The crucial meeting of the Federal Open Market Committee will be organized on Tuesday and Wednesday. In a recent speech, the American chairman Jerome Powell hinted that the organization would take a wait -and -see approach about interest rates, referring to the pandemonium created in the US Economic Landscape by the newly introduced economic policy, in particular the aggressive tariff policy. Uncertainty looks over the American markets. Crypto investors have responded to market uncertainties. In the last 24 hours, the Cryptocurrency market has seen a decrease of 3.1%. Bitcoin has fallen by 2.3% by 1.7% and Ethereum. Let’s dive into it for more information!

Drip Bitcoin and Ethereum

Yesterday the Bitcoin market showed a serious decrease in the single day of 2.09%. At the time of closing on March 16, the price was $ 82,577. 24. In the last 24 hours alone, the BTC market has fallen by 1.9%. Currently, the BTC price is 82,888.44 – at least 0.37% above the end of yesterday.

Yesterday, the Ethereum market fell from around $ 1,935.77 to $ 1,886.92, which marked a serious fall in a single day of 2.52%. In the last 24 hours alone, the ETH market has experienced a decrease of 2.4%. Currently, the ETH price remains $ 1,888.69 – slightly above yesterday’s final race.

Experts believe that the sharp fall in market sentiment was due to economic and regulatory care last weekend.

US Stock Futures & Federal Reserve’s Impact

In this week’s FOMC meeting, the FED is less inclined to make interest differences. At present, the federal fund percentage remains within a range of 4.25% to 4.5%.

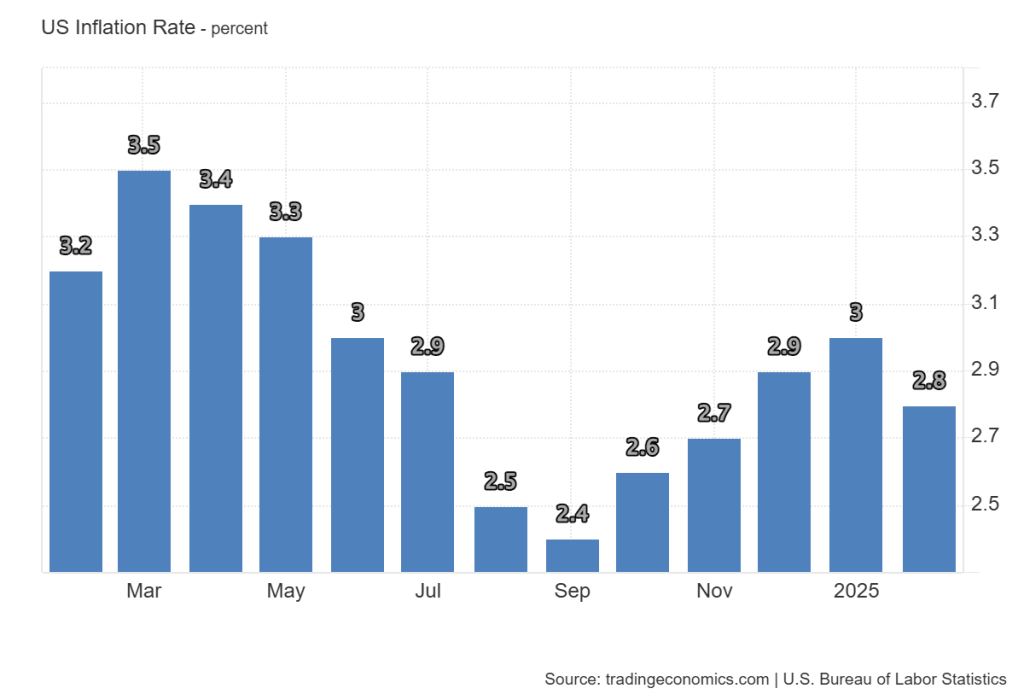

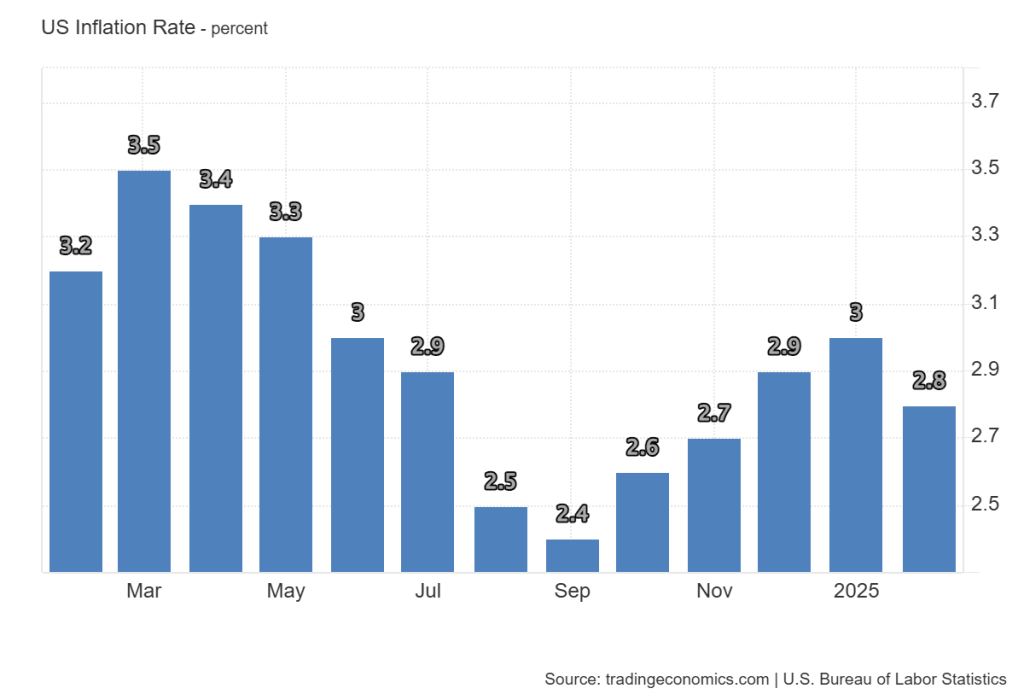

In February the American inflation percentage fell from 3% to 2.8%. According to Termast, it is expected that it will fall to 2.5%in March.

US President Donald Trump recently imposed import tariffs on China, Mexico and Canada. He has announced all his intention to expand the scope of his aggressive rate policy.

Many think that the Fed probably does not make a decision about interest rates until the US economy completely absorbs the impact of the aggressive rate policy.

There is a chance that the rate policy will increase inflation on the American market.

Uncertainty looms over American markets. Dow Jones, S&P 500 and Nasdaq Composite Futures have been taken, which carefully signals sentiment investors.

Crypto Derivatives and Market Trends

The Cryptocurrency market has seen a decrease of 3.1% over the past 24 hours. Almost all top ten cryptos have deteriorated during the period. Bitcoin has fallen by 1.9%, Ethereum by 2.4%, XRP with 1.9%, Solana with 4.6%and Cardano by 3%.

Reports indicate that leverage remains high in crypto futures markets despite $ 253 million in liquidations in the last 24 hours.

Financing percentages are stabilized on neutral, which shows a mixed market sentiment.

In conclusion, crypto traders are looking for a catalyst, such as the FED policy decision or an institutional investment signal, to determine the next direction of the market.

Credit : coinpedia.org

Leave a Reply