- TIA is trying to break out of its consolidation range, with the technicals showing bullish potential.

- The accumulation of whales and rising interest indicate growing market confidence, but caution is advised.

Celestia [TIA] is gaining significant momentum as it continues its efforts to break out of a prolonged consolidation phase that has kept its price movements limited for months.

The token was trading at $5.95 at the time of writing, with a gain of 6.85% in the past 24 hours, showing bullish potential. Will TIA maintain its upside momentum and move higher, or will resistance levels slow the rally? Let’s find out.

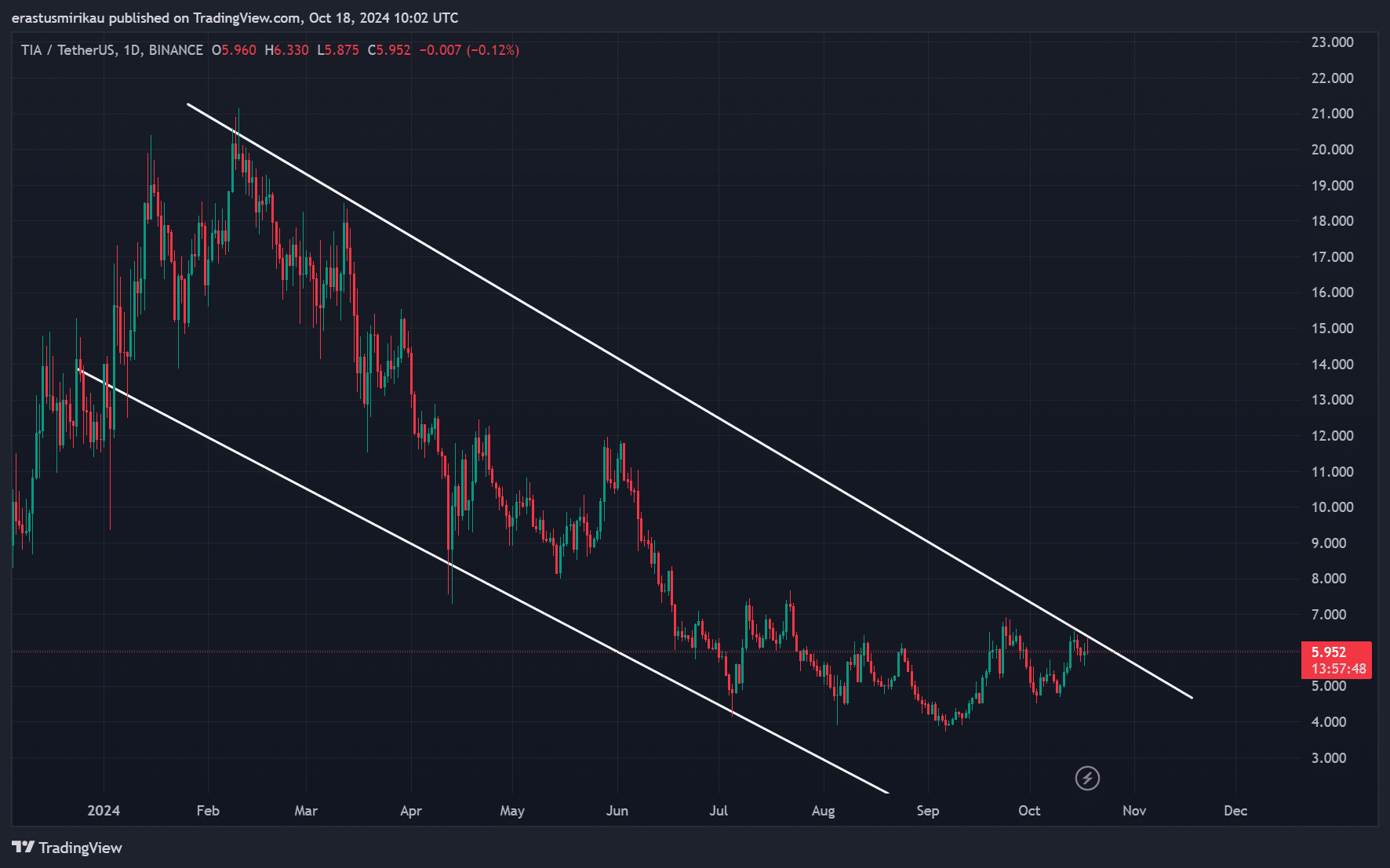

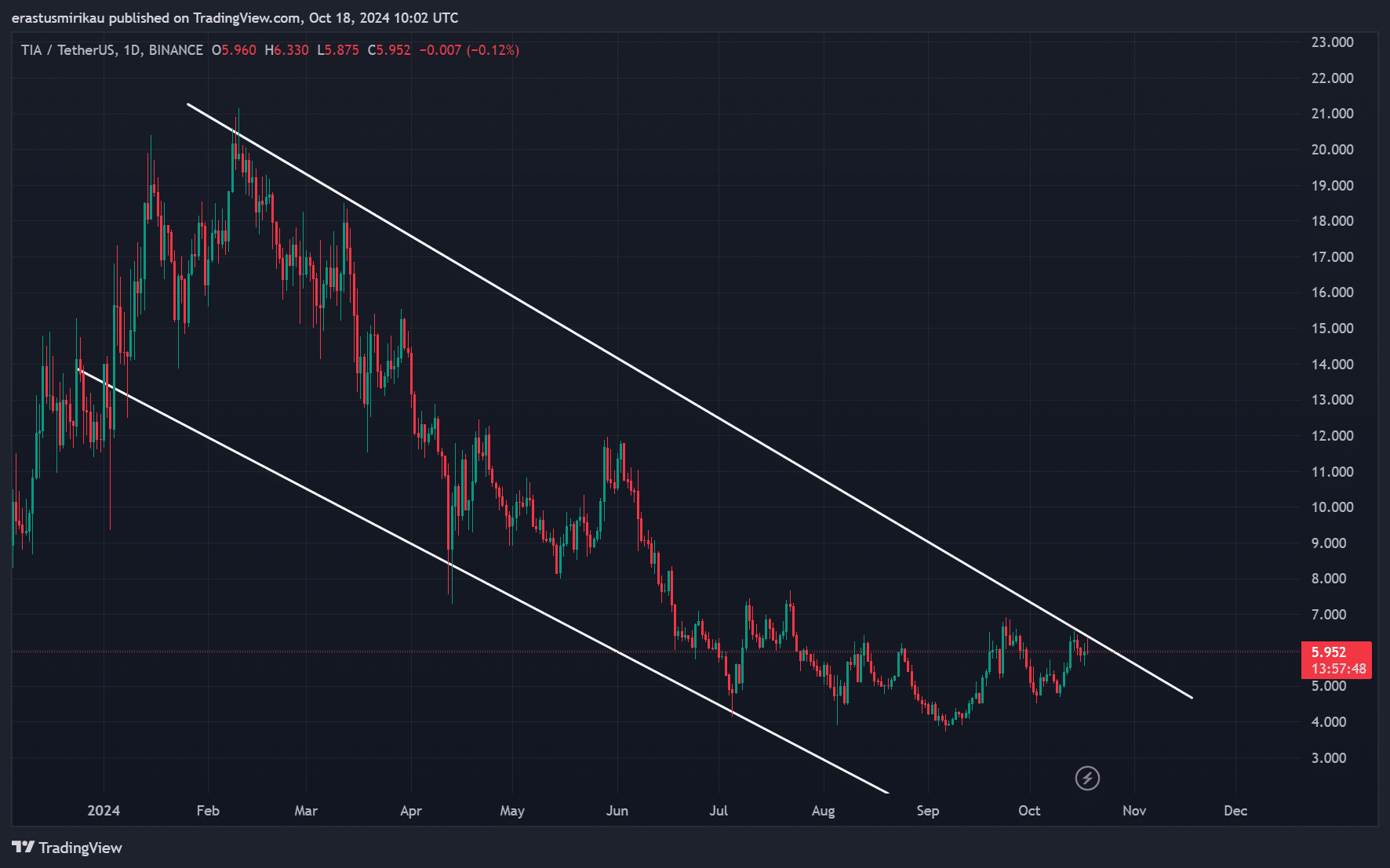

TIA Consolidation Scope Overview: Will It Break Free?

TIA is caught in a long-term downward trend, as evidenced by the declining price channel. For months, the token has struggled to break above critical resistance levels and stay within this channel.

However, the recent attempt to reach the upper limit could mean a possible breakout. If TIA successfully clears this key resistance, it could pave the way for further bullish momentum.

Source: TradingView

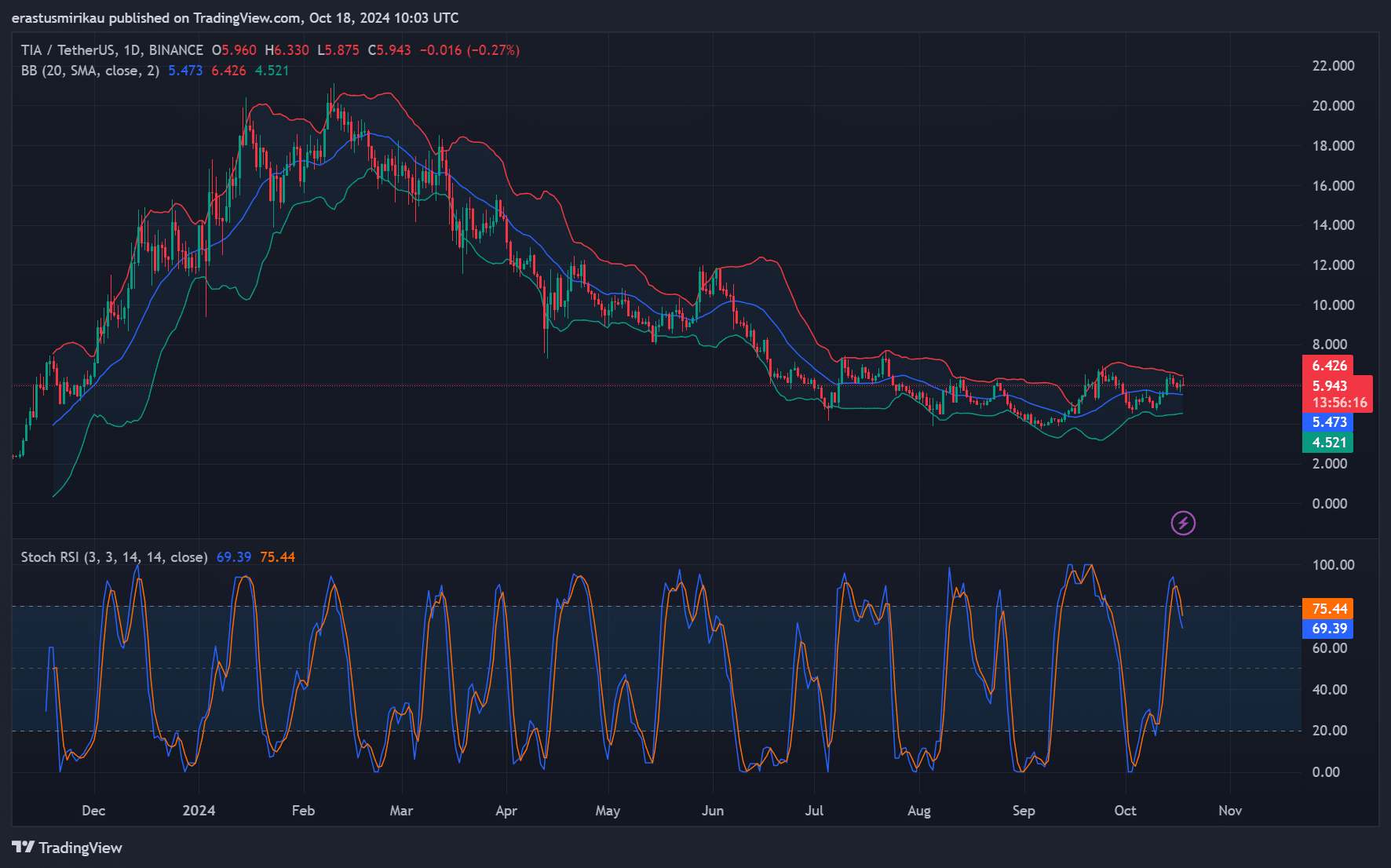

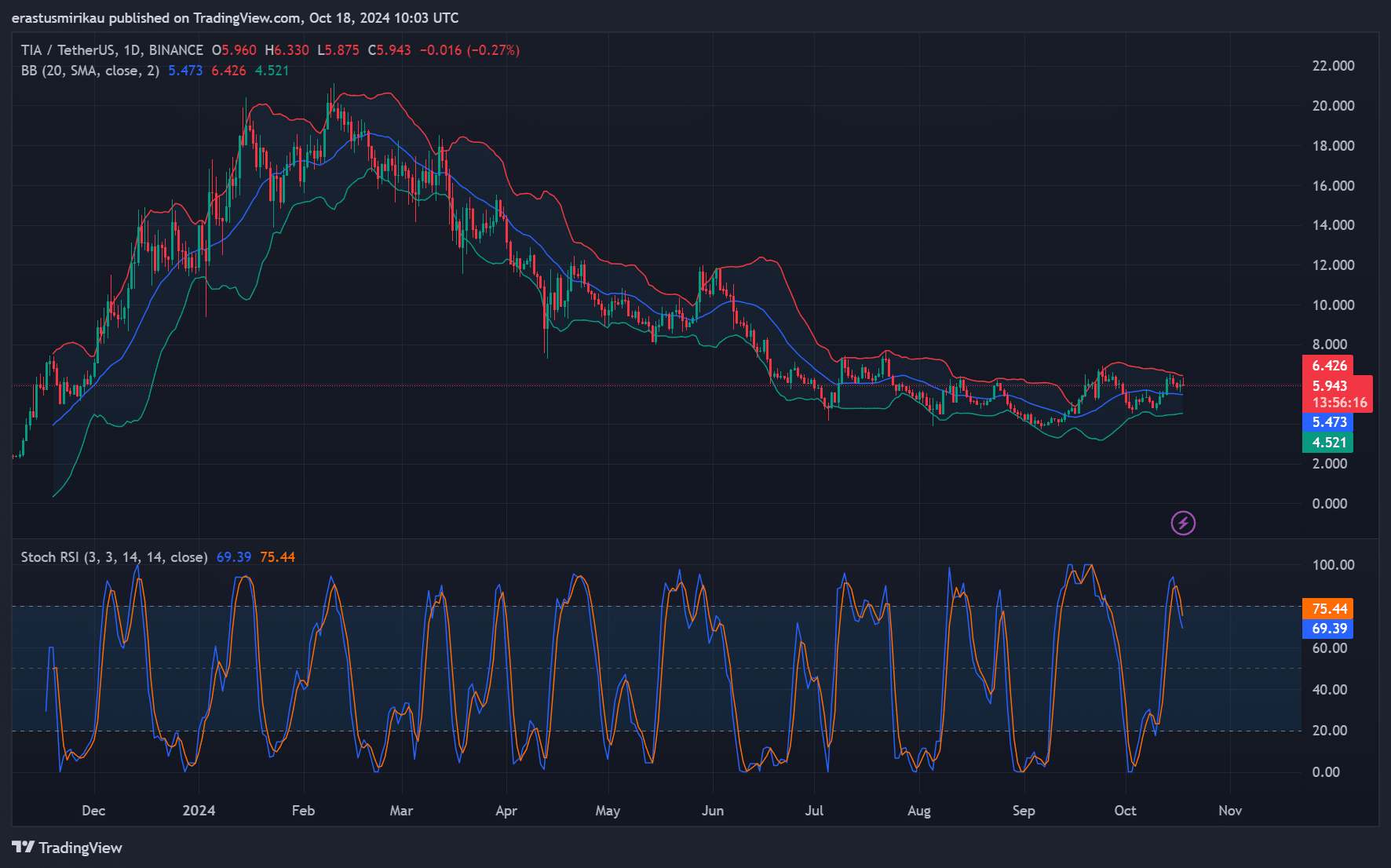

TIA technical analysis: what do the indicators show?

The technical indicators offer a mixed outlook. The Bollinger Bands (BB) on the daily chart show TIA testing the upper band, indicating increased volatility.

Moreover, the Stochastic RSI is near the overbought area, with values of 75.44. Although buyers currently dominate the market, there is a risk of a short-term pullback.

However, the overall trend suggests that if TIA manages to overcome immediate resistance, it could spark a strong rally. Therefore, traders should pay attention to the key levels before making any decisions.

Source: TradingView

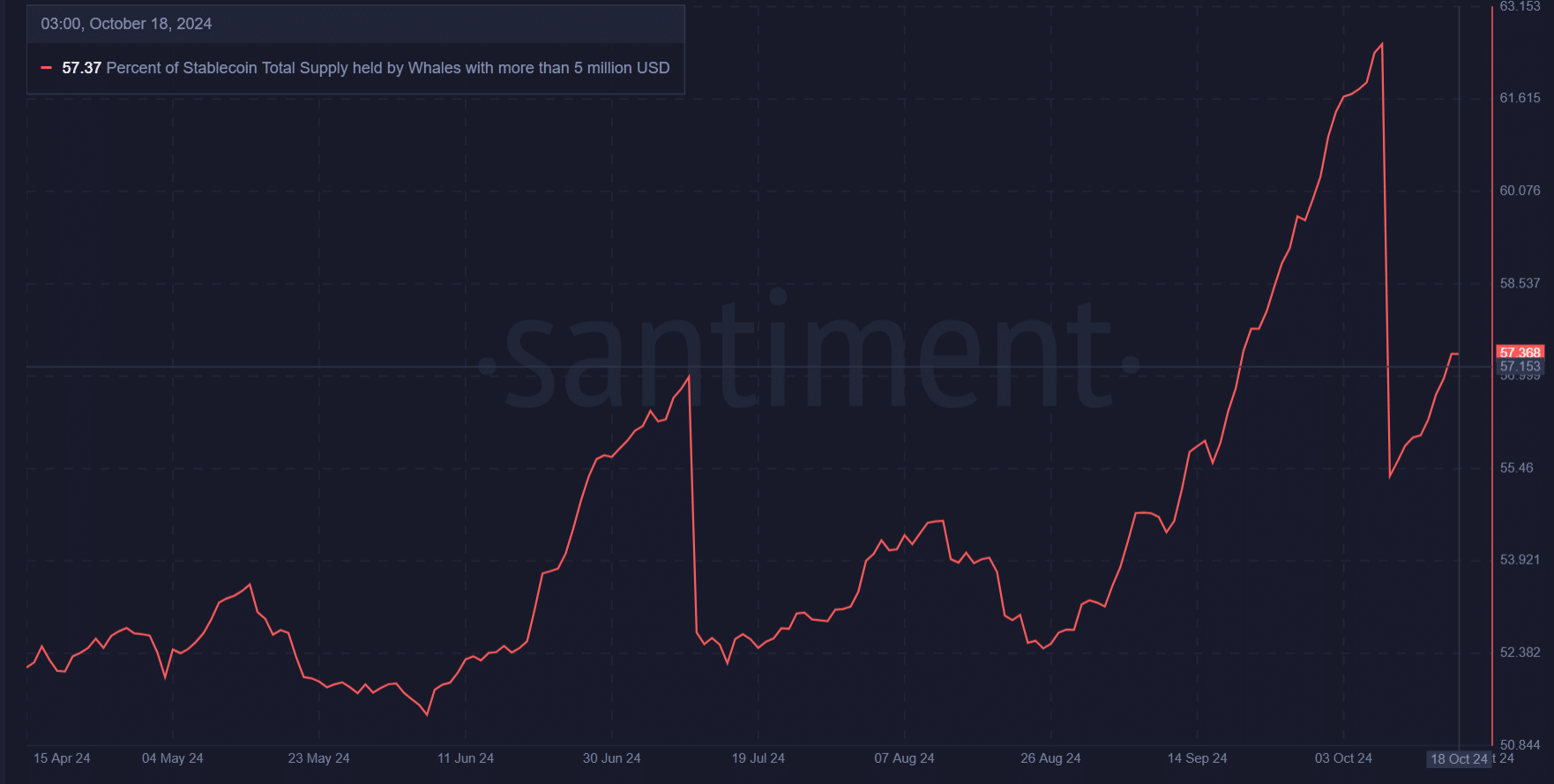

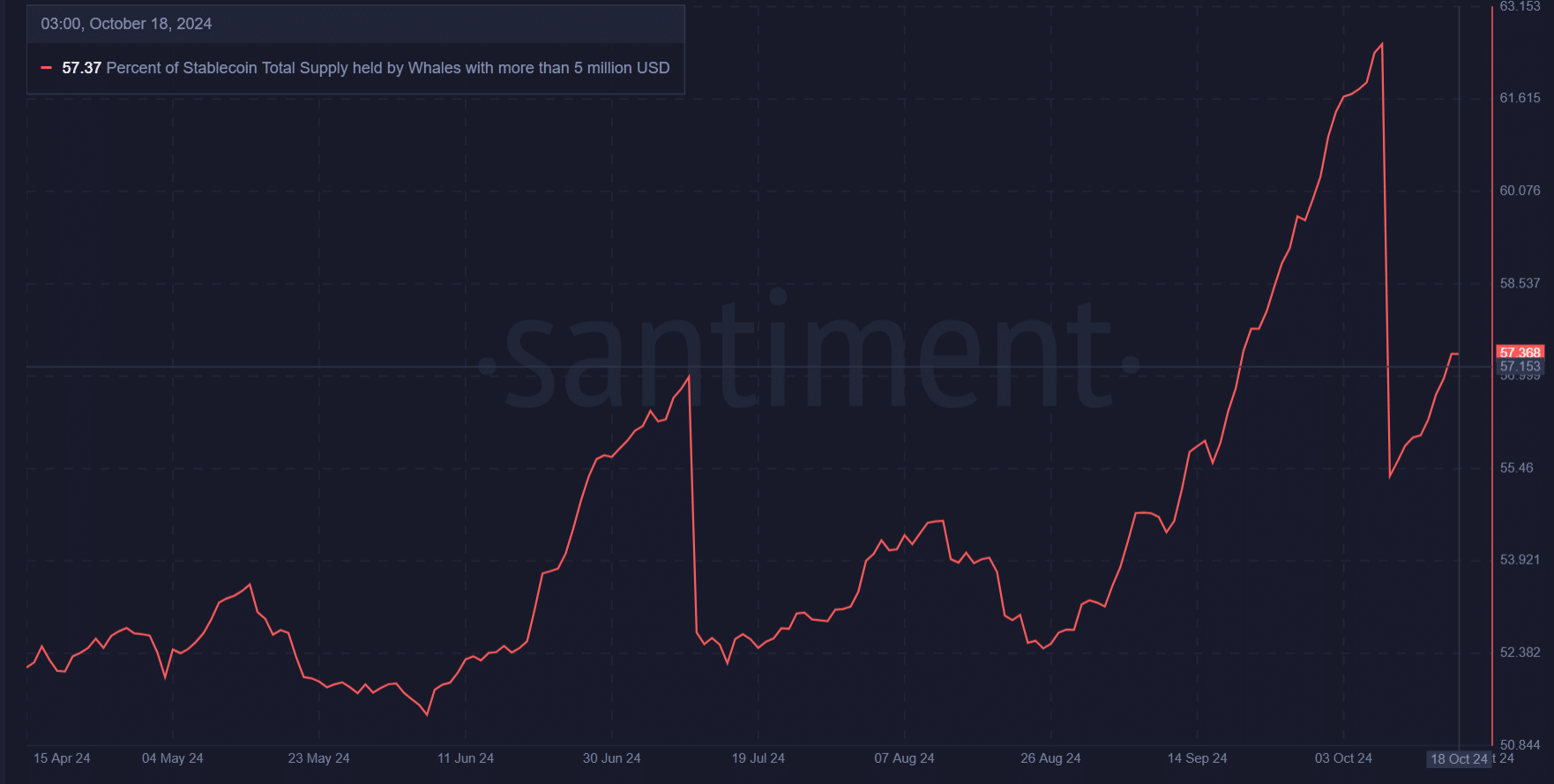

Top Holder Analysis: Do Whales Accumulate?

Analyzing the top holders provides valuable insights into market sentiment. Currently, 57.37% of the stablecoin supply is owned by whales, who own large assets of over $5 million. This level of accumulation indicates significant confidence in the asset’s potential for future growth.

However, recent fluctuations in whale activity indicate that large holders may be in a distribution phase. Therefore, close monitoring of these key players will be crucial in assessing TIA’s future price action.

Source: Santiment

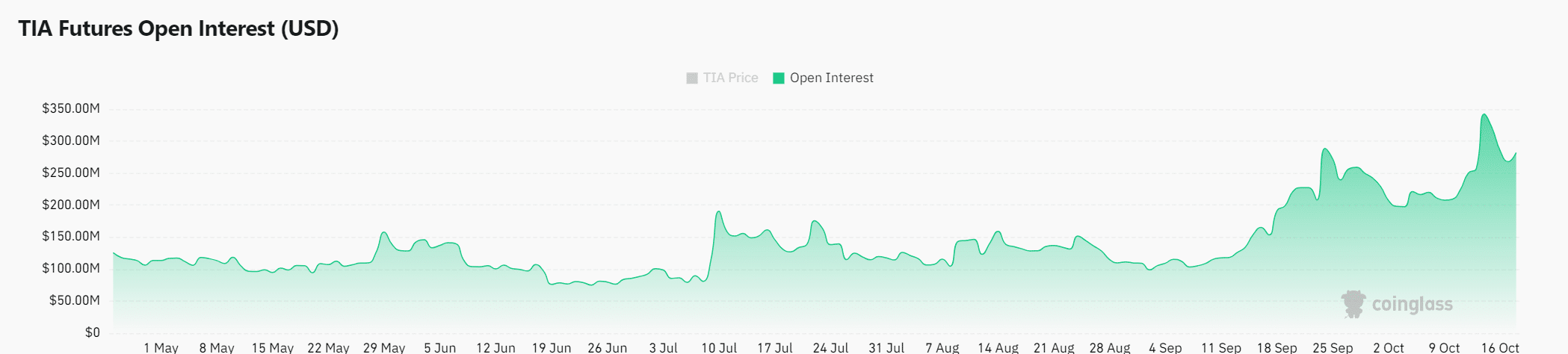

Rise in open interest: is bullish sentiment increasing?

Open interest, which increased 11.02%, now stands at $294.21 million. This increase signals increased investor interest, indicating traders are positioning themselves for significant price movement. Consequently, rising open interest often signals greater volatility, and for TIA, this could quickly translate into a breakout.

Source: Coinglass

Is your portfolio green? View the TIA profit calculator

In short, Celestia (TIA) is showing promising signs of breaking through its consolidation margin. With strong support for whales and increasing open interest, market sentiment is leaning towards bullish. However, technical indicators suggest caution as overbought conditions could trigger a pullback.

If TIA can clear its resistance levels, a strong upside rally could follow. However, investors should remain cautious due to the potential for short-term corrections.

Credit : ambcrypto.com

Leave a Reply