This article is available in Spanish.

In one analysis Shared on take place in the second half of 2025.

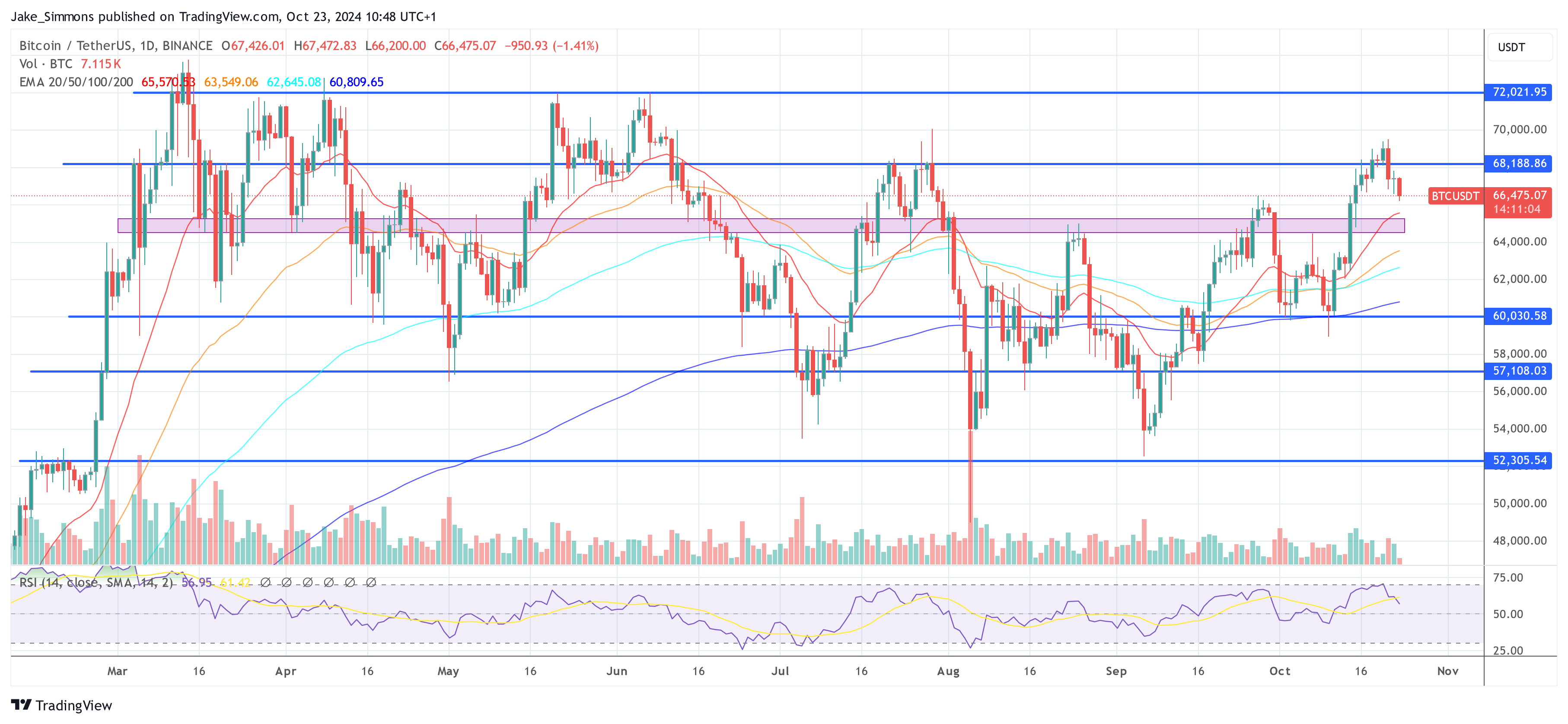

“Another month and a half has passed and the full macro breakout thesis is now really putting a lot of eyes on the crypto charts,” says Astronomer. Reflecting on his previous predictions, he notes: “The last time we published our fourth-quarter upside breakout plan, BTC was at $58k and ETH at $2.3k.” Since then, Bitcoin has risen 20% and Ethereum 13%, moves that occurred “against the expectations of technical analysis users, before the full breakout even occurred.”

When Will This Crypto Bull Run End?

Astronomer emphasizes that traditional order flow and price action analyzes are less effective on higher time frames, leading him to seek “an edge otherwise” through multiple data analyses. “We had our thesis in place, with multiple data analyzes supporting not only that the bottom has been reached, but also that we are likely to see a breakout in a high time frame,” he explains.

Related reading

Astronomer delves into Bitcoin’s macro perspective, using a combination of time, sentiment and volume to identify weekly cycle lows. “The capitulation in the Middle East [Israel-Iran tensions] That has clearly formed, well timed 28 weeks after the previous weekly cycle trough,” he notes. With the next weekly low not expected until late December, he “still sees room for upside” and anticipates that “price.” [will] speed up here.”

Regarding market psychology, he warns, “The market always finds a way to escape on the low time frames because most traders (‘investors’) get stuck in the short-term memory fallacy and simply forget about the high time frames.” The astronomer remains confident in his projection, stating: “The overall peak is still expected in the second half of 2025, where I think the real time to ‘sell it all’ could arrive.”

For Ethereum, Astronomer notes a similar but compressed cyclical pattern compared to Bitcoin. “ETH tends to decline later around the four-year cycle peaks (2014, 2018, 2022) and also peaks later in the four-year cycle (2016, 2020), making its moves appear more aggressive,” he explained.

Related reading

He also addresses the current sentiment towards Ethereum and other layer 1 protocols: “It’s clear by now that ‘useful’ coins are considered ‘useless’, typical things that are needed when the price isn’t moving. Yet anyone who has even remotely used ETH knows what it can do.” Astronomer attributes the stagnation in utility growth to cyclical and sentimental factors, noting, “We’ve seen a huge amount of hype around it in 2021 and it just hasn’t been digested yet.”

While maintaining its optimistic outlook, Astronomer acknowledges the possibility of unforeseen events that could disrupt the market. “Despite all the data, there’s always a small chance I’m wrong,” he admitted. Citing potential global crises such as “World War III (WW3)” or “the end of a nation,” he warns that such events “could always bring the market down significantly,” possibly causing Bitcoin to “fall back below $50,000.”

However, he remains steadfast in his strategy: “Cycles are powerful in nature, and we have shown why these events should not faze you. In that case, I will indeed hold on, hedged with big shorts, well timed, and just keep riding through the cycle, because I think the price will recover from that point on.”

Overall, the analyst cautions traders against losing sight of the broader picture due to short-term market movements: “You’ll start to wonder why… But so far, so good.” When a user asked him: “Wow! Do you think BTC can reach $350,000? That’s incredible!”, Astronomer clarified his position: “I don’t think so. Optical illusion on the map. I think we can reach more than $150-200,000.”

At the time of writing, BTC was trading at $66,475.

Featured image created with DALL.E, chart from TradingView.com

Credit : www.newsbtc.com

Leave a Reply