In the midst of the recovery of the cryptocurrency market, Ada, the native token of the Cardano blockchain, has returned considerably and is ready for a considerably upward momentum. The potential reasoning behind this bullish perspective includes its record 58% Intraday price revenue and growing interest rates, long -term holders and investors.

ADA Technical Analysis and the coming level

According to the technical analysis of experts, ADA has experienced a considerable price reverse, return to its bullish range and trade over the crucial level of support of $ 0.71. Moreover, it has successfully tested its 200 exponential advancing average (EMA) on the daily period, making the Altcoin more favorable for a potential bullrun.

Based on a recent price promotion and historic momentum, ADA can be confronted with mild resistance near $ 0.85. If it successfully breaks this level and closes a daily candle over $ 0.86, there is a strong possibility that it can rise by 45% and his recent high of $ 1.25 will be back.

Moreover, Ada has formed a bullish Hamer candlestick pattern that supports this positive prospect and indicates a potential coming rally.

$ 82 million worth Ada outflow

In the midst of these bullish prospects, whales and long -term holders have continued their accumulation, which started in the last 24 hours when Ada experienced a sharp decline.

A large company on chains, analysis, Coinglassrevealed that stock markets have witnessed an outflow of $ 82 million in XRP -Tokens for the past 48 hours. This substantial outflow in the midst of the ongoing price repair suggests potential accumulation, which could stimulate the purchasing pressure and further upward momentum.

The strong gamble of traders in a long position

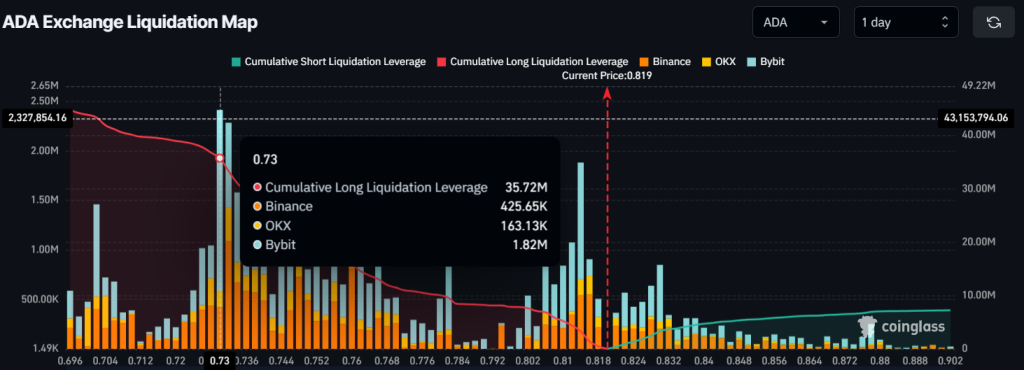

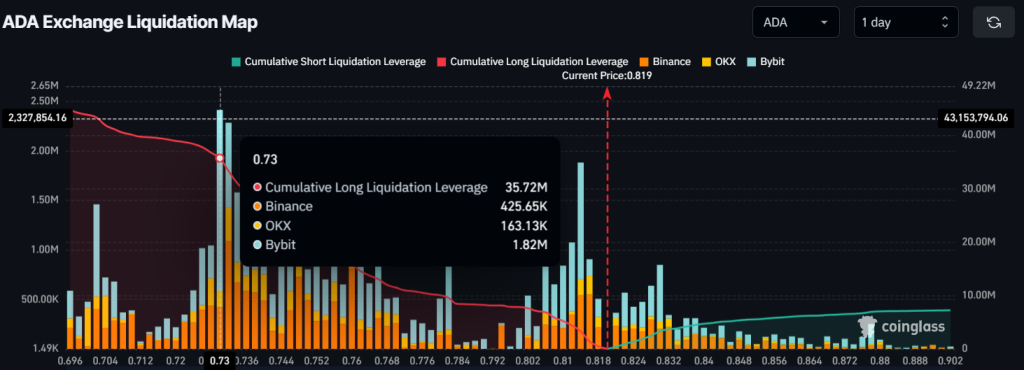

In addition to long-term holders, traders also appear to be used too much on the long side, as revealed by CoingLass data.

At the time of the press, the level of $ 0.73 is the over-delivered zone, where traders for $ 35 million hold in long positions, as a strong support for ADA. Conversely, $ 0.83 on the short side is another over-livered level, in which Short Sellers have only $ 3.32 million in short positions, ten times lower than the long interests of the bulls.

When combining all these on-chain statistics with technical analysis, it seems that bulls are back on the market and support the Altcoin for a considerably upward momentum.

Credit : coinpedia.org

Leave a Reply