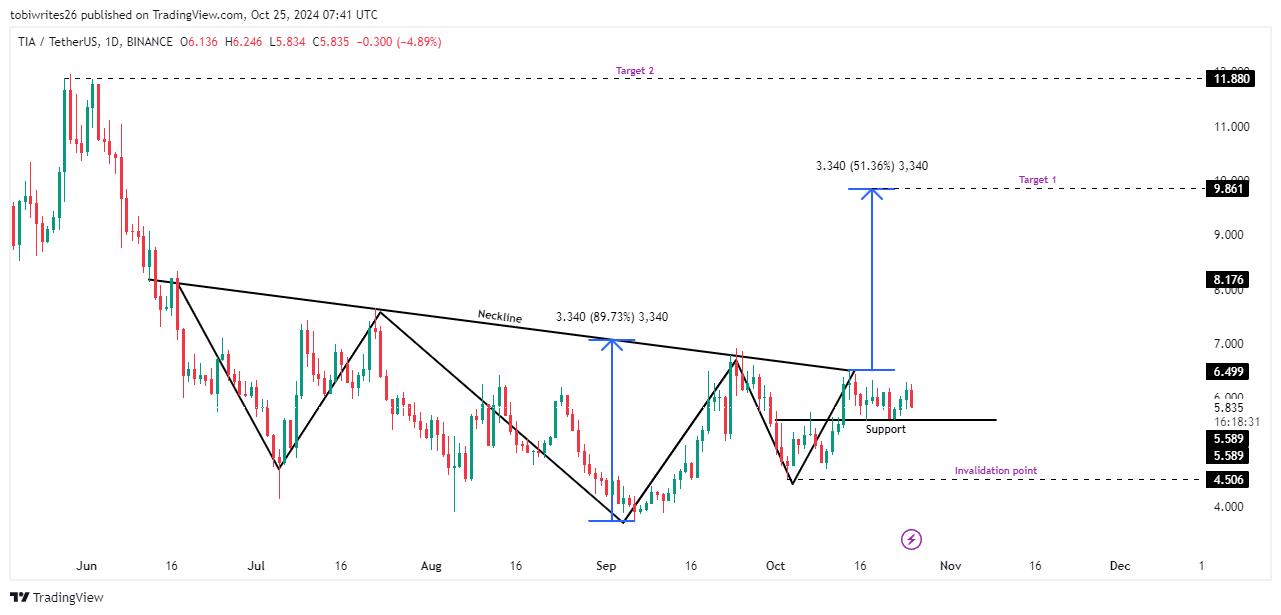

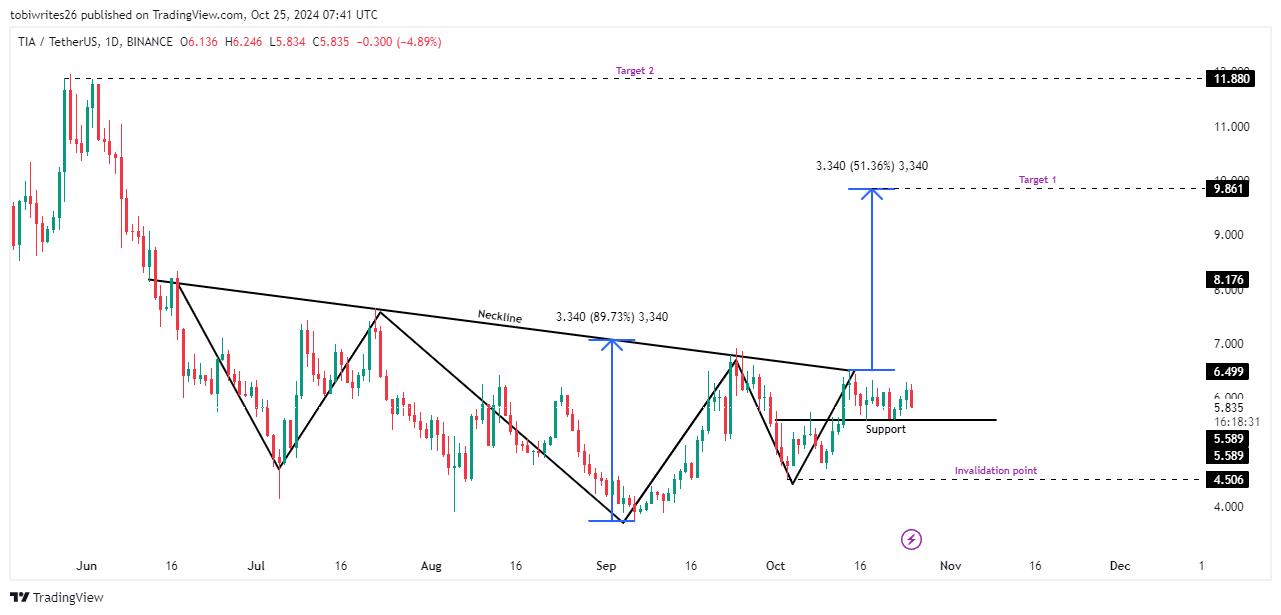

- Analysis shows that TIA has formed an inverse head-and-shoulders pattern, a signal that an asset is gearing up for gains.

- However, the expected rally has been postponed, with technical indicators pointing to a possible small pullback.

Over the past month, Celestia [TIA] has seen bearish momentum, with the stock down 6.54% to $5.93. Yet, despite this downward pressure, bullish signals are visible, indicating that a possible trend reversal is on the horizon.

Still, at the time of writing, TIA is down another 3.15% in the last 24 hours, and there may be further declines before a solid rally takes shape.

The bullish inverse head-and-shoulders pattern provides potential upside for TIA

For TIA, an inverse head-and-shoulders pattern – a bullish indicator that often precedes a significant rally – has emerged. This formation typically signals an upward move, with the target based on the distance between the neckline and the peak of the pattern.

For TIA, this could translate into an expected gain of 51.36%, bringing the price to a target of $9,861. Continued momentum could then further boost TIA, with a secondary target at $11,880.

Currently, the price of TIA is declining and could find support at $5,589, a level that could lead to a recovery and a continuation of the uptrend. However, if the TIA falls below $4,506, it would negate the bullish inverse head-and-shoulders pattern.

Source: trading view

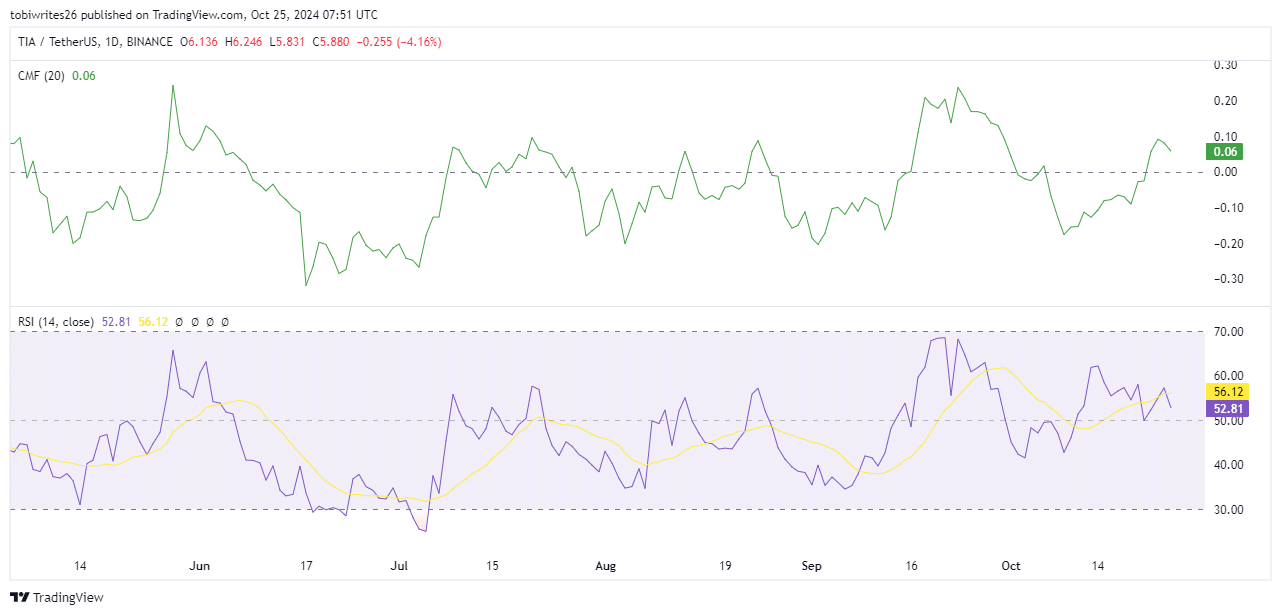

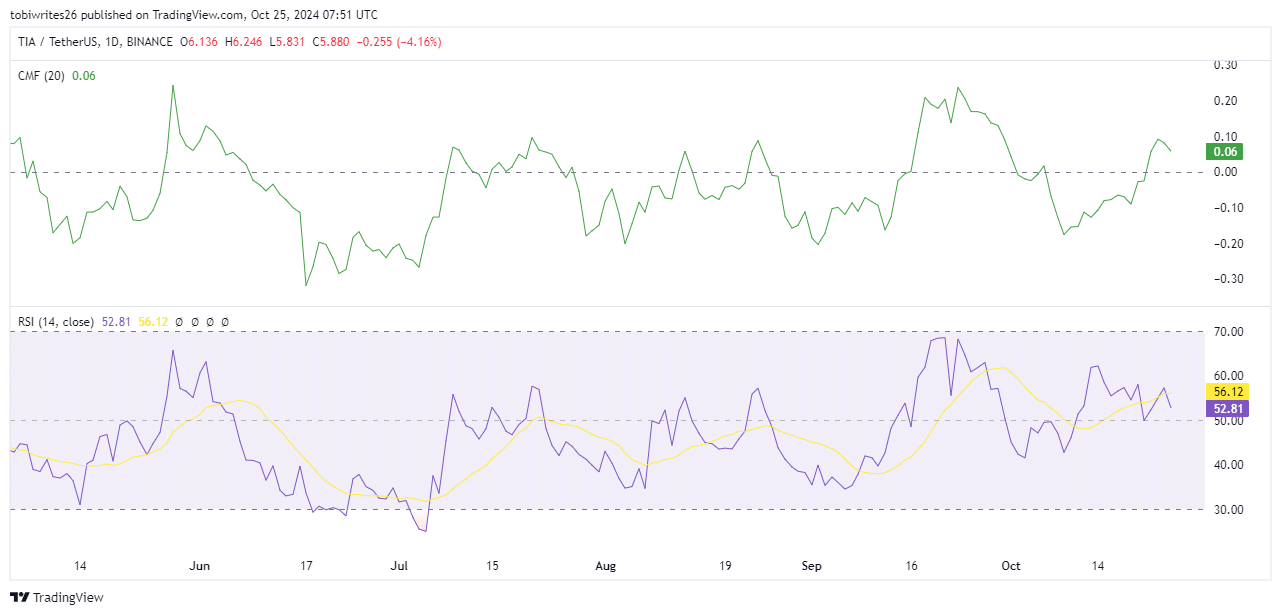

Celestia sees a corrective move that causes a downward movement

TIA’s rally has been postponed as it has yet to break above the neckline – an important level to signal a potential rally.

AMBCrypto’s analysis, using key technical indicators, suggests that while a small downturn may persist, TIA’s overall structure remains bullish, with both indicators remaining in positive territory.

One of the key indicators in this analysis is the Chaikin Money Flow (CMF), which measures buying and selling pressure by combining price and volume to determine whether an asset is being accumulated (buying pressure) or distributed (selling pressure).

With the CMF currently positive, there is underlying purchasing power, suggesting that any current downturn is likely a minor correction.

Similarly, the Relative Strength Index (RSI) – which measures the speed and magnitude of price movements – reflects the CMF’s outlook. Despite the recent decline, the RSI remains in the positive zone, supporting a bullish outlook.

Source: trading view

A reversal of these indicators to the upside could influence a rise in TIA’s price, with the potential for further gains.

Broad market prospects

AMBCrypto’s analysis over higher timeframes shows that market sentiment for TIA remains bullish, with participants showing greater interest in holding rather than selling.

Is your portfolio green? View the TIA profit calculator

Data from Mint glass Exchange Netflow indicates high negative flow, meaning more TIA tokens are being withdrawn from the exchanges than are being deposited. This trend implies that investors are more likely to hold their TIA rather than sell it.

If this pattern continues, it could push TIA’s price above current levels, fueled by continued interest among market participants.

Credit : ambcrypto.com

Leave a Reply