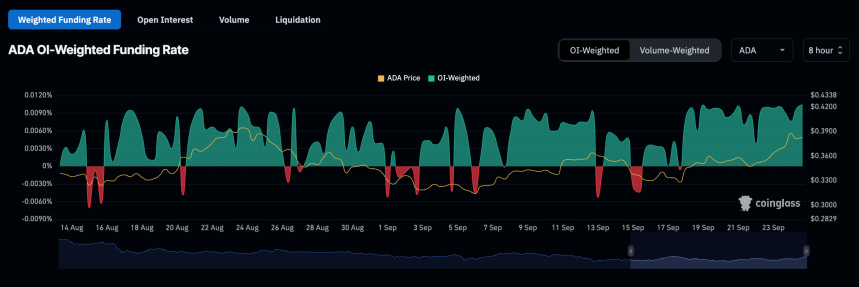

This positive sentiment is reflected in the spot trading and futures markets, where key data from Coinglass shows a bullish bias. The key market sentiment indicator of funding rate suggests traders are positioning for a potential breakout.

If Cardano breaks through its current resistance, a 20% upside is expected, potentially pushing the price to levels not seen in months. This breakout could strengthen the altcoin’s uptrend and pave the way for further gains.

As the price approaches this critical resistance, investors are closely watching for signs of increased volume and momentum, which would confirm the strength of the bullish trend. With market sentiment changing and technical indicators aligning, Cardano seems poised for a major move.

Cardano On-Chain Stats Suggest a Breakthrough

Cardano has risen more than 15% since last week’s rate cut announcement, fueling speculation about a possible alternate season in the crypto market this year. The broader market is turning bullish, and key data from Coinglass supports this sentiment, with a positive financing rate of 0.01%.

This percentage indicates that traders are paying a premium to hold long positions, reflecting their expectations of a possible price rally for ADA. A positive funding rate generally indicates a bullish market outlook, as it shows that traders are willing to incur additional costs to hold their positions in anticipation of further price appreciation.

As Cardano approaches its crucial resistance level at $0.40, market sentiment points to a possible breakout. Should the price maintain current momentum and break above this key resistance, analysts expect an aggressive rise to new highs.

Related reading

Investors are watching this level closely as a successful breakout could lead to a quick 25% rally towards the $0.50 mark. This scenario would mark a significant recovery for ADA and reinforce the growing belief that altcoins, led by Cardano, could outperform in the coming weeks.

However, the market remains cautious. While current sentiment and data suggest a bullish outlook, the price must maintain its upward momentum to validate these predictions. Failure to break the USD 0.40 resistance could result in a period of consolidation or even a near-term retracement.

While the crypto community eagerly awaits ADA’s next move, the coming days will be crucial in determining whether Cardano can capitalize on this newfound optimism and spark a broader altcoin rally.

ADA Price Action: Key Levels to Watch

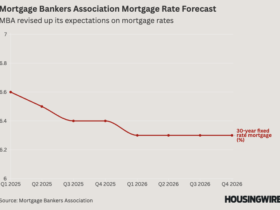

ADA is now trading at $0.39, hovering around a key resistance level that hasn’t been broken since late July. The price is less than 5% away from the daily 200 exponential moving average (EMA) of $0.41.

This EMA has been acting as a significant resistance level since mid-April and now aligns with a crucial supply zone, making it a crucial point for continuing Cardano’s bullish momentum.

For the bulls to gain momentum and establish a stronger uptrend, ADA needs to regain the 200 EMA and decisively break past the $0.40 resistance. This would be confirmation of a daily uptrend and could pave the way for a continued rally to higher price levels.

Related reading

However, a deeper correction could follow if ADA fails to break the current resistance and reach a new high. A pullback to lower demand levels around $0.35 would be the likely scenario as traders look for support ahead of a potential rebound. The coming days will be crucial in determining whether Cardano can break through this resistance and establish a more bullish trajectory, or whether a retracement is imminent.

Featured image of Dall-E, chart from TradingView

Credit : www.newsbtc.com

Leave a Reply