The CEO of digital asset analytics company CryptoQuant thinks a national strategic Bitcoin (BTC) reserve could offset US debt.

Ki Young Ju tells According to its 389,600 followers on the social media platform

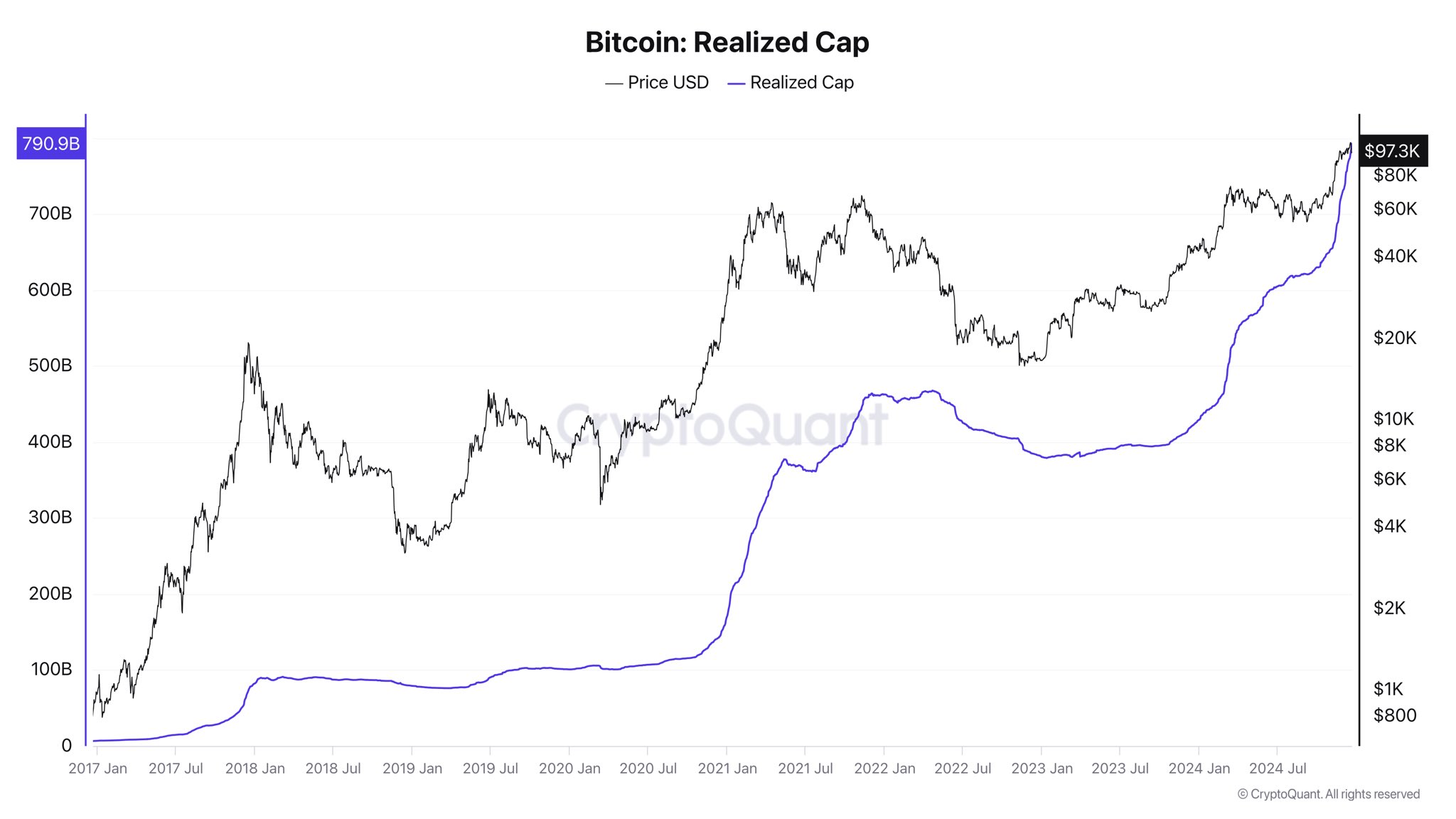

“This year alone, an inflow of $352 billion has added $1 trillion to the market cap.

However, using a pumpable asset like Bitcoin to offset dollar-denominated debt – instead of gold or dollars – could make it difficult to reach consensus among creditors. For Bitcoin to achieve broader market acceptance, Bitcoin must gain a global, nationwide authority comparable to that of gold. Setting up a Strategic Bitcoin Reserve (SBR) could serve as a symbolic first step.

With 70% of US debt held domestically, offsetting 36% of that by acquiring 1 million Bitcoin by 2050 becomes feasible if the US government designates Bitcoin as a strategic asset.”

CryptoQuant’s CEO adds that the 30% of debt held by foreign entities could resist this approach, but he says the strategy remains practical nonetheless.

“If consensus is reached on the status of Bitcoin, it is very possible to achieve this.

The only risk would be old whales dumping BTC to attack the US. But if governments continue to accumulate Bitcoin until 2050 and its price continues to rise, I doubt they will actually dump Bitcoin.”

Matthew Sigel, head of digital asset research at exchange-traded fund (ETF) provider VanEck, initially outlined how a strategic Bitcoin reserve could offset US debt.

“Suppose the US Treasury begins purchasing one million Bitcoin over a five-year period at a starting price of $200,000.

Suppose US debt grows at 5% (compared to a compound annual growth rate of 8% over the past 10 years) and the price of BTC grows at 25%.

In such a scenario, the US Strategic BTC Reserve would hold assets worth 36% of debt by 2050.

In that scenario, BTC would be $42 million per coin (same as Michael Saylor’s). target (coincidentally) and the market capitalization would be 18% of global financial assets.

But even at a compound annual growth rate of 15%, the BTC supply would still be quite valuable.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney

Credit : dailyhodl.com

Leave a Reply