This article is available in Spanish.

XRP has experienced an extraordinary rise in recent weeks, with its price rising 380% in the past 23 days. In the last four days alone, the price rose 75%, reaching a peak of $2.87 on December 2. This rapid rise appears to be fueled by significant buying activity from large investors, known as whales.

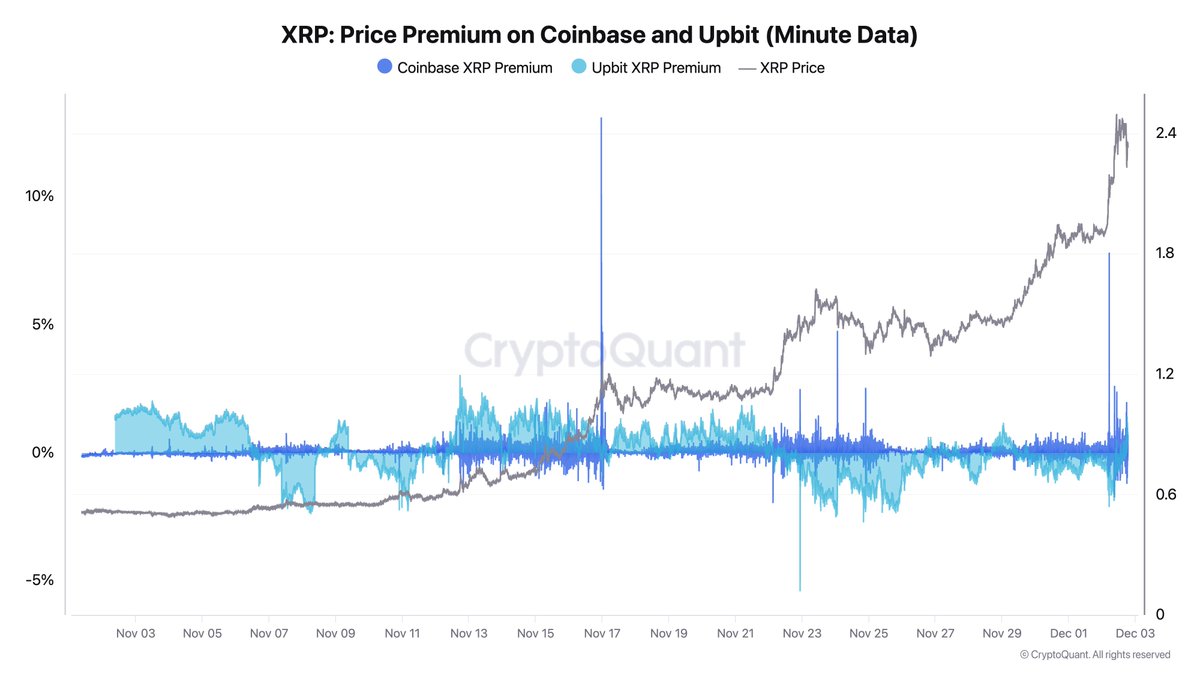

Ki Young Ju, CEO of on-chain analytics company CryptoQuant, marked that these whales operate primarily through the US-based exchange Coinbase. On December 2, he pointed out that “Coinbase whales are driving this XRP rally,” noting that Coinbase’s minute-level price premium ranged from 3% to 13% during the surge.

In contrast, Upbit – a Korean exchange with more XRP investors than Binance – did not show a significant premium, indicating that the buying pressure is mainly coming from the United States.

On his alternative

Related reading

Today, he warned traders against shorting XRP. “Shorting XRP right now seems risky, imo. $25 billion XRP deposit before the pump may look like market manipulation, but could simply be front-running. This insider whale may know something extremely positive about XRP, such as the endorsement of spot ETFs,” he speculated.

He further shared a chart ‘XRP: Retail Activity Through Trading Frequency Surge (Spot & Futures), which indicates that retail trading activity for all-round achievement. high of $3.92.

Related reading

Observing the one-year cumulative volume delta (CVD) of taker buy/sell volume, he noted: “1-year CVD of taker buy/sell volume for XRP shows a historic recovery. Whales are aggressively exploiting market orders, overwhelming demand.”

A 700% rally for XRP against BTC?

From a technical analysis perspective, crypto analyst Jacob Canfield emphasizes the importance of examining the XRP/BTC pairing. He notes that XRP is currently in a critical resistance zone on the BTC pair chart (XRPBTC), having just reached the $2.75 level on the USDT pair – a resistance point since December 2019.

Canfield suggests a breakout here could signal a possible 240% return to key resistance zones from 2017, 2018 and 2019. “If we get real FOMO, we could set ourselves up for another 700% move to all-time highs against Bitcoin,” he noted, acknowledging the “two of the strongest monthly candles for XRP we have seen in over five years.”

Looking at shorter time frames of the XRP/USD pair, Canfield highlights the usefulness of support and resistance levels to identify new entry points in these time frames. “In bull markets, you need to use low time frame support/resistance to find new market entries. 5 min/15 min are best. XRP as an example – $2.20 was the clear S/R invalidation. Base of the largest green candle = base of momentum. Usually the best place to re-enter a trade.”

At the time of writing, XRP was trading at $2.63.

Featured image created with DALL.E, chart from TradingView.com

Credit : www.newsbtc.com

Leave a Reply