- Japanese company Metaplanet added $10.4 million worth of Bitcoin, bringing its holdings to over 1,000 BTC.

- Market indicators, including rising open interest and the MVRV ratio, point to potential for Bitcoin’s continued bullish momentum.

After a dip in Bitcoin [BTC] price late last week, the cryptocurrency is showing signs of a recovery, with prices returning above $68,000 at the start of the new week.

As of Monday morning, Bitcoin was trading at around $67,953, up 1.3% in the past 24 hours and peaking at $68,210 in the early hours of today.

Metaplanet is expanding its Bitcoin holdings

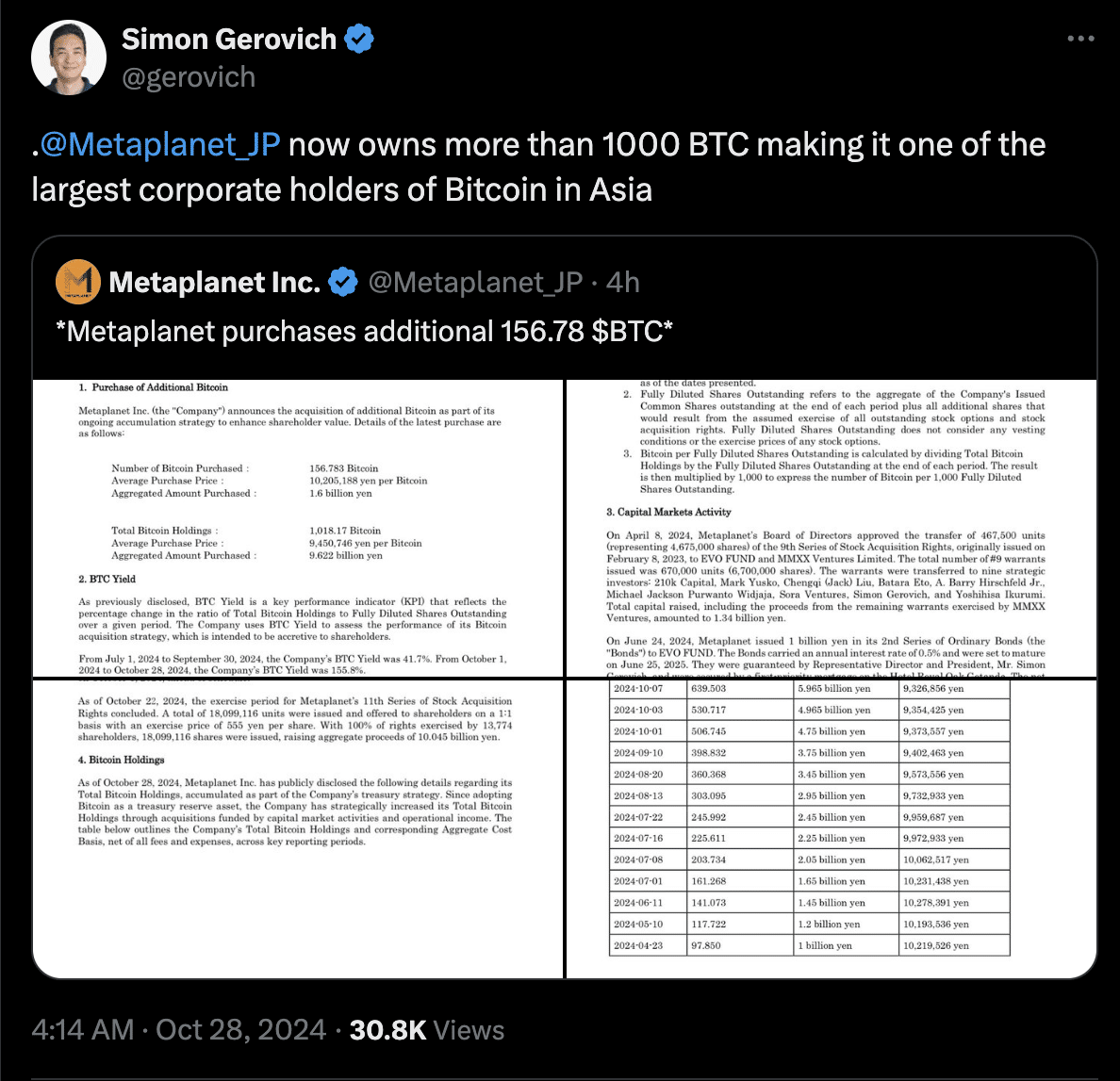

This recovery coincides with an important development: the Japanese investment company Metaplanet Inc announced another major Bitcoin purchase, adding $10.4 million worth of BTC to his holdings.

This recent acquisition brings the company’s Bitcoin reserves to over 1,000 BTC, placing Metaplanet among the top corporate Bitcoin holders in Asia.

Metaplanet’s renewed commitment to BTC reflects a broader trend of companies adopting cryptocurrency as a strategic treasure chest.

After the initial announcement in May, Metaplanet has been steadily building BTC, growing its reserves from 141.07 BTC at the end of June to a substantial 1,018.17 BTC today.

Source: Simon Gerovich on X

This commitment is reinforced by the company’s capital markets activities, including a recent $66 million raise through its eleventh share purchase program.

CEO Simon Gerovich shared that Metaplanet’s goal of keeping BTC as a primary reserve aligns with its long-term digital asset prospects. However, the company clarified that holding shares does not give shareholders a direct claim on the BTC in reserve.

BTC’s growing market indicators point to possible price stability

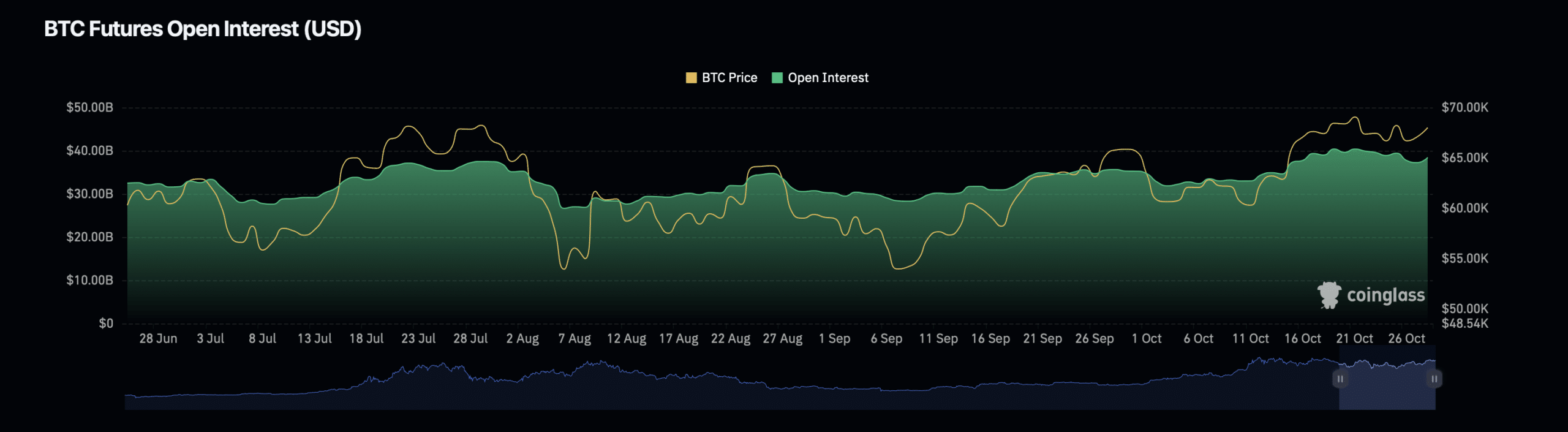

In addition to the positive momentum of corporate buying, Bitcoin’s technical indicators point to increased investor interest.

Facts from Coinglass reveals that Bitcoin open interest grew 4.26% to $38.89 billion, with open interest volume seeing a substantial increase of 61.13%, currently valued at $33.77 billion.

Source: Coinglass

Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not yet been settled.

An increase in open interest may indicate higher market activity, which is indicative of this investors anticipate further movement in the price of Bitcoin. When open interest rises along with a price increase, it can indicate a build-up of bullish sentiment.

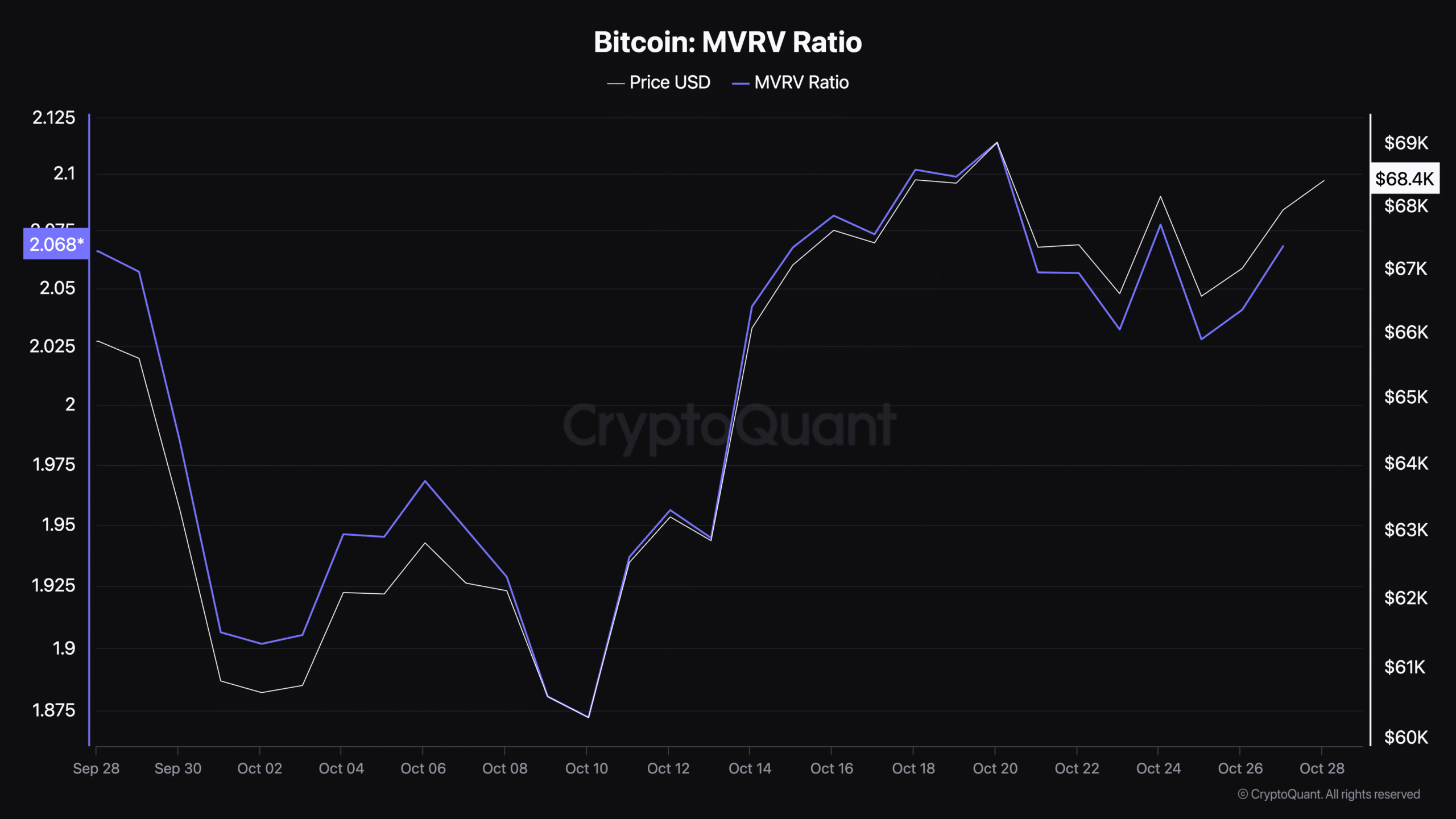

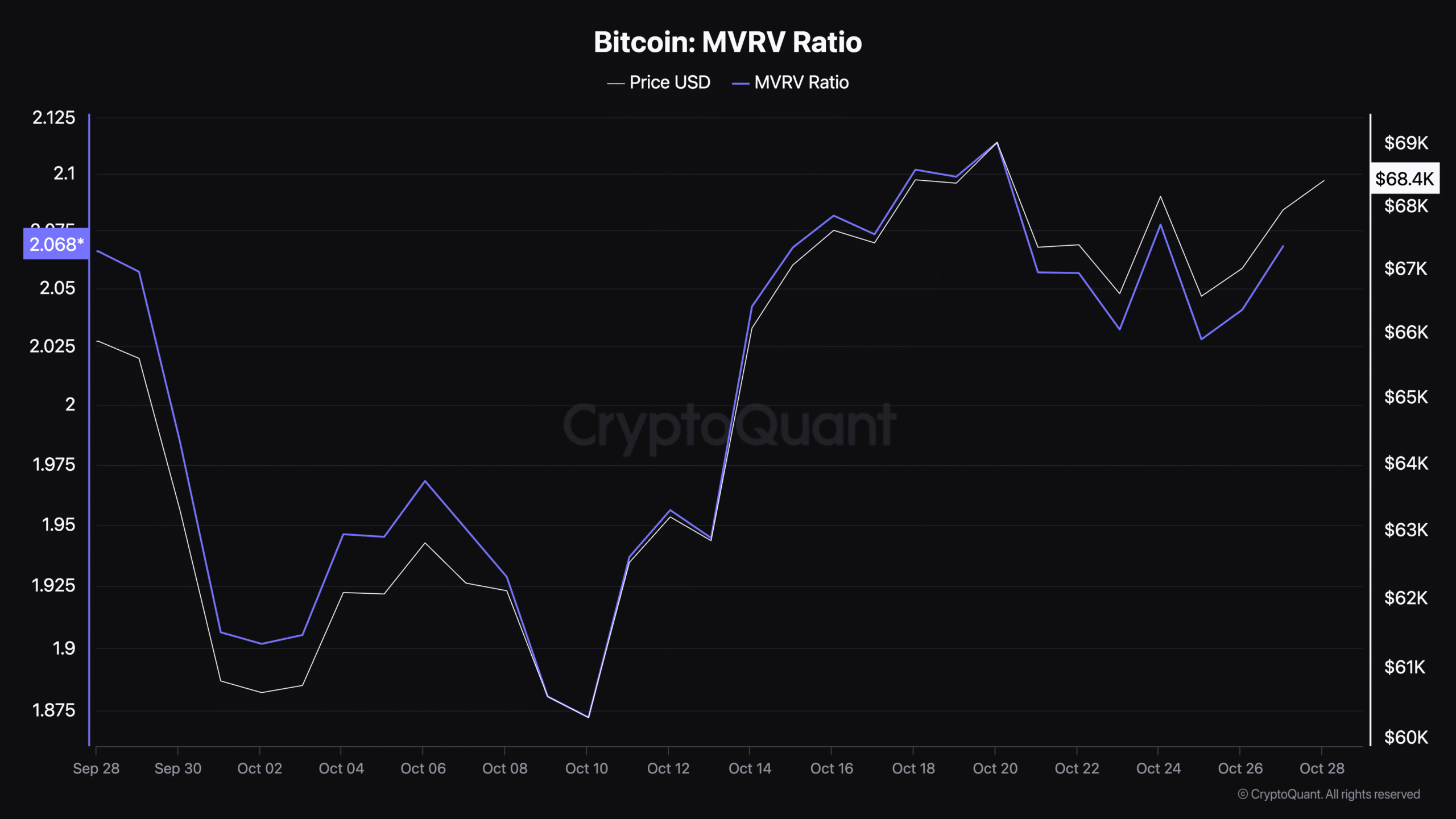

Furthermore, Bitcoin’s market value to realized value ratio (MVRV) recently increased to 2.06, according to CryptoQuant. facts. This metric compares Bitcoin’s current market value to its average realized value, providing insight into whether it is overvalued or undervalued relative to its historical performance.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024–2025

An MVRV ratio above 1 generally indicates that BTC is valued higher than its purchase price, indicating the potential for profit-taking by investors.

However, an increase in the MVRV ratio, especially during a period of price stability or appreciation, can reflect positive sentiment in the market as it implies that investors are willing to hold on to their gains rather than sell.

Credit : ambcrypto.com

Leave a Reply